AUD receiving commodity support

Australian commodity prices continue to rise with further gains in coal and iron ore prices this week, despite news that the Chinese government is moving to contain credit growth and its housing market. The medium-term outlook remains unclear, but taking commodity price moves at face value suggests the AUD should perform relatively well. Rising global bond yields and a stronger USD (mainly reflecting weakness in JPY, GBP, and more recently the EUR) and mixed EM markets may tend to cap the AUD against the USD, but it likely to outperform other currencies. AUD/NZD is approaching technical resistance, but still has further upside potential.

AUD receiving commodity support

Chinese industrial commodity prices have continued to firm despite the steady drumbeat of stories highlighting concerns over its financial sector stability, renewed efforts to control credit growth and the housing market (after both picked up this year and boosted demand for steel).

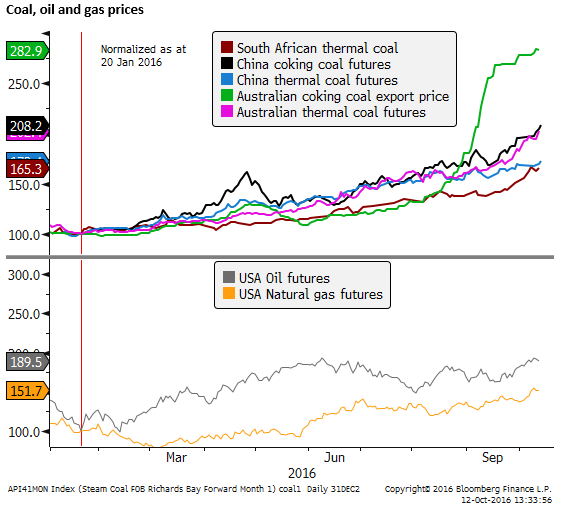

Australian coal producers, especially the steel-making (coking) variety, have benefited from production curbs in China. Again the outlook is unclear with reports that China is easing those curbs.

However, it is often better to follow the price signals, and consistently strong commodity markets in China are providing support for the AUD.

Coking coal prices have surged by around 180% this year. The first Japanese steelmaker contract agreement with an Australian coking coal exporter set the Q4 price at $200, up from $92.50 in Q3, at a high since 2012.

Iron ore prices have also firmed over the last month. They are down from their peak for the year in August, but are up 46% this year.

Government budget boost

Australian business journalist Peter Martin made a number of interesting observations in a story today. He noted that the Australian government is likely to receive some positive news for a change on the nation’s budget position. Based on Access Economics analysis, Martin estimates that the budget boost from the recent rise in coking coal prices is $7bn per year (assuming the price remains around the recent high). He wrote, “And that’s just for coking coal. The iron ore price is up 40 percent this year. The price of thermal coal (the stuff that makes electricity) is up 55 percent. It’s not bad for an industry that had been shutting mines and laying off workers.”

In May, the Budget deficit for the current fiscal year ended Jun-2016 was forecast by the government at around $A40bn, around 2.2% of GDP. Not disastrous by global standards. Budget repair remains a fairly high priority in Australia, although plans to return to balance are not particularly well-formed.

Martin also noted that, “Moody’s reported on Wednesday that it expects Australia to become the world’s fastest growing AAA-rated commodity exporter, beating Canada, Norway, and New Zealand. It’s not likely to take away the AAA rating any time soon.”

Suddenly coal prices are booming. Will the entire country be next? (By Peter Martin) – SMH.com.au

The rebound in commodity prices this year is likely to be treated with some skepticism by the resources industry in Australia as it observes the Chinese and global economy. The sustainable pace of demand growth is likely to remain at its down-shifted levels of recent years, preventing a significant bounce back in investment in the sector. Nevertheless, the income generated from the resurgence in commodity prices is likely to provide some broader support for the economy and help sustain economic confidence. A boost to the budget and external accounts should provide some support for the AUD.

AUD/NZD boosted by relative commodity prices

There remains little reason to expect an interest rate change by the RBA, with other sectors of the economy on a moderate growth path.

AUD performance against the USD is generally consistent with the stronger USD against many currencies in recent weeks. Higher global bond yields and a weaker JPY are likely to help cap the AUD. The market will remain wary of a downturn in Chinese commodity demand. We have no strong desire to take a long AUD position against the USD. However, it may continue to see gains against the NZD, still coming from a relatively low level.

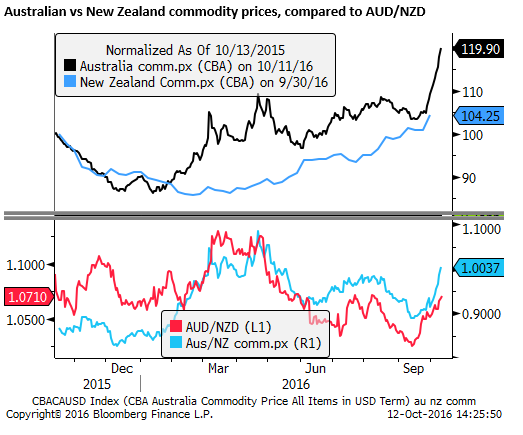

The chart below shows the rise in the CBA Australian commodity price index (last reading 11-Oct) against its more delayed New Zealand commodity price index (last reading 30-Sep). It suggests that much of the recent recovery in AUD/NZD can be explained by the movement in relative commodity prices. The divergence in these commodity indices is likely to be greater than shown below, considering the further rise in Australian coal and iron prices and fall in dairy prices since end-Sep.

Relative interest rate outlook supports AUD/NZD

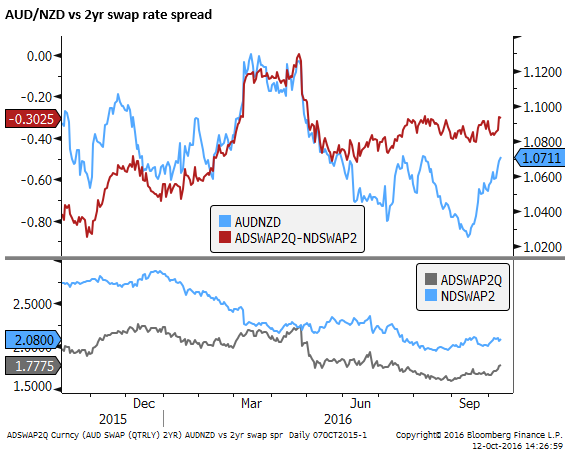

The chart below shows the 2yr swap rate spread between Australia and New Zealand. Higher commodity prices in Australia have contributed to less expectation of further rate cuts by the RBA over the year ahead. The new RBA Governor, Lowe, is also seen as somewhat less eager to stoke excessive housing market strength by easing rates further. On the other hand, the RBNZ is expected to push ahead with a further rate cut in November.

The yield spread between the two has been relatively stable in recent months, but has moved somewhat in favor of the AUD recently. The currency pair does appear to have significantly underperformed the yield spread over the last year, probably owing to a ‘reach for yield’ favoring the higher yielding NZD.

‘Search for yield’ premium for NZD diminishing

To the extent that NZD may have received an additional boost this year due to a global investor ‘search for yield’, it is possible with global yields now rising, that some of this out-performance in the NZD will also dissipate.

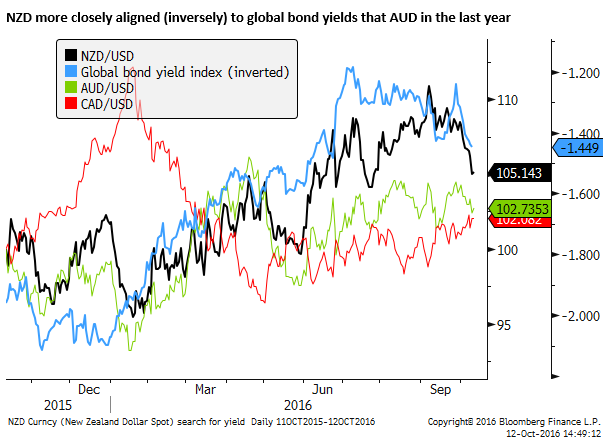

We have discussed using the JP Morgan Aggregate Global Bond Yield Index as a proxy for a ‘search for yield’ in recent reports (AmpGFX – RBNZ Communication failure and AUD/NZD fair value, 25 Aug) & (AmpGFX – Downside potential in NZD vs. CAD, 7 Oct). The chart below shows the NZD, AUD, and CAD vs the global yield index. It suggests that the NZD has been more closely aligned (inversely) with global yields in the last year than AUD. The CAD has shown little relationship to global yields, consistent with its low yield status.

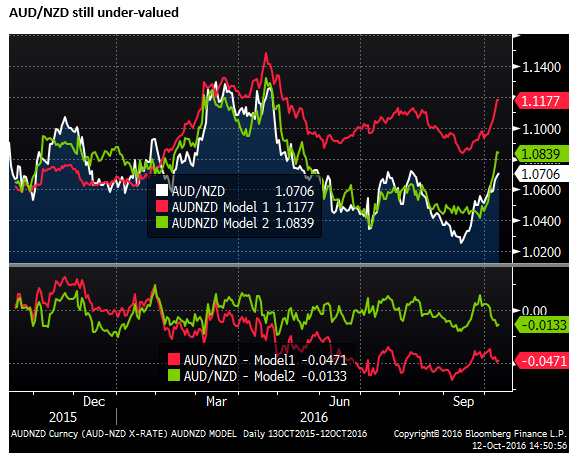

As discussed in the two reports above, we produced models of AUD/NZD and NZD/CAD based on relative commodity prices, two-year yield spreads and the aggregate global bond index.

The results for AUD/NZD are shown below. The red line (Model1) does not include the global bond yield index and is a more medium term model. It suggests that the AUD/NZD fair value is closer to 1.12. The green line incorporates the global bond yield index and is a shorter term model based on around a year of daily observations. It suggests that the AUD/NZD fair value is around 1.085. (Still above the current level near 1.07).

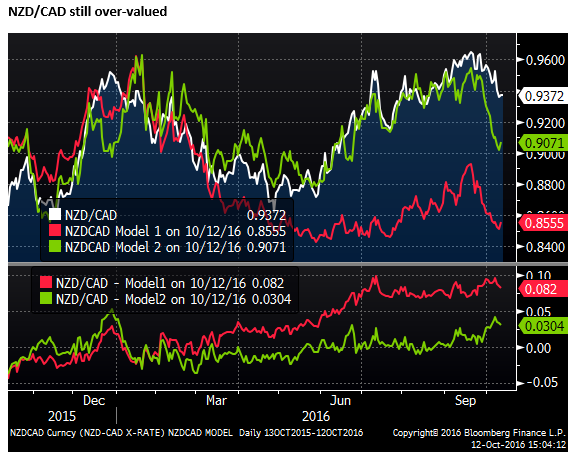

The chart below shows results for the NZD/CAD model. It also suggests there is significant further downside for the NZD/CAD.