USA economic momentum may sustain dollar rally into year end

The market is churning as it awaits key events this week, the OPEC meeting, Italian referendum, month-end position squaring. Oil prices slipped as hopes of a deal on Wednesday fade. This has taken some steam out of the rise in global yields and the USD/JPY. Italian bonds and equities have rebounded, pairing losses ahead of the vote this weekend, providing some support for the EUR. Metals prices have reversed some of their recent sharp gains on reports China is curbing speculation. Meanwhile, the case for a stronger USD continues to be supported by recent USA economic reports. Consumer confidence rose to a new high since 2007, dovetailing with recent evidence of strong retailing. GDP appears set to finish the year with second strong outcome in Q4. The labor data at end week may reinforce evidence of rising momentum in wages. Post-USA election, we may see more sustained optimism, in part related to the possibility of fiscal expansion. A rate hike by the Fed on 14 December is essentially a done deal, but there is scope for the market to raise its expectations for hikes across the next few years, providing the basis for further extension of the USD rally into year end.

Consumer set to underpin US recovery

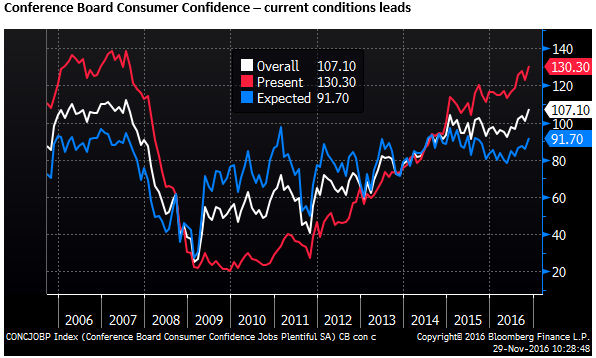

USA Conference Board Consumer confidence rose to a new peak since 2007. The rise has been led by current conditions. The outlook has lagged, but still rose to a high since mid-2015. Perhaps optimism for the future has been dragged back by Brexit and the US election and can catch-up to current conditions and fuel stronger economic activity in coming months.

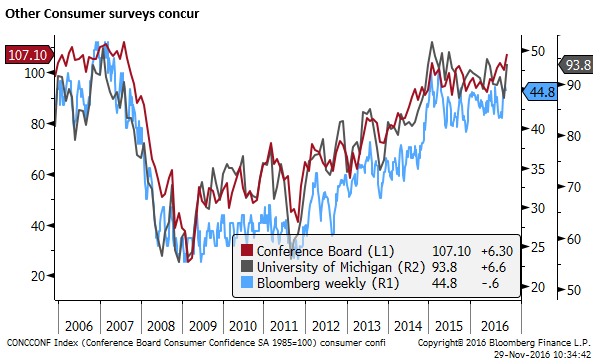

The rise in the Conference Board measure follows a higher than expected rise in the University of Michigan sentiment indicator, and may even portend further gains in the UoM survey.

The difference between the surveyed “jobs-plentiful” and “jobs hard to get” dipped back to near its low for the year, suggesting that the labor market may have tightened since the first have of the year.

The strength in consumer confidence bodes well for consumption to help sustain GDP growth. GDP was revised up to a strong 3.2% q/q saar in Q3, after 1.4% in Q2. The annual growth rate rose from 1.3%y/y in Q2 to 1.6%y/y in Q2.

Personal consumption rose by a healthy 2.8%q/q saar in Q3 after surging 4.3% in Q2. Consumption has been the mainstay of growth over the last year.

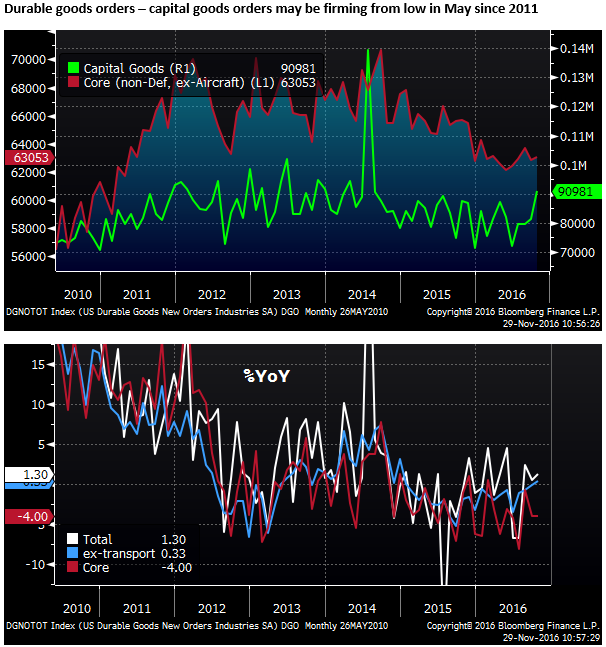

Business investment has been relatively weak over the last two years, detracting from growth in the first half of this year and adding little in Q3. Residential investment has also declined in the last two-quarters. These components of growth might be expected to recover over the year ahead.

The October retail sales data suggest that Q4 began on a strong footing, showing a re-acceleration in the last two months after a pause in July/Aug, up 4.3%y/y in October. Anecdotes from traditional post-Thanksgiving sales suggest retailing remained robust in November.

The Atlanta Fed GDPNow forecasting model based on the most up to date economic indicators is projecting another strong 3.6% q/q saar expansion in Q4.

Tentative signs of business investment recovery

Business investment has been weak in recent years. There is tentative evidence in the durable goods orders data that this may be turning; core capital goods orders have firmed from a low in May. However, the recovery to date has been tepid, still down 4.0%y/y in October. Post-election optimism, and even a sense that borrowing rates are now moving up, may help spur more investment.

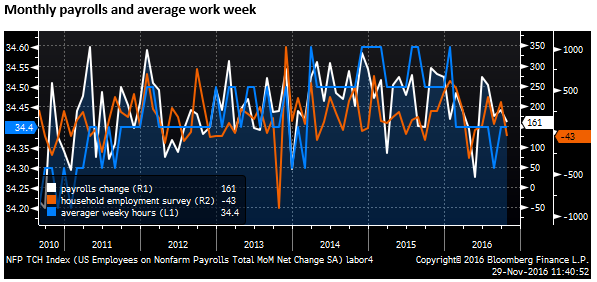

Labor data momentum

The payrolls data on Friday continue to be the most crucial for Fed policy deliberations. The previous report in October was quite supportive of the case for raising rates. The under-employment rate that incorporates those working part-time for economic reasons and marginally attached to the labor force ticked down to a new low since 2008, suggesting that slack in the labor market is limited.

There were upward revisions to August and September payrolls reports (+44K), raising the pace of payrolls growth in the last three months to 176K and for the year-to-date overall to 181K, significantly above the 80 to 100K that most Fed members see as needed to keep the labor market steady.

The timing of the election on 8 November, in the same period as that for most payroll survey responders, may detract from the November payrolls measure. On the other hand, weekly unemployment claims were at a low in over 4 decades in the same week as the election. They were at a four-week moving average low in over 4 decades on 18-Nov.

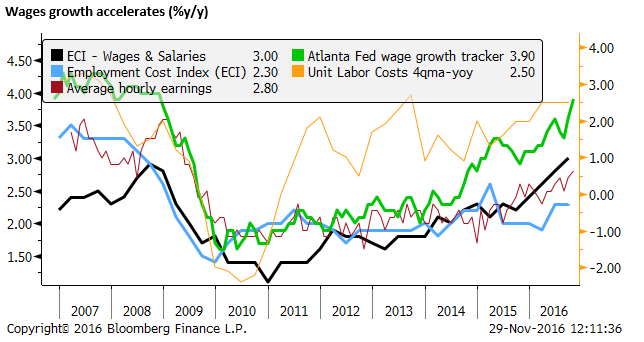

Perhaps the most significant component for the October payrolls report was a rise in the annual rate of wage growth to a high since 2009 of 2.8%y/y. The Atlanta Fed wage tracker has risen even more rapidly at 3.9%y/y.

The December FOMC may turn the tide from downgrades to upgrades for hikes over the cycle

The case for the next Fed’s rate hike on 14 December is essentially made, even a setback in the labor indicators is likely to be dismissed. However, there is scope for the market to push up the anticipated rate hikes next year. The market currently has about one and a half further hikes priced into next year. This does not include much risk that the Fed is forced to reassess its slow and gradual rates outlook to adjust to evidence that the labor market is already generating higher wages growth and moving into a steeper part of the Phillip’s curve sooner that it has forecast.

The Fed has spent most of this year downgrading its view of the economy over the medium term. While inching closer to a second hike in the cycle, it has persistently lowered its view of potential growth and the long-run neutral policy rate; fearing a secular decline in productivity in the USA and globally. These dovish tones contributed to a weaker USD through much of this year. The December Fed meeting may be the first in which we see some increase in the Fed’s longer-run expectations. If so, it could contribute to a more optimistic mood developing in the last month and propel the recovery in the USD.

JPY continues to set the tone in currency markets

All year, JPY has had a life of its own and it has been driving broader trends in the currency markets. As such, economic trends in the USA have tended to take a backseat. While it is true that recent economic reports and the election of Trump have contributed to the rebound in the USD, the power of the fall in JPY has surprised many and spilled over to a bigger rebound in the USD against other currencies. The story in currency markets is at least equal parts USD strength and JPY weakness in November.

USD/JPY has been more highly correlated with longer-term US Treasury yields this year, and the rapid rebound in USD/JPY in recent weeks has coincided closely the surge in yields. It may seem that JPY is following yields, but it is not all chicken and egg. The strong JPY over the first three-quarters of the year was a key element in diminishing confidence in the effectiveness of NIRP/QE policy, falling inflation expectations and falling global yields. The reversal in JPY strength is contributing to a revival in inflation expectations in Japan and globally and allowing the bond market to respond more forcefully to possible fiscal stimulus already underway and anticipated in the US, UK and other parts of the world.

We can see a case for global yields to continue to rise and JPY to fall as the global economy recovers, aided by extreme monetary policy easing measures in Europe, Japan, and the UK, relatively easy monetary policies in most parts of the world and a trend towards fiscal policy expansion globally.

There remains significant pockets of excess capacity in parts of the world and some markets. And there is a problem of high debt levels and balance sheet repair still needed in many parts of the world. This continues to generate risks to the global economy and we may see setbacks in global investor confidence.

The political risks have risen in many parts of the world as electorates grow tired of the establishment that appears to favor the rich in a prolonged slow recovery from the global financial crisis. Political risk appears most problematic for the EUR and European economy. The threat of a break-up of the Eurozone remains significant and may have increased. The region’s third-biggest economy, Italy is facing a potential banking and political crisis. Electorates have grown impatient with immigration and weak growth. The Brexit vote in the UK is indicative of social upheaval underway in Europe. With elections in France and Germany next year, the trend is for political parties to focus on their own countries’ issues rather than EU responsibilities. Brexit is generating economic challenges for the UK economy and adding to the burden on EU countries to balance their domestic and regional policies.

However, it is also true that excess capacity may have been mopped up in the USA and Japan. Inflation has been seen in China and commodity prices have risen this year. A sign perhaps that labor supplies in several major economies are now relatively tight and commodity markets are in better balance. As such, we may be moving into a period where inflation pressure becomes more prominent in the global economy.