CAD facing risks from a weaker housing market and NAFTA

Canadian house price growth has cooled abruptly in recent months from rapid growth in the first half of the year. After broad-based economic strength in the first half of the year, recent Canadian economic reports have been mixed. A reversal of fortunes in the housing market may contain consumer confidence and activity. In late-September, BoC Governor Poloz said that the Bank would be more data dependent in assessing future rate hikes after two back-to-back hikes in Jul/Sep this year. The risk is shifting to a more prolonged period before Canadian rates are raised further. NAFTA uncertainty also poses a risk for the Canadian economy. US PPI was stronger than expected and may reflect the impact of a weaker USD this year (CPI due tomorrow). The Fed minutes were seen as dovish, revealing FOMC concerns over low inflation. However, upside risk for US yields may arise from the impact of Hurricane recovery on growth, wages and inflation into year end. The Fed and the US rates market do not appear to have built-in much risk that tax reform will be enacted next year. Warsh would seem the best fit for Fed Governor and this prospect may boost US yields.

Canadian house price growth cooling fast

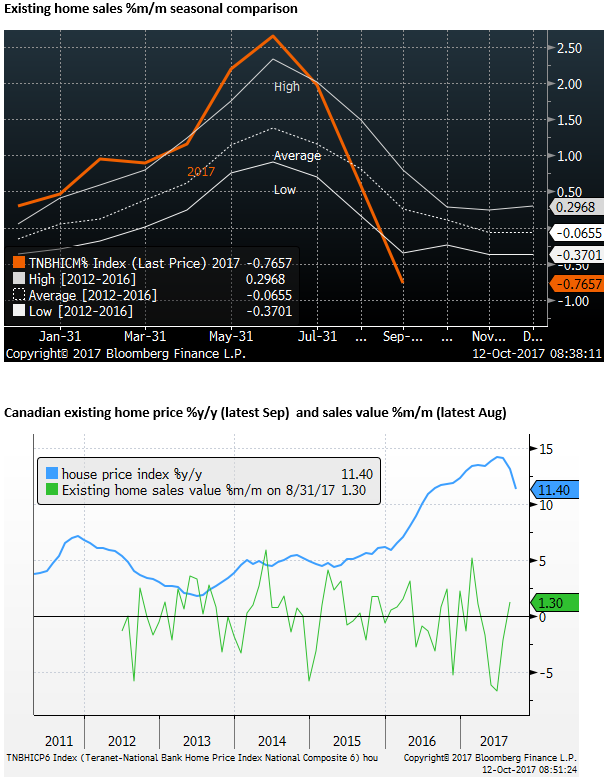

After rising at the fastest pace in five years in the first half of this year, monthly house price gains in the last two months have slowed to the lowest rate for a September in more than five years. The Teranet National Bank Home price index fell 0.8%m/m in September, and the annual increase slowed to 11.4%y/y from a peak in June of 14.2%.

The steepest monthly fall was in Toronto, and this may reflect the impact of the Ontario Fair Housing Plan announced in April. This 16 point plan includes a 15% non-resident speculation tax (NRST) in the Greater Golden Horseshoe; proposed in April. (Ontario’s Fair Housing Plan: 16 New Measures – baystreetblog.com)

Toronto house prices have fallen for two months from a peak in July, down 2.7%m/m in Sep, up 18.0%y/y.

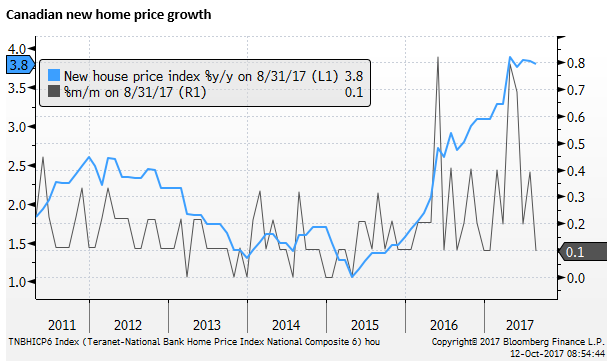

The Canadian new house price index rose 0.1%m/m in August, a bit below 0.2% expected. They rose 3.8%y/y, steady at around this rate since April.

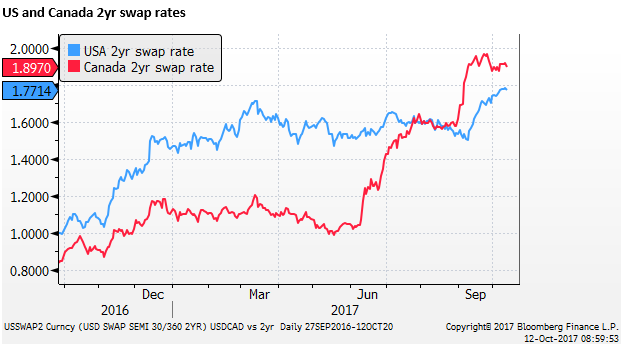

Canadian yield advantage slipping in recent weeks

Canadian 2yr swap rates have risen significantly this year following two rate hikes, but they have peaked so far on 26-Sep. BoC Governor Poloz made comments that suggest the Bank will move more cautiously on further rate hikes after hiking twice in quick succession (12-Jul and 6-Sep), reversing the emergency rate cuts delivered in 2015. We discussed his comments in the following report (Poloz walks back rate hike expectations; 28-Sep – ampGFXcapital.com).

In contrast, since the peak in Canadian rates, US two-year swap rates have continued to firm to a new high for the year.

We see Canadian economic data tending to cool from its first-half surge and the BoC staying on hold into next year, whereas we see some upside risk for US rates through the rest of the year (discussed below)

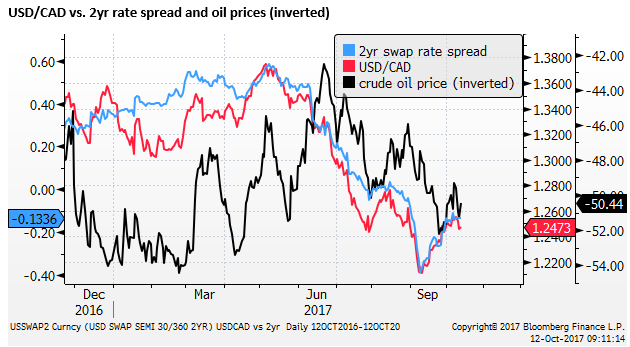

The USD/CAD has recovered from its lows in September, in-line with the narrowing in the Canadian 2yr yield advantage, although it has dipped recently reflecting some broader weakness in the USD in the last week. We see scope for USD/CAD to rise further into year end.

NAFTA is a risk for CAD

Another issue for the CAD is the future of the North American Free Trade Agreement (NAFTA) that is currently being renegotiated. It does not appear that uncertainty related to NAFTA has had any significant negative impact on the CAD to date. The MXN does appear to be more responsive.

The large USA goods trade deficit with Mexico (12mth sum $69.3bn) is seen more in the sites of the US administration than the narrower Canada deficit (12mth sum of $19.3bn). The recent weakness in the MXN, according to some analysts, relates to mixed messages on NAFTA coming from the US administration.

Nevertheless, the risk is significant that NAFTA will result in toughening in trade conditions for Canada with its largest trade partner. As such, it does pose a risk for the CAD. The outcome of negotiations remains highly uncertain.

BOC’s Poloz: Ripping up NAFTA would be negative shock to Canada – Reuters.com

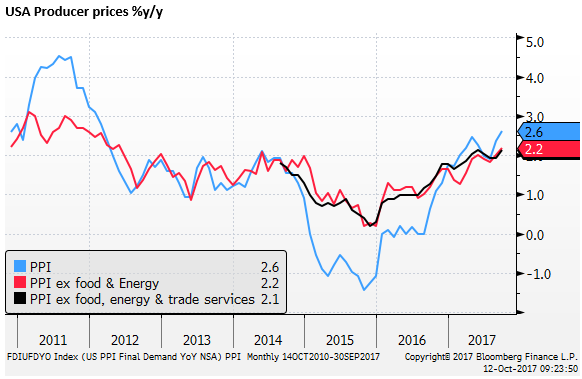

USA PPI inflation picks up

In the US, PPI core rose by 2.2%y/y in Sep, above 2.0% expected; its highest rate since 2012. This data may be starting to show the impact of a weaker USD this year. It may also reflect some hurricane impacts, although most of these effects should be in the headline rather than core measures.

It remains to be seen if this helps lift the CPI core inflation reading due tomorrow.

Fed Governor Choice seen as a three-horse race.

The choice of Fed Governor remains a potential market mover. The WSJ reported that “Business and academic economists surveyed saw a 28% probability that Mr. Trump would choose Mr. Warsh, a 22% probability of Ms. Yellen winning a second term and a 21% probability of Mr. Powell getting the nod.”

WSJ Survey: Kevin Warsh Seen as Trump’s Most Likely Pick to Lead Fed – WSJ.com

This decision could come at any time.

Yellen or Powell would largely represent a continuation of the current approach to monetary policy. But Powell has not been a strong voice on the direction of monetary policy. As such, he might be seen as more malleable by other members or the Administration. The market may see a choice of Powell as an attempt by Trump to implement a more dovish Fed.

A choice of Warsh would be seen more clearly as a move towards a less dovish Fed. Warsh is likely to be more responsive to financial stability concerns, lean more on a rules-based approach, and be less motivated by fine-tuning the economic cycle or targeting inflation.

Trump may choose Warsh because many of his advisors and Republicans in Congress would see him as highly qualified. They would prefer a Fed that was more rules-based on monetary policy, and Warsh would also be amenable to lighter regulation on the banking system. Arguably lighter regulation should go hand in hand with a Fed that is more concerned with containing financial markets exuberance, and Warsh offers this balance. Warsh appears to be the best fit for a Republican President and Congress, and has the presence to carry the burden of leadership at the Fed.

Fed minutes sound dovish on inflation, but point to upside risks to yields

The FOMC minutes showed that members were concerned by the persistently below target and recent lower inflation outcomes dragging down inflation expectations. Consistent with the FOMC policy statement that has said “the Committee is monitoring inflation developments closely” since June.

But there are reasons to see upside risk for rates in the minutes. First, the FOMC has included no impact of potential fiscal stimulus from tax reform. The market should be assigning significant odds to this next year. Even if there is considerable uncertainty over the timing and content of this reform, some reform is more likely than not to be implemented and is likely to boost growth and inflation expectations.

Secondly, the Fed sees at least a short-term boost to inflation and wages resulting from the hurricane disruption. In some respects, the rebuilding and replacement phase, which is expected to boost GDP in Q4, might be regarded as a short-term fiscal stimulus. This is likely to further tighten an already tight labor market, particularly for construction workers. As such, there is a risk that some of the likely bump to wages and prices may become more persistent. Neither the FOMC nor the market appears to be giving much consideration to the possibility that inflation or wage growth picks up more than expected.

FOMC minutes – low inflation vs. financial stability; 12-Oct – ampGFXcapital.com