USD punching with one hand tied behind its back

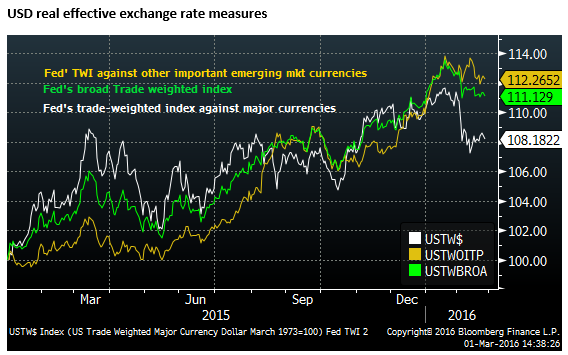

The USD is behaving like it is punching with one hand tied behind its back, struggling to rise even as the USA’s recent inflation data have diverged from that of a host of other countries. One reason is the sentiment expressed by New York Fed President Dudley, worried by low inflation expectations and global market volatility, distracting the market and the Fed from the hard data displaying a rising trend in inflation and wages. In contrast, most other countries are exhibiting falling inflation trends, many of which are still likely to ease monetary policy further; including the ECB, BoJ RBA and RBNZ. Notwithstanding dovish Fed comments, the recovery in global risk appetite has taken the foot off the chest of US yields and the USD yield advantage has improved against many currencies which should tend to support the USD. Comments and action from Chinese officials suggest that they will work harder via both monetary and fiscal stimulus to shore up growth at home and stabilize its currency. This may be helping impart a stronger tone on EM and commodity currencies. But there may be a limit to how much confidence can rebound in China, as it must also continue to address market concerns over major structural deficiencies. And key growth indicators remain weak. The rebound in global asset prices and commodities also appears to be partly a monetary phenomenon, less related to hopes of a recovery in real growth, more of a backlash against fiat currencies. This continues to support gold.

More Racket that Rhythm

There is a fair amount of volatility in global markets that appears to be just that – noise that is hard to make music out of. In some respects we have to wait for the din to calm down so we can distinguish the rhythm.

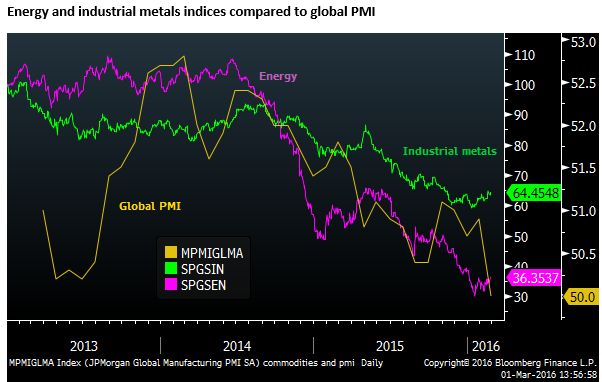

For instance it is hard to reconcile rebounding energy and industrial commodity prices and commodity producer equities with a sharp fall in the global manufacturing PMI to 50 in Feb, signaling essentially stalled global manufacturing, a low in data available on Bloomberg since 2013.

It may be the case that the commodities are so beaten down that they are no longer so responsive to weak global demand indicators.

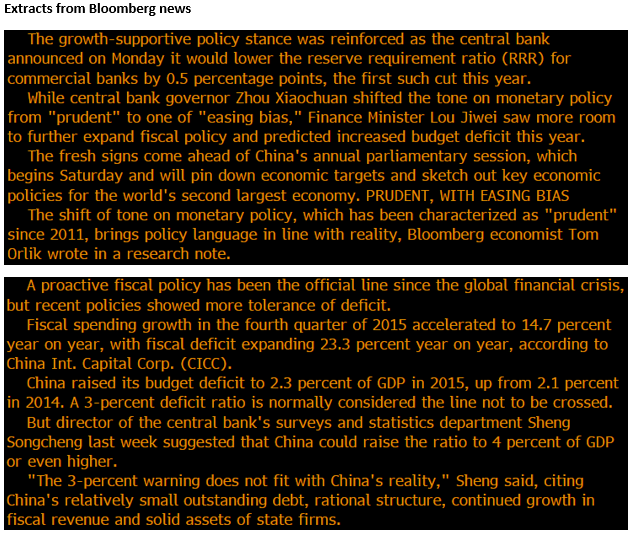

China stimulus

Alternatively it may be the case that the market is anticipating a shift in focus towards greater fiscal and monetary stimulus globally, particularly from China in the wake of the G20 meeting in Shanghai. Comments from Chinese officials suggest that they are now pursing easier monetary policy (they cut the Chinese Reserve Requirement Ratio for its banks) and are preparing to further loosen central government fiscal policy.

The National People’s Congress is scheduled to release its GDP forecasts this weekend along with statements around its policy agenda. Recent news reports suggest it may be paying more attention to boosting growth, stabilizing the CNY and its capital markets.

It is debatable whether a positive mood related to China will stick, given the broader concerns in the market that it has deepening structural problems, including excessive debt and bloated state-owned enterprises, against a backdrop of a persistently slowing economy over recent years, and recent weaker than expected PMI data. Nevertheless the media has been able to draw-out a fresh batch of market commentators dutifully proclaiming that China has a great deal of policy ammunition to deploy to support growth.

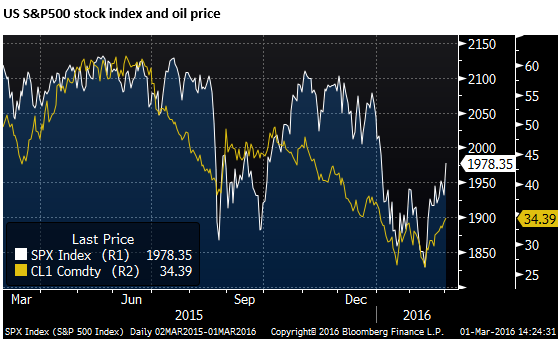

Oil prices rebound alleviates market stress

Oil prices are of course rising less because of greater demand optimism and more because there is hope of a production freeze agreed by key OPEC and non-OPEC countries. Oil prices have been an important driver of global investor sentiment via fears of fallout in high yield and emerging market debt markets, and the banking sector in general. The recent recovery in energy prices (that look more impressive in percentage terms since they are coming from a low base) have helped support global equity markets.

The USD is punching like it has one hand behind its back

Rebounding global equities should imply improving global investor risk appetite, and encourage more investment in emerging markets, and weaker negative or low interest rate currencies. We have seen this to some extent, although the rebound in USD/JPY remains rather muted, and even EUR is holding up reasonably well.

The USD is still punching like it has one hand behind its back, struggling to regain the form it had in 2014 and 2015. Sentiment toward the USD is certainly more mixed this year. Perhaps it is a case of fatigue after reaching multi-year highs in trade-weighted terms.

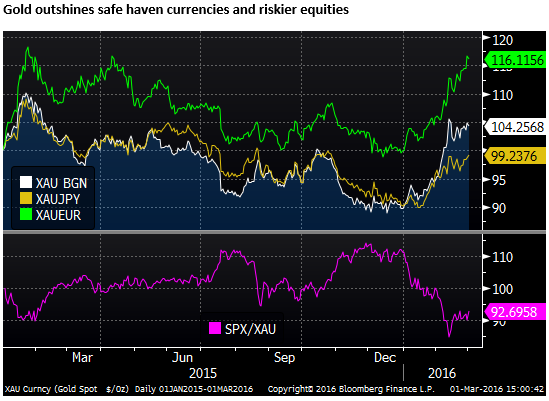

Backlash against fiat currencies

The recovery in equities, commodities, and emerging currencies recently also looks to be something of a global monetary phenomenon. Rather than rising on stronger growth expectations they’re rising on a broad devaluation of fiat currencies. The market doesn’t want to hold any of the negative and low yielding major currencies, all facing a degree of geopolitical instability (Brexit, Trump, Sanders, Greece, Syrian refugees). As such it is being forced back into assets and commodities and emerging market currencies.

Gold, offering its services as an alternative store of value, has noticeably outshone the relatively strong JPY. And the rebound in the US stock market looks far less impressive when measured in terms of gold.

The chart below shows the performance of gold against the USD, JPY and EUR. (It is trending up against all three since the beginning of the year). It also shows the US stock market performance in terms of gold. It has plunged sharply this year and remains well below the lows in Q3 last year.

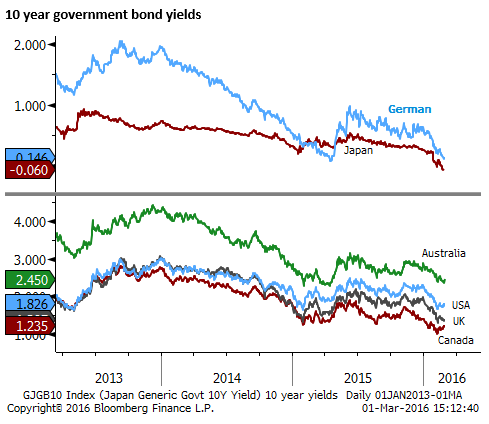

The threat of inflation is not showing up yet

The threat of broad-based currency debasement is yet to force its way into fears of higher longer term inflation; global government bond yield curves have flattened significantly, implying little risk that inflation at some point induces policy makers to unwind current easy monetary conditions.

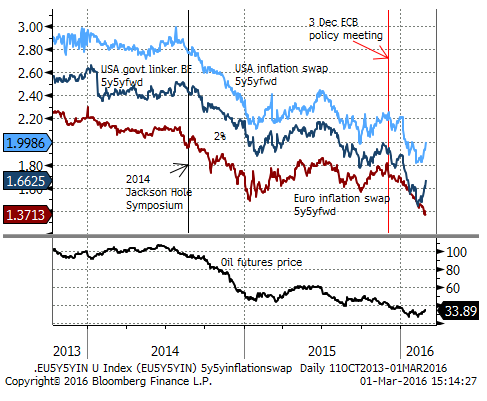

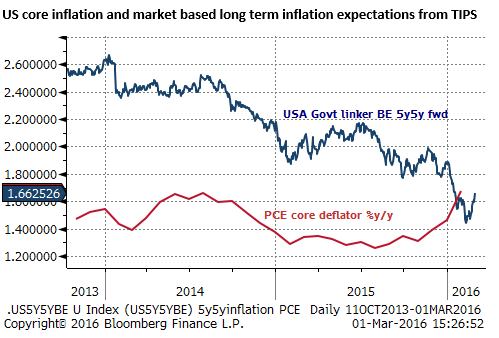

Market-based and survey measures of inflation expectations have been trending down to record lows in most countries. However, as the chart below shows market-based inflation expectations have lifted in recent weeks in the USA.

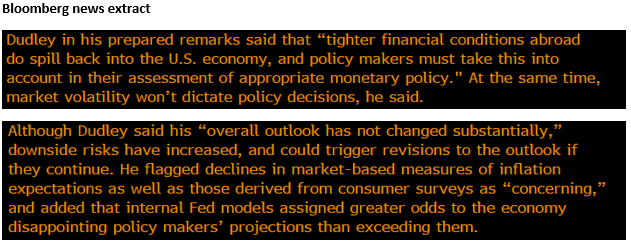

Dudley distracted by recent market upheaval

A factor that may be limiting or delaying a return to strength in the USD is the dovish comments from one of the most influential FOMC members, New York Fed President Dudley, highlighting his concern over falling inflation expectations (notably coming after the much higher than expected core PCE deflator for February).

Dudley and the Fed are floundering around in the greater market volatility and global uncertainty like the rest of us, and thus removing their focus on hard economic data including a clear uptrend in core inflation. This suggests that the Fed is now willing to see inflation run higher and approach target sooner before raising rates. This might dampen the positive influence of this data on the USD.

Gold on the other hand, may be receiving support from higher inflation indicators in the US before the USD, uninhibited by the vagaries of Fed policy, especially if the Fed ignore the hard inflation data.

USA inflation trends diverge

Nevertheless, compared to the EUR, JPY and even NZD and AUD, the USD may soon receive a boost from the rising trend in its inflation data. While US CPI and wages have a rising trend, the Eurozone, Japan, Australia and New Zealand have weak inflation and wage trends.

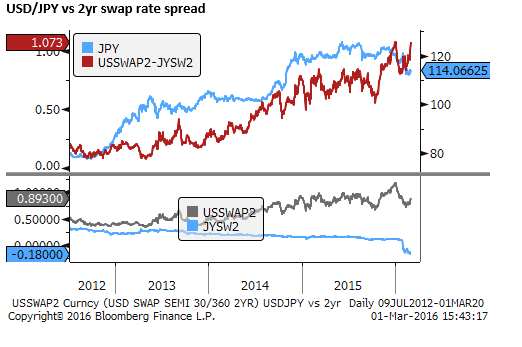

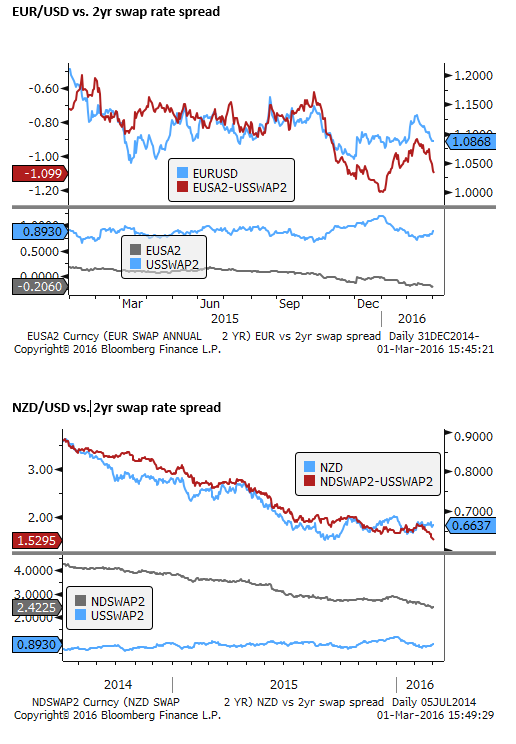

Rising risk appetite lifts USA rates more than the rest

The interest rate markets have moved in favour of the USD again in recent sessions. The recovery in global asset markets has removed the foot off the chest of shorter term interest rates in the US (notwithstanding a dovish Dudley). In contrast, expectations for further policy action by the ECB, Japan, Australia and New Zealand persists.

The charts below illustrate that rising risk appetite has boosted US rates and may tend to support the USD against other major and even a host of commodity and EM currencies that appear much further from generating sustainable inflation.