Without tax reform division may swamp the USD

Political turmoil has risen to the fore again in the USA. There are so many parts intertwined in the political and social turmoil in the USA that it is hard to know how much it will affect the real economy or financial markets. It is a moving feast that will persist for the foreseeable future. It has weighed on the USD this year, but the USA economy continues to truck along, strengthening recently, helping sustain support for the USD. Hope for positive news has coalesced around tax reform, which is struggling for air in the political and social discourse. Tax reform is potentially very positive for the US economy and the USD dollar, but it seems that the market is still giving it a relatively low delta. Tax reform is not easy, with many special interests to balance. On the other hand, it has become very important for the Republican Party. Failure to deliver threatens to unravel their majority in one or both Houses of Congress. Part of the reason why the USD is struggling to gain traction on prospects for tax reform is that the market must also weigh the risk that it fails and what follows may be political and social disintegration in the USA that makes the current political uncertainty seem like a walk in the park.

Political Uncertainty rises to knock down the USD

Since Friday the USD has come under pressure with political risk rising to the fore again. The catalyst has been the arrests anticipated on Friday, made on Monday, by the Mueller investigation. This event appears to have triggered a fresh and more intense round of attacks on Clinton, her 2016 campaign and the DNC over their alleged misconduct by Trump and right-winged media outlets.

Adding to the political uncertainty was a poll over the weekend that found that Trump’s approval rating had dropped sharply in the last month to a new low.

Politicization of the Fed

Further contributing to some dollar weakness were reports that Trump was likely to choose Jerome Powell as the next Fed Chair to replace Yellen in February. And that Trump was not likely to name a Vice Chair at this time, reducing the chances that John Taylor would get this job.

The Choice of Powell offers continuity following on from Yellen, reducing the risk of a hawkish tilt that might arise under Taylor. But it also suggests that the choice by the administration reflects their desire for easier monetary policy. And the market must wonder if Powell has given Trump an impression in interviews that he is likely to err on the side of easier policy.

The decision to remove Yellen, in any case, represents a politicization of the Fed. No one would argue that the Fed is completely independent of government, but it appears to have become more politicized. Given the confidence in the USA political system itself is deteriorating, the change in Fed personnel underway weakens confidence in its ability to act as a stabilizing force for the economy and financial markets.

How important are these political events for the USD, US financial markets, and the economic outlook? It is difficult to say. Much has and will be written about it. The media in the USA and public opinion is highly polarized. This both adds to the uncertainty and makes it harder to interpret the media reports.

The US economy continues to truck along

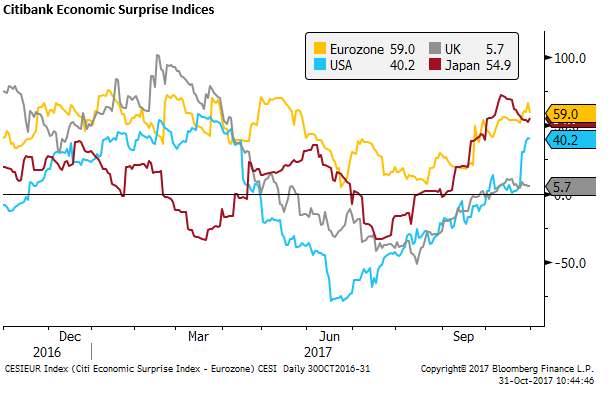

In the meantime, the US economy has trucked along at a reasonable clip, for the most part, undeterred by the political and social upheaval in the country. The most recent reports have in fact been stronger than expected. The Citibank Economic Surprise Index has risen from a low -78% in June to a strong +40%. In the end, it may be the economy that drives financial markets rather than political uncertainty (Payrolls data may be influential at the week’s end). It is often the case that political theatre turns out to be a sideshow to underlying economic trends.

However, there is something sinister and destructive going on in the USA. It may be part of a global phenomenon related to the rise of social media, technological disruption, climate change, and a range of other factors that are either symptoms or causes generating more intense geopolitical risks, but in the USA the instability seems more severe.

Trump is a catalyst, but the real worry is how he became president

Trump appears to be a major catalyst for the instability and uncertainty. But the real issue is that the American political system allowed him to become President. It speaks to something more fundamentally dangerous. Trump has growing clout over the Republican Party according to many pundits. He may have a low approval rating for this stage in his Presidency, but he remains very popular in surveys of Republican voters. His Alt-tight backers appear to be taking increasing power in selecting Republican candidates in primaries.

So while Trump’s behaviour may seem repugnant to a large part of the American public, and perhaps a bit distasteful to the majority, he represents a large minority of the country. They stand with Trump even as he tears down the foundations on which stable society in the USA has been built, and builds up the barriers that that divides the people.

USA society is being trashed

No one is innocent, and those aligned with the Democratic left-wing of the country are not bystanders. Many are down in the murky world of underhanded and manipulative politics. Trump can probably quite rightly call out some of their behaviour. Honesty, decency, honour, respect, empathy, and any other basic pillars of a stable society are being trashed in the USA, and before Trump’s first term is up, the brawling mess that is much of the political and social discourse in the USA could severely damage the economy.

There is little hope of reasonable voices rising up from the public. The main media outlets are extremely biased, and the local news stations cover stories like a horse crossing the highway, a juvenile out on a joy-ride, and of course the latest (almost daily) local shooting; whatever they have live footage of. Meanwhile, consumers wouldn’t know there was a world outside of the USA. Everyone is sucking down their content from social media, delivering a regular dose of only what people want to hear and see, false or true it doesn’t matter, tailored and biased.

Tax Reform is fighting for air

While the politicians, media and people squabble over who did or didn’t collude with foreign powers to influence the election, the lack of gun control, opioid addiction, who stands for the National Anthem, racially charged protest rallies, travel bans, trade agreements, immigration, border security, healthcare policy, environment policy, and hurricane relief, tax reform is fighting for air.

Tax reform is hard. And if the Administration, Congress, media, and public cannot damp down attention on these other issues that are very divisive and unlikely to be resolved anytime soon, then tax reform may not be achieved.

Tax reform is becoming a very binary event for the USD

Is tax reform necessary to support the USA economy? In the short term, it is not clear that it is. The economy is on a strong footing, and this may sustain rising interest rates and stronger USD over the coming year.

However, come the mid-terms in November 2018, if tax reform fails to materialize, the political and social instability may descend further into chaos with very uncertain consequences that threaten economic and geopolitical stability. While political uncertainty may be a distraction for the financial markets now, it could turn out to be debilitating by Q3 next year.

It is this possibility that continues to weigh on the USD. The hope lies in the very importance of tax reform for the Republican Party. Success on Tax reform would probably help lift economic confidence.

Trump is drawing political support from the strong economy

While Trump’s overall approval rating is relatively low, he scored well on management of the economy. He is often praised by some pundits for reducing regulation. And some think that this is responsible for stronger economic growth and buoyant financial markets. Whether or not this is true, Trump is drawing political support from economic growth and a strong equity market.

If Trump and the Republicans can deliver tax reform in time for the November mid-terms, the sooner the better for them, it may help further boost the economy and will offer the Republicans a big legislative win to take to the elections. This would allow them to sustain their majority in both Houses of Congress and help sustain stability in the country, albeit still with simmering divisions. The outcome would probably be a stronger USD.

Without tax reform division may swamp the USA

If Trump and the Republicans fail to agree on tax reform and passage gets stalled in Congress, then all the other divisive political distractions may rise to swamp the party. We already know that Trump reverts to blame and distraction when faced with setbacks, and as the mid-terms loom larger this may tear up the fabric of the Republican Party.

It may veer off into an Alt-right direction that undermines its electoral success in the mid-terms. Democrats may gain control of one or both Houses, and a lame duck Trump could be very dangerous; one can only imagine how far he would go in whipping up Alt-right support or escalating tensions with foreign powers to drive his narrative of success.

It feels like there is something very binary for the USD and global financial stability attached to Tax reform.

Tax Reform Timetable

At her press conference on Monday, Press Secretary Sanders began by laying out an ambitious timetable for tax reform, before opening question time that was all about the Mueller investigation.

She said that the initial House bill will be introduced by the Ways and Means Committee on Wednesday. The committee plans to mark up the bill starting on Monday. She said that the House is likely to consider the bill in the week of 13 November. And we want to see a House bill passed by Thanksgiving. She said this is a very aggressive timeline, but one that will help us get a tax bill this year so that businesses and families can plan for 2018.

The market will continue to assess the progress of tax reform along this timeline, and how much the Administration and Congress can remain on task. It is encouraging that Trump avoided taking any questions from the press on the Mueller investigation at one of his standard media event around a table of advisors and selected business leaders at the White House to promote tax reform on Tuesday.

Perhaps it will be a useful distraction from the Muller investigation and recriminations across party lines that from Friday Trump begins a 10 day trip to several strategic Asian countries.