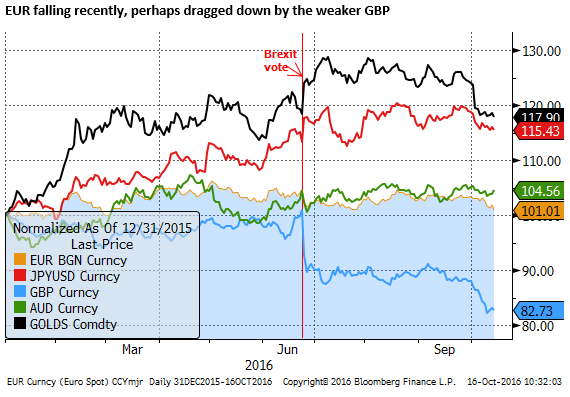

Weaker EUR & JPY, stronger commodity currencies

Looking over the map, recent USD gains are less about renewed strength in the US economy and more about weaker trends in JPY, GBP and EUR spilling over to several emerging markets through direct links to their currencies or via currency basket regimes. Commodity currencies and some emerging market currencies that are less influenced by these weaker major currencies, with more stable political environments, have performed solidly against the USD. We may continue to see weakness in non-dollar major currencies, provided the US economy and rates outlook remains stable. And we may see more spillover to some EM currencies in coming weeks. Both EUR and JPY appear to be developing more sustained weaker trends and they may have some way to unwind excess gains in the first half of the year as vicious cycles turn to virtuous ones (related to rising global bond yields). In essence, their currencies may weaken in response to their negative interest rates, improving inflation expectations, and a sense that their easy monetary policies are succeeding in holding down real yields. This may tend to perpetuate the recent trend towards a weaker EUR and JPY and relatively strong, if not outright strength, in commodity currencies. However, higher global bond yields may also tend to undermine currencies that have relied on flows into their bond market from investors seeking higher yield in an, until recent weeks, diminishing global yield environment.

A good run since end-September

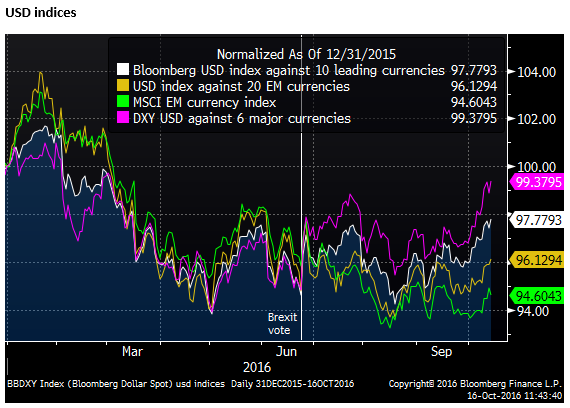

The USD has had a good run since around end-September. The chart below shows various indices. The DXY USD index against 6 major currencies is at a high since Q1 this year. The broader Bloomberg index against 10 leading currencies is not quite as strong, also at a high since Q1, but only around previous peaks in May and July. Two alternative USD indices against emerging market currencies show it has strengthened more modestly. An unweighted average against 20 EM currencies has the USD at a high since August. The MSCI EM equity weighted currency index has the USD at the high side of its range since August.

Change in JPY tone since end-Sep

But the gains in the USD probably have more to do with weakness in other currencies than strength in the USD.

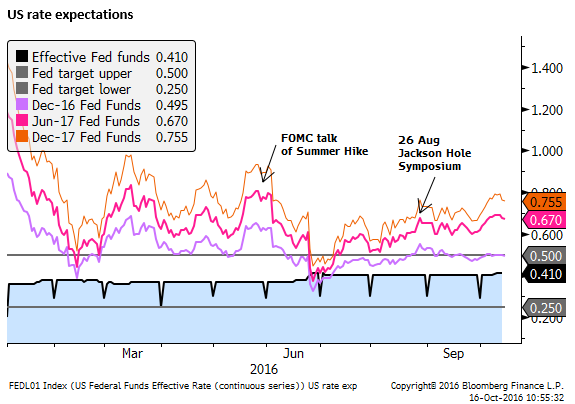

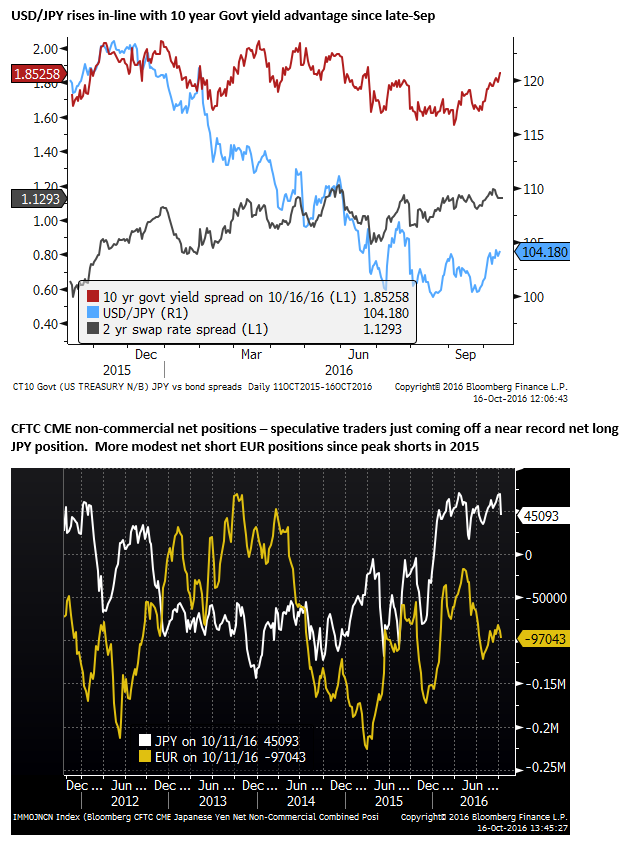

The turn in the tone of JPY since the beginning of the new half financial year in Japan is at best loosely related to renewed confidence in the outlook for the US economy and higher rate expectations in the US. The probability of a rate hike in the US by year end was already well formed before October, lifted by Fed member guidance in the lead up to the Jackson Hole symposium on 26 August.

The rise in global bond yields in recent weeks, has lifted the long-end USD/JPY yield advantage, and this may be contributing to a stronger USD, but there is a range of factors driving up bond yields globally, some this relates to the shift in BoJ policy to include Yield Curve Control.

The change in tone in the JPY may simply be a reversal in excessive strength in the first half of the year. The rise in global bond yields themselves may be supported by a weaker JPY, helping to alleviate fears that the BoJ is losing its battle to ease monetary policy and raise inflation in Japan.

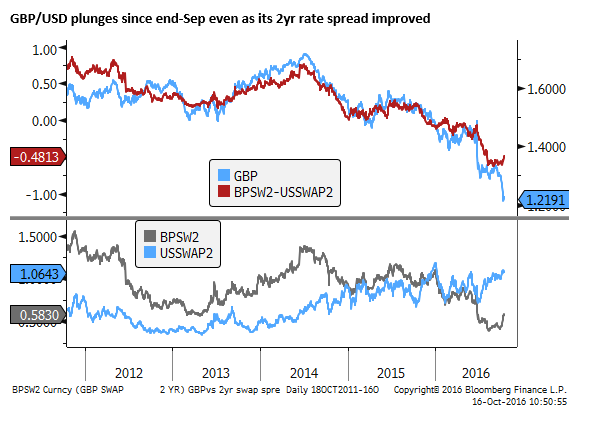

GBP plunge since end-Sep builds in Brexit risk

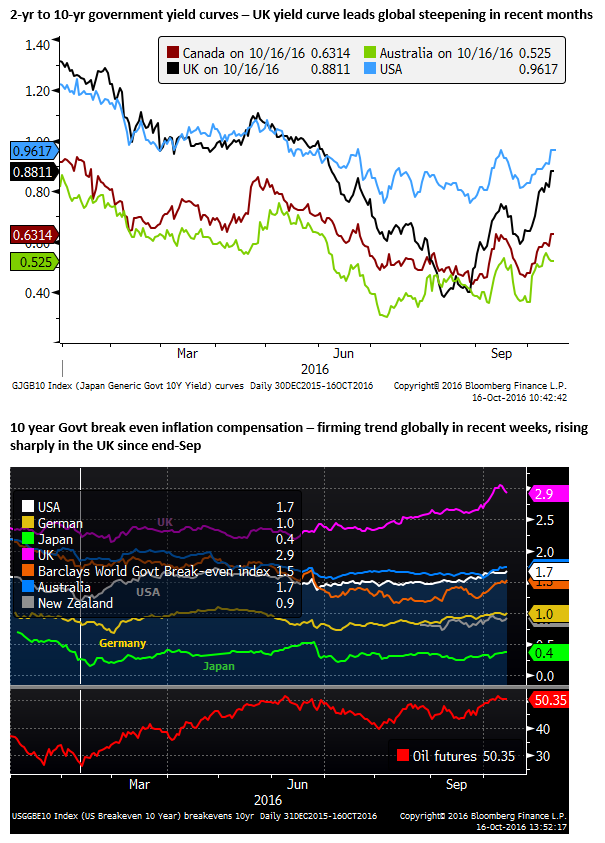

The big currency move since end-Sep has been a further sharp fall in the GBP related to renewed Brexit fears, notwithstanding stronger than expected UK economic data. The fall in the GBP has ignited higher inflation expectations in the UK, contributing to higher long-term yields in the UK, and perhaps spilling over into higher bond yields globally, even though these higher inflation expectations should be contained to the UK.

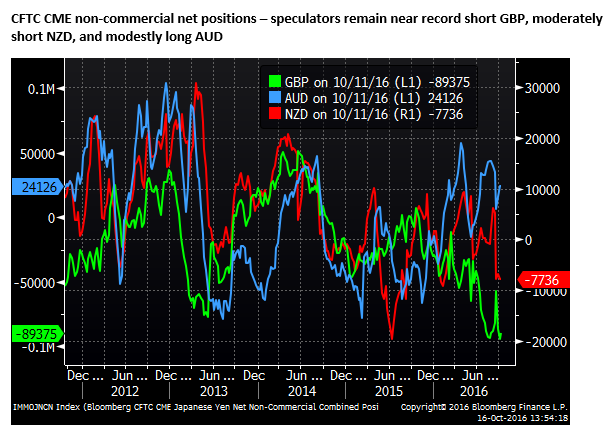

The most recent plunge in the GBP since end-Sep has been associated with higher UK yields across the curve and sharp curve steepening. This indicates that in recent weeks a significant risk premium to compensate investors for Brexit has now been priced-in to the GBP and its rates market. Sentiment towards the GBP will remain weak for some time, and we may see little-sustained recovery in the GBP, but equally it may begin to stabilize with the prospect of further rate cuts largely off the table and fiscal stimulus by the UK government in the works.

EUR respond to weaker GBP and broader fundamentals as repatriation diminishes

The EUR had been stubbornly strong this year, displaying some of the strength exhibited by the JPY in the first half of the year as investors feared that extreme policy easing measures by the BoJ and the ECB may be counterproductive by driving their financial sectors into contraction. The perception that these countries may be losing the battle to lift inflation and running out of room or ideas to ease monetary policy further was causing their currencies to strengthen, contributed to a vicious cycle of deteriorating inflation expectations and confidence in central bank policy.

The EUR may also have been perversely supported by Brexit risk aversion and increasing uncertainty over the prospects for some European banks, including Deutsche Bank, creating repatriation of overseas assets back to the Eurozone.

More recently some of this more intense risk aversion may have dissipated. The rise in global bond yields may be helping stabilize confidence in European bank shares. Brexit risk has become more clearly priced-in to the GBP and the outlook more mixed. Repatriation flows in support of EUR have shifted towards more fundamental pressures such as a competitiveness drag from a weaker GBP on the EUR.

There is also a shift from a vicious to a virtuous cycle in relation to the EUR and bond yields. As in Japan, higher global bond yields tends to make ECB monetary policy look more effective. It can more readily buy bonds when yields are rising, and tend to hold down real yields, improving inflation expectations. This may tend to reverse excessive strength in the EUR in the first half of the year.

Even if Japanese and European economic growth and inflation data start to improve, and there are fledgling signs that it will, we might expect their currencies to remain weak for some time during this phase. This may simply be a reflection of their negative rate policies doing what they were intended to do – weaken their exchange rates to help boost inflation.

US economic outlook fades in Q3

With the GBP, EUR and JPY taking a turn towards more sustained weaker outlooks, naturally the USD is looking considerably stronger, even if US rate hike expectations have not moved much in recent weeks.

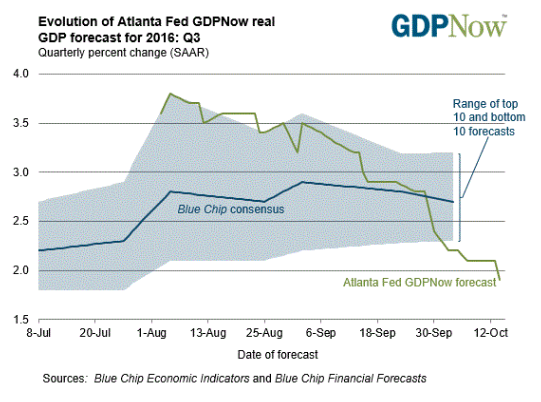

US rate hike expectations have firmed a bit recently, but this has more to do with some global investor confidence arising from more normal shaped global yield curves than any improvement in the US economy. The chart below from the Atlanta Fed shows yet another downward revision to its Q3 GDP forecast on Friday following the retail sales data and a weaker than expected outcome for the narrower control group of sales.

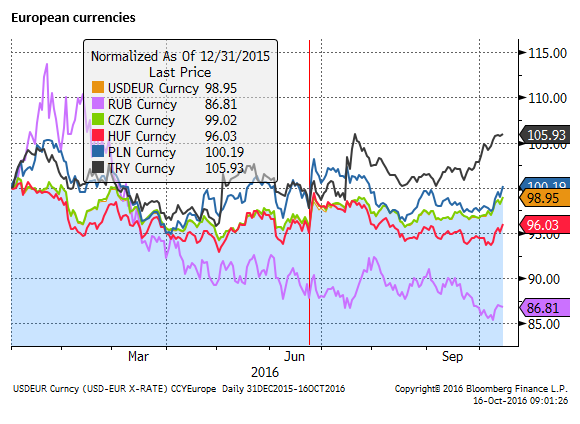

Emerging European currencies dragged down by EUR

Looking at the performance of emerging market currencies, they have been undermined by their links to the weaker major currencies, a range of political events increasing uncertainty in a handful of cases and some specific economic weakness. However, a range of commodity currencies have performed well and some emerging markets have outshone their peers. The overall gains in the USD against EM currencies are much less related to renewed confidence in the US economy or Fed rate hikes.

Emerging European currencies have broadly been dragged back recently by a weaker EUR. TRY has been relatively weak, declining from late September, RUB was strengthening until last week.

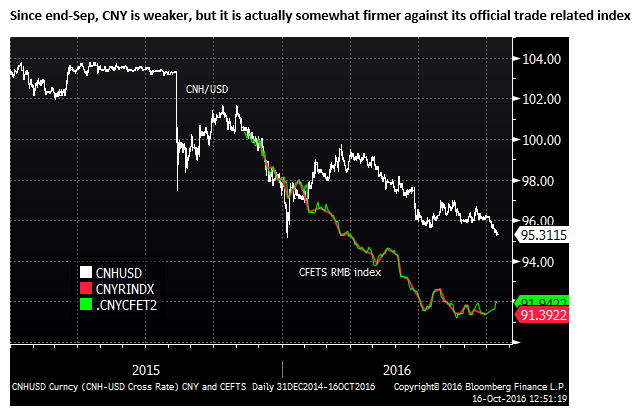

CNY stable against its basket in recent weeks

The CNY has been weaker recently against the USD. Its basket currency management approach has led its policymakers to allow the CNY to follow the decline in GBP, EUR, and JPY to some extent. Weaker Chinese trade data and broader efforts to sustain economic growth have also led the Chinese authorities to pursue a moderately weaker exchange rate in the last two years. China has experienced capital outflow over this period that is related to the broader issue of rebalancing the economy and dealing with excessive credit growth.

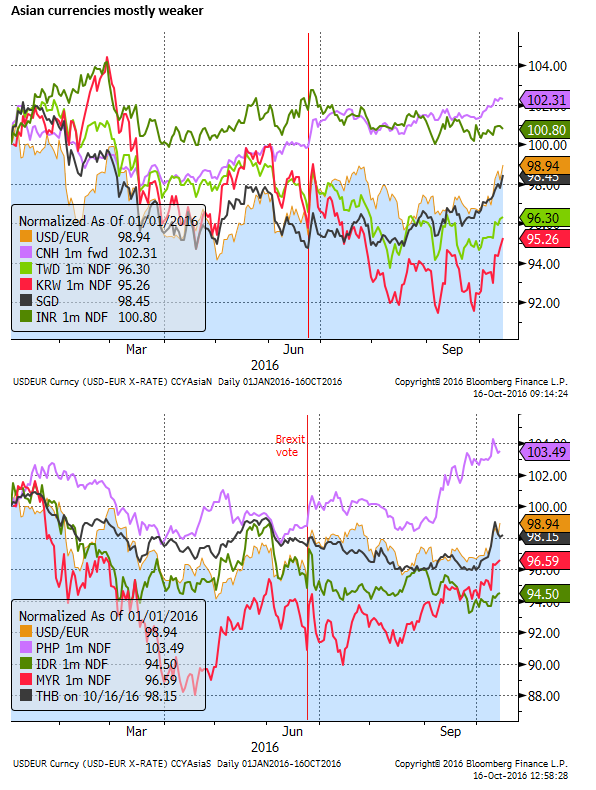

Several other currencies in Asia tend to follow the CNY and were undermined by weaker Chinese trade data. KRW has additionally been undermined by troubles at Samsung and broader economic weakness.

Singapore operates a tightly controlled currency basket and its economic performance also been weak. As such, the SGD has weakened directly as a result of the weaker JPY, EUR, GBP, CNY and other Asian currencies in its basket. THB and PHP have been undermined by political uncertainty. IDR and INR, on the other hand, have been relatively strong, supported by improved political stability, and more promising economic policy.

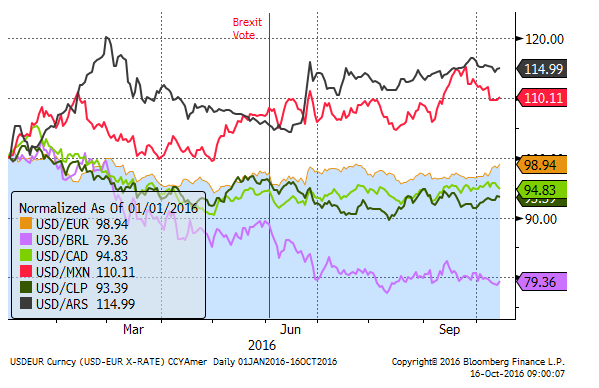

American currencies stronger

American currencies have performed solidly in recent weeks. MXN has bounced back as Trump has slumped in the polls and oil prices have firmed. BRL and CAD have also been supported by stronger commodity prices.

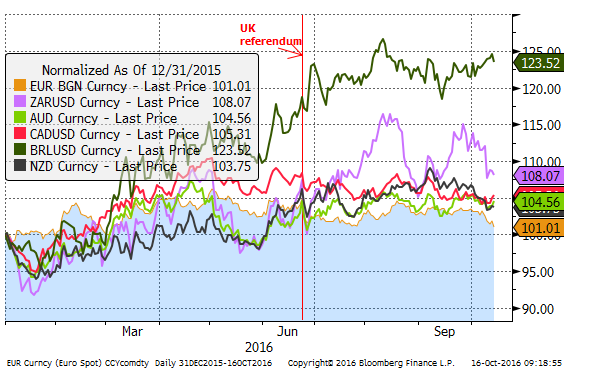

Commodity currencies relatively strong

Commodity currencies have performed solidly. The main exception is the ZAR, undermined by political risks. NZD has underperformed its peers lately receiving less support from dairy prices.

Looking over the map, recent USD gains are less about renewed strength in the US economy and more about weaker trends in JPY, GBP and EUR spilling over to several emerging markets through direct links to their currencies or via currency basket regimes. Commodity currencies and some emerging market currencies that are less influenced by these weaker major currencies, with more stable political environments, have performed solidly against the USD.

We may continue to see weakness in non-dollar major currencies, provided the US economy and rates outlook remains stable. And we may see more spillover to some EM currencies in coming weeks. Both EUR and JPY appear to be developing more sustained weaker trends and they may have some way to unwind excess gains in the first half of the year as vicious cycles turn to virtuous ones (related to rising global bond yields). In essence, their currencies may weaken in response to their negative interest rates, improving inflation expectations, and a sense that their easy monetary policies are succeeding in holding down real yields.

Chair Yellen steepens US yield curve

The speech by Fed Chair Yellen on Friday was bearish for the USD, offering a rationale for allowing the US economy to run hot and take more risk of higher inflation. This would imply that the Fed will be slow to hike rates in the face of improving economic data and higher inflation. It should point to lower short to medium term rates and higher long-term rates. This was reflected in the price action on Friday with some twist in the yield curve.

On Friday, the University of Michigan Consumer sentiment survey showed a fall in confidence and a fall in long-term inflation expectations. If not for the Yellen speech, this may have led to a fall in US yields across the curve.

The speech by Yellen will do little to change the outlook for a December rate hike, but is likely to feed a growing expectation that the Fed will be slow to hike rates through the cycle. If the US economy starts to reveal a stronger growth momentum it will probably perpetuate a rising trend in global bond yields and support higher inflation expectations.

This may tend to perpetuate the recent trend towards a weaker EUR and JPY and relatively strong, if not outright strength, in commodity currencies.

However, higher global bond yields may also tend to undermine currencies that have relied on flows into their bond market from investors seeking higher yield in an, until recent weeks, diminishing global yield environment.