Yellen has a communication challenge

The BoE is expected to announce some tightening in macroprudential measures tonight that should tend to weigh on the GBP. US economic reports continue to question the need for the Fed to hike in December, with soft manufacturing surveys, and some analysts are expressing more concern over rising corporate defaults and renewed strength in the USD. Nevertheless, it seems pretty clear from recent Fed comments that a hike is likely on 16 December. We expect Fed Chair Yellen to reaffirm this message on Wed/Thur this week. If so it will be difficult for her to contain USD strength, but she may attempt to do so by alluding to the role it could play in limiting policy hikes through the cycle. In any case, we continue to see downside risk for EUR on a broad and decisive further ECB policy easing on Thursday. AUD continues to defy the fall in commodity prices, but evidence of a peaking in the Australian housing market suggests the door may open for cuts next year and the RBA may begin to talk down the AUD as in approaches 0.75. It is possible that the RBA begins to highlight some concern over the recent divergence in the AUD from weaker commodity prices in its statement today.

BoJ attempts to dispel notion he has gone soft targeting higher inflation

BoJ Governor Kuroda’s speech on Monday has been interpreted by most media commentators as having a dovish leaning, emphasizing the desire to achieve inflation as quickly as possible. The results appear to have weakened JPY somewhat, suggesting it may not take as much of a set-back in inflationary conditions to trigger further easing.

Kuroda did reinvigorate the passion in his speech for achieving inflation, with a strong plea to business to prepare for it, including by continuing to raise wages.

And he raised the risk assessment related to the potential for weaker emerging market growth.

However, he also continued to highlight the progress Japan has already made towards higher inflation over the last two years, suggesting policy is still largely on hold.

While somewhat more dovish, Kuroda’s assessment still suggests that policy is likely to remain stable in Japan until well into next year, awaiting the outcomes of policy steps that appear very likely in Europe this week, including macro-prudential steps by the BoE tonight and a broad expansion of monetary policy easing by the ECB on Thursday. As such, JPY might still be expected to strengthen against the EUR and GBP.

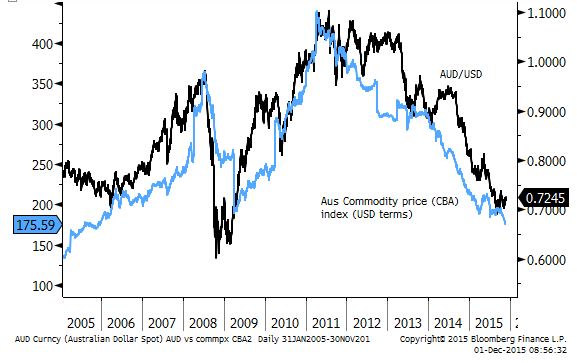

AUD continues to diverge from commodity prices

The AUD continues to remain relatively strong against weaker commodity price trends. We noted a risk that RBA Governor Stevens may highlight some concern in this divergence in his speech last week. However, he chose not to mention the exchange rate.

Today the RBA policy statement is released and no policy change is the broad consensus. However, several commentators are wondering if the RBA will insert some language into its statement today pointing to concern over the recent divergence between the currency and commodities. The previous statement said that, “The Australian dollar is adjusting to the significant declines in key commodity prices.” Perhaps that is true in a broad sense, but some qualification may be now required.

Iron ore prices in China dropped a further $3 to $4 on SGX AsiaClear on Monday to fresh lows.

We noted last week that the AUD has exhibited a stronger technical pattern in recent weeks and thought it best to hold back to see if the currency could rise towards 0.75 before selling it again.

We continue to look for a place to sell the currency. In data today, Chinese PMIs were mixed and remained below 50 for manufacturing. Australian house prices fell in November suggesting that the regulatory controls on banks and foreign investment may be biting as immigration slows and the supply of apartments is rising. The housing market may be losing momentum, generating scope for a further rate cut.

On the other hand business credit growth rose strongly for a second month above 1.0%m/m, up 6.6%y/y in October, the fastest annual growth since 2009.

Business credit growth suggests that business investment in the non-mining sectors may be stronger than the weak capital expenditure survey reported last week.

Some focus has been placed on the deteriorating budget outlook, driven mainly by a weaker outlook for commodity prices, as commentators predict a wider deficit in the Mid-Year Economic and Fiscal Update due in two weeks.

Economic news

- Japan: Capital expenditure rose 11.2%q/q in Q3, significantly stronger than +2.2% expected, up from 5.6%y/y in Q2, the fastest growth since Q1-2007. The data should help bolster confidence in the resilience of the Japanese economy.

- Japan: PMI was revised down from 52.8 to 52.6 in Nov, still a high since the pre-2014 consumption tax hike induced surge.

- Japan: Industrial production rose 1.4%m/m in Oct, weaker than +1.8% expected, after rising 1.1%m/m in Sep. The rise in recent months, suggests that a recovery may be underway from a weak Q2 and Q3.

- Japan retail sales rose 1.8%y/y in Oct, stronger than +0.9% expected.

- Australia Corelogic RP Data house prices fell 1.5%m/m in Nov. The annual increase slowed from 10.2%y/y in Oct to 8.9%y/y in Nov, the slowest rate since April. This is an abrupt slowing in the price index led by significant falls in Melbourne (-3.5%m/m) and Sydney (-1.4%m/m). The two cities leading the rapid growth in prices in recent years.

- Australia: building approvals rose 12.3%y/y in Nov, above 5.7%y/y expected, down from 22.0%y/y in Sep. Total private house approvals fell 2.1%m/m, after falling 2.3%m/m in Sep. The volatile private apartment approvals rose 10.1%m/m in Oct after rising 7.5%m/m in Sep. From a year earlier, private house approvals fell 1.9%y/y in Oct, and apartment approvals rose 30.2%y/y in Oct. The data are strong and continue to show a pipeline of construction that will support growth next year. However, concerns are growing for an over-supply of apartments and this may now be reflected in lower house prices in Sydney and Melbourne

- Australia: Net export volume rose 1.5%q/q in real terms, above 1.2% expected, rebounding strongly from a -0.6%q/q fall in Q2. This will add directly to GDP to be released on Wednesday and will help offset the much weaker than expected capital expenditure data reported last week.

- Australia: current account balance was a deficit of $A18.1bn in Q3, wider than $A16.5bn expected, narrowed from $A20.5bn in Q2 (revised wider from -19.0bn).

- Australia: weekly consumer confidence eased for a third week from 114.5 to 112.8 last week, down from a peak for the year, four weeks ago, of 116.6. Confidence is a bit below average for the last five years.

- Australia credit growth rose 6.7%y/y in Oct, firmer than 6.6% expected. Business credit rose a strong 1.0%m/m, after a strong 1.1%m/m rise in Sep, accelerating to 6.6%y/y in Oct, a high since 2009. The strong business credit growth suggests that business investment in the non-mining sectors may be stronger than the weak capital expenditure survey reported last week.

- Australia: Overall housing credit growth was stable at 7.5%y/y, but the data show a rotation from investor growth that slowed to 0.4%m/m in Oct, down from 0.9%m/m in May-June. Owner Occupier loans rose 0.7%m/m, up from a stable monthly rate of growth around 0.4/0.5% over the two years up to July-2015. However, some of this compositional shift may be just a matter of reclassification of existing loans after banks implemented tougher lending conditions on investors around mid-year.

- Australia: company operating profits and inventories were stronger than expected in Q3, helping firm expectations for the GDP report due on Wednesday, however, the capital expenditure component is set to be a bigger drag than expected a week ago after the soft capex survey reported on Thursday last week.

- China: Government manufacturing PMI was down from 49.8 to 49.6 in Nov, below 49.8 expected, a low since Aug-2012.

- China: Government non-manufacturing PMI rose from 53.1 to 53.6 in Nov. This is a modest improvement from a low in this series since 2010.

- China: Caixin (Markit) manufacturing PMI rose from 48.3 to 48.6 in Nov, firmer than 48.3 expected. This is the second rise in a row from a low in Sep of 47.2, to a high since June.

- New Zealand: Business confidence own activity outlook rose for a third month in a row from 23.7 to 32.0 to a high since May. The data suggest urgency for further rate cuts is not significant. However, the inflation expectations component was down from 1.7% to 1.6%, suggesting scope to ease policy further. The market is pricing in a 48% chance of a 25bp cut in the Official Cash Rate next Thursday, 10 Dec.

- New Zealand: Housing credit growth accelerated from 6.8%y/y in Sep to 7.2%y/y in Oct, a high since 2008. Some of this increase may relate to a rush to beat new limits of high-LVR loans for investment in Auckland implemented in Nov. Nevertheless, the data do not support the case for a rate cut. However, the RBNZ have said they anticipate these limits cooling housing lending activity in coming months.

- New Zealand agricultural credit growth had picked up sharply in recent months, perhaps a sign of some distress related to weaker dairy prices. However, it eased back from a recently high of 9.2%y/y to 9.0%y/y in October. Business credit growth was steady at 6.1%y/y

- New Zealand: building permits rose 5.1%m/m in Oct, after falling 5.8%m/m in Sep. In trend terms, approvals rose 0.7%m/m in Oct, continuing a moderate growth trend.

- USA: Chicago PMI fell from 56.2 to 48.7 in Nov, below 54.0 expected. Milwaukee PMI fell from 46.7 to 45.3 in Nov, weaker than 48.0 expected. Dallas Fed Manufacturing index rose from -12.7 to -4.9 in Nov, stronger than -10.0 expected.

- USA: Pending home sales rose 2.1%y/y in Oct, below 4.3% expected, but were revised up from +2.5% to +3.2%y/y in Sep. Pending home sales peaked in May this year, and are 4.1% below this peak.

- UK: Consumer credit rose GBP1.2bn in October, less than 1.3bn expected, but up 8.2%y/y, a rate seen as high by the BoE. Mortgage approvals were 69.6K in October, less than 69.9K expected, but up 17.2%y/y. The BoE is expected to introduce a countercyclical capital buffer on banks designed to cool credit growth.

- UK: Lloyds bank business barometer rose from 50 to 55 in October, rebounding in the last two months to its highs for the year in May/Jun.

In the News

- The FT reports on the falling price of leveraged loans in the USA and decline in issuance of Collateralised Loan Obligations – investment vehicles that buy loans. This is also consistent with the rising spreads on high yield corporate bonds. The conclusion of some people is that the credit cycle has turned into decline, threating growth in the US economy even before the Fed begins its rate tightening cycle. (US credit tightens ahead of Federal Reserve policy shift – FT.com)

- 2015 is on track for the largest number of corporate defaults since 2009, according to S&P. These have been led by US oil and gas companies. The FT reports: “While the proportion of outstanding bonds judged to be in default remains below long-term averages, indicators of distress point to further problems ahead. For instance in the US, almost three-quarters of high-yield bonds issued by oil and gas companies trade at a more than 10 percentage point spread over the yield on US Treasuries.” (Global defaults climb to 6-year peak of $95bn – FT.com)

- The IMF voted to make the CNY the fifth currency in its Special Drawing Rights (SDR) basket of currencies. The new basket, which will take effect on October 1 next year, will see the US dollar remain the biggest currency with a 41.73 per cent weighting followed by the euro with 30.93 per cent. But with a 10.92 per cent share, the renminbi will trump the yen (8.33 per cent) and the pound sterling (8.09 per cent). (IMF gives renminbi strong weighting in currency basket – FT.com)

- The BoE has strongly hinted it is leaning towards a general increase in bank capital, achieved by raising what is known as the countercyclical capital buffer from its current rate of zero. Countercyclical buffers require banks to hold more capital than is necessary under the Basel III international standards. The BoE’s Financial Policy Committee has been hinting it will raise the CCB marginally, perhaps to 0.5 per cent but that will not be formally binding for UK banks who already hold capital at or over that level. High quality global journalism requires investment. The BoE governor, said last week that any rise in the CCB “would ultimately be passed on in higher interest rates to businesses and households, which would be akin to some form of monetary tightening”. (Bank of England set to reveal action against credit growth – FT.com).

What they said

BoJ Governor Kuroda:

- Corporate profits are extremely high and some decline in exports and production could be easily absorbed. On the other hand, what does warrant attention is the possibility that increased uncertainty regarding emerging economies undermines business confidence in Japan, which might lead firms to scale down investment and wage increases. Although business confidence has been improving, it would be premature to say that it is sufficiently strong.

- The Bank considers it desirable to achieve a situation in which both prices and wages rise in a balanced manner. However, this does not mean that the Bank will adjust its policies aimed at achieving moderate inflation simply in response to the pace of increase in wages. From both a theoretical and an empirical perspective, prices generally move in parallel with wages. If the Bank were to move slowly toward achieving the price stability target, wage adjustments would also be slow. At the end of the day, this issue comes down to a chicken and egg situation. In order to overcome deflation — in other words, break the deadlock — somebody has to show an unwavering resolve and change the situation. This means that, when it comes to price developments being at stake, the Bank must be the first-mover.

- In sum, while Japan’s economy has continued to recover moderately and the underlying trend in inflation has steadily improved, due attention should be paid to risk factors such as developments in emerging economies. With regard to monetary policy, QQE has been exerting its intended effects, and the Bank will continue with QQE, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. The Bank will make the most appropriate policy decisions by scrutinizing the current situation of economic activity and prices and their outlook, various risk factors, and developments in financial and capital markets at every Monetary Policy Meeting. Let me reiterate that the Bank will make adjustments without hesitation if judged as necessary to achieve the price stability target of 2 percent at the earliest possible time.

- (Japan’s Economy and Monetary Policy, Speech at a Meeting with Business Leaders in Nagoya, Haruhiko Kuroda, Governor of the Bank of Japan – boj.or.jp)

- Deloitte Access Economics partner Chris Richardson predicts that the Australian government Mid-Year Economic and fiscal Outlook, expected in two weeks, will unveil a underlying cash deficit in 2015-16 of $40.3 billion –$5.2 billion more than foreshadowed in the budget and wider than last year’s deficit of $37.9 billion. The budget deterioration reflects weaker commodity prices. Richardson predicts a long string of deficits as the government remains reluctant to curb spending. The weaker budget position, nonetheless is likely to dampen economic confidence somewhat. (Budget bust and China stymie Libs – The West Australian)

On the Radar

- UK– BoE bank stress test results, Financial Stability Report, Governor Mark Carney press conference, Financial Policy Committee recommendations

- UK – PMI manufacturing,

- USA – ISM manufacturing, Markit PMI manufacturing final, Construction spending, Vehicle sales

- New Zealand – Dairy auction

- Eurozone – PMI manufacturing final

- German – Unemployment

- Canada – GDP Q3, PMI manufacturing

This week and beyond

USA

- 2 Dec – ADP Employment, Fed Beige Book

- 2 Dec – Fed’s Yellen speaks to the Economic Club of Washington

- 3 Dec – Fed’s Yellen annual Congressional testimony

- 3 Dec – ISM non-manufacturing, Markit services PMI final

- 4 Dec – payrolls

- 16 Dec – FOMC

UK

- 2 Dec- PMI construction

- 3 Dec- PMI services

- 4 Dec – Car registrations

- 7 Dec – CBI industrial trends survey

- 8 Dec BRC retail sales monitor

- 9 Dec – record of meeting of BoE Financial Policy Committee

- 10 Dec – BoE policy decision

- 15 Dec – CPI

- 16 Dec- Employment and wages

Australia

- 2 Dec – GDP Q3

- 3 Dec – PMI services, Trade balance

- 4 Dec – Retail Sales

- 7 Dec – PMI Construction, ANZ Job ads

- 8 Dec – NAB Business survey

- 9 Dec – Westpac Consumer confidence

- 10 Dec – Employment report

- 15 Dec – RBA policy minutes

- mid-Dec – MYEFO

China

- 8 Dec – trade balance

- 9 Dec – CPI

- 12 Dec – Retail sales, IP, FAI

- Week of 10 Dec – Credit growth and money supply

- 18 Dec –Property prices

Japan

- 3 Dec – PMI services

- 4 Dec – Labour cash earnings

- 8 Dec – Q3 GDP final estimate

- 14 Dec – Tankan

- 18 Dec – BoJ

New Zealand

- 2 Dec – ANZ commodity price index, terms of trade

- 3 Dec –Value of building Q3

- 8 Dec – Manufacturing volume Q3

- 10 Dec – RBNZ MPS and policy announcement

- 15 Dec – Govt Half Year Economic and Fiscal Update

- 17 Dec – GDP Q3

Eurozone

- 2 Dec – CPI first estimate

- 3 Dec – PMI services final and retail sales

- 3 Dec – ECB meeting

- 4 Dec – PMI retailing, German factory orders

- 8 Dec- GDP Q3 revision

Canada

- 2 Dec – BoC rate decision

- 3 Dec- Parliament reopens after election, new PM Trudea Throne Speech

- 4 Dec- Trade balance, productivity

- 4 Dec – Labour data

- 9 Dec – BoC Governor speech

- 15 Dec – BoC Financial Systems Review

- 18 Dec – CPI

- OPEC 4 Dec – group meets in Vienna to discuss the production ceiling. At issue is plans by Iran to boost production by 1m barrels per day within 5 to 6 months of sanction being removed