USD correction not trend change, gold remains asset of choice

Our bias is to fade this period of correction in the USD. It is hard to judge how far it can go, so we will watch and wait for now. Notwithstanding the pull-back in US rate hike expectations, the sharp divergence in major countries’ central bank policies has been maintained, with further policy easing measures delivered and expected in Japan and the Eurozone. The USD correction has happened across the risk spectrum of alternative currencies. However, global risk appetite remains highly constrained, and has risen significantly in the European banking sector. As such it is hard to see a sustained recovery in EM or commodity currencies. As discussed yesterday, the current environment supports the case for gold; we favour a basket approach in a long gold trade, in case the USD correction ends and USD strength resumes.

De-risking long USD positions

The biggest news in global markets this week is the broad-based fall in the USD. Some of the biggest movers come from either end of the risk spectrum. So the move is not really about shifting global risk appetite that remains relative low compared to recent years. However, it may be about de-risking a consensus view that the USD should be the strongest currency following the Fed’s delivery of a rate hike in December.

No other economy besides the USA is in a hiking cycle to address economic growth above trend and approaching full-employment. This unique characteristic of the USA was a key factor in the strength of the USD over the last 18-months. The approaching rate hike supported the USD.

But over the last year, and particularly in Q4, the US economy lost momentum, so just at the time the Fed lifted rates for the first time since the 2008 Global Financial Crisis, the case for that rate hike was finely balanced. Now the case for follow up hikes has weakened to the point where virtually no one expects a hike in March, and many can see no hikes for the rest of the year. The long build-up to the first hike, and the associated strong sustained rally in the USD, created a market that was significantly over-weight USD. That over-weigh position was built up against both major, developing and commodity currencies.

The case for a long USD is not built on US rates alone

But the case for a stronger USD was not built on the US economy alone, and we view the USD fall as corrective rather than the start of a weaker USD trend. The case for EUR and JPY remains very weak indeed, both the ECB and BoJ are now pursing negative rates and threatening to cut them even deeper and further expand QE policies.

‘No limit’ to Japan easing, says Kuroda – FT.com

ECB will not ‘surrender’ to low inflation, Draghi says – FT.com

Draghi Warns on Risks of Low Inflation – WSJ.com

New European border controls could hit growth, EU warns – FT.com

Bank of England cuts UK growth forecasts – FT.com

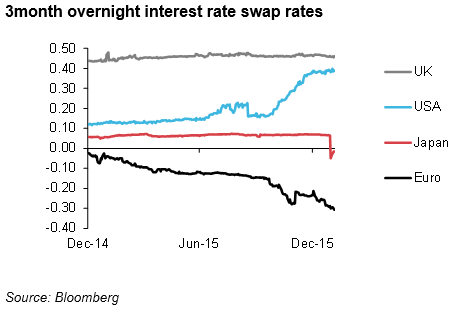

Even if the Fed may be putting further hikes on ice for the time-being, the short term interest rate differentials between the EUR and JPY on one side and the USD on the other are at multi-year wides in favour of the USD, indicative of diverging polices. As short term rates in the US reach multi-year highs, rates in the Eurozone and Japan hare hitting record lows, in negative territory (chart below)

Currencies’ relationships with interest rates waxes and wanes and will move up and down the yield curve, but the clear and significant widening at the front part of the curve may well turn the tide in favour of the USD against JPY and EUR before too long. In risk positive environments, investors chase diminishing returns, and differentials at the front of the curve tend to matter more, as they reflect the actual carry return or costs of currency positions.

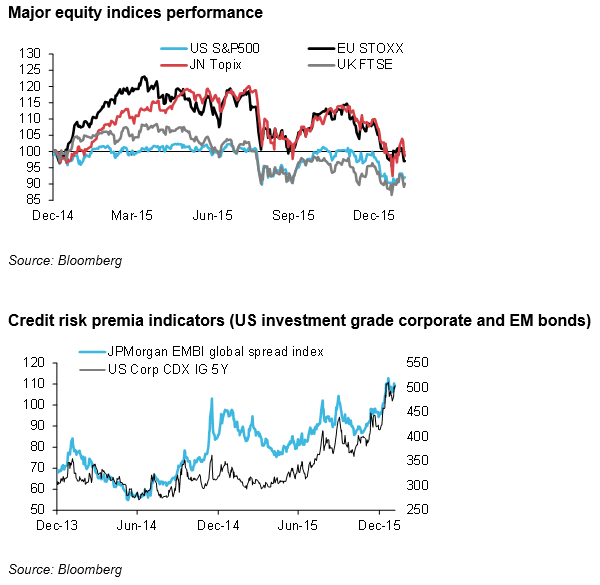

Market risk aversion still quite high

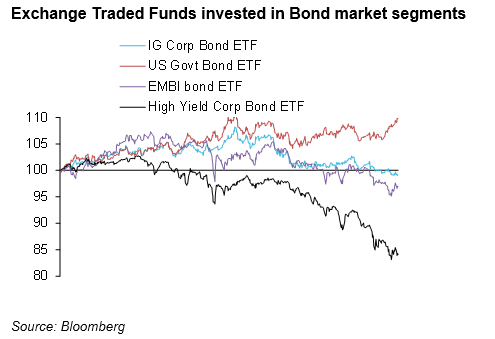

The market is exhibiting more sustained global risk aversion. Even though the major central banks have tilted dovishly and Chinese policy makers are aiming to calm fears over its financial and economic restructuring we are not seeing a quick and consistent rebound in global equites. And credit risk premia remain at multiyear highs.

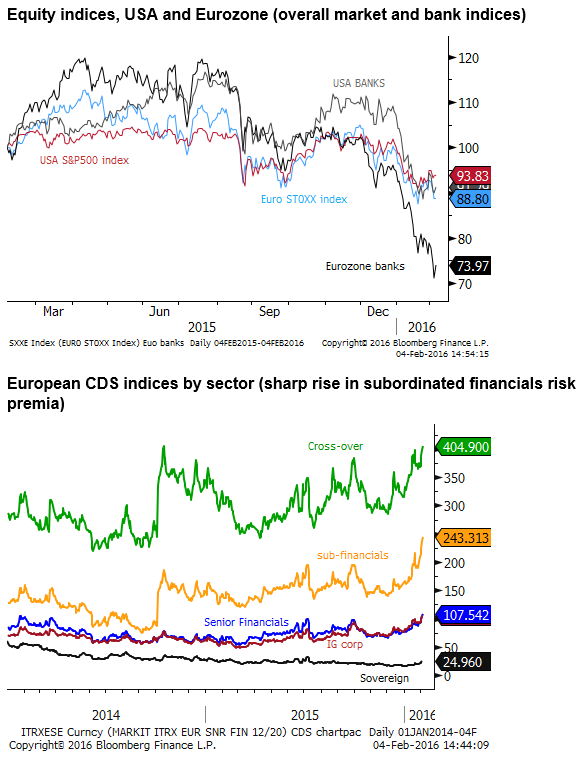

European bank credit risk has risen more sharply than in the USA

European bank shares have significantly under-performed the broader European equity market, and credit risk premia for European financials have risen sharply to new highs.

It appears that the market has become concerned over still high levels of non-performing loans at European banks. The issue may have been highlighted recently by Italian government plans to provide government guarantees to help its banks sell-off these assets. Other analysts have noted the still relatively high level of exposure of European banks to troubled emerging market economies and loans to the energy sector. A third issue appears to be profitability concerns raised by increased regulatory requirements for banks to hold ‘safe’ liquid assets and negative interest rates.

Forget the U.S., European Banks Are Ailing – realmoney.thestreet.com

The strength in the EUR therefore seems against the grain if the market senses risk is a bigger problem in European banks than in the USA.

Perhaps the market may think if negative interest rates are a problem, then the ECB may be constrained from cutting them further. However, the European rate market is not pushing rates higher.

If financial stress is developing in Europe, in fact it should encourage the ECB to ease more. At this stage with rates already well below zero there is unlikely to be any pull-back on rates, and the ECB could be urged by financial system stress to both cut more and expand QE more significantly.

Ultimately, this is likely to weaken the EUR more significantly.

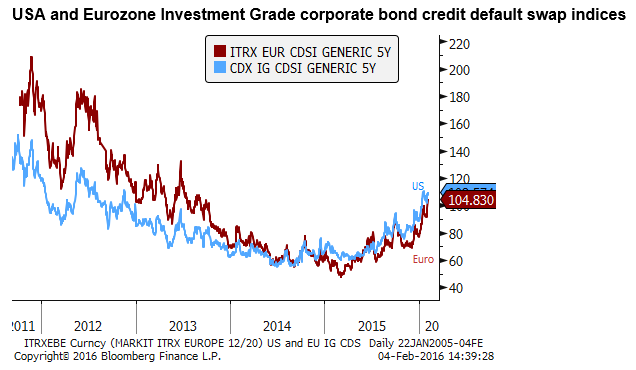

The oil price recovery has done little lower credit risk premia

Weaker oil prices have been blamed by many for dragging down high yield bonds and increasing risk premia on bank credit. Oil prices have recovered in recent days, in part boosted by the broad decline in the USD. However, we have not seen much if any turn around in high yield credit markets or banks credit risk premia.

This suggests that the market sense oil prices have fallen below a threshold of pain for newer high-geared investments in the energy sector, and there is a lack of confidence that the recent recovery in oil prices is sufficient or likely to be sustained

In consideration of still high levels of risk premia in global asset markets, it is hard to get bullish EM or commodity currencies. The broad correction in the USD may have helped lift these currencies recently, but as yet there is a lack of evidence to suggest that this will be enough to trigger a sustained recovery in commodity prices or resurgence of confidence in emerging market assets.