BoC Poloz to get out in-front of the tide, BoE Carney sets tone for Fed

Bank of England Governor Carney said all the factors that might have triggered a rate hike this year have turned the other way. Sounding emphatically dovish a hike is no-where in sight. Perhaps as important is what this view translates to the USA. While Carney himself noted several reasons why a hike in the US may have been more appropriate, much of his assessment for an extended wait and see period applies to the USA. We see this as potentially undermining the USD, especially if labor indicators confirm recent ebbing in activity indicators. The Fed is yet to shift its thinking much, but it might and this could help restore some confidence to global markets. As such, we are wary of shorts in EM and commodity currencies. That said, we see the Bank of Canada getting out in-front of the shifting tide and cutting rates tomorrow. It should also endorse the weaker CAD. The risk is still higher to the upside for USD/CAD, and we see scope for AUD/CAD to also rise as the Australian economy appears much more advanced in coping with the down-turn in its resources sector. The GBP has already fallen enough to adjust to lower rate expectations. However, the uncertainty over the EU-referendum is high and rising. GBP/USD has already breached its 2010 low and with a cloud of uncertainty hanging over it, the risk is that it falls further to test the 2009 lows towards mid-1.35, if not lower. Recalling the Sottish independence referendum hub-bub, it is hard to see investors being brave enough to pick a bottom for the GBP over the next six months.

UK hikes nowhere in sight

Bank of England Governor Carney put any thoughts of rate hikes off the agenda in a dovish speech on Tuesday. In the later half of 2015 he told markets that “the decision as to when to start raising the Bank Rate would likely come into sharper relief around the turn of this year.” In a speech entitled “The Turn of the Year”, Carney delivered his assessment of a resounded no-where in sight. All the relevant indicators that might have triggered a hike have turned the other way.

He said that the market has observed “the renewed collapse in oil prices, the volatility in China, and the moderation in growth and wages here at home since the summer and rightly concluded that not enough cumulative progress had been made to warrant tightening monetary policy.” Indeed, the market is not projecting any hikes this year, and very gradually after that with only one full hike in the rates curve in Q4 2017.

He said, “The world is weaker and UK growth has slowed. Due to the oil price collapse, inflation has fallen further and will likely remain very low for longer. This may mean modestly weaker cost growth through this year, with the likely path for inflation, both headline and core, softer as a result. In short, recent developments suggest that the firming in inflationary pressure we had expected will take longer to materialize.”

It doesn’t get much more emphatic than that, and not surprisingly the GBP fell further as the headlines graced the newswires.

GBP faces high and rising uncertainty

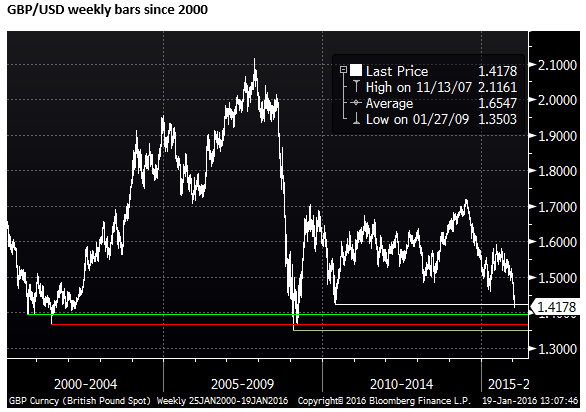

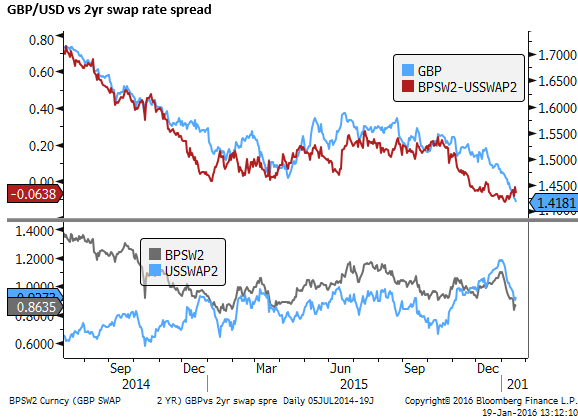

GBP has dropped sharply over recent weeks to new lows against the USD since 2009 and the EUR in 12-months. As such, it has already reacted to weaker rate hike expectations. However, it has also been hit by the high uncertainty over the UK referendum on EU membership expected around mid-year, making it hard to judge how far the GBP may fall.

GBP/USD has broken a previous low in 2010 of 1.4250, with little support for the market the grab hold of until 1.40. A move to 1.35, around the low in 2009, appears to be a significant risk in light of considerable EU-referendum uncertainty. Recalling the hub-bub around the Scottish independence referendum, GBP could come under significant pressure through the first half of this year

The GBP’s better hope of finding support may be against the EUR, as EUR/GBP approaches resistance around .7765. Much may depend on the tone of the Draghi post ECB policy press conference on Thursday. Draghi may need to sound dovish to prevent EUR/GBP breaching this high.

The pressure for more ECB action is not high at this time, so soon after the December policy easing. The Eurozone economic data has proven relatively stable of late, holding up noticeably better than other developed economies. However, Draghi and the ECB, like all central banks, can sound more dovish in light of the weaker oil prices, slowing Chinese economy and greater global financial markets uncertainty. However, there is little indication that the mood has swung at the ECB sufficient to raise the stakes on more policy easing at this time.

Implications for the USA

Perhaps the saving grace for the GBP may be that pressure will turn on the Fed to also abandon its rate hike agenda. But in this case, GBP might still expect to lag many other currencies.

As discussed in my report on Monday, the outlook for the US economy is waning, inflation expectations may have fallen abruptly, credit spreads suggest financial conditions have tightened significantly, and the US energy sector is highly cyclical and dragging on the overall economy, even if lower oil prices may be helping underpin consumer spending. The Fed is only starting to waver on its rate hiking agenda, relying almost exclusively on sustained strength in the labor market to underpin its forecasts. As such the US rates outlook and the USD may depend much more on labor indictors, including the weekly jobless claims data that have drifted gradually higher in recent weeks. (AmpGFX 18 Jan – Confidence in Fed hikes waning)

Bank of Canada may get out in front of the tide

The Bank of Canada rate decision is being viewed by the market as a line-ball call. Bloomberg survey shows 16 of 34 analysts calling for a 25bp cut to 0.25%, and 18 of 34 calling for unchanged at 0.50%. Market is pricing in about a 60% chance that a cut is delivered.

I view the odds of a cut very high: the recent trend in activity indicators in Canada has been weaker than expected; The energy price outlook has deteriorated to extreme bearishness and it is very hard to presume it will change for the foreseeable further; The US economy may be losing momentum, Canada’s main trading partner; The Mexican peso, similarly influenced by oil and the other side of the NAFTA trio, has depreciated as much as the CAD has recently; The BoC cut in January last year as insurance against the fall-out from oil in a surprise move, so it has form; Global risk premia has risen; Chinese growth has slowed; global inflation expectations have fallen. The tide has shifted and the smart move is to get out in front of it.

The case for not cutting at this time is that the CAD has fallen significantly and is acting as a shock absorber for the economy. The BoC can assume that the currency is doing all the easing in monetary conditions required. True, but the broad picture is one of a still wide current account deficit and weak overall manufacturing and economy-wide surveys, and compared to the last time oil was this low, USD/CAD was often in the 1.50s. As such, the currency does not appear too low considering the level of commodity prices. A cut at this time might be seen as endorsing the fall in the CAD exchange rate. (AmpGFX 13 Jan – $CAD is still not cheap vs oil, trade balance and economic activity).

Even if the BoC decide not to cut, presumably they will attempt to use the policy statement to endorse the fall in the currency and limit any rebound.

Some analyst have argued that the BoC will wait to see the Government’s plans for fiscal expansion in the March budget. The government campaigned on moderate fiscal expansion to fund infrastructure investment. It had projected spending $C5bn in the first year of government. PM Trudea reaffirmed last week that there were no plans to scale back this spending. There is speculation that the government will speed up spending plans.

However $C5bn is worth around 0.25% of GDP, it will help but it is not a game changer. Infrastructure projects have very long lags, and it is very uncertainty over what time-frame they will be implemented. The government is not rumored to be planning any short-term fiscal pump-priming. As such, if the BoC thinks some policy easing is warranted as insurance to bolster confidence for the economy heading into 2016, it is unlikely to be swayed by the planned infrastructure spending, although it may also highlight this as a supportive factor in its statement.

What they said

Bank of England Governor Mark Carney

Reasons why the Fed may hike while the BoE does not:

“First, cost pressures are stronger in the US. American unit costs have increased by 3% in the past year and are growing above historical averages, while unit costs in the UK are currently rising by around half that rate or at a speed notably below that consistent with the inflation target.

“Second, the UK economy is twice as open as the US and is therefore more exposed to global weakness, dragging on exports.5

“Third, this also means that pass-through of weak global inflation, compounded by exchange rate appreciation, is likely to exert a greater and more persistent drag on UK inflation. Partly as a result, after adjusting for one-off factors, core inflation is firmer in the US than the UK.

“Fourth, the stance of fiscal policy differs markedly. The UK is undergoing the largest fiscal consolidation in the OECD, with the structural deficit projected to decline by around 1 percentage point a year on average over the next four years, having fallen only 1/3 percentage point on average over the past three. In contrast, US fiscal policy is expected to loosen notably over next three years.

“Finally, the Bank of England’s control over macroprudential policy reduces the need to use monetary policy to address financial stability considerations.”

“Last summer I said that the decision as to when to start raising Bank Rate would likely come into sharper relief around the turn of this year.

“Well the year has turned, and, in my view, the decision proved straightforward: now is not yet the time to raise interest rates. This wasn’t a surprise to market participants or the wider public. They observed the renewed collapse in oil prices, the volatility in China, and the moderation in growth and wages here at home since the summer and rightly concluded that not enough cumulative progress had been made to warrant tightening monetary policy.”

“Although different indicators will merit focus at different times, as I highlighted last summer, three types warrant particular attention at present:

“1. The prospects for growth momentum in excess of trend consistent with eliminating spare capacity in the economy;

“2. Evidence of and expectations for a sustainable firming in domestic cost pressures; and

“3. Developments in core inflation consistent with a reasonable expectation that total CPI inflation will return to the target in around two years’ time.”

“In my opinion, we need to see cumulative progress in these three areas to have reasonable confidence that inflation is on track to return to the target and that a modest tightening in monetary policy will be necessary to ensure it does so sustainably. This means: sustained momentum relative to trend; domestic cost growth resuming a path consistent with headline inflation at 2%; and core inflation measures moving notably towards the target.”

“It is clear to me that, since last summer, progress has been insufficient along these dimensions to warrant a tightening of monetary policy. The world is weaker and UK growth has slowed. Due to the oil price collapse, inflation has fallen further and will likely remain very low for longer. This may mean modestly weaker cost growth through this year, with the likely path for inflation, both headline and core, softer as a result. In short, recent developments suggest that the firming in inflationary pressure we had expected will take longer to materialise.”

The turn of the year, Mark Carney, Governor of the Bank of England – bankofengland.co.uk