USD reprieve, but a lot to prove, NZD facing economic and political headwinds

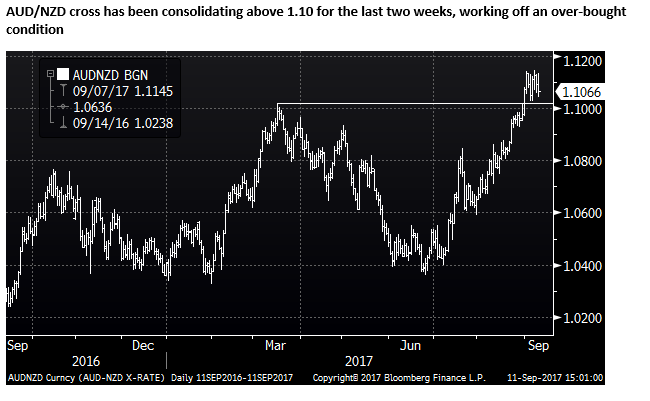

USD had a reprieve so far this week after hitting new lows for the year last week. However, EM currencies, in particular, have held most of their recent gains and retain their uptrend. We see some risk of a correction in EUR from an over-bought condition. After two weeks of consolidation in AUD/NZD, we see upside risks building on a weaker NZ economic performance and political risk, while stronger global growth underpins industrial metals prices and lends support for the AUD. There is every reason to see the Australian labour data this week continuing its improving trend, while NZ housing data may again show a weaker trend.

USD has a lot to prove

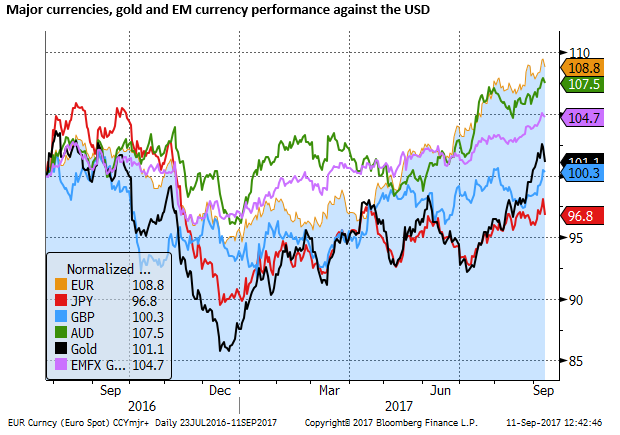

The USD spiked lower last week and rebounded on Monday, but it remains to be seen if it can sustain a period of consistent strength. Its rebound is more noticeable against safe havens – JPY, gold, CHF. It is more mixed against EM and commodity currencies; many are holding on to most of their recent gains.

The main exception is the CNH that is significantly weaker on government rule changes designed to weaken CNY after its recent surge.

The USD has been in a dive all year, led by the EUR and EM currencies. It accelerated lower across the board with safe-haven JPY and gold taking the lead in recent weeks. It is interesting to note that this safe haven demand didn’t help the USD against EM currencies.

The safe haven demand has retreated on the passing of hurricanes and some easing of tensions in North Korea. US Congress and Trump have also had some success with the passage of hurricane relief spending and kicking the debt ceiling a little further down the road.

This has given the USD a reprieve, but it may have limited capacity to turn the trend in the dollar, especially against EUR, EM and commodity currencies.

It is interesting to note that the GBP has also strengthened since its recent low on 24 August, rising more than other currencies against a weaker USD. Some of the Brexit related fear may be easing.

Immediate fear in the US has eased (Hurricanes, NK, debt ceiling), but broader uncertainty remains high (Fed ambivalence on rate hikes, Congress still has to content with DACA, a wall, tax policy, and debt ceiling, and Trump remains erratic). The Hurricane aftermath is a near term uncertainty for the economic outlook.

In the mean time, global growth confidence continues to support the case for EM currencies that remain on a solid improving trend.

EUR may be more vulnerable to a correction

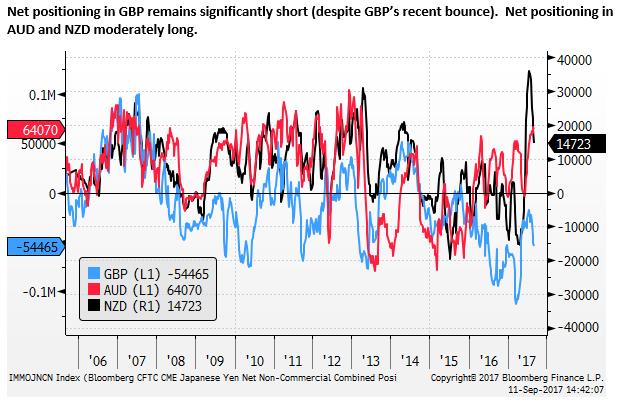

Perhaps the USD can retain a positive bias near term from an oversold condition. The recent EUR/USD trading pattern suggests some downside correction is possible. It has lost its leading status in the market in recent weeks, with EM and commodity currencies holding their own, and in some cases taking the front running. Its RSI momentum indicator is showing divergence from the rising EUR/USD spot trend, a sign that it may be over-extended. The CFTC position data shows traders are at their longest net position since 2007.

The ECB lowered its inflation forecasts somewhat in response to a higher EUR. This is likely to result in a more gradual taper. The market tended to dismiss the ECB warnings related to the high exchange rate last week, but they could tend to cap the EUR near term. If upside seems more limited, short term traders may get nervous and look to take profit.

NZD batting weaker data and political risk

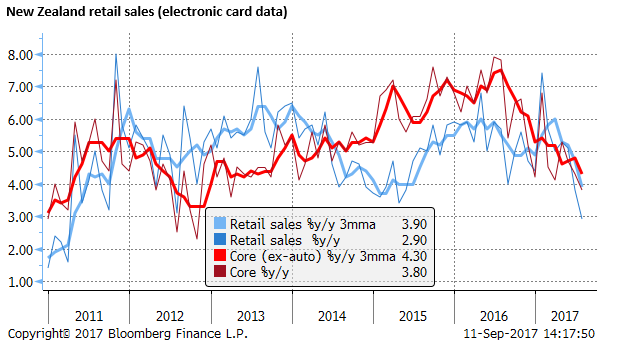

In data on Monday, New Zealand retail sales continued their declining growth trend since around mid last year; core sales have slowed from 7.9%y/y in June-2016 to 3.9%y/y in July.

The NZ economy may still be operating around trend, but it has come off the boil and the housing market has been weaker than expected in the last year. Housing data due this week may continue to show weakness.

The election looms as a risk for economic confidence. A hung parliament seems the most likely result on 23 September. Horse trading with NZ First being courted by the major parties for support is likely to follow, creating a sense of vacuum in leadership. NZ First has run on an anti-immigration agenda, including tighter restriction on foreign investment in housing.

Some of this political risk may now be priced into the NZ. However, uncertainty over the make-up of the next government and how well a potential coalition can work together threatens a more prolonged period of uncertainty, dampening economic confidence and the NZD. There have also been suggestions that the Labour party would like to tinker with the RBNZ mandate to broaden its focus from inflation.

NZD has been one of the weaker performers in the EM/commodity currencies space in the last month. It recovered some lost ground in the broader global uncertainty last week that encouraged some general position squaring. However, we may again find the NZD languishing in the coming weeks.

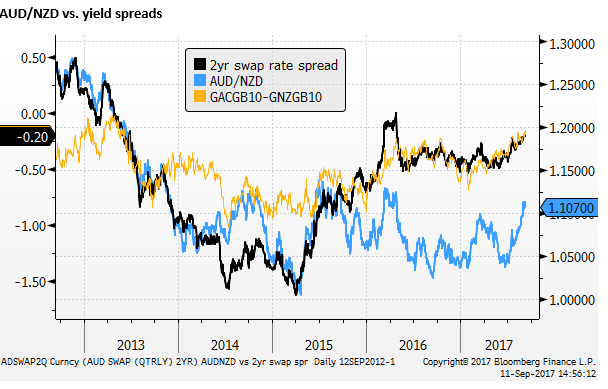

AUD/NZD may resume rising trend

We see AUD as a good foil against which to reflect NZD downside risk. The AUD/NZD yield advantage has improved to around its high since May last year on 2 yr swaps and to a high since 2013 on 10-year government bond spreads.

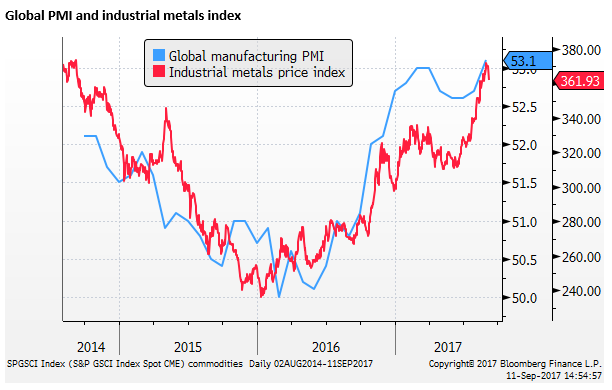

Strength in industrial commodity prices tends to support the AUD. While these fell somewhat last week, they appear to be supported by stronger global indicators such as PMI data and export growth.

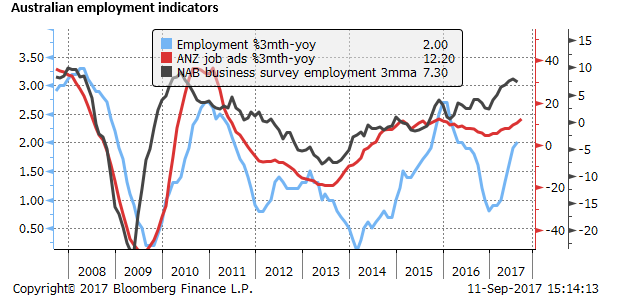

We see the odds favouring another solid Australian employment report; job ads accelerated to 13.3%y/y in August and business confidence remains at a relatively high level.