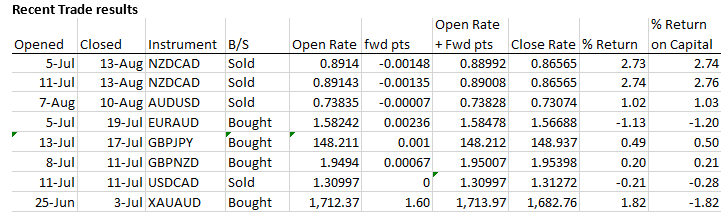

Short NZD/CAD (from 5-July to 13-Aug)

Real-Time AmpGFX – Bought NZD/CAD to close short position – (Mon 8/13/2018 4:13 AM MT)

Bought one unit of NZD/CAD at 0.8657 to close our short position.

Comment

Trump made comments on Friday evening threatening to impose car tariffs on Canada if it can’t get its way in upcoming trade negotiations. My initial thoughts were that this was a negotiating ploy, not a serious threat, but on further reflection, the comments do increase the risk of more protracted and difficult negotiations, within which Trump is likely to threaten and increase uncertainty.

Trump has proven willing to use economic sanctions and tariffs to pressure nations on various levels, including to the point of generating negative feedback on the US economy and markets. It is not inconceivable that Trump does go ahead with tariffs on Canadian autos.

It does not help that Trump does appear not to like the Canadia PM Trudeau, and this could play into chances of a deal with Canada.

We also see risk towards stronger confidence in China and Asia, at least for the near term as China has eased monetary and fiscal policy and may underpin growth in the region. Asia may be seen as a relative safe haven to developments in Turkey.

US Tariffs on China may continue to escalate tensions and eventually play out more negatively for Asian markets. But in the near term, China may work harder to stabilize its markets and economy.

With significant data out in China and Australia this week that may prove relatively solid, and a Canadia CPI at end week that could go either way, we have decided to lock in gains and take a step back to assess developments for the time being.

We currently have no positions.

Real-Time AmpGFX – staying with CAD/NZD short, latest thoughts (Thu 8/2/2018 10:26 PM MT)

The data in the last week supported our short NZD/CAD trade.

NZ business confidence was again particularly disappointing, suggesting the economy has slowed well below potential. ANZ said, the own-activity reading of +4 was “the lowest reading since May 2009 and well below the long-term average of +27”

The NZ employment report was close to expected. The quarterly increase in jobs was a bit above expected, but the unemployment and under-employment rates ticked higher, weaker than expected, and wage growth remained subdued, as expected.

Job ads on Friday rose after recent weak readings. However, overall the market may be left with the impression that future employment growth will slow from here.

(Chart 1: Employment leading indicators suggest weaker jobs growth ahead)

Canadian economic reports, on the other hand, were robust. Monthly GDP rose significantly more than expected in May, running well above potential; up 2.6%y/y in May, down from the peak last year, but settling at a still high level. Leading indicators rose 0.2%m/m in June, on a stable growth trend this year.

The Markit manufacturing PMI dipped only modestly from its high in June of 57.1 to 56.9 in July.

Next week Canadian housing data and the employment report is due. There is every reason to expect a solid employment report.

(Chart2: Canadian leading indicators and monthly GDP – settling still above trend)

(Chart 3: Business surveys – PMI remains relatively high in July)

RBNZ meeting may offer fresh downside impetus for NZD

Next week the RBNZ policy statement should maintain a neutral policy stance noting that it is “positioned to manage change in either direction – up or down – as necessary”

And “The best contribution we can make to maximising sustainable employment, and maintaining low and stable inflation, is to ensure the OCR is at an expansionary level for a considerable period.”

This RBNZ meeting is accompanied by the MPS and press conference. So there will be more fodder for the market to move on.

The Q2 inflation data did show an uplift in underlying inflation. The RBNZ’s preferred sector factor model rose from 1.5% (revised up to 1.6% in Q1) to 1.7% in Q2, moving closer to the 2% inflation target, a high since 2011. So the RBNZ will probably not need to sound more dovish. On the other hand, the recent weaker business surveys suggest underlying activity has weakened, so they are likely to maintain a balanced outlook.

It will be interesting to see how Governor Orr balances the softer activity indicators with the higher inflation outcome. He may decide to indicate that while the pick-up in inflation is encouraging, NZ has experienced several years of below-target inflation, dragging down inflation expectations, and the RBNZ could afford a period of above-target inflation to help lift and sustain inflation around the target. If so this could be viewed as a dovish outcome and propel further weakness in the NZD.

The NZD/USD is at a relatively crucial juncture, scraping along the bottom of a slightly declining trend line over the last two years. A sustained and significant move below this line may signal deteriorating sentiment.

(Chart 4: NZD/USD scrapping a key trend line)

Weaker Asia and Global Risk Appetite

Contributing to the further weakness in NZD/CAD in the last week has been some intensification of the US-China trade threats, leading to a further fall in CNY and a weaker Chinese equity market. This generated some contagion to other Asian markets; including the AUD and NZD.

There was also broader weakness in global risk assets and USD strength. Contributing factors were an uplift on global yields in part generated by a more flexible BoJ yield target, steep falls in the TRL, in part generated by threats of US sanctions. The EUR and GBP were weaker perhaps in sympathy with broader USD strength, but certainly lacking their own strength with issues related to Brexit and Italy contributing to weakness in European assets.

In the midst of this greater global uncertainty and a stronger the USD, the CAD held its own against the USD. News from the week continued to suggest that the US, Mexico and Canada are making progress on NAFTA negotiations, in contrast to the US-China trade dispute.

A weaker CNY and weaker EM markets, in general, may continue to weigh on NZD more than CAD in the week ahead. However, on the same token, we need to be wary of a potential break-through in US-China trade relations that might see a rebound in Asian markets, and/or a set-back in NAFTA talks, that might undermine the CAD.

The oil price is always a wild-card for the CAD. It has been relatively stable in recent weeks, not playing a big role in CAD direction. USD/CAD is hovering near the psychological 1.30, supported by stronger Canadian data and firmer Canadian rates in recent weeks. But held back by broader USD strength. In general, it seems likely that the CAD will remain relatively stable against the USD.

As such, our short NZD/CAD position may tend to be driven by developments in the NZD/USD, that could come from either movement in the NZD or USD.

We are staying with our short NZD/CAD position, lowering our stop loss.

Positions

Short half unit NZD/CAD at 0.8914; s/l 0.8888; t/p 0.8513

Short half unit NZD/CAD at 0.8914; s/l 0.8888; t/p 0.8513

Real-Time AmpGFX – comment on NZ inflation (Mon 7/16/2018 10:34 PM MT)

Contrary to our expectation, the core NZ inflation data has lifted, generating a picture of accelerating inflation after being long stagnant below the RBNZ 2% target.

The NZD has shot up after the RBNZ released its analytical series, the Sectoral Factor Model. This is their preferred underlying measure, and it had been little moved at 1.4 to 1.5% since Q3-2015. Today the RBNZ revised up the Q1 reading to 1.6% and reported Q2 at 1.7%; a significant shift for this series.

The NZD may be experiencing a bit of a short squeeze which may underpin the currency in the near term. NZD is up around 0.8%. NZ 2yr swap rates were up 3bp, but have eased back to only up 1bp.

Strength in the NZD is tending to drag up the AUD as well.

The inflation data seems to remove the risk that the RBNZ might consider cutting rates again, and makes the next move more likely to be a hike, although the timing remains distant.

We have a decision to make as to whether to close out of our short NZD/CAD position and/or long EUR/AUD position following this data release.

There is no doubt that the inflation data makes the picture more positive for the NZD. However, after the NZD jump on the data, we are not convinced it should continue to rise. We expect policymakers will be cautious to change their view. Inflation still has to rise to meet the 2% inflation target. A range of activity indicators suggest that the NZ economy has slowed to be only at or below trend growth. It remains to be seen if inflation will continue to rise or again stabilize closer to, but still below target.

Furthermore, milk futures prices have declined somewhat further in the last two weeks after a sizeable fall following the GDT biweekly dairy auction on 3-July. The next auction is later today and may limit further upside in the NZD.

Australian labour force data are due this Thursday. Some recent indicators such as the NAB business survey employment component suggest jobs data may not be as strong as expected.

Canadian existing home sales showed recovery in June today. Canadian inflation data is due on Friday. We have no strong guide as to how this will go. The market is expecting core measures to remain at 1.9% for a fifth month in a row in June, just below the BoC target.

The recent fall in oil prices may be weighing on the CAD somewhat.

As such we have decided to stay with our existing strategy for these currencies’

Positions

Long half unit GBP/JPY at 148.21; s/l 146.43; t/p 149.98

Long half unit of EUR/AUD at 1.5824; s/l 1.5673; t/p 1.7234

Short half unit NZD/CAD at 0.8914; s/l 0.9013; t/p 0.8513

Short half unit NZD/CAD at 0.8914; s/l 0.9013; t/p 0.8513

(Chart: NZ inflation indicators %y/y)

(Chart: Quarterly weighted median and trimmed mean %q/q – also firmer in the last two quarters)

Real-Time AmpGFX – Sold NZD/CAD, adding to short, watching USD/CAD closely (Wed 7/11/2018 9:18 AM)

Sold half unit of NZD/CAD, adding to short

Comment

My preference is to manage the CAD long through NZD, taking out the USD component.

The rebound in USD/CAD from lows since the BoC statement reflects some USD strength.

My intention is to close the USD/CAD short, but want to wait and see how the market develops, this could be a short-lived bounce in USD/CAD, and will be watching it closely.

Positions

Short USD/CAD half unit at 1.3100

Long half unit of EUR/AUD at 1.5824; s/l 1.5673; t/p 1.7234

Short half unit NZD/CAD at 0.8914; s/l 0.9013; t/p 0.8513

Short half unit NZD/CAD at 0.8914; s/l 0.9013; t/p 0.8513

Long half unit GBP/NZD at 1.9494; s/l 1.9233; t/p 2.0623

Real-Time AmpGFX – Sold NZD/CAD (Thu 7/5/2018 4:39 PM MT)

Sold half unit NZD/CAD

Comment

We see the potential for the US to tone down its trade rhetoric with Europe and NAFTA while concentrating its attention on China. This may tend to support EUR and CAD and undermine Asian currencies.

Recent indicators suggest the NZ economy has slowed. Milk futures prices have fallen significantly in recent weeks.

The BoC is likely to proceed with a hike next week (89% priced in), the fourth this cycle taking rates to 1.5%. They should continue to maintain an outlook for gradual rate increases.

Canadian employment data released on Friday should be reasonably upbeat.

Position

Long half unit of EUR/AUD at 1.5824; s/l 1.5673; t/p 1.7234

Short half unit NZD/CAD at 0.8914; s/l 0.9013; t/p 0.8513

Our Capital at Risk: 101bp (EUR/AUD); 104bp (NZD/CAD)

By setting an initial stop loss of 0.9013 on the NZD/CAD short trade, our (AmpGFX) percentage loss would be 1.10%. Based on our trade size this represents 104bp or 1.04% of our trading capital.

In the past, I have provided some guidance on the relative size of our trades using “units”. I am working on providing a clearer understanding of the actual amount of capital we have at risk, as reflected in the results we report on our website.

How much capital an investor will allocate to each trade will depend on their capital base (assets under management), risk tolerance, and how each new trade might be considered to add to the existing risk in the portfolio.

As an investor or portfolio manager, you have to decide how to size your trade, and whether to trade at all. We are not providing any advice on these matters. To confirm we are licenced to provide only “general advice.” Please see our disclaimer and Financial Services Guide for more information.