Weak Taiwan orders reflect weaker Asian demand, a drag on regional currencies

Weak Taiwan export orders and industrial production data suggest Chinese and Asian demand remain weak. A steady depreciation in the Chinese currency over the last month may also be symptomatic of a weaker economic growth trend and steady private sector capital outflow; this may prove a persistent drag on Asian Pacific currencies, including the AUD. UK rates are starting to behave more like Euro rates and the GBP/USD 2yr swap spread has turned negative for the first time since 2006, suggesting further downside pressure for GBP. RBA’s Glenn Stevens may sound more dovish, especially with respect to the desire for the AUD to reflect weaker commodity prices, creating downside risk for AUD.

RBA Stevens may talk down AUD

With mining sector and Chinese demand indicators deteriorating significantly in the last month, we think that RBA Governor Stevens may turn more dovish in his speech late today in Australia; specifically with respect to the exchange rate.

He may still express confidence in the services sector and talk about the significant progress in transitioning through the mining sector down-turn. But he may also emphasize that the exchange rate needs to continue to adjust to weaker commodity prices to ensure this process continues smoothly.

Weak CNY and Taiwan data

Consistent with a weaker trend in Chinese economic growth, CNY onshore and offshore exchange rates have been on a steady weakening trend since early-November, reversing much of its recovery phase since the sudden devaluation in August. This trend may influence other currencies in the Asia Pacific region, including the AUD.

Taiwan export orders and industrial production data continue to show a significant pace of deceleration in activity from a year ago. Demand from the US has picked up, but orders from its main trading partners in Asia remain weak.

UK rates fall below US rates

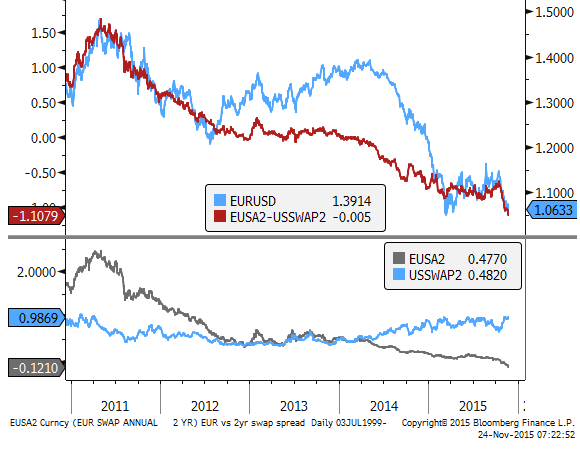

UK interest rates have been dragged down, it appears by the weaker trend in EUR rates, significantly lagging the recent rebound in US interest rates since the October FOMC meeting, and more recently drifting lower as Eurozone rate have fallen to new lows. The result is that 2yr swap rates in the US have risen above UK 2yr swap rates for the first time since 2006, suggesting more downside risk for GBP/USD.

Eurozone rates have continued to sink relatively fast, even as US rates have been stable to firmer over recent weeks as ECB officials have reaffirmed intentions to further ease policy next week. The market may be reluctant to sell EUR as it approaches its lows for the year around 1.05 after a rapid decline over the last month. But the degree of policy divergence is as significant as it has been over the last two years, suggesting little respite for the EUR is in store.

In the news

- Japan government fiscal stimulus plans are reported to include an increase in financial support for pensioners and a 3% rise in the minimum wage. It also plans regulation changes to encourage small business investment and a time frame for lowering the corporate tax rate to be low 30%, including cutting it to 31% next fiscal year. Plans are expected to be finalized by the end of this month. Japan government plans to raise minimum wage in stimulus package to revive economy – Reuters.com. Raising the minimum wage may be seen as part of broader message to business to accept higher wage growth. BoJ policy is likely to remain stable as fiscal measures are implemented and private sector Spring wage negotiations proceed, tending to support the JPY vs the EUR.

What they said

- Saudi Arabia’s official press agency on Monday quoted the cabinet in a statement as saying it was ready to cooperate with countries within and outside the Organization of the Petroleum Exporting Countries to maintain the stability of the market.

Economic news

- Japan manufacturing PMI flash rose from 52.4 to 52.8 in November, a high since the pre-April 2014 consumption tax hike surge in production.

- Australia: weekly consumer confidence dips modestly for a second week from a recent high for the year two weeks ago of 116.6 to 114.5. Overall sitting around long run average levels.

- New Zealand: Net migration rose to 6210 in October a new month record and 12month sum record, placing more pressure on New Zealand housing and other infrastructure while contributing the rising trend it its workforce and keeping wage growth in check. The data is a double-edged sword for policy-makers but it should on balance tend to reduce the scope to further cut rates in the current cycle.

- USA: Chicago Fed National Activity Index was -0.04 in Oct, below +0.05 expected, up from -0.29 in Sep (revised up from -0.37). A level below zero implies that the economy may be growing below its trend potential; it has been below zero for the last three months, and in fact much of this year with a 3mth average of -0.20, a 6mth avg of -0.08, and a 12mth avg of -0.02. This is down from an average last year of +0.21. However, prior to 2014, since 2011, it averaged -0.09 more in line with the recent trend.

- USA: Markit manufacturing PMI flash reading for November fell from 54.1 to 52.6, below 54.0 expected; a new low since October 2013, continuing a weakening trend since the peak in August 2014. The data suggests the weak energy sector and strong USD are significantly dampening US manufacturing. However, this sector should now be expected to lag overall economic growth.

- USA: Existing home sales fell 3.4%m/m in Oct, weaker than -2.7% expected after rising 4.7% in Sep. Sales have lost momentum since a high in July since early-2007.

- Eurozone: manufacturing PMI flash reading was 52.8 in Nov, somewhat above 52.3 expected and 52.3 in Oct. This was the second rise in a row to a high since April 2014.

- Eurozone: service PMI flash reading was 54.6 in Nov, firmer than 54.1 expected, up from 54.1 in Oct, a high in this series in data available back to end-2011. The composite index also rise to a new high of 54.4.

- Taiwan: Industrial production fell 6.2%y/y in Oct, weaker than -5.4% expected, down from -5.5%y/y in Sep, revised down from -5.3%. This was the weakest annual growth (outside of Chinese New Year distortions) since 2009.

- Taiwan: Export orders, reported on Friday, fell 5.3%y/y in Oct, weaker than -4.3%y/y expected, down from -4.5%y/y in Sep. Orders to the USA rose 5.6%y/y, up from +0.6%y/y in Sep. Orders to China mainland and Hong Kong fell 10.6%y/y down from -9.5y/y in Sep. Orders to Asia overall fell 11.7%y/y, down from -10.1%y/y. Orders to Europe fell 2.1%y/y, down from +1.8%y/y in Sep.

- Singapore CPI inflation fell from -0.6%y/y to -0.8%y/y in October. Core inflation fell from +0.6%y/y to +0.3%y/y, below 0.6% expected

On the Radar

- Australia: RBA Governor Stevens speech at Australian Business Economists’ Annual dinner

- UK: CBI retails sales monitor

- USA: Trade balance, GDP Q3 second estimate, House Prices

Rest of the week

Australia:

- Wednesday: Construction Work Done

- Thursday: Private Capital Expenditure

New Zealand

- Thursday: Trade balance

Japan

- Tuesday: Manufacturing PMI first estimate

- Wednesday: Small business confidence, Cabinet Office Monthly report

- Friday: CPI, labour data, Household spending

USA:

- Wednesday: PCE deflator, Personal income and spending, durable goods orders, Markit services PMI first estimate, new home sales, University of Michigan consumer confidence final estimate for November.

- Thursday: Thanksgiving

Eurozone:

- Thursday: Money and credit growth

- Friday: EC business surveys

UK

- Wednesday: BBA loans for house purchase

- Friday: consumer confidence, GDP Q3 revision and components