Clarida puts the ball in Powell’s court, but amenable to a pause

Last week we saw the first signs that the Fed might be softening its tone on the path for higher rates. Both the Fed’s Powell and Clarida suggested that they have to be more data-dependent and pay closer attention to a range of factors from global growth indicators, liaison with business, and financial market conditions. Both noted some increased risks from a weaker global outlook.

Fed rate pause in view; 20-Nov – AmpGFXcapital.com

They did not go so far as to suggest that they may not go ahead with a projected hike in December, or project fewer hikes next year. They retained a quite optimistic outlook for the US expansion. However, the market is looking around and can see more reasons why the Fed might at least pause for breath.

Vice Chair Clarida gave a speech on Tuesday called Data Dependence and U.S. Monetary Policy

Notably missing from Carida’s text was any reference to tariff policy, global economic moderation, or a tightening in US financial conditions related to weaker stocks and wider credit spreads in recent months. Nor was there any deeper dive into recent economic data, some of which, like housing data, have moderated.

Clarida left this for others to shed more light on; including, potentially, Powell on Wednesday. Overall not a very enlightening speech. It appeared to be an attempt to remain neutral and follow the led from his captain – Powell.

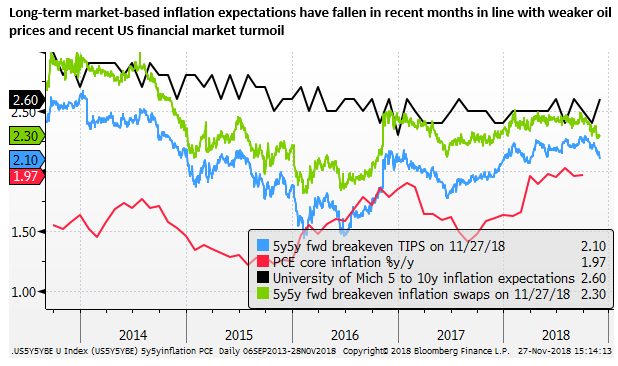

There were some dovish elements to suggest he might support a slower pace of hikes, and be amenable to an extended pause. He noted inflation expectations were a bit low and the potential for more labour force growth, suggesting he has little fear of inflation rising sustainably above target, even if the economy were to continue to grow above potential for some time.

Inflation expectations a bit low

He suggested that while inflation is near to the Fed’s target, inflation expectations are a bit too low.

He said: “The median of expected inflation 5-to-10 years in the future from the University of Michigan Surveys of Consumers is within–but I believe at the lower end of–the range consistent with price stability.”

“Likewise, inflation readings from the TIPS (Treasury Inflation-Protected Securities) market indicate to me that financial markets expect consumer price index (CPI) inflation of about 2 percent to be maintained. That said, historically, PCE inflation has averaged about 0.3 percent less than CPI inflation, and if this were to continue, the readings from the TIPS market would indicate that expected PCE inflation is running at somewhat less than 2 percent.”

Rapid pick up in aggregate supply

He also noted that while GDP growth has been strong this year, averaging 3.3% over the first three-quarters of the year, on track for its fastest annual growth in the current near-record 10-year long expansion, aggregate supply has grown even faster this year, helping keep a lid on inflation. Aggregate supply growth, made up of labour productivity growth of 2% and growth in hours worked of 1.8% annualised, has expanded at a 3.8% rate over the first three-quarters of the year.

Potential for more labour force growth

Growth in hours worked might not be sustainable at this year’s rate, but Clarida suggested that he can still see significant potential for labour force growth in the near term. He noted that the recovery in the participation rate of prime-age workers (25 to 54-year-olds) might not be complete, as it remains 3% below the peak for men in the late 1990s, and 1.5% below the peak in 2000 for women.

He noted his uncertainty over the sustainability of the pick-up in productivity this year. But he said that “an improvement in business investment will be important if the pickup in productivity growth that we have seen in recent quarters is to be sustained.”

Business investment was robust in the first half of the year, but stalled in Q3. As Clarida said, “one data point does not make a trend”, and it remains to be seen how robust business investment will be.

There are some reasons to be less confident about business investment. Tariff policy uncertainty may delay investment, global demand growth looks less rosy, and the fading impact of the tax policy and weaker oil prices may also dampen capital expenditure. On the other hand, a tightening labour market and strong US consumer demand should encourage more capital expenditure.

Try not to surprise

Clarida emphasised the importance of communicating the Fed’s expected path for the policy rate. We might conclude from this that Clarida would be against surprising the market. As such, if the market widely expected a hike in December, and it does, he would probably be against not delivering it unless there were very good reasons.

At the same time being more data dependent suggests that the Fed will be more flexible overall, and may be prepared to alter the path of policy as data and events dictate. So looking into the year ahead, we might expect less clarity on future rate decisions.

Gradual

Clarida then emphasised his preference for “gradual” rate rises owing to the uncertainty over what is the neutral policy rate, the likelihood that rates are now “much closer to the vicinity” of neutral, and the “economy has moved to a neighborhood consistent with the Fed’s dual mandate”.

But what does gradual mean? The Fed has described the current pace of one hike per quarter as gradual. But perhaps being even more gradual might be appropriate in light of the recent tightening in financial conditions and increased economic uncertainty. Perhaps we will learn more from Powell, other Fed speakers, and Fed policy minutes later this week.