Australian economy hitting its stride, but AUD is pricing a growth stumble

The US wages data and trade policy announcements that may come before end week will keep global markets on edge. There is scope for a corrective bounce in EM assets, but the prospect of further US rate rises and an escalation of the US-China trade war may hang over global markets for some time. The Australian GDP report was much stronger than expected, rising at an annualised 4.1% in H1, well above the trend growth rate of 2.75%, suggesting that the economy has significant momentum. Global and domestic risks to growth have become more elevated, but the economy appears reasonably placed to take a few punches. The AUD has built in a discount for these increased risks and is cheap relative to Australia’s still solid commodity export prices, helping support income growth.

US inflation remains a major risk for an unprepared market

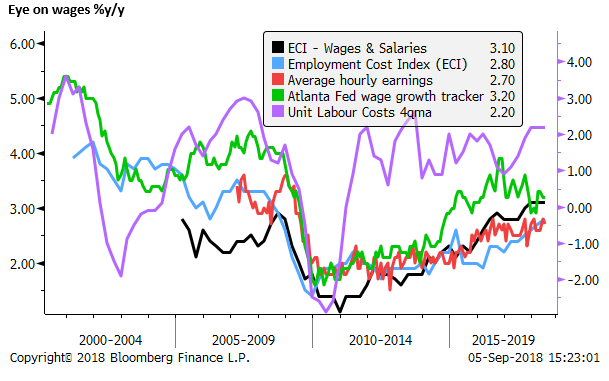

We are still awaiting significant news this week that may yet determine the tone of the FX markets. The US payrolls report is due on Friday. The market is looking for strong activity outcomes which may help underpin an already strong USD. But the crux may be wages.

The market has become numb to inflation risks from a tightening labor market, witnessing only a very slow grind in wages growth. But the US average hourly earnings data do occasionally move significantly more than forecasts, and we have to remain watchful for a pop in wages considering the tightness of the US labor market.

We agree with RBA Governor Lowe that one of the major risks to the global economy, one that does not get mentioned very often, is that US inflation rises more than expected.

RBA Lowe said on Wednesday that, “The United States is experiencing a large fiscal stimulus at a time when the economy is at full employment and is growing quickly. This is an unusual combination to say the very least. Past experience suggests that it could lead to inflation increasing significantly. Financial markets are, however, heavily discounting this possibility, which means that if it did take place it would come as quite a surprise, with repercussions for markets and the real economy.”

Remarks at Reserve Bank Board Dinner; Philip Lowe ; 4 Sep – RBA.gov.au

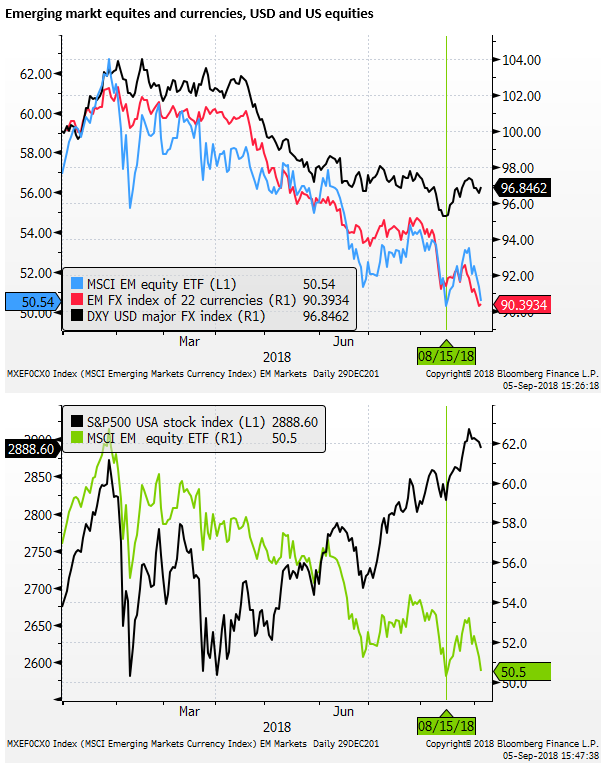

Bracing for more US tariffs in China

The other key risk we are waiting for this week is whether the US administration will announce a go-ahead on tariffs of up to 25% on an additional $200bn in Chinese imports. The market may already have braced itself to some extent for this outcome. However, it will represent a significant escalation of the US trade war on China and reinforce the troubled outlook for China as it grabbles with credit excesses, and growing unease over the state of global growth and emerging market assets.

Furthermore, the tariffs threaten to undermine confidence in the US, raise consumer prices and place additional pressure on Fed policy. While the Fed might see tariffs on consumer goods as a temporary boost to inflation, they can have more sustained effects in an economy facing capacity constraints. For instance, they may encourage workers to push for higher wages, and US companies may feel they have scope to pass on more of their rising costs to selling prices.

A decision to move ahead on these tariffs may be seen as a more permanent drag on global growth, and extend a destabilising rise in the USD, placing pressure on companies and governments in several emerging market economies with USD debt.

Scope for correction in recent EM slump

While rising US rates, a strong USD, and US trade policy are major risks to global asset markets that do not look like they will go away any time soon, we acknowledge that after the recent plunge in emerging markets and currencies, there is scope for a corrective bounce if the US administration delays tariffs on China, or US wages appear more benign.

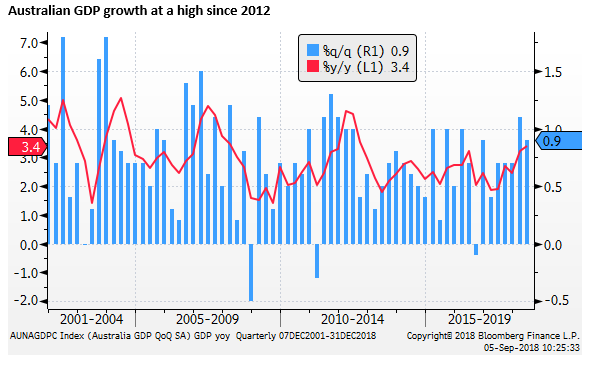

Strong GDP buys the RBA more time

We had noted increasing risks to the Australian economic outlook that might have seen the RBA adjust from a distant tightening bias (the next move in rates is expected to be up although not for some time) to a neutral bias acknowledging that a rate cut was back on the table.

RBA may tweak guidance; 3-Sep – AmpFGXcapital.com

We noted that external risks were increasing, including weaker emerging market assets, undermining the growth outlook for these countries, and raising the risk of contagion. And the increasing likelihood that the US administration will escalate its trade war with China, directly impacting Australia’s largest trading partners. We also noted the ongoing and potentially accelerating slowing in the Australian housing market and some out-of-cycle increase in mortgage rates, and greater political uncertainty in Australia. There were some tentative signs that the business confidence was deteriorating from strong levels.

RBA rate cut may soon be back on the table; 31-August – AmpGFXcapital.com

However, the very strong GDP growth data for Q2 (0.9%q/q, 3.4%y/y) suggests that the economy has momentum and has bought the RBA more time to assess the growing threats to growth.

The RBA has forecast GDP growth running at a little above 3% for this year at next. The GDP data on Wednesday showed growth annualized at 4.1% in the first half of this year, so it is well on the way to exceeding this forecast.

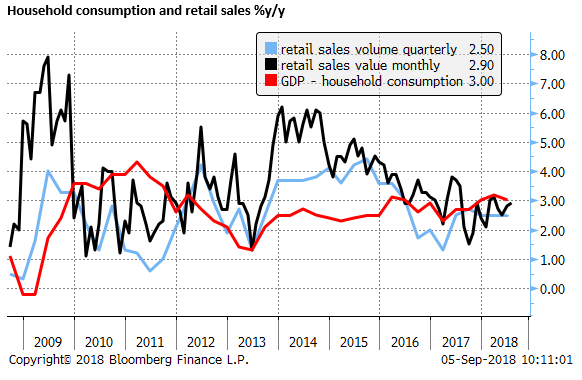

Household consumption solid – but facing headwinds

Household consumption (+0.7%q/q, +3.0%y/y, contributing +1.7%y/y) is showing resilience to the weakening housing market, growing slightly above the perceived trend for GDP (2.75%). Wages growth (2.1%y/y) remains sluggish, so income and consumption growth has been sustained mainly by strong employment growth in the last year. The savings rate (1.0%) has also deteriorated rapidly in the last three years, supporting consumption, which may not last as falling house prices drag on household wealth and confidence.

Strong business investment

A major contributor to GDP over the last year was private business investment (-0.7%q/q, +9.9%y/y). In the quarter, dwelling investment was strong (+1.7%q/q, +3.8%y/y, contributing 0.2%y/y). Total private sector investment was flat in the quarter, up 6.7%y/y, contributing 1.3%y/y.

The mining sector investment downturn has largely run its course. In fact, it rose 5.1%q/q, down 9.7%y/y. Dwelling investment might be expected to flatten and decline in the year or two ahead, from a high level, but the RBA is looking for an ongoing strong contribution from private sector business investment with strength in the non-mining sector (-2.4%q/q, +17.7%y/y).

Government spending strong

The government is also spending more on consumption (+1.0%q/q, 5.1%y/y, contributing 1.0%y/y) (Health, aged care and disability services were the main contributors).

Corporate profit strong benefiting from strong commodity prices and a weaker AUD

Corporate profits have grown strongly. Private non-financial corporations gross operating surplus rose 0.7%q/q and 9.7%y/y. Financial corporations GOS rose 1.4%q/q and 6.2%y/y. Mining was the main contributor to profit growth, driven by higher production and strength in commodity prices, even as the AUD has fallen. Total mining investment is expected to fall further as larger LNG projects are completed, but other mining investment is now recovering.

Strong income growth is helping improve the government budget and support government spending and underpin private sector investment growth.

Public infrastructure missing

The RBA often cites strong growth in public infrastructure spending as a support to growth, including non-mining private sector investment, although this was not born out in the GDP report. Public investment has flattened out in the last 18-months (flat q/q, -8.1%y/y contributing -0.5%y/y). However, this data is volatile; the construction work done report released two weeks ago showed public sector work done rose 2.5%q/q, 17.2%y/y.

Australian economy normalising

The bottom line is that the Australian economy is on the road to normalization. GDP has been growing above trend and may continue to do so. There is slack in the labour market, and wages growth is below that needed to return inflation sustainably to target, but unemployment is falling. At 5.3% in July, it is the lowest since 2012 and getting close to historical perceptions of full-employment (NAIRU) around 5%. However, broader measures of under-employment suggest that there is still considerable slack in the labour market.

International experience suggests that the labour market may have to tighten much more and sustainably to generate more significant wage growth, but the RBA appears quietly hopeful that Australia will be different. RBA Governor Lowe said on Wednesday that, “Firms are currently reporting a record number of job vacancies and increasingly telling us that it is hard to find workers with the right skills. One way of dealing with this increasing tightness in the labour market is, of course, to lift wages.”

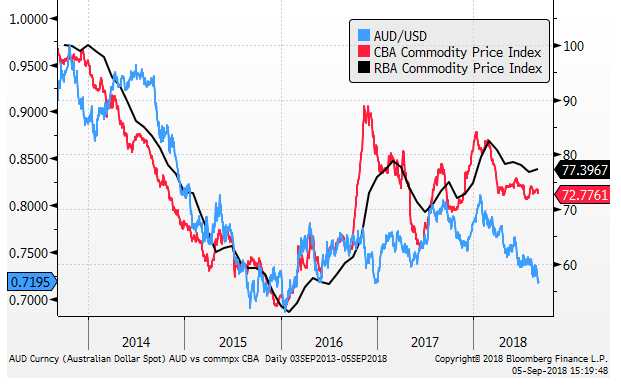

Australian Commodity export prices hold up

The risks to global growth may be coming through in copper and other base metals, but it hasn’t affected much iron ore, coal and LNG that are the primary export commodities from Australia. Oil prices remain elevated, underpinning LNG. Australia may even be placed to benefit from a US-China trade war, turning China more towards Australia for LNG. Australian coal export prices are solid, especially thermal coal used for electricity generation, boosted by China’s environmental protection policy.

Notwithstanding slower growth in China, its steel production remains strong, steel prices have increased this year, and iron ore prices are relatively stable.

As such, even though risks to global growth and China’s growth may be dampening the AUD, its commodity prices have held up, helping to generate stronger income and underpin economic growth in Australia.