ECB unlikely to over-deliver on taper

It is universally anticipated that the ECB announces a significant taper or reduction in the pace of its asset purchases on Thursday this week. Expectations have settled on a halving in the monthly amount to EUR30bn, while adding nine months to the current program that ends in December this year. However, it appears that most market analysts see a risk that the ECB over-delivers with either a faster or larger taper, creating upside risk for Euro yields and the EUR. They may be justified by the stable and solid Eurozone recovery underway. However, the ECB has been at pains this year to avoid severe market reaction to a seemingly inevitable policy taper. And they have expressed explicit concern over the strength in the EUR since its September policy meeting. The ECB is likely to be very wary of exceeding taper expectations; expectations that it appears to have fed the market some weeks ago. Market positioning appears to be quite long EUR. In our view, the EUR is more vulnerable to a correction lower as the market shifts focus from the taper to the ECB’s low rate commitment and the wider EUR yield disadvantage this year.

Market strategist see a risk that the ECB over-delivers

Bloomberg Reporter Stephen Spratt wrote on Monday that “most [rates] strategists are bearish” predicting higher rates. From his survey of analysts, he found that the consensus is for a reduction of monthly purchases from EUR60bn to 30bn, and for the new program to run for nine months through to Sep-18 (from Dec-17 currently). However, most see the risks skewed towards a faster or larger taper.

One prominent analyst predicts that the ECB will not place a new time-frame for its purchase program, but will announce a total amount (EUR150 to 200bn) giving them more flexibility over the time frame and pace of purchases. Such an outcome, especially if the amount were lower than the consensus amount (9mth X 30bn = 270bn), would be bullish for EUR and bearish for bunds.

Others have speculated that the amount of purchases per month might be lower, at 20bn per month, or that the ECB might opt for a shorter, six-month schedule for purchases.

The time frame for purchases is also important, especially for the front of the curve, because the ECB is expected to repeat that, “The Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases.”

PIMCO European PM laid out his thoughts in the following Blog. He too sees risks skewed towards a less dovish, bund bearish, EUR bullish outcome.

ECB Preview: Expect Emphasis on Forward Guidance, Continued Tapering – blog.PIMCO.com

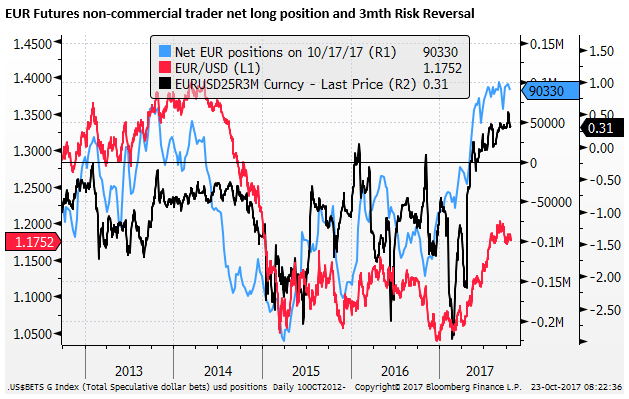

FX positions still long EUR

The latest CFTC FX futures positions data shows that speculative traders have little changed their net long EUR position in the last week to 17-October; net longs remain around extremes. Similarly, the call/put skew in the options market remains around its high, implying the market is bullish and long EUR ahead of this ECB meeting.

We should expect some pretty skittish trading around the ECB announcements on Thursday. Much of the volatility may come around the policy announcement that comes 45 mins ahead of the press conference, as this will presumably include the basic details (amount and timetable for the next phase of the Asset Purchase Plan).

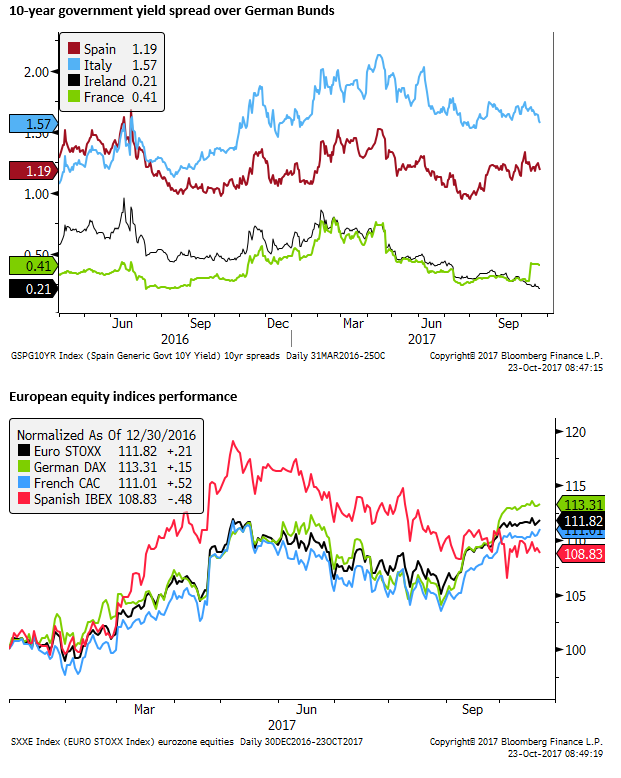

Spanish political risk

The independence aspirations of Catalonia continue to simmer at a high temperature after the Catalonian regional government President Puidgemont refused to back down from his position that he has the mandate to pursue independence, and the Spanish PM Rajoy invoked his constitutional powers (under article 155) to oust the Catalonian government.

It is unclear whether this spat has had much impact on the EUR. There has been minimal impact on the overall European asset markets, and only modest under-performance in Spanish assets.

Further news around this event is expected to overlap with the ECB meeting, with the National government Senate expect to debate and vote on article 155 on Thursday/Friday this week. Puidgemont may attempt to pre-empt and/or react to this vote.

The case for taper is clear

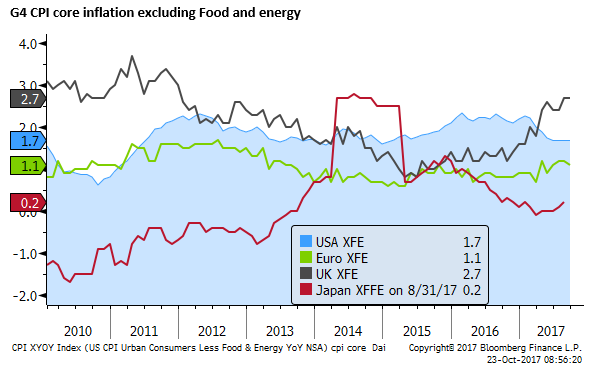

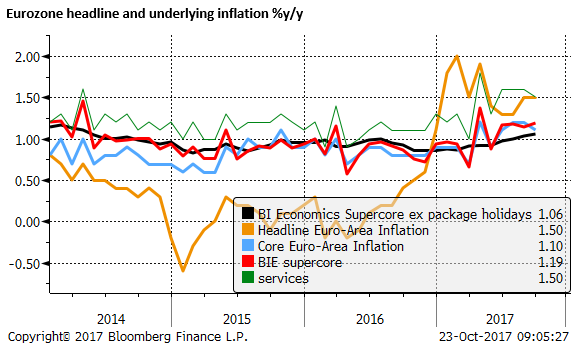

The recent economic reports from the Eurozone continue to show stable solid growth and gradual progress towards the ECB’s objective for lifting underlying inflation towards its just below 2% target.

Core inflation, excluding food and energy, was 1.1%y/y in Sep, up from around 0.9% a year ago, and noticeably closing the gap with a weaker US inflation trend this year.

Bloomberg Intelligence analysts’ “supercore inflation, less package holidays” measure of underlying inflation that “includes just the categories of prices most closely related to the amount of spare capacity” rose from 1.0% to 1.1%y/y in Sep, a high since 2014.

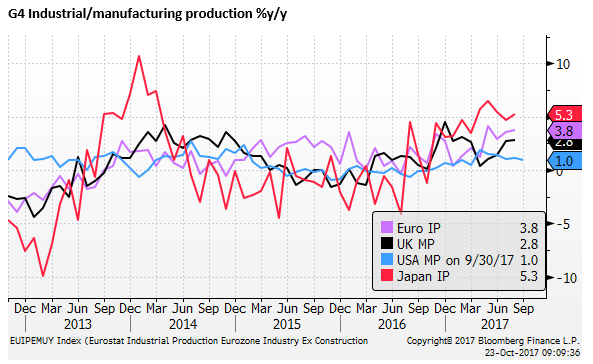

Industrial production in the Eurozone rose a solid 3.8%y/y in August; around its high since 2011, and stable at around this rate since May. USA manufacturing production growth has been weaker at 1.0%y/y.

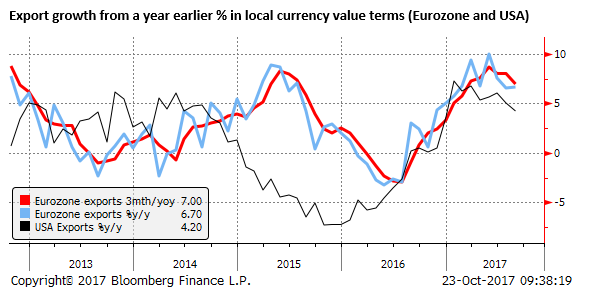

Export growth from the Eurozone does not appear to have been much dampened by the stronger EUR; at least not yet. Exports in EUR terms from the Eurozone to non-Eurozone countries rose 6.7%y/y in August, down from a peak of 10.0%y/y in May. On a three-month moving average basis, export growth was 7.0% 3mth/yoy in August, down from a peak of 8.7% 3mth/yoy in May. USA exports rose 4.2%y/y in August.

The Eurozone trade balance has narrowed only modestly over the last year; at EUR 21.6bn in August it is broadly around its record.

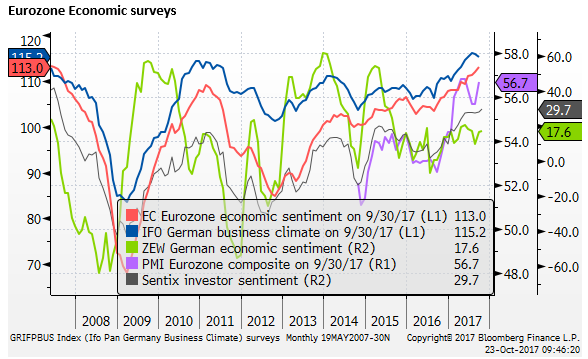

Economic surveys for the Eurozone remain around their highs since the 2009 global recession.

ECB sees labour market slack and very gradual rise in inflation

There is little evidence that the strength in the EUR this year has had much impact on the recovery, and underlying inflation has firmed modestly from a year ago. This explains why most analysts see some risk of a faster or larger taper announcement.

However, ECB Board Members have in recent speeches pointed to limited progress in lifting wages and inflation. While hailing the significant improvement in the labour market in recent years, broader measures of under-employment suggest that part of the answer to why wages remain subdued is that there remains significant slack in the labour market.

Assessing labour market slack – Box in 11 May 2017 Economic Bulletin; ECB.europa.eu

At the meeting this week on 26 October, the ECB will not update their staff forecasts for the coming years. But they are unlikely to see that the outlook has changed much. In September, they revised down their inflation forecast slightly from 1.6% to 1.5% in 2019, “mainly reflecting the recent appreciation of the exchange rate.”

This leaves their forecast for inflation still significantly below the just below 2.0% target at the end of their forecast horizon.

As such, the ECB believes that “a very substantial degree of monetary accommodation is still needed to secure a sustained return of inflation towards levels below, but close to, 2% over the medium term – in line with the ECB’s mandate.” (Source: Draghi statement to IMF on 13 October).

Since the last ECB Board meeting on 7 September, several members have reiterated the sentence in the press conference introductory statement that, “the recent volatility in the exchange rate represents a source of uncertainty which requires monitoring with regard to its possible implications for the medium-term outlook for price stability.”

ECB is likely to be careful not to over-deliver

The ECB has been at pains this year to avoid severe market reaction to a seemingly inevitable policy taper next year. This includes attempts to dampen upward movement in the exchange rate.

As such, they may have carefully leaked to the media a strategy to taper purchases in half and extend the time-frame to September next year, to set a clear goal post for expectations to avoid disruption when it is announced.

ECB to Consider Cutting QE Purchases in Half Next Year; 12-October 2017 – Bloomberg.com

We presume therefore that the ECB will not want to shock the market, and certainly not over-deliver on the taper this week. At the press conference, we expect that Draghi will continue to emphasize that prolonged policy accommodation is intended. The ECB will always be evasive in discussing the exchange rate, but the statement is likely to reiterate the risks to medium-term inflation from a volatile exchange rate.

The recovery in the EUR this year is consistent with the strength in growth and inflation in the Eurozone relative to the USA. However, it has moved well ahead of interest rate and yield differentials. As discussed in our report last week, we see a risk of a clean-out in long EUR positions into year-end as the market moves beyond its focus on the taper to the widening EUR yield disadvantage.

EUR and CAD need to square up to growing threats – AmpGFXcapital.com