USD held down by a large risk premium

The failure of the USD to make clearer gains despite near record high yield advantages across a wide range of currencies suggests that there is a sizeable risk premium built into the USD. This risk premium may reflect the high-risk domestic and foreign policies adopted by the Trump administration, the polarisation of the US electorate and likelihood of a split Congress after the mid-term elections, creating a more unstable outlook for the US and global economy.

Directionless currency markets

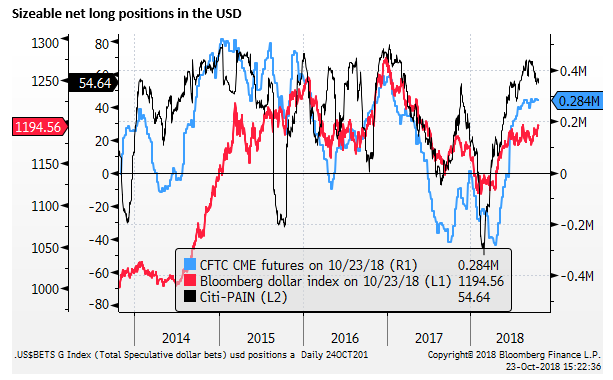

Currency markets remain largely directionless buffeted by short-term trading and position-adjustment. Correlations to equities, rates and commodities are relatively weak. Positioning indicators such as the sum of non-commercial trader futures positions or Citibank Positioning Indicators estimated from currency manager performance results suggest that the market retains a sizeable net long position in the USD.

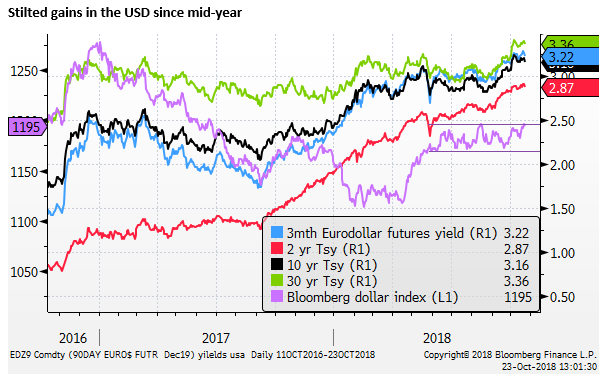

The USD has generally strengthened this year, but it has been a stilted rise with frequent and sizeable set-backs. The Fed has adopted a more assertive policy of hiking rates over the last year or so. US yields have risen to new highs, and the US equity market has vastly outperformed in a bear market for other equities. However, the USD failed to show consistent strength, apart from a rebound in April/May.

The failure of the USD to make clearer gains despite near record high yield advantages across a wide range of currencies suggests that there is a risk premium built into the USD. This risk premium may reflect the high-risk policies adopted by the Trump administration, the polarisation of the US electorate and likelihood of a split Congress after the mid-term elections, creating a more unstable outlook for the US and global economy.

This risk premium may remain high and even increase further into and after the mid-term elections. As such, we cannot be sure that the USD will decisively break higher, in-line with its higher yield advantage and relatively strong economic growth. The onus will remain on the US data and earnings reports to keep punching above their weight; including the GDP report on Friday.

The confused state of the USD in response to recent equity market upheaval reflects the risk that a spillover in weaker global equities to US equities may delay or even reverse Fed rate hikes if the fall in equities becomes severe and persistent.

Global equity markets better reflect global macro trends

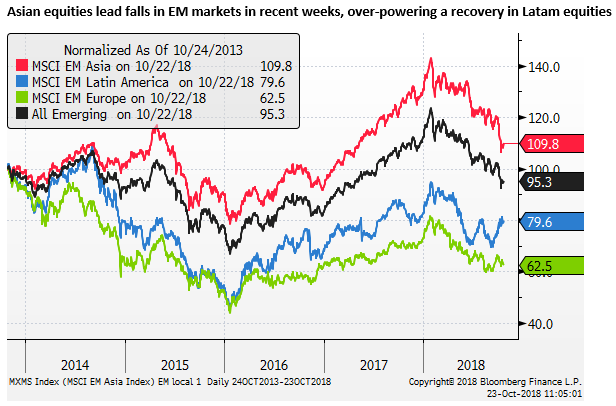

Global equity markets may reflect more clearly the evolving nature of global macro developments. We started the year in a global synchronised economic recovery, and synchronised rise in global equity markets. Despite rising US rates, the USD was weak at the beginning of the year, approaching its lows since 2014 as investors increased their exposure to global markets and unwound currency hedges on Eurozone and UK assets.

In late-January, the bull-market for global equities ended abruptly. At least it did for all equities outside of the USA. Emerging market equities have trended steeply down since this date, and other developed markets outside of the USA have also fallen fairly persistently. The US equity market opened a wide performance gap over most of this year, finally being dragged lower by a weakening global trend in the last month.

Chinese financial system risks

There may be several catalysts for the global equity market sell-off. The deep falls in the Chinese equity market this year may reflect fundamental concerns over the state of the Chinese financial system and the fears for its export sector driven by US trade policy. China has led a fall in global equities in the last month.

There has been much reporting of forced sales of pledged shares in the Chinese equity market in recent weeks; ie. shares pledged by Chinese companies as collateral for loans. This appears to be a symptom of the troubled state of the Chinese financial system. The fact that large numbers of Chinese companies have resorted to such a high-risk form of short-term financing suggests they have struggled to access finance elsewhere.

The Chinese authorities have pulled out all stops to stabilise the market in recent days. This may prevent a financial crisis In China and help underpin global financial markets. However, underlying stress in the Chinese financial system and economy are likely to remain a problem for some time, threatening a resumption of a fall in Asian equities.

Rising dollar funding and tighter liquidity

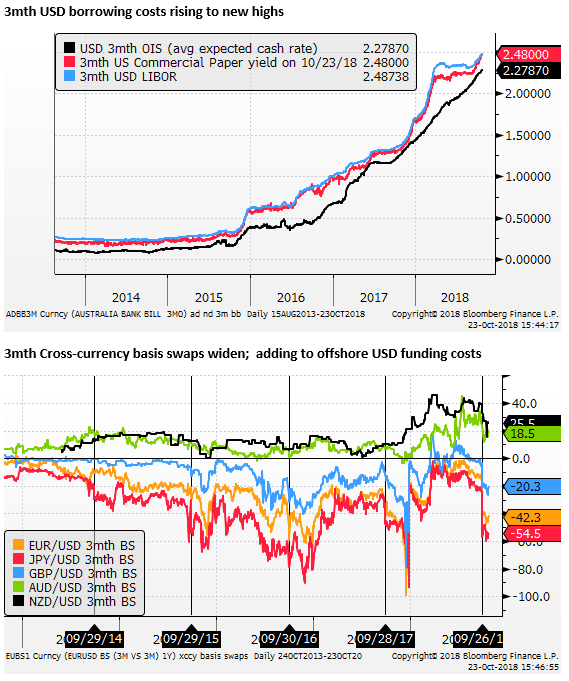

Rising US rates and yields appear to have contribute to funding difficulties for several emerging market economies. USD borrowing costs rose sharply early in the year over and above the expected rise in cash rates (LIBOR spread). It was widely believed that this reflected changes in US tax policy, encouraging repatriation of US offshore corporate earnings and increased borrowing by foreign companies in US short-term money markets. The US Treasury also increased its bill issuance.

The LIBOR spread has narrowed, but now cross-currency basis swaps have widened since end-Q3 making it costlier to borrow USD for many non-US domiciled companies. This suggests there is tightening in liquidity conditions which may reflect stresses in the global financial system from a variety of sources; Fed policy tightening, less offshore dollar assets held by US companies, financial stress in some emerging markets, Italy, Brexit, and bank exposures to troubled assets globally.

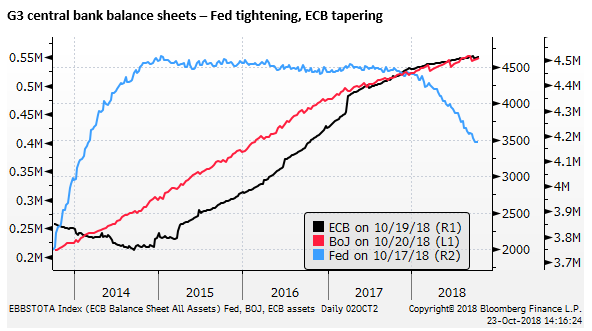

Quantitative Tightening

The cumulative effect of the Fed’s quantitative tightening, net sales of Treasury and agency bonds, may be weighing on global equities.

The ECB has also tapered its purchases and plans to end then in December. This may be contributing to spread widening and weaker asset prices in the Eurozone.

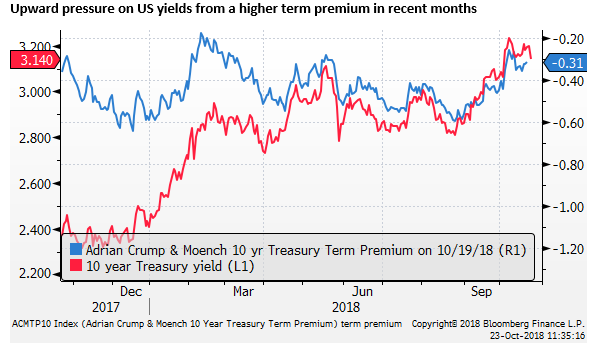

The increased US government fiscal deficit has increased the supply of US government securities and may also be playing a part in lifting USD borrowing costs across the curve.

The Fed’s estimate of the term premium in the US yield curve appears to have lifted in the last two months, accounting for most of the rise to new highs in 10-year US government yields. This suggests that quantitative tightening may be having a bearing on global asset prices.

Geopolitical tensions

Geopolitical stresses on a variety of fronts are also likely contributing to weaker global equities. This includes US trade policy, its withdrawal from the Iran nuclear deal, and a variety of unilateral policy actions that are straining USA relations with several countries. The Khashoggi murder damages the moral authority of the USA after it has staked so much in its relationship with Saudi Arabia.

Populist policy

Populist political trends globally may be weakening public policy and global cooperation building in greater risks for the global economy and financial system. Example include the fraught Brexit process and Italian budget plans. Troubles in several emerging markets this year have their roots in populist policy trends.

Not least this is occurring in the USA, and Trump is moving the debate in the USA ahead of the mid-terms to tougher border protection and other divisive issues that have no economic benefits.

Mid-Term elections

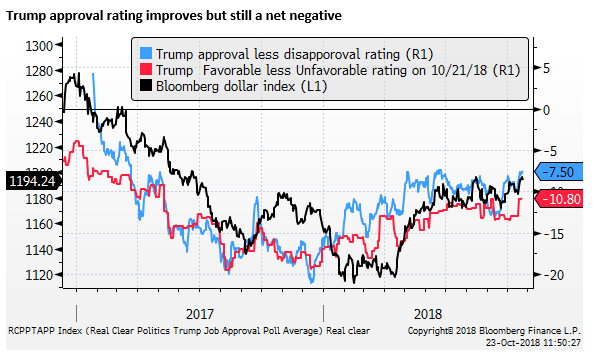

Trump policies have boosted US growth to significantly above its long-term potential, and boosted after-tax corporate earnings, driving a wedge between US and global equity performance. These policies have helped boost his popularity, driving down unemployment and improving consumer and business confidence. They have resulted in higher US rates and a stronger, albeit stilted, USD this year.

However, Trump is still polling net negative ratings of approval. The betting market prices the odds of Democrats taking control of the House of Representatives at around 67% compared to 35% for the Republicans. The spread in these odds has narrowed modestly in the last month, and it is not so large to suggest the Democrats have it in the bag.

Which party will control the House after 2018 midterms? – PredictIt.org

Nevertheless, the odds favour Democrats taking control of the House. This might be expected to contribute to deadlock on new legislation, and may raise legal pressure on Trump related to the Mueller investigation revelations. Trump might be expected to fight back by latching onto populist issues that divide the nation and weaken confidence in Congress to deal with domestic policy challenges.

It is somewhat encouraging for stability in US government that the Republicans are expected to retain control of the Senate by 86% to 15%. This might help avert severe policy battles between Congress and the Administration.

Which party will control the Senate after 2018 midterms? – PreditIt.org

If the Democrats take control of the House, and Congress is split, the market reaction may be muted, but it might help prevent the USD from rising further and ensure it retains a higher risk premium.

Reckless talk of US income tax cuts

Trump has floated the idea of a middle-class income tax cut in the last week. It highlights the reckless nature of the Trump administration. Throwing more fiscal fuel into an economy that is already running at full capacity with a large structural fiscal deficit and relatively high government debt is likely to alarm global markets. A major concern already apparent in many investors minds is that the US will have limited fiscal capacity to cushion the economy in the next downturn, and is over-cooking the economy now, building in financial excesses and laying the groundwork for the next recession.

Attacks of the Fed

Trump is placing the Fed in an awkward position; openly criticising the institution, and attempting to blame it for the recent correction in the US stock market. The Fed is clinging to its credibility and offers a sense of stability for US markets, but the Trump administration policies are building in bigger financial stability and economic risks domestically and globally.