Dr Copper prognosis is negative

US Equities recovered and the USD is generally firmer. However, US retail sector equities recovered less than half of their sharp loss on Friday, and question-marks must remain over the strength of USA retail sales. US rates are still off their peak on Wednesday last week. EUR is weaker as prospects for ECB easing build, probably enhanced by the terrible events in Paris last week. As such, we continue to see downside risk for EUR/JPY. Copper prices fell sharply to new lows since 2009, iron ore prices are scrapping the lows since July again, while Chinese steel prices continue a gradual slide. The market is not paying enough heed to the downside risk to Australian growth.

RBA’s Kent warns but does not alarm

In a short and concise speech, RBA Assistant Governor (Economic) Christopher Kent laid out the basic outlook for China and the channels through which this is relevant to Australia. Kent has highlighted a basic assessment but perhaps purposely leaves out any overall conclusions for the Australian economy and thus monetary policy. This may reflect the uncertainty over the outcome in China and its impact through different channels in Australia (some negative and some positive) and a desire not to scare the natives that may be prone to thinking the worst at a time when business confidence in Australia is starting to show some resilience.

He notes both secular and cyclical elements to the recent slowing in Chinese growth. On the cyclical elements he said, “As earlier excesses in residential construction gave rise to a large stock of unsold housing, house prices declined and so too did housing construction. Sales and prices have recovered a bit since the start of this year, but there is little sign to date of a sustained improvement in construction activity.” He notes that the “weakness in China’s property and manufacturing sectors is clearly of concern to commodity exporters like Australia.”

However, he tempered the bad news by highlighting “countervailing forces”; including: resilient growth in the Chinese service sector, stable growth in household consumption, easier monetary policy in China and approval of additional infrastructure projects.

Nevertheless he warned that such countervailing forces “cannot be taken for granted; if the industrial weakness is sustained, it might eventually affect household incomes and spending”. And, “[Chinese authorities have] scope to provide further support if needed, although they may be reticent to do too much if that compromises longer-term goals, such as placing the financial system on a more sustainable footing”

He said, “The substantial slowing in industrial production has contributed to a further decline in commodity prices over the course of this year.” More predictively, but with a natural central bankers’ tendency for understatement, he said, “The changing nature of China’s development implies that the potential for commodity prices to rise from here is somewhat limited.”

The developments in China are not all bad; offsetting the weight on Australia’s resources sector, Kent said that, “The shift in demand towards services and agricultural products within China and the Asian region more broadly presents new opportunities for Australian exporters.”

Kent leaves an ambiguous final comment in his speech. He said, “While our comparative advantages in service industries are perhaps less obvious than they are for mineral resources, the rise in the demand for services from a large and increasingly wealthier populace in our region will no doubt be to our benefit.”

What does he mean by less obvious?…. Less obvious because they are obviously less than the comparative advantage in resources? Or less obvious because Australia is better than widely appreciated in service industries?

I would guess he left it ambiguous because he wanted to leave a hopeful message that Australia will cope well with the rotation in China from heavy industry to services led demand, but overall Australia may still face a heavier burden of adjustment than other countries given its comparative advantage is in the weaker resources sector. Furthermore, there is a risk assessment imbedded in this outlook that even the stable household demand growth cannot be taken for granted.

RBA minutes have a positive base-line but with substantial risks and an easing bias

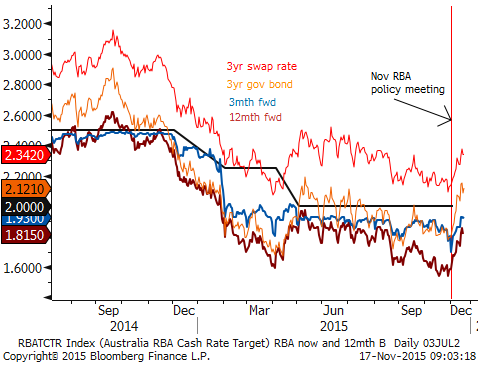

The Minutes of the RBA Monetary Policy meeting on 3 Nov are consistent with the tone set in the press release and quarterly Statement on Monetary Policy (SoMP) released on 6 November. Since this policy meeting, Australian rates have lifted significantly as the market has moved away from expecting a rate cut before year end, even though the RBA did move to include an easing bias in its November statement.

The chart below illustrates the rise in rates, providing significant support for the AUD in recent weeks. At one stage in the week before the November meeting, the market was pricing in around 60bp of further easing over the coming 12-months, now it is pricing in less than 20bp.

The rise in rates and the AUD following the November policy meeting was kicked off by the policy statement that said, “The Board judged that the prospects for an improvement in economic conditions had firmed a little over recent months”. Even though the statement also included an easing bias; saying, “Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand. The Board will continue to assess the outlook, and hence whether the current stance of policy will most effectively foster sustainable growth and inflation consistent with the target.”

The market had become overly ambitious in expected a cut in late October, and the RBA offered a more optimistic tone its assessment, emphasizing the recovery in non-resource sectors; in particular services.

Downside risks coming more apparent

However, the RBA is clearly exhibiting an open mind and can see a number of uncertainties around its more optimistic tone. In particular it can see greater uncertainty more so to the downside in the outlook for growth in China and demand for commodities.

The RBA downgraded its outlook for trading partner growth since August and reminded us today in the minutes. They said, “…. growth in Asia had slowed by more than had earlier been expected. This slowing was likely to be more persistent than expected and, as a result, growth in Australia’s trading partners was expected to be slightly below its decade average over the period ahead. The outlook for the Asian region, particularly China, remained one of the key uncertainties in forecasting global growth.”

However, perhaps surprising, the RBA said its quarterly SoMP on 6 November and again in the minutes released today that, “members noted that the outlook for Australia’s terms of trade was little changed.”

Why are they little changed? ….. In part because the outlook was already that they would remain low. And the RBA is also looking for lower supply from high-cost producers. It said in the minutes, “One upside risk for commodity prices was the possibility of high-cost producers, particularly in China, cutting production in response to the already lower commodity prices.”

However, since this meeting, commodity prices have weakened further and the risk is surely greater now that they fall more than previously forecast. Copper prices (not one of Australia’s major exports but a metal that reflects global industrial demand) fell a further 2% on Monday and are down 9% since the RBA policy meeting to a new low since 2009.

Iron ore prices are down 1.5% today in Chinese futures trading, reversing gains in the last week to be around their lows since July. Little changed since the last RBA meeting, but surely troubled with steel prices still sliding and Chinese industrial activity in key commodity demand sectors in decline. The RBA’s own discussion on China offers little hope of a turn up, so it is a bit odd that they have not made more of their risk assessment. The aim may be to keep the natives focused on the good news to help bolster the improvement in business confidence.

Upbeat on services

The RBA indeed are pleased to be seeing non-resource sectors showing more sustained improvement. The minutes said, “Recent data indicated that survey measures of business conditions in the non-mining sector had remained clearly above their long-run average levels, particularly for services. Support provided to the economy following the depreciation of the exchange rate was particularly apparent in the sizeable contribution to growth from net service exports over the year to date. Growth in net service exports was expected to continue to boost growth in output over the forecast period.”

Since the minutes there has been more good news, consistent with this outlook for the service sector in the form of a much stronger than expected employment report released last week.

As yet, the RBA has not seen a pick-up in non-resources investment and notes that the stronger service sector is more labour and less capital intensive. However, it is forecasting that pick-up to arise eventually, albeit in the second half of a three-year forecast period and with a high degree of uncertainty.

It said, “Members noted that the ongoing improvement in domestic demand, together with the increased competitiveness from the lower exchange rate, were expected to lead to a pick-up in non-mining business investment in the second half of the forecast period. However, there remained considerable uncertainty surrounding the strength and timing of this recovery.”

Getting through the down-turn from the mining investment boom

The Economy is well on the way to getting through the down-turn from the boom in mining investment, and perhaps there is a glimmer of light at the end of the tunnel. But the minutes note that it is still in the meat of the downturn this fiscal year ended June-2016 and it will have run its course by the end of 2017.

Beware low wage data tomorrow

The low inflation outcome in September, reported in late-October was a factor bolstering rate cut expectations ahead of the November policy meeting. Indeed the RBA has downgraded its inflation outlook and it sees scope to ease.

The RBA minutes remind us that, “Underlying inflation was now expected to be close to 2 per cent in year-ended terms over the course of most of the next year, before picking up to around 2½ per cent in the second half of the forecast period.”

The lower inflation outlook reflects slack in the labour market and low wages. (Wages data are updated on Thursday and we see down side risk to already low growth, as discussed in our report last week (AmpGFX – CAD and AUD in the hot-seat posted 13-Nov)). It also reflects competitive pressure limiting the pass-through from a weaker exchange rate over the last two years.

Risk lies to downside for AUD

As it stands after the recent rebound in rates in Australia, the market is now more closely aligned with the RBA’s optimistic base-line forecast. As such, it does not appear to be paying enough attention to the downside risks. Considering the outlook for commodities looks weaker than that outlined by the RBA, and is fitting more into its downside risk assessment, we are seeing potential for a weaker AUD in coming months.

A key to the positive outlook for the Australian economy is sustained strength in service sector demand offsetting weaker resource sectors. As commodity prices deteriorate, the income from the later declines and threatens the former. The former also relies on a sustained period of a weaker exchange rate to ensure confidence does not slip again. As such, a low or lower exchange rate, moving in line with commodity prices is essential to maintaining the RBA’s positive assessment.

Minutes of the Monetary Policy Meeting of the Reserve Bank Board, 3 November 2015 – RBA.gov.au

What they said

- RBA Assistant Governor (Economic) Kent: “The changing nature of China’s development implies that the potential for commodity prices to rise from here is somewhat limited.” … “While our comparative advantages in service industries are perhaps less obvious that they are for mineral resources, the rise in demand for services from a large and increasingly wealthier populace in our region will no doubt be to our benefit.”

Economic news

- USA Empire (New York State) manufacturing index rose a bit from -11.4 to -10.7 in Nov, weaker than -6.5 expected. The relatively minor improvement was reflected in the components. While improving gradually from the low in August of -14.9, it is still lower than levels prior to July in data back to 2010.

- Canada: Manufacturing sales fell 1.5%m/m in Sep, weaker than +0.2% expected, after falling 0.6%m/m in Aug (revised down from -0.2%m/m). Petroleum products fell 7.1%m/m and 28.2%y/y. transportation equipment fell 5.9%m/m and rose 4.8%y/y

- Canada: Existing Home sales rose 1.8%m/m in Oct, after falling 2.1% in Sep.

- Eurozone: CPI inflation was revised up from 0.0% to 0.1%y/y in October, and underlying inflation was revised up from 1.0% to 1.1%y/y, up from 0.9%y/y in Sep, to a high since Aug-2013, well up from the low in Mar/Apr of 0.6%.

Markets on the move

- Copper fell sharply by -2.2% on Monday, and prices are sinking further in Asia on Tuesday, iron ore futures soft, new low in 12mth forward contracts, new lows in steel

- US 2yr swap rates recovered only 0.3bp from the close on Friday, albeit off the earlier lows in Asia on Monday. They are down 4.5bp from the high on Wednesday last week with most of that fall in Friday.

- Euro 2yr swap rates firmed 0.7bp from their record lows on Friday to be -0.069%

- UK 2yr swap rate were down 1.9bp on Monday, after falling 2.6bp on Friday, down 4.8bp since the peak on Wednesday last week, falling in line with US rates since mid-last week, but just a touch more.

- New Zealand 3mth OIS are down 0.4bp on Tuesday in Asia to a new low this cycle. 2yr swap rates opened 5bp lower on Monday from the close on Friday, little changed in Monday

- Australian 2yr swap rates have firmed to a new high since August, down from intra-day peaks on Thursday and Friday, but stable from close to close on Thursday to Friday despite the 4bp fall in US rates, firmer on Monday by 1.1bp.

- The AUD/NZD swap spread is at a high since November last year, attracting demand to the cross.

- US equities rose 1.5% on Monday, fully reversing the 1.1% fall on Friday, and the weaker open on Monday in Asia.

- Eurozone equities were firmer by 0.1%, and were closed by the time US equities began their strongest part of the session.

- Canada equities rose 1.9% reflecting a strong energy sector.

- US energy sector share surged 3.3% on Monday, after a relative stable session on Friday, albeit from the low since 5 October.

- Metals and mining sector shares rose 1.5%, in line with the broader index, after a slightly firmer session on Friday to be off the lows for the year and since 2009, but still below the close on Wednesday last week. Steel sector shares rose 0.9% on Monday, still below levels since Wednesday last week

- Consumer discretionary shares recovered by 1.2%, still somewhat lagging the overall index and recovering less than half of their 2.7% plunge on Friday.

On the Radar over the rest of this week

Australia:

- Wednesday: Wage cost index; RBA Assistant Governor (Financial Markets) Debelle speaks at a conference in Sydney in the morning.

- Friday: RBA Head of Economic Analysis Heath speaks at a government Resources and Energy event in Canberra in the morning.

New Zealand:

- Tuesday: RBNZ surveyed 2yr Inflation expectations; Fonterra biweekly dairy auction.

Japan:

- Thursday: Trade balance; BoJ policy meeting

USA:

- Through the week there are many Fed speakers every day.

- Tuesday: CPI; Industrial production, NAHB housing market index

- Wednesday: housing starts and permits; FOMC Oct 28 minutes

Canada:

- Friday: Retail sales, CPI

Eurozone:

- There are many ECB board member speaking at conferences through the week and the ECB releases its account of the monetary policy meeting in October at which it put the market on notice for further easing in December. Draghi speaks twice this week. The second at a speech on Friday may be the most significant.

- Thursday: ECB account of the 22 Oct MPC meeting at which the ECB hinted at further policy easing in December; ECB’ Coeure and Prat speak

- Friday: ECB President Draghi speaks in Frankfurt (text will be available)

UK

- Tuesday: CPI

- Wednesday: Retail Sales; BoE Deputy governor Broadbent speech on the outlook for Britain’s recovery from the financial crisis, followed by Q&A; UK Government committee to hear testimony on the economic and financial costs and benefits of UK membership of the EU from business leaders.