USD and US fiscal policy off-the-rails

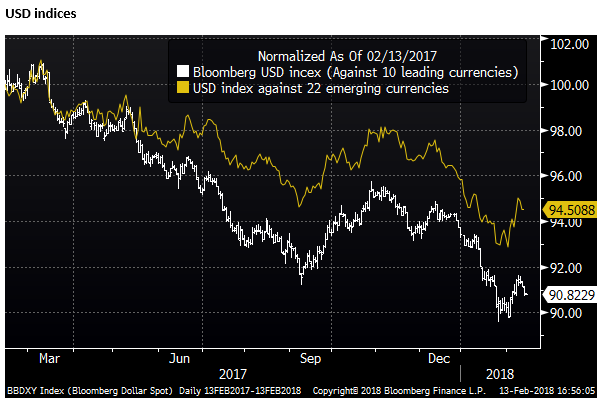

The tepid recovery in the USD, in spite of higher US yields and improving economic outlook, raises the question – is the market becoming spooked by the worsening US fiscal outlook. Normally the market would not question the US Treasuries capacity to borrow. And it may be considered heretical to see the USD as other than a safe haven. However, this US fiscal expansion is especially risky, coming near the end of the business cycle, closer to a steepening demographic fiscal slope, and politics more partisan than ever. It is hard to imagine how Congress could cope with even a minor economic or financial crisis.

Tepid USD Recovery

The dollar’s recovery has stalled and reversed a bit in recent sessions, especially against the EUR and JPY. Some of the recent fall in the dollar, especially against the JPY, is related to increased volatility and uncertainty in asset markets as the equity market gyrations remain elevated.

However this volatility should be supporting the USD against emerging and commodity currencies, and perhaps also against the EUR, where CFTC speculator positions are around record longs. Nevertheless, emerging market and commodity currencies are mixed to firmer.

It appears that the USD is more easily reverting to a bearish trend, despite ongoing firming it its yield advantage.

Two ways to look at fiscal expansion

The weak USD performance suggests that the market may be expressing concerns over the weakening in fiscal discipline in the USA.

On the one hand, the tax cuts and increased spending agreed by Congress, and embedded in the White House budget should boost economic confidence, raise inflation expectations, lift yields and support the USD.

Trump’s Budget Proposal Projects Big Jump in Deficits – WSJ.com

On the other hand, the expansion in fiscal spending may raise fears that the government will not be in a position to repay its debts over the long-term, and result in a risk premium demanded by investors in US bonds that can result in both higher yields and a weaker currency.

Historically, the safety of US bonds has rarely been questioned, and they are considered one of the most reliable havens in times of global uncertainty. But in the current political environment, confidence in Treasury bonds may be slipping.

Key concerns over this US fiscal expansion

A key concern is the procyclical nature of government spending in the USA. More than any other country, the USA is expanding its fiscal deficit right at the time when its economy is close to full capacity and employment. Apart from generating greater economic uncertainty over how the economy and financial markets will absorb this, it generates a high risk that the USA will have less space to use fiscal policy to supplement economic growth in the next economic downturn.

A second concern is the ease with which Congress has been able to agree on tax cuts and spending, and the apparent disappearance of once ardent fiscal hawks, particularly in the Republican Party. Under the Trump doctrine, the imperative is to increase spending on the military and infrastructure, after cutting taxes.

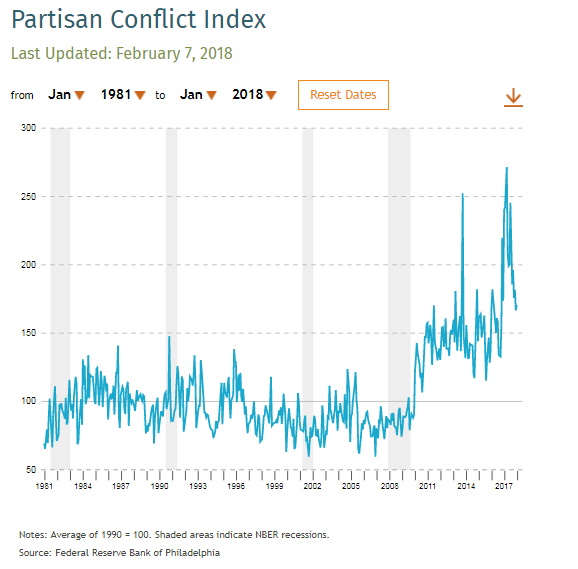

A third concern is the increasingly partisan nature of Congress which makes the chances of finding savings by cutting spending on social programs or healthcare very unlikely. Partisanship increased sharply in the Obama years and has increased to a record under Trump. This will make it even more difficult for Congress to deal with another crisis adequately. It is hard to imagine the US government dealing with a financial crisis with anything like the speed and force that it mustered in the 2007/08 period.

Partisan Conflict Index – PhiladelphiaFed.org

Fourth, the demographic slope in the USA is steepening faster and the focus of government and politicians on addressing the embedded rise in spending on entitlement programs and healthcare has become almost non-existent.

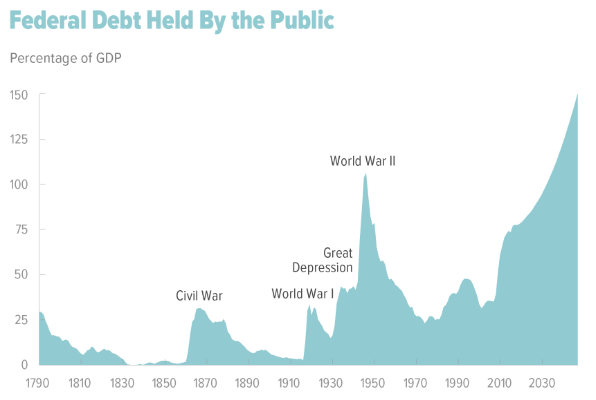

The 2017 Long-Term Budget Outlook – CBO.org

An Update to the Budget and Economic Outlook: 2017 to 2027 – CBO.org

The US Administration and Congress have assumed that they can borrow without consequences, such as higher borrowing costs, a weaker currency, inflation, market volatility, and crowding out of private financing. Part of this complacency is born in the recent history of low and stable bond yields, and assumptions that it will continue. But of course, the market is beginning to see risks that yields will not be so stable or low in coming years.

The reasons for a weaker USD since 2016

The expansionary fiscal policy in the Trump Presidency could have been viewed as a bullish development for the USD. It was in the first month after the election in November 2016, but this has steadily faded.

The fall in the USD may reflect a number of other factors, including improving conditions in other major countries, in particular, the Eurozone in the last year, and a shift in its QE policy. It also may reflect the elevated starting point for the USD, and a reversal of capital flows from the USD to the Eurozone and EM markets.

You could argue that the USD rose towards its peak in 2015/2016 as the market built in the anticipated reversal of US monetary policy accommodation, other major countries further expanded their nontraditional monetary policy easing, and the market sought safety from financial and political uncertainty in Europe, China and several other large emerging economies.

In the last year or so, these factors have been in reverse, weakening the USD. The policy tightening in the US was, arguably, largely anticipated, and failed to support the USD.

The Trump presidency could have done more to support the USD, with the promise of fiscal expansion. But, if anything, it only served to inject more political risk by first delaying tax cuts and infrastructure spending behind a failed bid to revamp healthcare, generating division in American society over a range of social policy issues, battling against the Mueller investigation, and courting controversy on a constant basis.

Negative factors for the USD should be fading

Arguably many of these negatives for the USD should be fading. The USD is no longer clearly expensive; a lot of the capital that had sought safety from Europe and EM has returned. The US government has passed major tax cuts. Congress has passed a two-year funding bill and suspended the debt ceiling for over a year. The market has got used to White House controversy, and the US economy has strengthened. The Fed has somewhat over-delivered against market expectations of policy tightening, and the US yield advantage has widened significantly.

Trump’s net disapproval polls have eased somewhat since the passage of tax reform. Divisions in Congress on immigration policy appear to be narrowing, and Trump has become more dogged in his pursuit of Americal First Policies that may serve to support the US economy; including trade policy while spruiking the benefits to US business from his tax policies that incentivize companies to move more of their operations onshore. Begrudgingly there may be an acceptance that his administration may be good for demand and growth in the US economy.

As such, there are reasons to see the USD stabilize or even recover this year. Perhaps it just needs time to shake of the bearish mindset that has been established in the last year.

Fiscal policy off the rails

However, this more positive scenario for the USD is countered by the fact that Trump and Congress are taking more risks with government financing. Trump may have turned the corner in terms of his performance, but he remains a highly divisive figure. USA Political uncertainty is heightened by the proximity of the November mid-term elections. And the partisan trend combined with the new proclivity for fiscal expansion suggest that the US government is clueless to the risk of a fiscal crash and incapable of fixing the problem.

Few people will argue that the USD or Treasury bonds should be considered other than safe-havens. It is difficult to argue that its decline, therefore, should be related to risks to government finances. Such arguments are more typically applied to emerging market economies.

However, such concerns may account for a further decline in the USD towards the cheap-side of its long-run average levels, or at least keep the USD from rising in response to rising USA yields as the market sees reasonable growth without fiscal and political risks in other major or EM countries.

As we have discussed in previous reports, a weak USD tends to raise inflation expectations in the US and may contribute to higher US yields. If the USD remains hemmed at low levels or falls further because of political and fiscal risks, then it will tend to place more upside pressure on US yields.

The optics of a weak USD in spite of higher US yields may begin to generate increasing uncertainty over the US and global equity markets. It will place increased pressure on the Fed to raise rates faster, either to control inflation or to bolster the USD and counter the notion that a higher risk premium is being attached to US Treasury bonds. This itself would inject more pressure on Government to address the elephant in the room (its budget deficit), something that it appears largely incapable of doing.