USD down but not out, further rebound expected

We are leaning towards some further modest rebound in the USD after its significant retreat this year. We suspect we may see this against both EUR and JPY as the market refocuses on the aggressive monetary policy easing stances of these two currencies’ central banks. We retain a fairly balanced view on the US economy, with strength in housing, ongoing evidence of a tightening labor market, firming wages and higher inflation outcomes seen so far this year. We may even see some modest improvement in weaker indicators over the last 18 months such as in capital spending, manufacturing and exports. If so the USD could benefit from simply retaining prospects for higher rates. Emerging markets may be mixed, with potential for Brazil, Russia and India to show better prospects, while China remains highly uncertain with greater downside risk. This has weighed on Asian currencies and the AUD.

USD finds its feet at previous supports

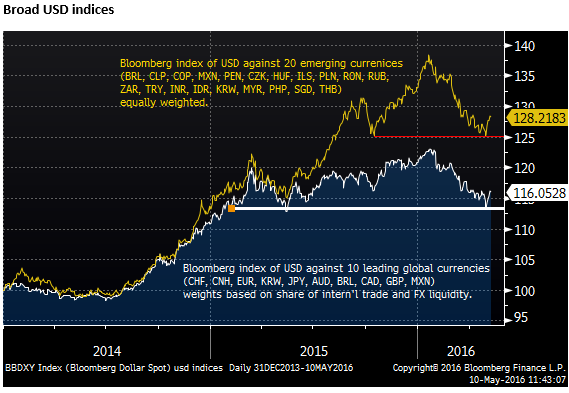

Technically (i.e. looking at the charts) the USD appears to have potentially put in a significant bottom after several months of broad decline. The chart below uses two broad Bloomberg indices, one against 10 leading global currencies, chosen for their share of international trade and FX liquidity, the second an unweighted basket of 20 emerging currencies from around the world.

The USD had been weakening since peaks in the second half of January, reaching lows a week ago that matched previous lows for the USD during retracements last year. It has bounced from these supports and is now testing previous highs in the recent down-trend, suggesting a period of strength or at least stability in the USD may now evolve in the weeks ahead.

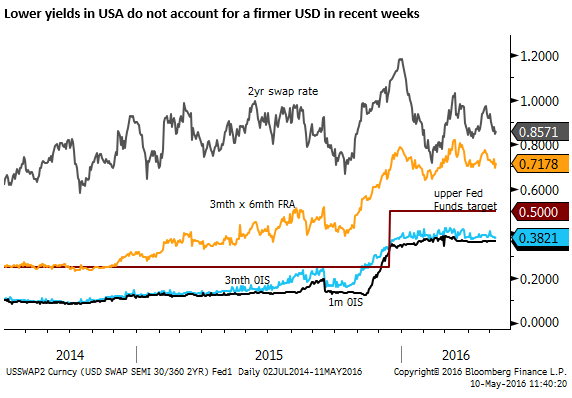

USD firms even as US rates have fallen in recent weeks

There is little specific news that might explain a stronger USD performance in the last week; it even persisted after the weaker than expected payrolls report on Friday. And came after the Fed left rates unchanged two weeks ago and provided no balance of risk assessment. Furthermore, Q1 GDP (0.5% q/q saar, 1.9%y/y) was the weakest quarter and annual growth since Q1-2014.

Some news reports suggest the USD’s improvement may be related to comments from Fed officials suggesting that June was still a live meeting and it was still reasonable to expect two rate hikes this year.

However, the comments appear more about encouraging the market to keep an open mind rather than warning that it is wrong. Actions speak louder than words and when it comes down to game-time the Fed has proven very cautions in delivering rate hikes. In any case, US 2 yr yields have fallen in recent weeks.

Weaker developments outside the USA play a role

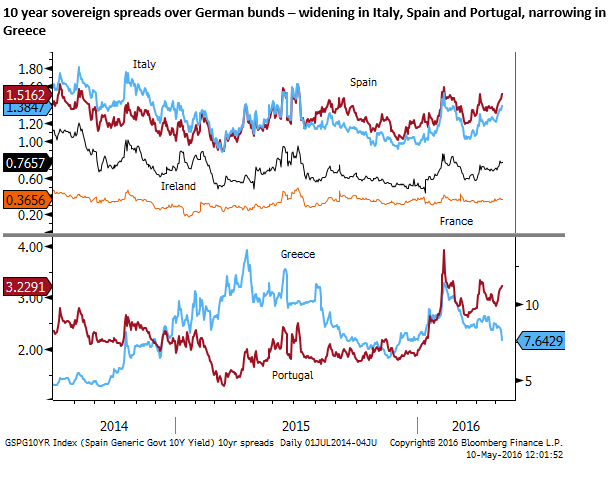

On the other side of the equation, there have been some developments that might weaken other currencies. Japanese government officials have warned about FX intervention more fervently and frequently, UK economic data has deteriorated, market risks in China have increased, Australian inflation was much lower than expected and the RBA cut rates. Equity markets in Europe have been relatively weak and political uncertainty in Spain appears to have spilled over into weaker Spanish and Italian sovereign bond markets, even as hope improves of debt relief for Greece.

Spanish leftwing deal spells trouble for Socialists – FT.com

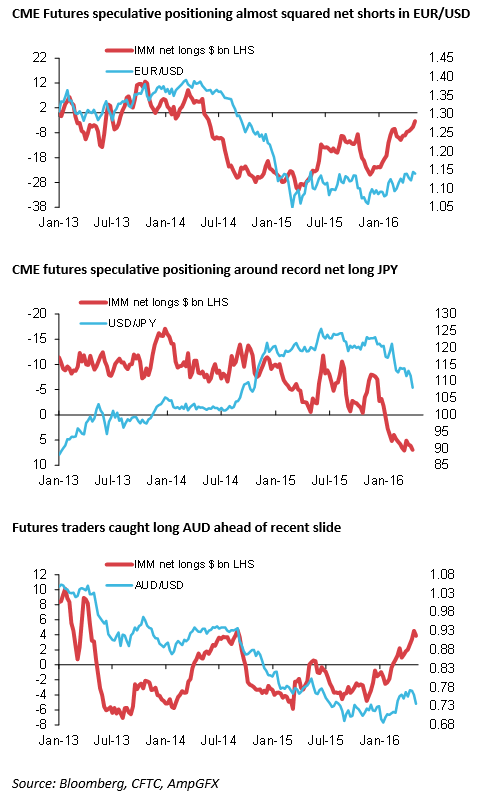

Excessive long USD positions cleaned up

In many respects the market has simply corrected some of the very large gains in the USD over the 18 months or so before in peaked in January, it has rebalanced its positioning back towards emerging and commodity assets after flooding out of these late last year and in January.

Still reason to see rates rising in the USA

The market has adjusted to a much lower expected path for US rate hikes, unless the US economic data were to deteriorate more significantly, it is hard to see a significant further decline in the USD.

There is still solid momentum in the US housing market, unemployment claims have continued to trend lower, Job openings rose to a new high in March, and wage growth appears to have picked up modestly over the last year.

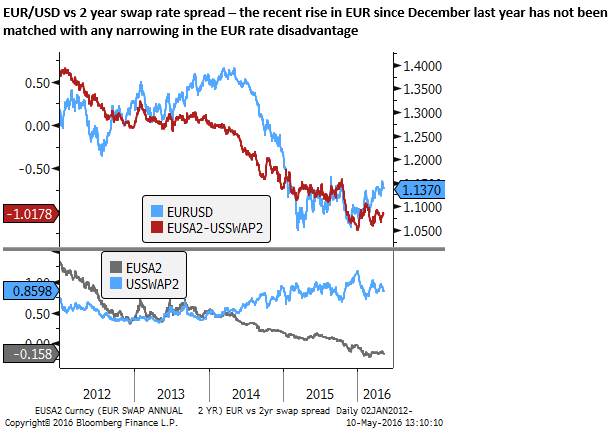

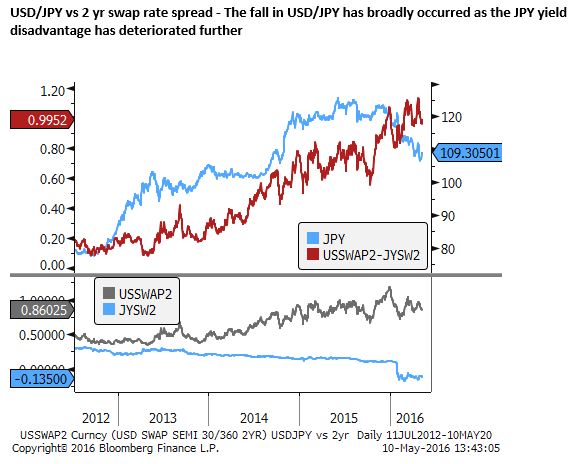

Negative rate policies in Europe and Japan ultimately limit gains in EUR and JPY

The market has probably been shocked by the gains in EUR and JPY this year despite further monetary policy easing including rate cuts and negative interest rate policy. But ultimately, provided the market cannot see an end date for NIRP policy in the foreseeable future, it is difficult to see ongoing strength in these currencies. We may be starting to see the potential for gains now being close to fully exploited.

EUR has trended higher since early December despite cutting rates twice and expanding QE policy over that period. It recently failed to hold above its pre-QE levels (implemented on 22-Jan-2015) in the 1.15s. This was the second failure after it broke above briefly in August last year amidst global market upheaval. The market may begin to see rising above this region as a step too far for EUR.

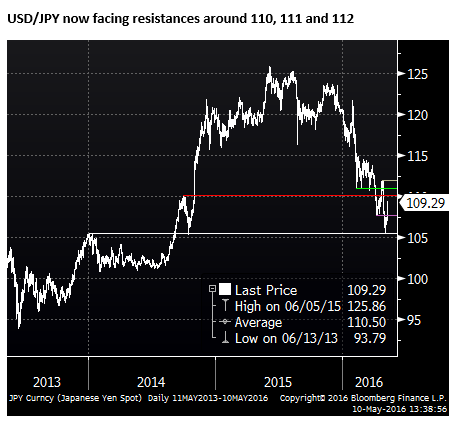

USD/JPY reached and held a key support, key resistance now in play

JPY has proven to be one of the strongest currencies this year. Unlike the EUR, it clearly broke the range lows in the USD/JPY set over 2015. However, it has rebounded strongly from around 105 in the last week. This was the low point in the USD/JPY in October 2014, just ahead of the BoJ’s second wave of QE. And also the high USD/JPY around end-2013. As such this now appears to be solid support for the USD/JPY, especially since the deep fall in the last two weeks has prompted stern warnings of intervention.

The USD/JPY now faces some key tests on the topside. One is in the 110/111 range. 110 was the high that preceding the October 2014 second wave of QE, and the USD/JPY held above 110 on several tests in the wake of its 29-Jan policy easing; eventually falling below after the Japanese PM Abe spoke out against currency intervention in early April. The next key resistance is around 112, where USD/JPY rebounded to on heightened expectations of more BoJ policy easing on 28 April (only to be disappointed).

The strength in EUR and JPY in part relates to their current account surpluses and a lack of overseas investment opportunities. Should all rates and inflation expectations fall globally and drag other countries into more policy easing, these currencies may rise. However, the BoJ and ECB have taken more extreme monetary policy action this year, and Japan may well ease policy further in coming months.

It is not yet the case that recovery in the US has fallen off the rails or that the global deflation risks have increased so dramatically to see a spiral into global deflation fears dominating investor behavior. There are pockets of optimism, oil prices have held the recovery, supporting RUB and BRL. Political risks in Brazil appear to be diminishing.

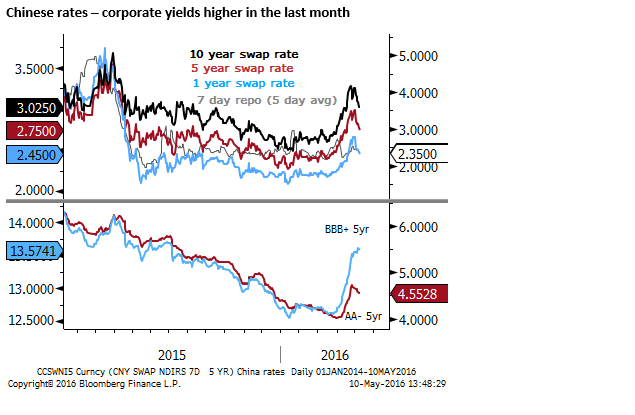

China a downside risk with another policy twist

A clear and present danger for the global economy remains the Chinese economic conditions and financial markets. This continues to fuel uncertainty and keep optimism in check. Recent volatility in Chinese commodity futures markets, a rise in corporate bond yields, a sluggish Chinese equity market and weaker CNY currency trend have spilled over to a moderation in global risk appetite, and some weakness in Asian and commodity currencies. This risk may continue to be a factor undermining these currencies.

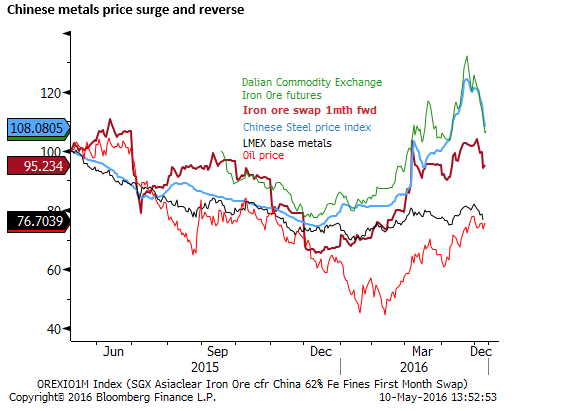

Earlier this year, market focus shifted towards a stronger growth outlook in China as its government sent signals through fiscal, administrative and monetary policy easing, and growth and money targets that suggested it was more intent on achieving solid growth over structural reform. Chinese metals markets bounced sharply on frenzied speculation, property prices rose sharply in major cities, construction activity and production in cement and steel jumped back up. This contributed to a sharp rebound in the AUD and broader gains in emerging markets.

In recent weeks, focus returned to an alarming surge in total social financing, renewing global investor fears of unsustainable growth in already relatively high gross national debt, several corporate debt defaults, a rise in corporate bond yields and a decline in PMI surveys for March, suggesting the overall growth dividend from surging debt is diminishing.

The government policy direction also appears to have responded to excessive speculation in commodity futures markets, fearing another bubble, by increasing margin requirements and greater scrutiny. There has been some renewed crackdown on unregulated lending activities that may have fueled recent house prices gains.

On Monday, the People’s Daily, sometimes thought to project the government policy agenda, ran an article that is reported to have started on page one and covered page two quoting an un-named “authoritative person” saying China needed to put deleveraging ahead of short term growth.

The topsy-turvy policy direction in China is increasing uncertainty. The market may now revert back to a more subdued view of Chinese growth and brace for some tightening in financial conditions. Overall the market is likely to remain wary that China is on an unsustainable path and fear deeper financial and economic fallout, and a lack of clear policy narrative.

Uncertainty may also prevent a significant fall-back in JPY or EUR and may keep the US Fed on hold for longer and curtail USD strength. However, the additional policy easing implemented by the ECB and BoJ, the prospect for more in these countries, and the more balanced investor positioning in their currencies, limited further room for the market to push down US rate expectations, suggests that we may see less risk haven demand for EUR and JPY.

US Presidential election may become an issue in coming months

Donald Trump’s rise to the presumptive candidate for the Republicans greatly increases policy uncertainty in the US. His flamboyant proclamations on a range of policies that at face value seem absurd could undermine confidence in the US economy or generate fear of a change to a more hawkish leader at the Fed.

The fact that Hillary Clinton still can’t throw off the challenge from her far left opponent in the Democratic Primaries, Bernie Sanders, seems to reduce the chances that she could prevail in a national election, even though she is still a firm favorite with odds of around 72% that she will win vs 23% for Trump.

Betting on 2016 US Presidential Election – betfair.com

We do not yet see this as a major factor for currency direction, but it may limit USD gains in the months ahead, and potentially undermine the USD closer to the November election.