USD topping out, Opportune for RBA cut

The accelerated broad fall in the USD cannot be ignored and is consistent with recent moderation in USA activity. It may be a bit oversold near term, but the focus should be to sell rallies for the time being. The Australian employment report was ho-hum and the RBA may see November as an opportune time to give the economy another shot in the arm and prevent a rally in the AUD.

USD topping pattern

The USD Bloomberg index against 10 leading global currencies fell sharply breaching recent lows, the low in Sep, and closed at a low since July. It is down 2.4% from recent highs only two weeks ago, after making a double top. It may feel a bit over-sold on a short term basis, but this does not look like the time to be dipping the toe to buy USD. The chart pattern may be exhibiting a significant turn of trend and the mood on the street is probably not bearish enough to assume the worst is priced in for the USD.

USD index against 10 leading currencies

Source: Bloomberg

The US rates market also capitulated overnight with weak retail sales and PPI and a profit downgrade from an economy bellwether, Walmart. The US Beige book was also less strong that the previous one, consistent with an economy that has lost some broad momentum, albeit still growing modestly. That does not appear to be enough to regenerate thoughts of US rate hikes. The labour market still appears to be tightening, according to the Beige Book, and there still are some nascent wage pressures. But the risk is that these ebb and take the pressure off the case for higher rates for a more sustained period. The bias on the street now may be to sell USD rallies against most other currencies.

Even though the US economy appears to have lost momentum, emerging market currencies were broadly stronger, apparently getting more solace in recent weeks from the prospect of a longer delay in a potential rate hike in the US that then may help sustain its modest USA recovery.

There are a multitude of US housing data out next week. This part of the economy appears to be performing solidly and the Beige Book concurred. So we might expect this data to show better results. But at this time it is hard to see housing triggering renewed expectations for a rate hike within the next three to six months. As such, it may do less to support the USD than EM and commodity currencies.

RBA may see November as opportune to cut rates

The Australian labour data today was unimpressive, suggesting at best that the trend for unemployment is stable over the last year, but stuck significantly above neutral. This may start to put pressure on the RBA to increase efforts to boost growth again.

Even though domestic activity has shown broad signs of improvement recently, the news that Westpac plans an independent hike in its standard variable mortgage rate suggests that macro-prudential guidance over the last year is starting to pay-off, and may open the door a little wider for the RBA to lower its cash rate again in coming months.

The fact that the evidence in the USA is leaning against a hike for the next few months may encourage the RBA to move ahead with a cut of its own to prevent the AUD rising. It would probably prefer the currency to remain in the low .70s and would not fret below 70 given the low wages pressure.

While recent momentum in the economy does not pressure the RBA to cut next month, November would be an opportune time, coming after the Q3 inflation data, and in the same week as its quarterly Statement on Monetary Policy. If the RBA sense that the economy could do with another shot in the arm there is no better time to proceed. The market will look to the RBA financial Stability Report on Friday for any possible hints that it may cut in November.

On the other hand, recent trend in New Zealand suggest they should hold steady for the time being. Its housing market has resumed extraordinary strength, suggesting macro-prudential steps taken around mid-year are not biting, and recent data releases have generally improved. However, the RBNZ Governor is likely to jawbone for lower rates and a lower currency after its recent rebound.

In the news

- Walmart shares fell by after it announced a profit warning

- New Zealand government report an operating surplus for the year ending June-2015 of 0.2% of GDP, the first since 2008, better than previous guidance for a small deficit.

- Westpac Bank announced plans to raise its variable mortgage lending rates by 20bp from Nov 20. Macquarie bank economist says this “all but seals the deal on a Nov RBA rate cut”. Goldman Sachs’ Australian economist Tim Toohey said on Wednesday a 25 basis point cut to the cash rate, to 1.75 per cent, at the RBA’s November meeting was now “highly likely” and a “strong case for a further rate cut in early 2016” could also be made, while other economists and analysts also adjusted their outlook for monetary policy. (AFR)

What they said

- The New Zealand Government may bring forward $2.5 billion of tax cuts scheduled for 2017 after recording its first surplus, Finance Minister Bill English says.

- RBNZ Governor Wheeler “Recent economic indicators have been more encouraging. Some further easing in the OCR seems likely but this will continue to depend on the emerging flow of economic data. At the same time however, we remain conscious of the impact that low interest rates can have on housing demand and its potential to feed into higher price inflation. It is important also to consider whether borrowing costs are constraining investment, and the need to have sufficient capacity to cut interest rates if the global economy slows significantly.” (plenty of caveats here)

Economic news

- Australian labour market softer. Jobs fell 5.1k, weaker than +9.6K expected. The unemployment rate was steady at 6.2% as expected. Full time jobs fell 13.9K, part-time jobs rose 8.9K. Jobs growth the previous month in Aug were revised up slightly from 17.4 to 18.1K. Jobs growth has averaged 17.4K for the last three month, the ABS trend measure is +12.4K per month.

- The unemployment rate is up from around 6.0% in May/June, to be back around the highs around the end of last year and early this year. The trend may be deteriorating a bit, but is around stable for the last year, still regarded above neutral seen closer to 5.0%.

- Australian vehicle sales jumped5%m/m in Sep to be up 7.7% y/y. the trend.

- New Zealand PMI firmed from 55.1 to 55.4 in Sep, recovering from recent lows of 52.0 in April and May.

- New Zealand consumer confidence firms from 110.8 to 114.9 in Oct, up for a second month from the low for the year in Aug, still well down on levels around 125 earlier in the year, still modestly below the long run average.

- USA Retail sales weak. Bloomberg analyst notes that the control group (excluding food, autos, building materials and gasoline), a direct input to GDP, was running at an annualized 5.4% in Q3 prior to the result on Wednesday, but with the weaker Sep outcome and downward revision to August it is now at 4.2%. Not a disaster, but significantly below expected.

- Total US retail sales rose 0.1%m/m, and 2.4%y/y. Ex-autos they fell 0.3%m/m and rose 0.8%y/y, so autos are significantly contributing to spending. The control group fell 0.1%m/m and rose 2.9%y/y.

- USA PPI weak. Ex food and energy down 0.3%m/m and +0.8%y/y, below +0.1% m/m and +1.2%y/y expected

- USA Beige book weaker. Continued modest expansion in economic activity during the reporting period from mid-August through early October. Consumer spending grew moderately in the latest reporting period. Most Districts reported that non-auto sales grew at a modest or moderate rate, while vehicle sales generally grew more strongly; tourism across the nation was mixed. Manufacturing turned in a mixed but generally weaker performance during the latest reporting period, with a number of Districts noting adverse effects from the energy sector. Both the housing and commercial real estate markets improved since the last report. Labor markets tightened in most Districts, with some reports of labor shortages–particularly for skilled workers. Wage growth was mostly subdued, though there were scattered reports of increased wage pressures. Prices remained fairly stable across the nation (unchanged on labor, wages and prices from the previous Sep BB).

- Eurozone industrial production fell5%m/m in Aug, although the decline in energy production accounted for much of that. July was revised up from 0.6% to 0.8%m/m. Overall showing a flat modest trend

- UK labour data solid as expected. UK unemployment rate fell from 5.5% to 5.4%, a bit stronger than 5.5% expected in the three months to August from the three months to July. The employment gain was a solid 140K as expected over the same period, up from 42K previously. Average weekly earnings rose 3.0% 3mth-yoy in August, slightly below 3.1% expected, up from 2.9% 3mth-yoy a month earlier. Underlying wage growth measures are around the same low 3% mark, a solid outcome suggesting the labour market is contributing to inflation pressure, perhaps more so that in the USA.

- China CPI 1.6%y/y in Sep, weaker than 1.8% expected, down from 2.0% in Aug. Non-food CPI fell from 1.1%y/y to 1.0%y/y, a low since May. So most of the fall appears related to food.

- Australian monthly consumer confidence firms from 93.9 to 97.8 in October, reversing much of the fall in Sep, still below the long run average, but somewhat above the average for the last 18 months.

- Singapore GDP a bit firmer than expected at 1.4%y/y in Q3

On the Radar

- USA CPI, Feds Bullard, Dudley & Mester

- Canada House prices, existing house sales

- Indonesia Trade balance and rates policy decision (no change expected)

- Singapore Retail sales

- Philippines Overseas Remittances

- South Korea rates policy (no change expected)

Later this week

- NZ 16 Oct CPI

- 16 Oct – Financial Stability Report

- Japan 16 Oct – BoJ Gov Kuroda speaks in Tokyo

- USA 16 Oct – IP/CU, JOLTS, UMCC

- Canada 16 Oct – Manufacturing sales

- Eurozone – 16 Oct TB and CPI final

- UK 16 Oct – BoE Kristin Forbes speaks at a Brighton Summit

- Singapore 16 Oct – Trade balance

- India 16 Oct – Trade balance

- Malaysia 16 Oct – CPI

Further out

- China 19 Oct – Retail sales, IP, FAI, GDP Q3

- Australia 20 Oct – RBA minutes

- Australia 28 Oct – CPI

- Australia 3 Nov – RBA rates policy

- Australia 5 Nov – RBA Governor Stevens speaks

- Australia 6 Nov – RBA Statement on Monetary Policy

- Japan 21 Oct – Trade balance

- Japan 29 Oct – IP

- Japan 30 Oct – Employment, Household spending, CPI, BoJ policy and semiannual outlook report.

- USA 19 Oct – NAHB Housing market index

- USA 27 Oct – Durable goods orders

- USA 28 Oct – FOMC

- USA 29 Oct – GDP Q3

- USA 6 Nov – Payrolls

- Canada 21 Oct – BoC meeting

- Eurozone 22 Oct – ECB

Markets on the Move

- The USD Bloomberg index against 10 leading global currencies fell sharply breaching recent lows, the low in Sep, and closed at a low since July. It is down 2.4% from recent highs only two weeks ago, after making a double top, suggesting a downtrend may now ensue

- NZD new high since 30 June. AUD/NZD down sharply to lows since early-June.

- USD/JPY trading at low end of range since 24-August. EUR/USD above peaks in May, June and Sep. Only below spike high in August, exhibiting rising trend since low in May.

- ZAR rose strongly reversing Tuesday’s loss to make new high since 18 Sep. Other EM currencies stronger near their recent highs vs the USD.

- USD/KRW at low since 14-July.

- SGD strengthened solidly after the MAS policy statement on Wednesday and continued to gain with the USD slide offshore. USD/SGD at a low since 4-Aug.

- Gains in MYR, PHP and IDR are less convincing at this time after a recent pick-up in volatility.

- CNY was relatively stable in offshore markets, failing to extend gains against the USD, despite its broad declines against other currencies.

- Oil was little changed after its recent falls, despite the weaker USD, back below $50 per barrel on the Brent contract, back in its stable range over September, reversing gains earlier in October.

- Copper recovered losses in the LME session, to be slightly firmer. Off lows in late September, stable in recent sessions, but weaker against other currencies in light of the recent falls in the USD.

- Thermal coal contracts in China fell to new long term lows on Wednesday

- Iron ore futures edged lower in recent sessions to low side range for the last week, around mid-range since slide to lows for the year in July and recovery through Q3.

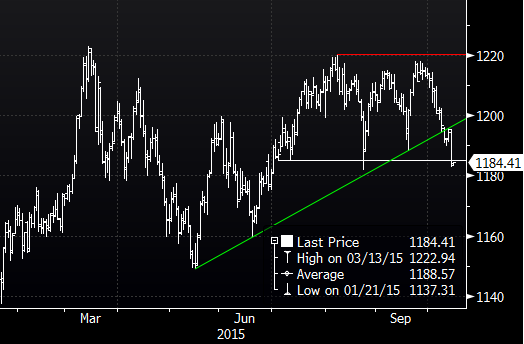

- Gold rise in line with a weaker USD to a high since 22 June.

- US 2y and 10 year yields fell by around 7bp on Wednesday. 2yr swap rates are at a low since January, falling rapidly over the last month. Yield compression vs EUR and JPY, and all other currencies is contributing to a weaker USD trend.

- UK 2y swap rates are down 4.5bp on Wednesday, also falling sharply in recent months, but not as much as the USA.

- Australian, New Zealand and Canadian rates have been much more stable than US rates over the last month, and again in recent sessions. Australian two year rates fell sharply on Wednesday morning on the Westpac announcement, but were relatively stable offshore as US rates fell. New Zealand rates are down more in-line with US rates offshore with 5 yr govt bond yields down 5bp, although 2yr swap rates are little changed and flat over the last month. Australian 2yr swap rates are down 7.5bp since Tuesday, around the low in the August global market upheaval and low in early April. Nevertheless, both AUD and NZD yield advantages have firmed over the last month with a rapid fall in US rates.

- US stocks down 0.9%, turning from the top of the range since 20-Aug after a solid rebound in the last two weeks. However material sector stocks firmed on Wednesday, bucking the broader trend. Metals and mining sector stocks rose 1.3%, US steel sector stocks firmed 0.2%. Home-building stocks fell relatively sharply by 3.1%, especially considering lower US yields, the sharp reversal in the gains in weekly mortgage applications may have hurt sentiment.

- Indonesian stocks fell sharply by 3.2% on Wednesday, after its strong recent rebound. Philippine equities were also relatively weak for a second session down 1.2%. Chinese equities are moderately weaker in recent days.