Short USD/CAD (From 27-Aug to 30-Aug) Thoughts on NAFTA

Real-Time AmpGFX – Contagion risk from EM chaos, closed CAD position (Thu 8/30/2018 10:11 AM)

CAD position closed

We were stopped out of our short USD/CAD position (in a modest profit) on the move above our stop loss at 1.2988.

It rose on the softer than expected Canada GDP report (although the report was still quite strong).

Uncertainty over the Canada-US trade negotiations is very high and poses a significant event risk. We think a deal will come, but if it is delayed beyond this week, held up by sticking points on dairy or the dispute resolution mechanism, we may see a period of weakness in CAD.

Broad strength in the USD on emerging market chaos also suggests holding back from re-entering a long CAD position. Although strength in oil prices are a supportive factor.

Positions

Short one unit NZD/USD at 0.6679; s/l 0.6773; t/p 0.6388

Short one unit of AUD/USD at 0.7310; s/l 0.7413; t/p 0.6888

(Contagion risk commentary was later released in this AmpGFX report (https://ampgfxcapital.com/reports/emerging-market-chaos-returns/)

Real-Time AmpGFX – Lowering USD/CAD stop loss, trading thoughts (Tue 8/28/2018 8:24 AM MT)

Comment

The USD continues to soften this week. This may reflect broad confidence that the US is taking a softer line on trade with its North American trading partners, notwithstanding the threatening and negative comments made by Trump towards Canada and China in his press conference yesterday.

Perhaps the market is viewing actions as more important than words from Trump, and the deal announcement with Mexico was a signal of policy direction.

Auto sector equities globally have bounced sharply suggesting the market is removing some of the discount for the risk that Trump moves on auto tariffs against either Canada or Europe, or more generally, in the wake of a deal with Mexico that was largely built around conditions in the auto sector.

The strength in the EUR is probably helping lead broader weakness in the USD. This may reflect unwinding of risk aversion trades related to Italy, Turkey, Trade policy, Euro-economy uncertainty.

However, the reality is that there remain hurdles to a Canada deal with the US and its inclusion in a trilateral trade deal. Trump is set to intensify trade pressure on China. Turkey and Italian risks on Europe remain, and US yields are rising again with strong further gains in US equities. As such, we see risks of a reversal of gains in CAD and falls in the USD this week.

We are guarding against a loss on this trade by moving our stop loss down.

But we retain the position seeing scope for it to move further in line with potential for strong Canadian GDP on Thursday, and a further technically inspired squeeze of long USD positions.

Position

Short one unit of USD/CAD at 1.3013; s/l 1.2988; t/p 1.2788

Real-Time AmpGFX – Our thoughts on Trump’s press conference to announce a US-Mexico trade deal (Mon 8/27/2018 10:52 AM)

Comment

Trump said that he would get rid of the name NAFTA and accept the deal with Mexico as a bilateral deal. He said he is prepared to deal with Canada on a trilateral deal, but indicated that it was not necessary.

The USD/CAD bounced rapidly on the comments from its lows on the day so far. We did anticipate Trump throwing some doubts over making a deal that includes Canada. And this bounce in USD/CAD was not unexpected.

A deal with Canada will no doubt take time, and we should expect threatening language from Trump. There is a risk that Trump and Trudeau get into a war of words that derails any deal.

However, we still see the agreement made today between the US and Mexico as a step in the direction of a trilateral deal.

In the press conference where Trump spoke with Mexico President Pena Nieto over speakerphone, Trump again reiterated that he was ditching the name NAFTA and wanted to call the deal the US Mexico Trade deal.

He also reiterated his issue with “300%” tariffs on some dairy products applied by Canada and threatened to place tariffs on Canadian cars. He implied that a trade deal with Canada was not necessary and that the US may have bilateral deals with Mexico and Canada, or a trilateral deal.

Pena Nieto said twice that he would like to see Canada included in the deal both before and after Trump’s threatening comments against Canada.

And Trump closed after the call with Pena Nieto by again suggesting tariffs on Canada’s cars would be an “easy way to go” suggesting that might be better for the US and hurt Canada. So this remains a negotiating tactic. Trump said he would be speaking with Canada PM Trudeau later in the day.

Trump also said that this was not the time to talk with China on trade. He suggested that he was pleased with the way the current trade policy with China was placing pressure on China and implied it was helping the USA.

The tough language by Trump against Canada and against NAFTA as a trilateral agreement suggest that a deal between the US and Canada may still be difficult to make. This remains a negative factor for the CAD.

However, the CAD should also be benefiting from its robust economic performance and stronger oil prices in recent weeks. We sense that there remains significant upside for the CAD if a trade deal is agreed.

More broadly the USD has weakened today against a range of currencies. This may reflect capital moving back into higher risk assets including EM equities and currencies. China’s move to stabilise its exchange rate has been a contributing factor. The market more generally is displaying some renewed confidence in global asset markets.

There is not any new reason to be confident that risk factors such as higher US rates, political upheaval in a number of countries, and US trade policy, have been reduced. As such we need to be sceptical that the fall in the USD will last. Nevertheless, positioning may have moved to underweight EM assets and an adjustment back to a more balanced view may be underway, supporting some further unwinding of USD strength near term.

Trade adjustment

As the first headlines were announced that Trump was getting rid of the name NAFTA and replacing it with a US-Mexico trade deal, we decided to trim our risk on the short USD/CAD trade taken earlier in the day to evaluate the rhetoric and market reaction. However, as the USD/CAD stabilized we re-established our initial position to be again short USD/USD one unit. (We bought a half unit at 1.2986, and sold half unit at 1.29825 for a cost of 3.5 pts. We have revised down slightly our opening trade rate from 1.3015 to 1.3013 to reflect this small loss.)

Position

Short one unit of USD/CAD at 1.3013; s/l 1.3113; t/p 1.2788; (capital at risk 0.74%)

Real-Time AmpGFX – sold USD/CAD (Monday, August 27, 2018, 8:01 AM MT)

Sold one unit of USD/CAD at 1.3015

Comment

News that the US and Mexico are close to solving bilateral issues on NAFTA brings a possible trilateral deal including Canada closer to fruition. While issues will remain to be resolved with the US and Canada, we see the probability of a deal improving.

The USD is trading broadly weaker on Monday, and we suspect, at least through the early part of the week, the USD will remain on a broadly weaker trend. This may simply be a technical move that began last week.

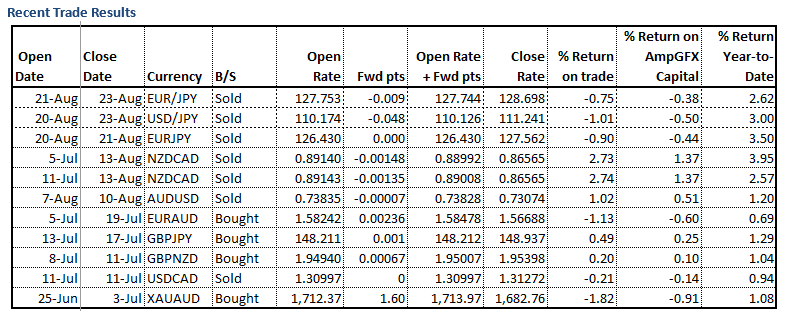

We were stopped out of short EUR/JPY and USD/JPY positions last week, so this is our only trade at this time.

Canadian economic reports have been beating expectations and oil prices have been strengthening again recently. We see Canada still on track to hike in October.

Positions

Short one unit of USD/CAD at 1.3018; s/l 1.3113; t/p 1.2788; (capital at risk 0.74%)