USD facing a negative feedback loop, JPY placed to benefit more than EUR

Asian markets have stabilized awaiting fresh US-China trade talks. Chinese policymakers may be more focused on stabilising the CNY and Chinese equities ahead of these talks, helping stabilise Asian markets. Turkish asset markets remain in deep distress, notwithstanding some rebound in the TRL. Italian markets are also likely to display ongoing stress. Combined with fears over US sanctions on Iran Russia and Turkey, these risk factors are likely to prevent a significant recovery in EUR. US bond yields have slipped in recent weeks, and we see increased risk that global market uncertainty generates negative feedback to US asset markets and economic confidence. More stable Asian asset markets, but ongoing heightened global uncertainty, particularly in Europe, may contribute to more sustained gains in the JPY. Trump’s criticism of the Fed, and accusations of foreign currency manipulation may tend to further undermine global economic confidence and support the JPY.

US-China trade limbo

US-China trade policy has moved into a degree of limbo. US tariffs are scheduled to be extended from 25% on $34bn of goods to $50bn on goods on Thursday this week. However, this is well heralded and may not have a significant further dampening impact.

Asia EM currencies and equities have strengthened from lows on Wednesday last week with the help of news that China Vice Minister Wang Shouwen is to visit the US for trade talks at the end of August. This has generated some hope that the US and China may find a way to ease tensions and perhaps delay the proposed US tariffs on an additional $200bn of Chinese goods.

Many will doubt that significant progress towards a trade deal will be reached. Trump and his trade spokespeople continue to suggest that they will not back down from a wide array of demands related to Chinese economic and trade policy.

Nevertheless, the outcome of these talks remains unclear and this may be sufficient to keep the market from making significant new bearish bets for Asia EM for the time being.

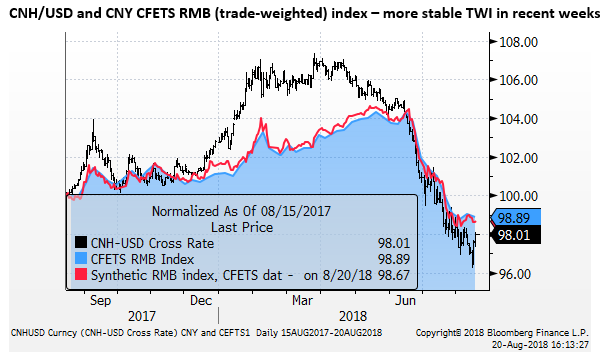

Stabilising Chinese markets

Chinese policymakers also appear to be encouraging more stability in equities and the exchange rate and may increase their support of the Chinese economy through monetary, fiscal and administrative means.

Given the significant underperformance in Asian equities in recent months and the fall in their exchange rates relative to the USD, there is now more balanced risk in the market and potential for some retracement on position-squaring as we await the outcome of trade talks.

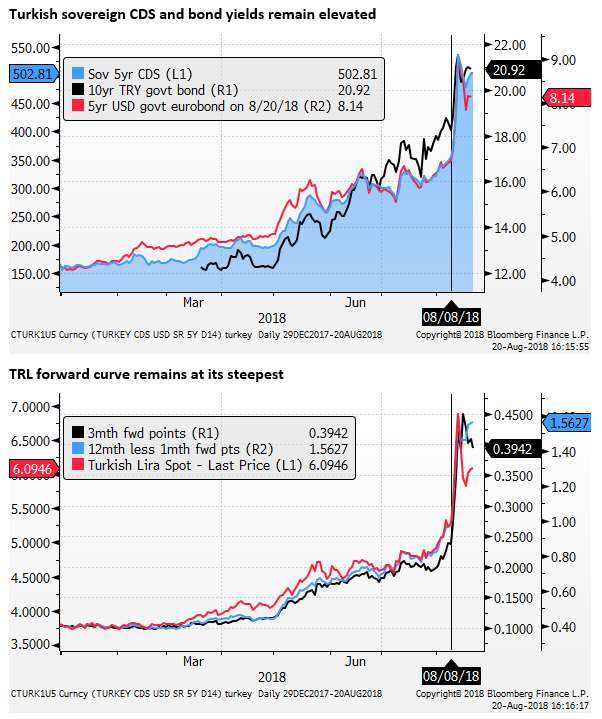

Deep trouble in Turkey

The EUR and EM European currencies have recovered partially from their fall to a low on Wednesday last week led by the currency and financial market collapse in Turkey. Turkish markets are shut this week, but ended last week still in a precarious situation.

While they at least stabilised, they point to much tougher financial conditions for some time in Turkey that is likely to undermine its economic growth significantly. This is likely to have a lasting impact on dampening confidence in European economies and financial markets.

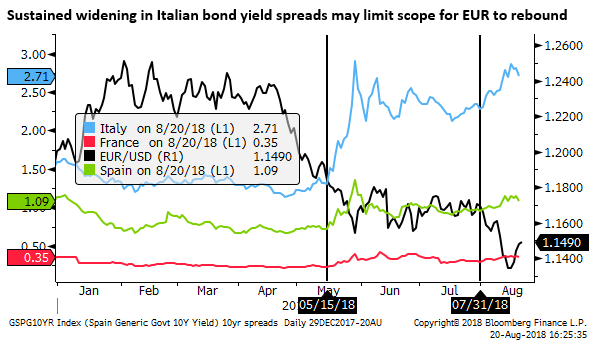

Italian asset markets remain weak

The problems in Turkey have led to contagion in particular to Italian bonds and equities which face their own challenges from its populist government that is generating home-grown instability.

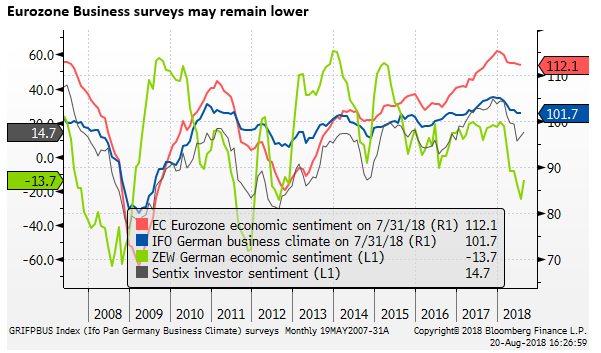

Eurozone economic confidence may remain weaker

The US has stepped up sanctions on Iran, Russia and Turkey and this is probably also contributing to weaker Eurozone economic confidence that has deteriorated significantly this year. The fall in economic confidence in the Eurozone may appear more permanent tending to cap a significant rebound in the EUR exchange rate.

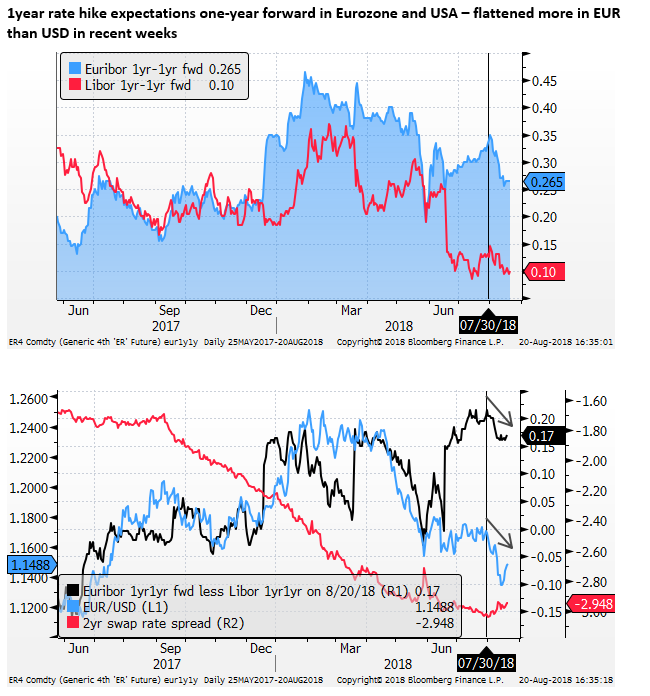

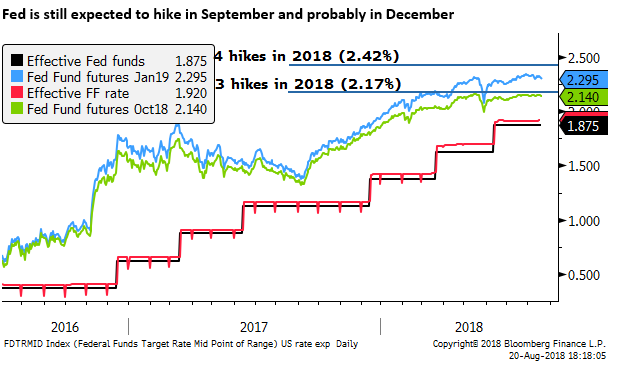

Limited scope for ECB policy adjustment, but plenty of scope at the Fed

However, the case for a further deep fall in the EUR may also be limited by its significant current account surplus and limited room to adjust monetary policy. The ECB is likely to proceed with tapering its QE policies in October and January and rely largely on its rates policy from here on out.

Rate hike expectations have been lowered significantly for the EUR, and there is unlikely to be any further ECB policy maneuvres unless there is a return to EUR crisis mentality.

While this cannot be ruled out, the market may fear contagion to US markets and rates policy that undermines the USD as much, if not more, than the EUR. As we have found in past episodes in the EUR crisis, a risk of default in the periphery does not always lead to capital flight from the EUR.

We need to be aware now of the risks of negative feedback from troubles in the global economy to the US economy and financial markets. Such considerations may result in a weaker USD and a more stable EUR.

Gains in the JPY may be more sustainable

Gains in the JPY on Monday may be more sustainable. The market may begin to look for an alternative safe have to the USD, considering the risk that US rate hikes may be stalled if global uncertainty begins to feed doubts for the sustainability of the US economy.

We also see scope for the JPY to find support if Asian currencies continue to show stability. At times in the last year, JPY has appeared to develop a closer connection with Asian currencies. This left JPY in a confused state at times as it wavered between acting as a safe haven, or following a weaker trend in Asian currencies.

Trump’s currency and rate comments are unsettling

It has not helped the USD on Monday that President Trump has again felt compelled to speak out against the Fed raising rates and accuse China and the Eurozone of “manipulating” their currencies.

The parallels with Turkish President Erdogan’s criticism of his central bank are hard to ignore. Trump does not have a direct capacity to interfere with Fed policy. But his comments increase the pressure on the Fed to justify its position. Should the economy appear to lose even modest momentum, the Fed may face intense broad political pressure to halt further hikes.

Other nations would no doubt reject the accusation that they are manipulating their currencies, but Trump may use threats of increased tariffs or sanctions against other nations if their currencies depreciate further.

The Trump administration has already linked an increase in proposed tariffs on a further $200bn of Chinese goods to a weaker CNY exchange rate. It doubled steel and aluminium tariffs on Turkish imports reportedly because of its currency depreciation.

Such considerations may appear to lessen downside for these currencies. China, in particular, may see stabilising the CNY/USD rate as helping in upcoming trade talks.

To the extent that Trump is willing to increase economic pressure on foreign countries in response to weaker currencies, the recent gains in the USD may be another threat to global growth.

Trump’s currency comments seem to heighten global market uncertainty, and increase the risk of negative feedback on the US economy and in turn the USD. Perhaps not the way Trump would like to see his currency weaken, but his currency talk could work. In any case, it may further undermine global markets and confidence by drawing currency into his trade war.