Dollar up today, but down tomorrow? Fed and govt shut-down risk

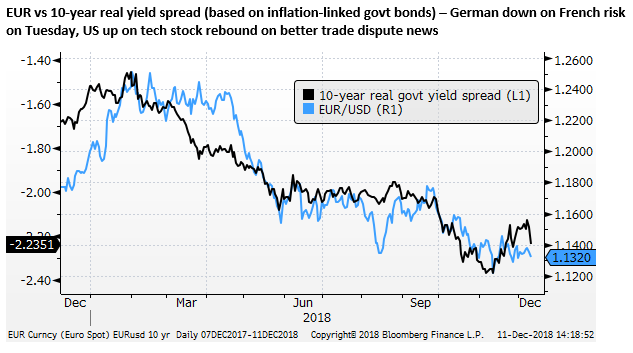

It feels a bit like if I write something on the FX today, it will be redundant by tomorrow as conditions in the market are changing so quickly due to a range of global risk factors. Today French budget risk and Brexit uncertainty are dragging down the GBP and EUR, despite growing political risk in the USA as Trump threatens to shut down the government over border wall funding. Next week, US political risk and a dovish Fed may reverse gains in the USD. The ECB meeting poses a near-term risk for the EUR if it follows the recent trend of more dovish central bank statements, although it should stick to its current policy guidance. US-China trade war fears eased on Tuesday and may help support Asian markets.

The Fed needs to get off the escalator

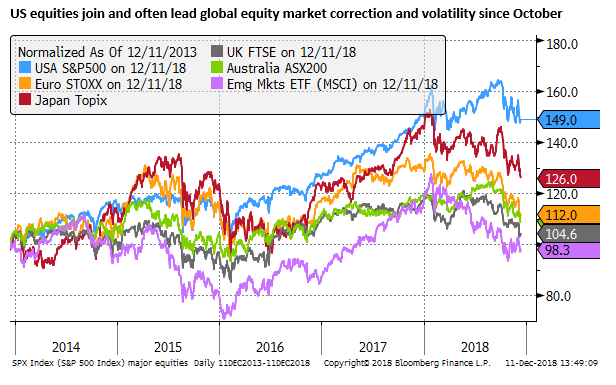

I had thought that we might go into a weaker USD phase as more of the asset market volatility in recent months appears to have come from the US markets, and tightening financial conditions in the USA would lead the Fed towards a more dovish view.

Fed rate pause in view; 20 Nov – AmpGFXcaptial.com

I anticipated that the Fed would step off the escalator of steady rate hikes and signal a willingness to be more reactive to current uncertainty.

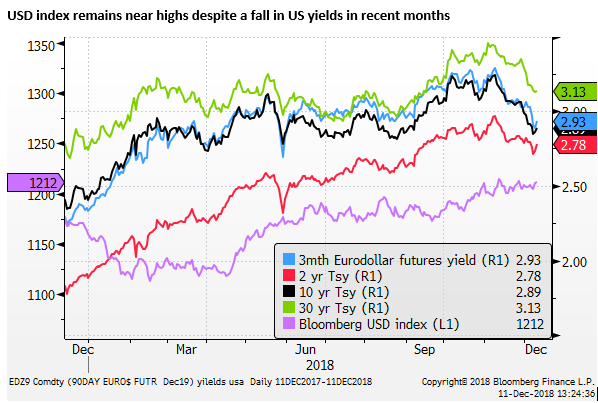

This has happened to some extent, and the USD has been less strong. But it hasn’t fallen much or broadly. Global risk factors have picked up again, and while the Fed has signalled that it will be more data-dependent and raise rates more cautiously, they have not stepped back from signalling a December rate hike.

Fed inertia a risk to global markets and the US economy

For the record, I think the best policy choice by the Fed would be to leave rates unchanged in December to demonstrate a capacity to respond to increased market uncertainty, and project three hikes next year to illustrate they are still confident in the sustainability of the US economic recovery.

The sooner the Fed starts to shift the message towards this view, the more they will appear to be in front of developments rather than lagging them. However, to date, they appear to be reactive and lagging events. There is still a degree of inertia in this Fed led by a still untested Chair Powell.

Fed inertia is keeping the USD bid, and it is not helping to stabilise US and global financial conditions. This increases the risk of weaker real economic conditions in the US and globally over the coming year. If the Fed is waiting for weaker economic data before pausing, it risks being too late and causing unnecessary slowing in the US economy, or perhaps worse if it does not pay more attention to warning signs in global financial markets.

Those warning signs include new highs in US corporate credit spreads since 2016, a significant fall in US equities and a sustained pick up in volatility. This is coupled with anecdotes from companies that are concerned about the trade war.

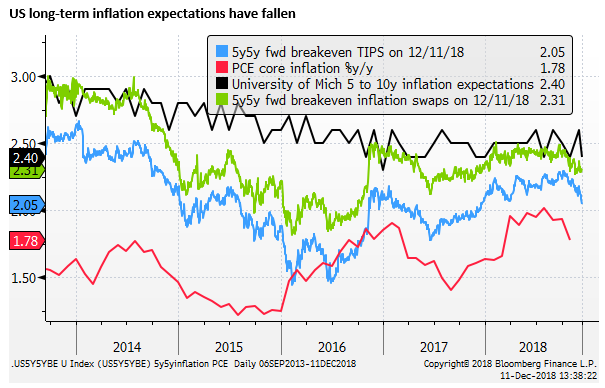

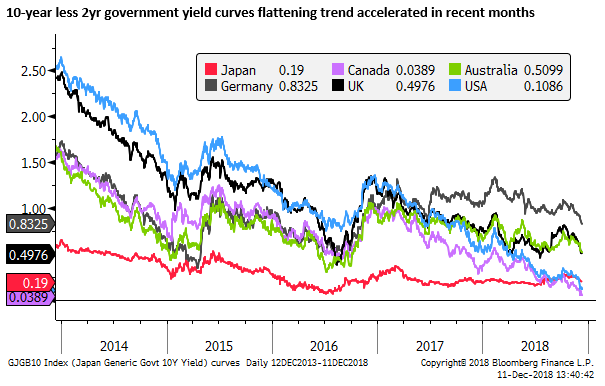

Evidence of slowing in global economic growth, sustained strength in the USD, and weaker commodity prices suggest that inflation risks have diminished. Weaker breakeven inflation rates and curve flattening provide further evidence of lower inflation risks. US inflation data have also eased, and some US economic reports and surveys have stalled and turned down albeit from solid levels.

Credit spreads widen in the Eurozone

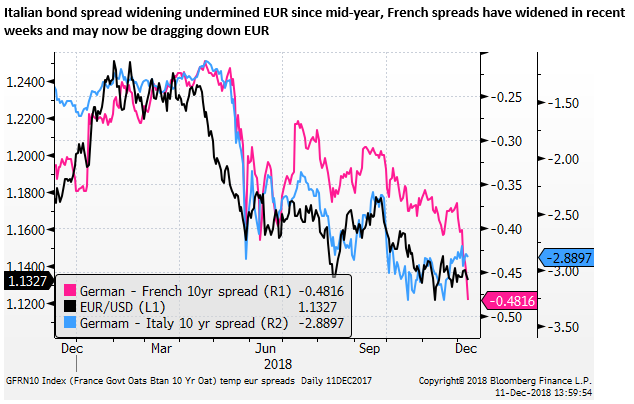

The slump in GBP appears to be a drag on other currencies against the USD. EUR also appears to have fallen today in part due to the social spending initiatives announced by the French government in response to the Yellow Vest protests in France. This has resulted in some spread widening in French government bond yields over German Bunds.

Fiscal expansion plans in Europe might be considered positive for the Eurozone growth outlook and the EUR. However, they also undermine political stability in the region by placing pressure on the budget control agreement that binds countries to the single currency regime.

The EUR regime has, of course, survived a lot worse threats in the last decade, and it is almost certain to survive some budget pressure in Italy and France. But these issues often require sustained periods of political, market and economic stress to find solutions.

One might say that the US is running a lot higher deficits and debt in aggregate than the Eurozone and it has not suffered from either a weaker exchange rate or higher government or corporate funding costs. But the USA has only one national budget and bond market.

The USA may face its own budget reckoning one day, but the market may also view its recent fiscal expansion led by corporate tax cuts as providing more opportunity for productivity gains than increased social spending increases in Italy and France that threaten to reduce productivity growth and more sustained debt and deficits.

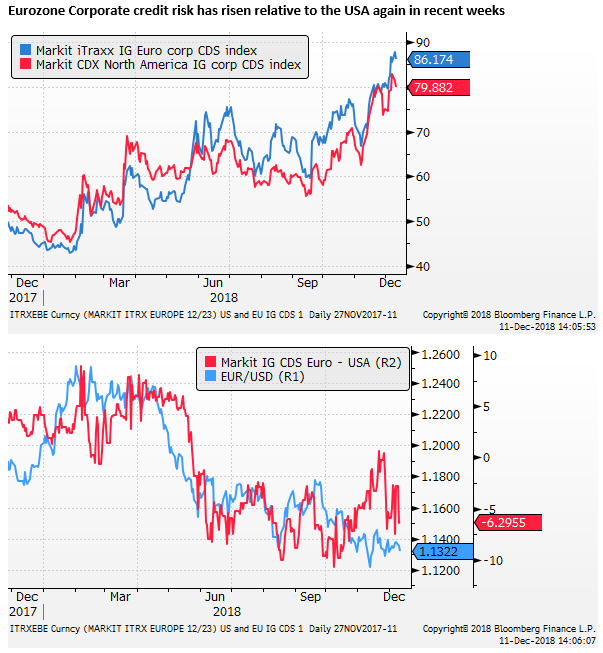

The bigger picture fundamentals aside, the FX market may be immediately focussed on risk metrics such as the sovereign spreads in the Eurozone that have widened somewhat on Tuesday. Corporate credit risk as measured by Investment Grade Corporate Credit Default Swap indices has also widened further in the Eurozone in recent days which may reflect the spillover from wider sovereign spreads and the increased Brexit uncertainty.

It is hard to say if credit spreads in the Eurozone will widen further and become a significant negative for the EUR. This is just part of the broader uncertainty adding to the volatility in the FX market.

Fundamental traders are factoring in a wide range of possible outcomes, reducing their commitment to trades, increasing the influence of short-term trading strategies, generating volatility without sustained trends.

The ECB may further weaken EUR in a skittish market

The ECB policy meeting on Thursday poses an additional downside risk for the EUR. Even though the ECB is expected to stick to its current policy stance, there is a risk that ECB President Draghi does sound more dovish and acknowledge downside risks to their medium-term inflation goal.

Recent labour cost data for Q3 in the Eurozone suggest that a tightening labour market is generating stronger wage growth and might keep the ECB on track to end asset purchases in December and keep forecasting progress towards their inflation goals.

However, in recent weeks we have seen a less hawkish Fed and a less hawkish Bank of Canada. Both acknowledging increased risks in global markets, it would not surprise if this was a trend that extends across central banks, including the ECB this week.

Given the skittish nature of the FX market, even a modest shift in language could weaken the EUR, especially if coupled with what is likely to be some downward revision to the growth forecasts by the ECB staff.

Waiting for the UK political crescendo

Few fundamental traders are willing yet to step in to buy the GBP even though many perceive it to be cheap, and few can see the UK crashing out of the EU on 29 March without a plan agreed with the EU to provide a transition period. They cannot be sure that in the interim the GBP does not suffer another flash crash on political stalemate in the UK. The path forward for the UK to resolve its impasse is highly uncertain in a deeply divided parliament and public.

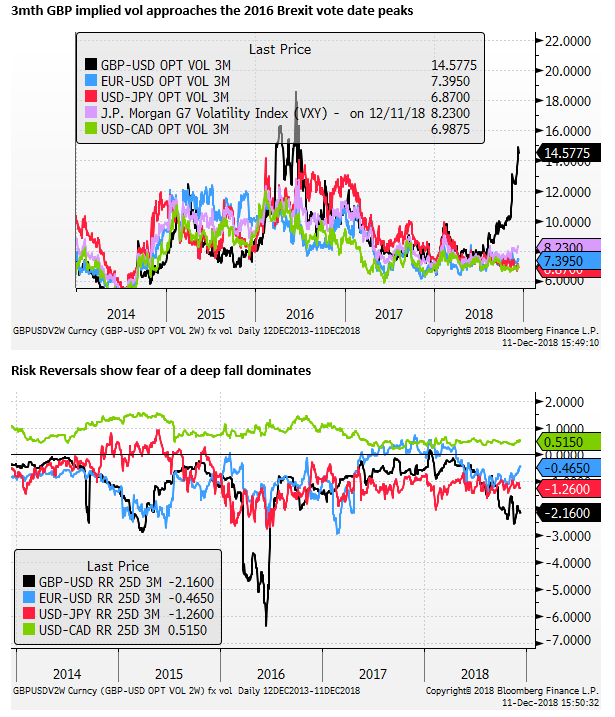

The sharp fall in the GBP on the postponed vote in the UK Parliament has fuelled fear of even further sharp falls as government turmoil builds to a crescendo.

However, we would equally caution that upside spikes in the GBP could follow if the political turmoil moves towards a fresh election and/or hopes of a new referendum, and the possible delay or reversal of Brexit. Such scenarios have a higher likelihood than hardline Brexiters taking control of parliament.

It may not take all that much evidence that the probability is moving in that direction to cause a spike in GBP. If, as we suspect, short-term traders are dominating moves, they will not be wedded to short positions.

Tempered enthusiasm for a big rebound in GBP

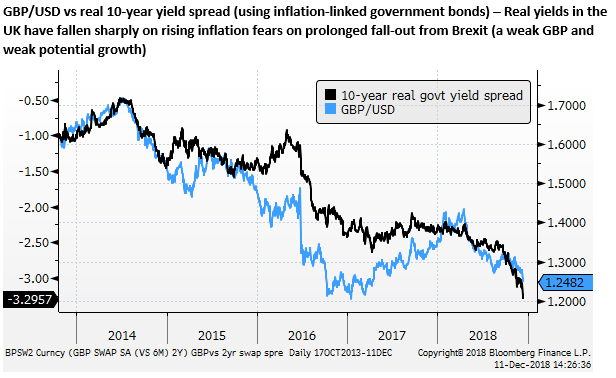

Nevertheless, there are reasons to temper enthusiasm for a big rebound in the GBP. The public and political divide over Brexit will remain wide, and the resolution to this crisis in terms of a clear path forward, either establishing a basis on which to leave or a decision to remain, could take a long time yet to be resolved.

The 29 March Article-50 Brexit date may force a near-term government upheaval, but it may take a lot longer to establish a sold government mandate to provide clear leadership. The prolonged uncertainty could continue to detract from business confidence and investment in the UK for the foreseeable future.

Political Risk rising in the USA

On Tuesday the entertaining press conference held in the White House Oval Office involving President Trump and Congressional Democratic leaders Pelosi and Schumer, meant to display the leadership qualities of the Trump administration, just ahead of a private meeting of the leaders, instead provided a glimpse into the rancour we might expect in US government over the coming year.

The immediate concern of the meeting was to sort out funding for border security and Congressional approval of bills required to keep funding government business beyond the current month. In the press conference, an argument broke out over funding for a wall on the border with Mexico. Both sides expressed hard positions, and Trump said in clear terms he was prepared to shut down the government, i.e. see Congress fail to pass funding bills necessary to keep government departments operating, if the bills do not provide additional wall funding.

As such, the market must now factor in the risk of a period of government shut-down that could undermine consumer and investor confidence. The current date up to which funding is approved is 21 December. It might also raise the risk, albeit modest, that a prolonged stalemate could delay interest payments on US government securities. It might point to ongoing risks to stalemate in Congress on a range of legislation.

Soon to be the leader of the House of Representatives, Pelosi, struck a defiant tone in her interaction with Trump and in her press conference afterwards. She emphasised that when Democrats take control, there will be greater transparency in government, meaning more in-depth debate over administration policy. It also points to the possibility of the wide-ranging Mueller investigation getting a bigger hearing and response in Congress, raising tensions with the White House.

Political risk in the USA appeared to diminish in 2018 as Congress agreed on tax cuts, increased spending, and pushed out the perennial concerns over the debt ceiling. However, the debt ceiling suspension ends on 1 March 2019, the Congress is now split, and evidence suggests that stubbornness in the White House and the House of Representatives raises the risk of deadlock over funding bills and policy over the coming year.

This may add to economic uncertainty and asset market volatility in the US, a factor that may undermine the USD.

Rising political risk in the US, coming around the time that the Fed meets to decide on its rates policy on 19 December, could undermine the USD and US asset markets. It is another factor that adds to the uncertainty in the FX market. The EUR may be pressing supports today on political uncertainty in Europe, but it could quite conceivably be busting resistance in the days or weeks ahead as focus shifts to US rates and politics.

Trade war reprieve

US and Asian asset markets have been in upheaval over US trade policy. They received a short-lived reprieve after the G20 when both sides agreed to restart trade talks with an initial 90-day time frame. However, confidence was rocked by the arrest of Huawei CFO Meng.

High Tech shares, previously the darlings of the US stock market have been undermined by the USA China trade dispute and evidence that secular demand growth for the current crop of products like smart-phones and services like social media is peaking and facing structural headwinds.

The US-China dispute over trade, intertwined with geopolitical and long-term strategic goals in key industries, remains a significant risk for companies globally; particularly in China and the USA.

News on Tuesday appeared to ease market fears over trade. Both sides appear to be continuing with trade talks and news reports that the Chinese government is considering removing the punitive tariffs it imposed on US car imports as part of its retaliation to US tariffs.

On Monday, reports that a Chinese court had ruled in favour of Qualcomm in its patent claim against Apple, threatening the sale of its older iPhones in China, appeared to feed fears that fraught trading relations between the US and China were impacting legal proceedings.

The bottom line is that we can’t be sure when and how the dispute between the US and China over trade and economic policy will impact on global financial markets. This is another reason for fundamental traders to be wary about setting long or short USD positions, particularly against Asian currencies, including the AUD, which has been closely aligned with Chinese equities this year.

Event risk builds in Q1

Looking into next year, the US President could be at loggerheads with the Democrat-held House of Reps, facing pressure from the Mueller investigation, at the same time as the debt ceiling issue returns and US-China trade talks are reaching the end of their 90-day initial deadline. This points to significant event risk and asset market uncertainty in Q1 next year. At around the same time, the UK is facing its Brexit deadline.

The case for buying the USD is not strong since we might expect greater US financial market volatility, and economic and political uncertainty may lead to a prolonged period of pause in US rate hikes. It may increase expectations that the Fed will consider cutting rates sooner rather than later. Lower US yields could then reverse a significant portion of the gains in the USD in the last year.

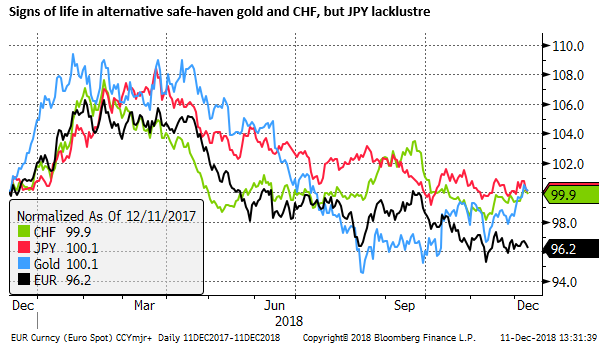

However, the fact is that the USD has so far remained resilient. Global risk factors related to Brexit, EU politics, trade, economic and financial risks in China, appear to be, for now, weakening other major currencies more than the USD. Gold is stronger over recent months, however, illustrating that confidence in the USD has weakened.

Surprisingly we haven’t seen a stronger performance from JPY. Overall FX remains a muddled picture with a range of competing influences that are highly uncertain and difficult to evaluate.