Bank of Canada on hold this time

In our view, the probability of a Bank of Canada hike on Wednesday is essentially zero, creating some risk of a further kneejerk rise in USD/CAD. The market is pricing in a modest 19% chance of a hike. The tone of the Bank’s statement, press conference and Monetary Policy Review will probably reflect the message delivered by Governor Poloz’s speech on 27-Sep; that the Bank is now more data dependent, and not a slave to its models. The tone of recent data is that the economy has moderated from its rapid growth in the first half of the year. There is enough reason to wait for a few months to see how the economy responds to the two quick-fire hikes in Q3. However, the Bank is still likely to view the economy in-line with the forecasts presented in its July MPR and retain a clear tightening bias. The labour market in particular retained its strength in September, and wage growth has lifted from low levels. The recent retreat in the CAD exchange rate is consistent with the narrowing in its yield advantage in the last month. Further gains in USD/CAD are possible in the context of a stronger USD and NAFTA uncertainty.

Hike a non-starter this time

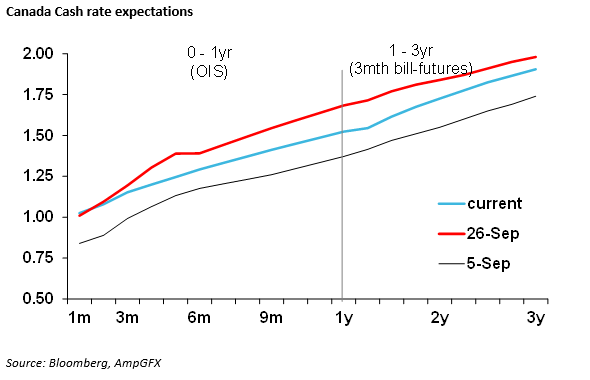

As we head into the Bank of Canada monetary policy meeting on Wednesday, the market has 5bp of hikes (around a 19% chance of a 25bp hike) priced-in. It has 13bp priced-in for the last meeting of the year on 6-Dec, suggesting there is a better than even chance that a hike will occur by year-end, and a hike is fully priced in by the 17-Jan meeting next year. A second hike is fully priced by around Q3 next year.

After hiking twice in succession in the previous two meetings (12-July and 6-Sep), and a speech by BoC Governor Poloz on 27-Sep, where he suggested the Bank would be more cautious, a hike tomorrow is, in our view, a non-starter. We give it essentially zero probability.

However, beyond that it is more difficult to judge, our guess is that the market is not too far off the mark on the overall rate outlook in the year ahead.

Not a slave to its models

If the BoC were to be a slave to its economic modelling, it might hike again and quite aggressively in the next year. According to its analysis in the July Monetary Policy review, and more recent events, it would conclude that its output gap has essentially closed and inflation would rise to and possibly above its 2% target by the second half of next year.

This might suggest that the Bank needs to get rates towards neutral by around mid-2018. Neutral rates might be around 3%; accounting for 2% inflation, real growth potential of around 1.5%, and perhaps giving back some to account for the high household debt levels. This would suggest that the Bank has some work to do just to get back to neutral rates from the current level of 1%.

However, hiking rates by as much as 2% by mid-2018 would be insane given the low rate environment globally. The CAD exchange rate would probably surge, and itself generate significant policy tightening, diminishing to need to raise rates.

The distance from neutrality, combined with the rapid closure of the output gap, made the first two hikes in Q3 this year an easy call. In any case, this can be viewed as removing the emergency rate cuts in 2015 delivered to offset the oil price shock.

However, the Bank of Canada needs to be more cautious about further hikes. It needs to give the economy a bit of time to absorb its recent hikes and assess their impact before ploughing on. Even though it takes 1.5 to 2 years for rate hikes to be fully absorbed, the Bank needs to at least gauge how the recent hikes have affected current sentiment and activity. This should take a few months at least.

But beyond this, there are a number of reasons not to be a slave to the economic models. They are in fact likely to over-estimate the need to hike rates, unable to fully account for a number of structural factors that may dampen inflation and lower the neutral policy rate.

This was the theme of Governor Poloz’s speech on 27 September (The Meaning of “Data Dependence”: An Economic Progress Report).

Poloz spelt out that the Bank is not a slave to its models. He said, “we simply cannot rely mechanically on economic models. This does not mean we are abandoning our models. It does mean we need to use them with plenty of judgment, informed by data, sentiment indicators and intelligence, as we go through the delicate process of bringing inflation sustainably to target. We will continue to watch all the data closely, as well as developments in financial markets, in terms of their impact on the outlook for inflation. We recognize that the economy may act differently than in previous cycles. We will not be mechanical in our approach to monetary policy.”

Reasons to be more cautious about further hikes

Poloz identified several reasons why he may need to raise rates more cautiously from here.

- Capacity in the economy may rise faster than projected, reflecting an increased pace of business spending. Poloz said, “To some extent, this happens at this point in every economic cycle, but the protracted cycle we have been through makes this issue particularly relevant this time around.”

- Structural factors dampening inflation: The Amazon effect – disruption and increased price competition across many industries.

- Low wage growth trends that are a global phenomenon.

- Elevated Household debt: interest rate hikes may have more impact than in the past.

- Macroprudential policy may be dampening the housing market and have some tightening impact.

- “The rise in protectionist sentiment in some parts of the world” (who could he have been talking about?). NAFTA negotiations are a clear uncertainty for the Canadian economy.

- “The evolution of the neutral rate of interest is also a topic of significant debate in the profession.”

- Financial Market developments: The appreciation of the CAD this year will have tightened monetary conditions to some extent.

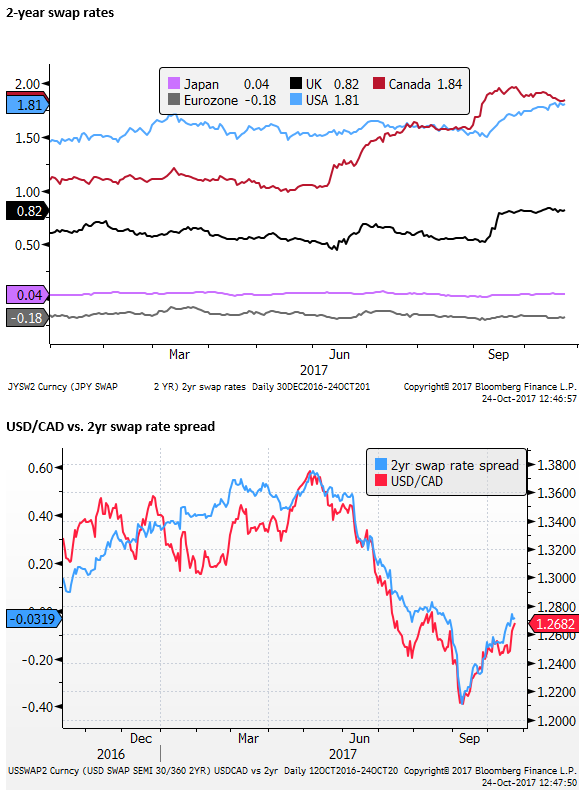

USD/CAD in-line with the 2yr rate spread

Not surprisingly after this speech was delivered, rate hike expectations in Canada retreated from a peak for the year-to-date. The chart below shows the shift down in the Canadian rate expectations curve since the peak, just ahead of the Poloz speech of 27-Sep.

The USD/CAD exchange rate rebound from its low for the year in early-Sep is largely consistent with a narrowing in the CAD yield advantage as rate hike expectation in Canada have cooled, whereas they have lifted in the USA from near a low for the year in early-September.

We can see some scope for further gains in the USD/CAD into year-end, but much depends on the evolution of the Candian economy. We tend to think that it will continue to moderate into year-end, and the BoC will push its next hike out into next year, giving the economy more time to absorb the two rapid hikes in Q3, and time for the BoC to assess the state of the economy and inflation.

Moderation in Canadian Economy

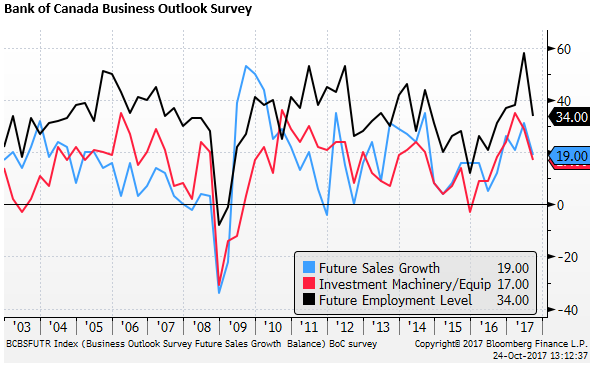

The Bank of Canada Business Outlook Survey, on which Poloz said, is “one of the most important vehicles” for gauging business sentiment, showed a cooling in its key Q3 measures from the peaks in the first half of the year. The levels are still relatively strong, but the direction of change is consistent with remaining on hold to give the economy more time to evolve after recent hikes.

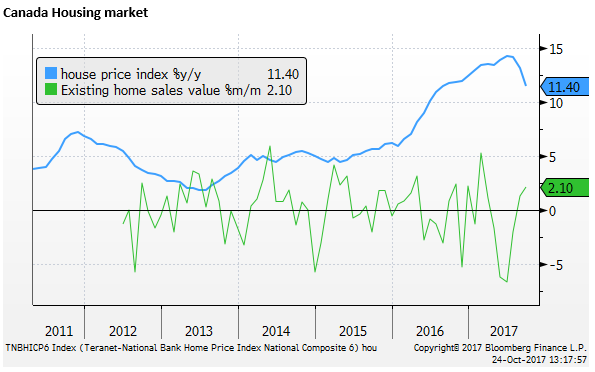

Housing market indicators have also softened from earlier in the year. House price growth, in part driven by an increase in a tax on foreign buyers in Toronto, has slowed abruptly from a peak in June. (CAD facing risks from a weaker housing market and NAFTA; 13-Oct – AmpGFXcapital.com)

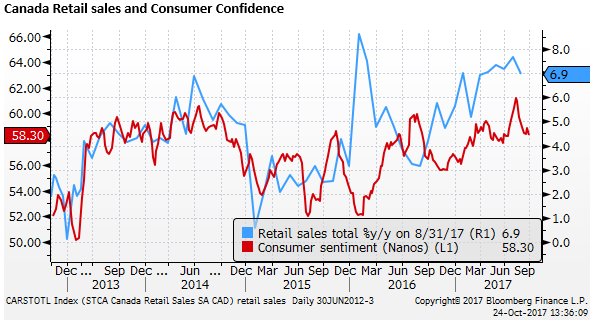

Canadian retail sales released last week were much weaker than expected falling 0.3%m/m in August, when they were expected to rise 0.5%m/m. From a year earlier, sales rose 6.9%y/y, down from a peak of 7.7%y/y in July.

The broad thrust of recent activity indicators is some moderation from strong levels in the first half of the year. The Bank of Canada did say this is what they expected, and it is by no means alarming. But it is reason to watch-and-wait to see how the economy unfolds for a few months.

Strong Labour Market

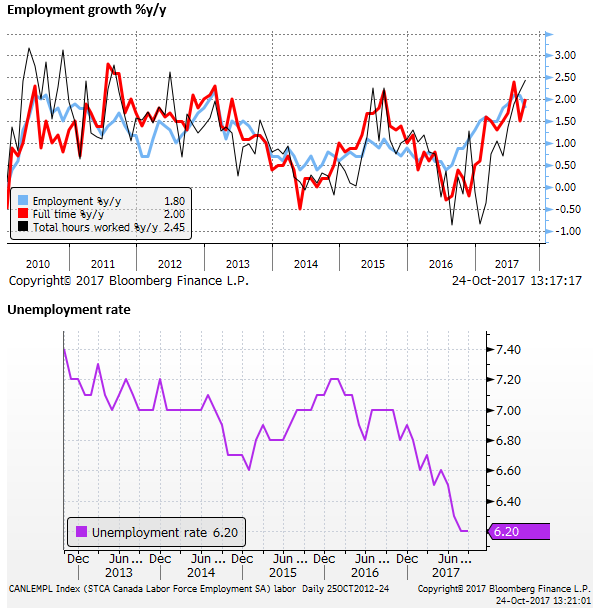

The labour market continued to show considerable strength in the most recent data, including higher wages. This should give the Bank of Canada reason to retain a clear tightening bias.

Total hours worked rose 2.5%y/y in September, a high annual increase since 2012. The unemployment rate was steady in Sep at 6.2%, a low since 2008.

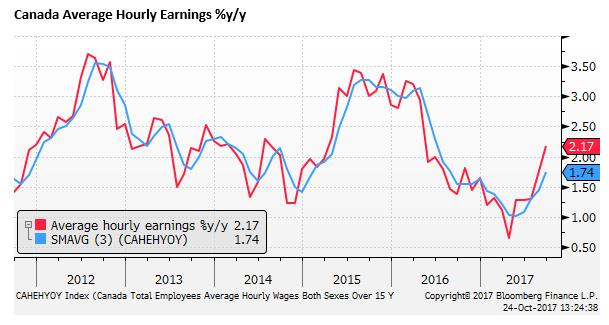

Poloz said on 27 Sep that wage growth “has been slower than would be expected in an economy that is approaching full output …. although there were signs of an increase in the latest monthly employment report.”

The September report, released in early-October suggested wages growth had accelerated further. This data may give then BoC more confidence to move forward with rate hikes.

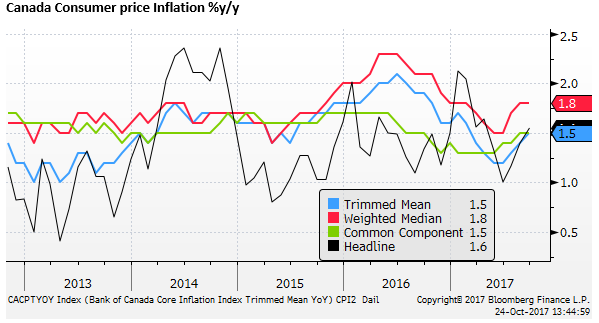

Inflation on track

The latest CPI inflation data showed two underlying measures steady at 1.5% and another, the weighted median, firmer from 1.7% to 1.8%y/y in September. The data will probably be viewed as consistent with the Bank of Canada’s forecast that inflation is on track to return to its 2% target on the schedule projected in July; around mid-2018.