Yield curve flattening reflects tightening monetary conditions, safe haven currencies may benefit

The USD has been undermined by doubts over the strength of the economy and intensifying political uncertainty. There has been strength in EUR and JPY, however, both have been dampened by negative interest rates. The GBP is looking increasingly shaky as its economy begins to show evidence of slowing in response to the Brexit fallout, and uncertainty has risen since the UK election. Equities have been underpinned by lower global bond yields. However, energy equities have lagged and technology share appear to have become overbought. A weaker USD trend, falling yields, and rising equities, have boosted demand for EM currencies. Oil prices have fallen to lows for the year as global supply rises faster than expected, despite OPEC production cuts; this may tend to support the JPY, Asia importer currencies, and high yielding EM currencies. However, risks are mounting for equities and investors may soon switch to seek out more traditional safe havens, gold and the JPY. Investors should begin to worry that the US Federal Reserve is sticking to its plan to normalize policy. This is contributing to yield curve flattening in the US, a sign of tightening monetary conditions. It is noteworthy that the Bank of Canada has also moved to a tightening bias, despite the fall in its underlying inflation to near record lows. Furthermore, the UK yield curve has flattened, despite higher inflation, indicative of a weaker growth outlook. Flatter yield curves, in part driven by weaker oil prices, will tend to undermine bank and energy sector equities, and technology share may be overbought. Fed policy normalization, including a plan to begin balance sheet unwind this year, should tend to help stabilize a weaker USD, more so against EM and commodity currencies, especially if it coincides with some correction in global equities. The balance of risks is swinging towards out-performance in JPY vs EM and commodity currencies.

Oil prices weighed down by supply

Oil prices fell significantly, revisiting lows since November last year. The International Energy Agency (IEA) monthly report noted that the global oil supply rose in May as both OPEC and non-OPEC nations produced more. It said, “Output stood 1.25 mb/d above a year ago, the highest annual increase since February 2016. Gains were dominated by non-OPEC, particularly the US.”

OPEC compliance with its production cap was good, but output expanded from exempt OPEC producers, Libya and Nigeria.

The IEA reported that OECD commercial stocks of oil rose in April by more than the seasonal norm, were above their 5-year average, and have increased since OPEC agreed to cut output in November last year. The IEA said, “stocks might not fall to the desired level [5-year average] until close to the expiry of the [OPEC production cut] agreement in March 2018.

The IEA noted that the production cut agreement is not having as quick an impact as expected, and their comments on rising supply from non-OPEC member, particularly in the USA, suggest that balance may take a lot longer to be achieved.

Oil Market Report Highlights – IEA.org

Oil prices fell after the release of the IEA report from the top of the range for the last week to the low side, but they fell further after the weekly USA Energy Information Agency (EIA) Petroleum report.

The US data had tended to be more supportive of oil prices since February, showing declining inventories and rising demand for gasoline relative to the seasonal norms. However this rebalancing has stalled in recent weeks, and inventories remain uncomfortably high. US oil production continued to grow, although grows has slowed in recent weeks, perhaps in response to weaker oil prices.

Weekly Petroleum Status Report – EIA.gov

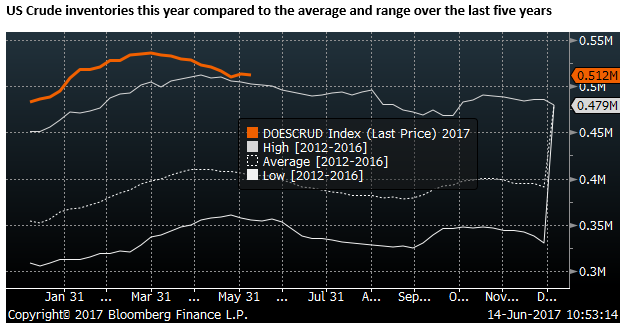

The chart below shows US crude oil inventories (last data point 9 June). They remain above the high of the last five years. They had been declining significantly since March, despite a rising seasonal pattern, closing the gap with the 5-year average. However, inventories have firmed in recent weeks, widening the gap again somewhat.

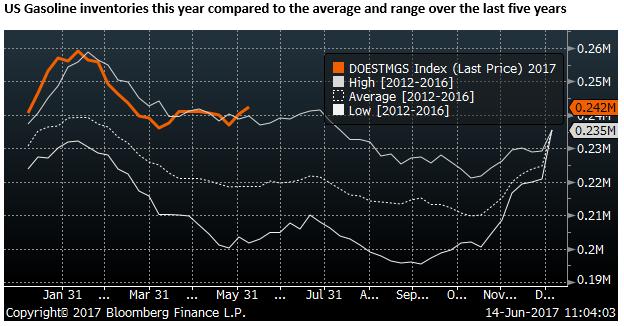

Gasoline demand had risen relatively rapidly since January, reaching near its seasonal high for the last five years. However, demand has eased in recent weeks

Gasoline inventory has also risen in recent weeks, to above the seasonal high over the last five years.

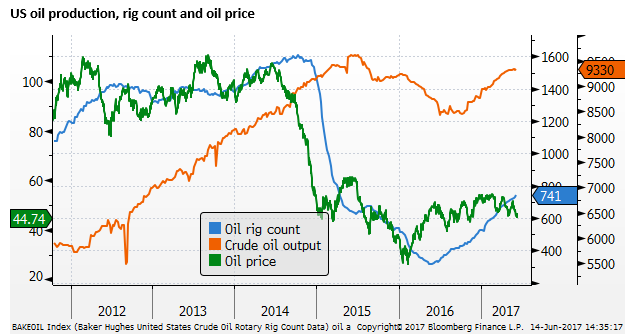

USA oil production has risen rapidly since October last year, but it does appear to have slowed in the last month. Perhaps US producers are cooling their heels as oil prices have weakened recently.

Lower oil prices provide a boost to JPY and other Asian importer currencies

Weaker oil prices are probably contributing to lower global yields and lower inflation expectations. Low bond yields appear to be providing support for the JPY. It may also be supporting other Asian oil importing currencies; KRW, TWD, INR. The low yield environment is adding further support for high yielding EM currencies.

Considering the supply dynamics in the oil market, it appears there is a risk of further oil price declines. This might continue to support Asian oil importer and higher yielding currencies.

The US has become a major swing producer in the oil market. A key question is how quickly will its producers turn off the tap again in prices fall too far? Is the recent slowing in US production already a sign of this response?

While in past cycles, lower oil prices were seen as bullish for the US economy, boosting consumer spending power. In recent years, it appears that the energy production sector in the US has been more important for the overall US economic outlook. Business investment in the US has been boosted since late last year due to a recovery in the energy sector. Manufacturing surveys picked up sharply in energy intensive regions in the last year. However, in April/May, these surveys have ebbed. If oil prices were to continue to fall it might dampen the US economic outlook and contribute to a weaker USD and lower US yields.

Hawkish tilt by Fed and Bank of Canada flattens yield curves and threatens global equity markets

The USD was whip-sawed by weak retail sales and CPI data in the morning and a more hawkish than expected FOMC event in the afternoon. It is interesting to note that both the Canadian and US central banks were hawkish this week despite significant falls in their key underlying inflation readings in recent months.

These central banks have paid more attention to evidence of stronger economic growth, in the case of Canada, and a relatively tight labor market in the USA, tending to see the setbacks in inflation as temporary. The market, on the other hand, may be beginning to wonder if the low inflation outcomes, including low wages growth, will persist for much longer, and force these central banks to delay further tightening.

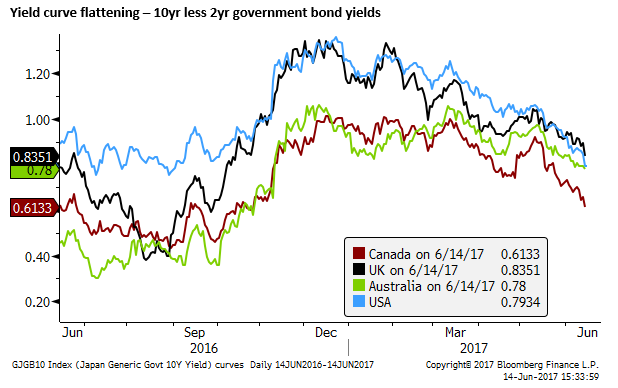

A result of a more hawkish Bank of Canada and a Federal Reserve persisting with its steady, albeit gradual, policy tightening in the face of weaker inflation outcomes and lower oil prices, is that yield curves are flattening.

Even in the UK, where inflation has accelerated in recent months, its yield curve has flattened significantly reflecting the increased fear over the economic outlook as growth begins to wane and Brexit uncertainty rises in the wake of the UK election.

Flatter yield curves in this instance might be regarded as tightening monetary conditions. Low bond yields have probably helped underpin global asset prices; including equities and house prices. However, flatter yield curves have tended to damp performance of bank shares, and weaker energy prices have undermined energy shares. IT shares have powered the global rally in equity markets this year, but they are showing signs of peaking from what might be regarded as over-bought levels.

Growth and earnings optimism has increased this year, supporting the rally in global equities. Persisting low global bond yields have probably also helped boost equities overall. However, from more elevated levels, especially for the technology sector, equities may now be more vulnerable to factors that might cause a correction.

Factors that may trigger a correction include ongoing Fed policy tightening, even if inflation may have fallen again well below target, and lower oil prices that begin to threaten the energy sector. Bank shares may also struggle if curves continue to flatten.

A weaker USD trend, related to falling US bond yields may have also boosted capital flows to emerging market bonds and equities. However, if the Fed appear willing to push on with their policy tightening in the face of weak inflation, it may bolster the USD and dampen recent enthusiasm for EM assets.

Major currency doldrums

It is not clear that the USD will immediately break out of its doldrums this year. It has continued to broadly slide despite the Fed persisting with its gradual policy normalization. This reflects doubts over the sustained strength in the US economy. The Fed remains relative optimistic, but it still only described the growth rate as moderate. In the meantime, there are pockets of weakness, such as weak auto sales. Auto financing has tightened up and new and used car prices have been falling this year, helping contribute to lower US inflation outcomes.

Inflation readings in the US have plunged in recent months, and despite the willingness of the Fed to look through the data, the market is not so sanguine. US rates and yields still ended lower on Wednesday, as the Fed statement did not fully offset the weaker retail sales and CPI inflation data earlier in the day.

Political risks in the US remain heightened as President Trump’s administration struggles to overcome investigations and courts controversy. An approaching debt ceiling issue and a failure to pass any significant legislation in Congress have arguably weakened global investor confidence in US assets and the USD.

As investors look for alternatives, they may be moving exposure towards Europe and Japan, but interest rates in these currency regions are embedded below zero discouraging exposure. The GBP is suffering from fallout from Brexit now dampening its economy. It is facing increasing uncertainty since the national election weakened the mandate for PM May to lead Brexit negotiations. As such, EM currencies, and even commodity currencies, have tended to perform well.

The Fed policy stance should help stabilize the USD, although ultimately the Fed will respond to evolving economic conditions. We see a potential for the market to turn more mixed on EM currencies as it contemplates higher risks for equity markets, further Fed hikes, and Fed balance sheet unwinding.

A more hawkish Fed, contributing to curve flattening, and a peaking in tech shares, may lend more support to the JPY as a safe haven alternative.