You’ve been Comeyed

Former FBI director Comey may go down as one of the most enigmatic figures in US history seemingly unwittingly taking down candidate Clinton and chopping President Trump off at the knees. US political uncertainty may have just blown over the top, and may settle down, but the controversy is likely to simmer at a high heat for quite a while and prove a significant distraction for Congress, threatening to dampen US economic confidence. The EUR is looking even more like the safe bet, as we discussed earlier this week. However, as the market has cut positions in general uncertainty, EUR has wobbled higher, while the JPY surged. The hackers’ favourite Bitcoin is popping this year. Investor uncertainty has taken some of the steam out of the recently strong emerging markets, not helped by Brazil homegrown political crisis. EM markets will still find support as capital seeks an alternative to the US equity market. However, recent slowing in the Chinese economy could leave the market in two minds. AUD and NZD remain in downtrends in recent months, notwithstanding improving Australian labour data, but near-term direction remains unclear.

US Political uncertainty may simmer

Events regarding Trump, Russia, security leaks, firing the FBI Director, inferences of impeding investigations have been moving so fast it is hard to keep track with the web of controversy. Perhaps this has been all now blown out of proportion and market conditions will settle back down. But it will not just go away. The investigations into the President and his team have intensified.

The DoJ has appointed former FBI Director Robert Mueller as Special Council to oversee the investigation into President Trump’s campaign and Russian officials. The decision to appoint a Special Council helps the crisis from spinning out of control, creating a more independent and dedicated procedure to find out if there was collusion. But at the same time, to the extent that there was collusion, it is now more likely to come to light in a way that cannot easily be dismissed as politically motivated.

The Comey memo disclosure essentially forced the hand of DoJ Deputy Rosenstein to appoint a Special Council. Recalling that the DoJ Head, Attorney General Sessions, presumably could not make this decision because he had to recuse himself from the Russia investigation after he was found to have misled Congress during his confirmation hearings by saying he had not met Russian officials when in fact he had.

The curious case of why Trump stood behind the former National Security Advisor Michael Flynn for so long after he was found to have been untruthful over his dealings with the Russian Ambassador now looks more sinister in light of the Comey memo that suggests President Trump attempted to dissuade Former FBI Director from investigating Flynn. This issue will not go away with the House of Representatives Committee on Oversight and Government Reform asking the Acting Director of the FBI McCabe to hand over all memoranda, notes, summaries and recordings referring or relating to any communications between Comey and the President before 24 May.

https://oversight.house.gov/wp-content/uploads/2017/05/2017-05-16-JEC-to-McCabe-FBI-Memos.pdf

Perhaps we have reached a peak in uncertainty. But uncertainty will continue while these investigations unfold. Imagine the media glare when Comey faces hearings in Congress (Oliver North anyone?).

It remains to be seen if Trump can avoid inflaming the situation with outrageous claims and misdirections on Twitter. He has been more controlled in recent days (notwithstanding his claims that the Russia probe is a witch hunt).

He appears to have gone a step too far by firing Comey, and threatening and defaming him on twitter. These actions may have unleashed the intense blowback, including the Comey memo disclosures. Trump has cultivated a lot of enemies in the “fake” media and Washington “elite”. They are going to keep after the President if any further revelations can be uncovered.

The controversy has significantly reduced the prospect of Trump getting his policy proposals through Congress, including tax reform. Republicans may continue to push on with developing their own versions of tax reform, but it will be harder to find agreement without strong leadership from the administration.

It remains the case that Republicans control both houses of Congress, at least until mid-term elections in November 2018. The pressure of these elections may encourage Republicans to work harder to make policy progress, conscious that a weak President may undermine their chances of retaining control of Congress.

The administration still has capable heads of key departments (Treasury and Commerce) that have been able to stay out of controversy and can help drive policy negotiations. Vice President Pence is offering a contrasting stable image to the President. The administration could contribute to forward policy momentum, in spite of a controversial president.

There is an argument that if Trump were to be impeached, it would remove the swirling controversy from the administration and leave “the adults” in place to get the job done. However, the process of impeachment would be prolonged and even more distracting, and would probably unleash even more erratic behavior from Trump, and possible social unrest considering the capacity for Trump to stir up his loyal voter base.

The more optimistic outcome is that Trump manages to buckle down, the controversies, that will undoubtedly simmer, will do so without boiling over, the adults in the administration can show leadership and consistency, and Republicans in Congress use the controversy as motivation to come together on any sort of tax reform. Considering that the market is now wondering if any tax reform will happen, this would be a positive outcome. However, this is indeed the optimistic outcome, and the market must accept the high probability that political uncertainty and discord weaken economic confidence.

As mentioned in our report earlier this week EUR now looks like the safe play, this is even more apparent in light of recent events.

US economic reports offer some support, but if they falter…..

However, while the political uncertainty has knocked back the USD, some more recent economic reports suggest the US economy retains momentum and the labor market is tightening.

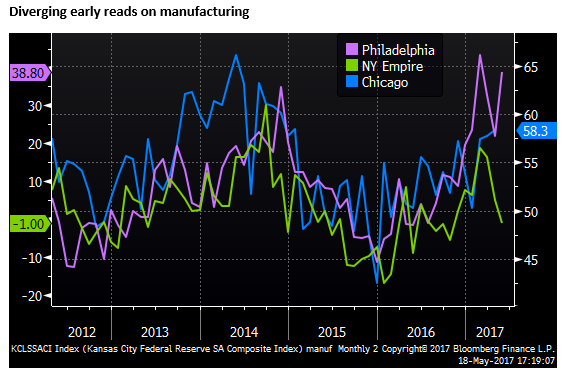

The Philadelphia Fed Activity index was very strong, contrasting with the weak Empire State (NY) index released on Monday. These are the first two of the regional surveys to be released, several more come next week, including the preliminary Markit PMI data. The tone of this data will be important to keep the USD from falling further. The market is likely to react more to evidence that the US economy is faltering.

Also supporting the USD today was unemployment claims that suggest that the labor market is getting quite tight.

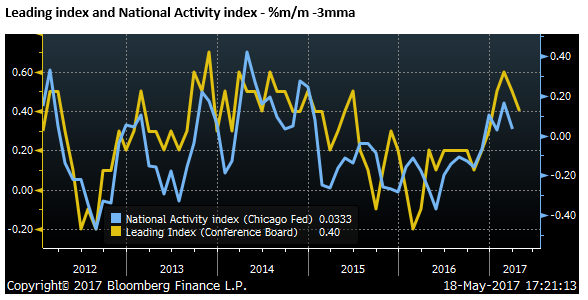

The leading index rose 0.3%m/m, not as much as expected, and revised down a bit last month, but it still strong enough to suggest the economy has significant momentum.

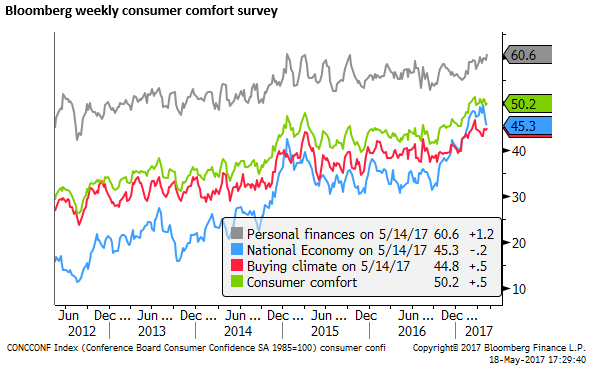

Much attention will turn to sentiment surveys that have not had a chance to take on the full force of the latest controversy. The weekly Bloomberg Consumer Comfort index rose a bit, and remains at a high level. It would have at least taken in some of the controversy that started with the firing of Comey. However, it did show a dip for a third week in the survey of perceptions of the national economy.

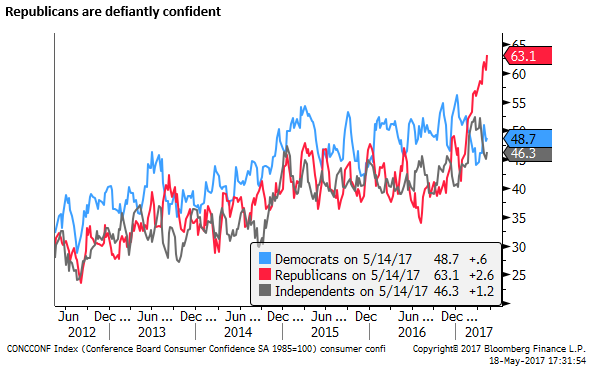

One interesting feature of this survey is the contrast between survey results for Republicans and others. Republicans are professing increased confidence this year, while Democrats and independents have high, but fading confidence recently. One wonders in Republican feel the need to show defiance with their survey responses as their party and President come under attack.

Currencies struggle to find direction in uncertainty

The clear currency market winner so far in the turmoil, if you don’t count Bitcoin, is the JPY. But the FX market is very choppy with a range of uncertainties swirling.

The AUD rallied after signs of improvement taking hold in the Australian labor market. But on the other hand, Chinese property prices were weaker, following on from weaker activity indicators early in the week, generating risks of slowing demand for commodities. Both the AUD and NZD failed to bust out of the negative trends taking hold in recent months.

The market is likely to remain in a mixed frame of mind with respect to emerging markets. A damaged US president and stalled policy agenda may tend to weaken the USD, slow US rate rises and encourage more capital outflow from expensive US equities to emerging markets and Europe. On the other hand, the risk of US market turmoil may undermine global equity markets and see capital retreat to cash. At least for a time, this may undermine emerging markets as investors retreat from positions taken over the last month or so.

The sharp drop in BRL on its own political scandal will not help restore jittery investor confidence. However, this is a very Brazil-specific event.