Emerging markets take charge while Fed free-wheels

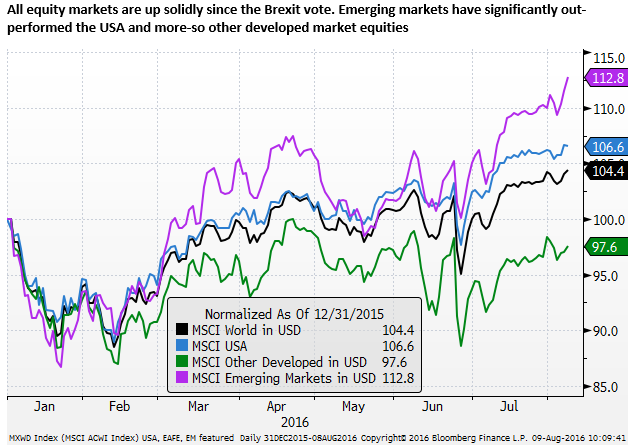

High beta assets globally have significantly out-performed over recent months. Emerging market equities, bonds and currencies have led the recovery since the Brexit vote. They have been supported by fiscal and monetary policy easing, two strong US payrolls reports and other supporting US economic data including PMI surveys that suggest that the US economy is recovering solidly from a weak first half of the year. And recent PMI data from emerging markets that suggest they have stabilized and are now contributing to global growth again, including strong improvement in Brazil and Russia and stable China. Information Technology equites are leading the global recovery and helping support demand for KRW and TWD currency and assets. The USD has weakened against the rising in EM and commodity currencies as the preferred funding currency despite a recent modest improvement in its yield advantage against most currencies. US rates have not yet risen sufficiently to force investors to consider alternative funding currencies.

Ongoing uncertainty over policy direction in Japan and related volatility in the JPY and Japanese rates and bond yields is discouraging use of JPY as a potential funding currency, contributing to broader weakness in the USD that appears excessive in light of the improving prospects for the US economy and the risk that the Fed resumes rate hikes before year end.

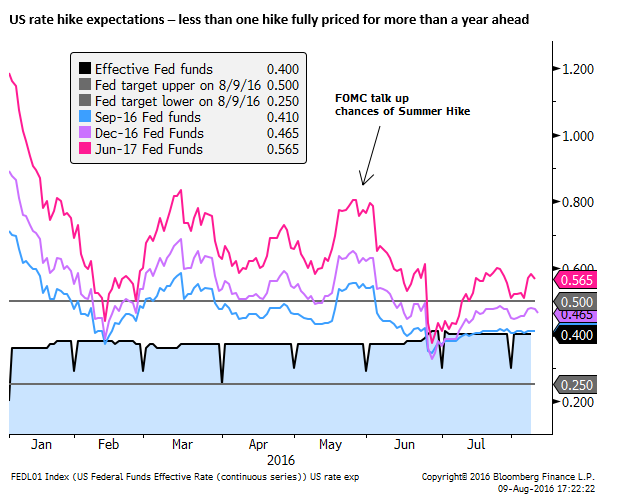

However, the market is still pricing in only a modest chance that the Fed hikes this year and has less than one full hike priced in over more than 18 months. Most of the recent rise in USD term money market rates relate to tightening funding conditions for borrowing USD, rather than increasing expectations of Fed policy tightening. Fed speakers have offered little indication that they have been moved by recent US and global events to consider raising rates sooner. The weaker trend in the USD is becoming more imbedded as the year progresses and may take some time to turn around, especially if Fed Chair Yellen remains lukewarm on the prospect for rate hikes over the cycle. The improved state of investor confidence and upswing in emerging markets appears more resilient to the prospect of higher US rates and may continue to set the tone for the USD.

Emerging Markets take charge

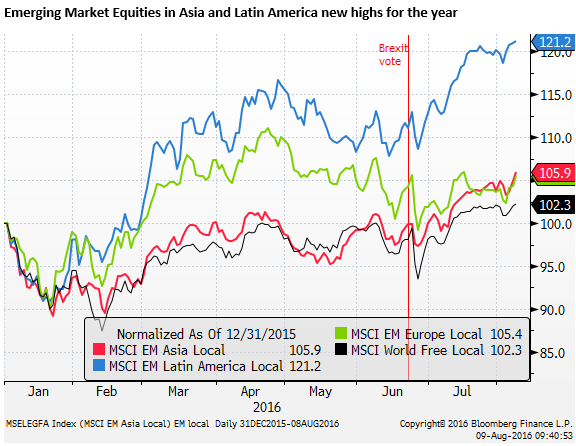

The clearest development in recent trading is a rebound in riskier assets. Latin American and Asian equites have led gains in global equities rising to new highs for the.

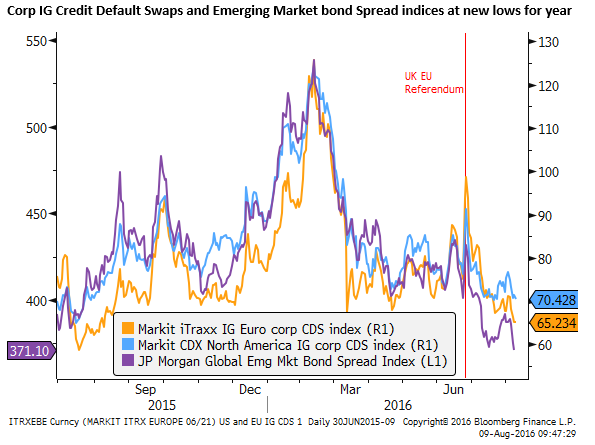

Credit spreads and Credit Default Swap indices for corporate bonds and emerging market bonds have also moved to new lows for the year.

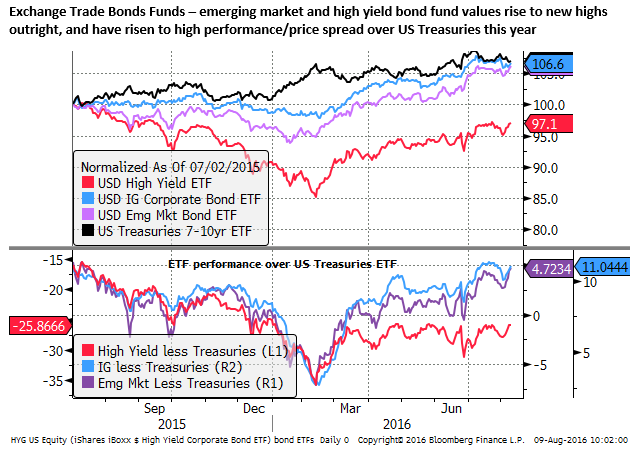

The chart below shows the performance of Exchange Traded Bond Funds. The top panel shows the relative performance of four different sector funds. High Yield Corporate bond and Emerging Market bond funds have hit new long term highs. More recently the US Treasury bond and Investment Grade Corporate bond funds are modestly weaker (reflecting somewhat higher US Treasury yields in the last month following stronger US data and a rise in Japanese Government Bond Yields since the 29 July BoJ meeting.

The lower panel shows the spread in performance between the higher yield funds and the US Treasury bond fund. In recent days the Emerging Market fund and High Yield Corporate fund have risen to new highs in performance over the safe-haven US Treasuries. The Investment Grade bond fund has also risen in value to approach its high spread over US Treasuries.

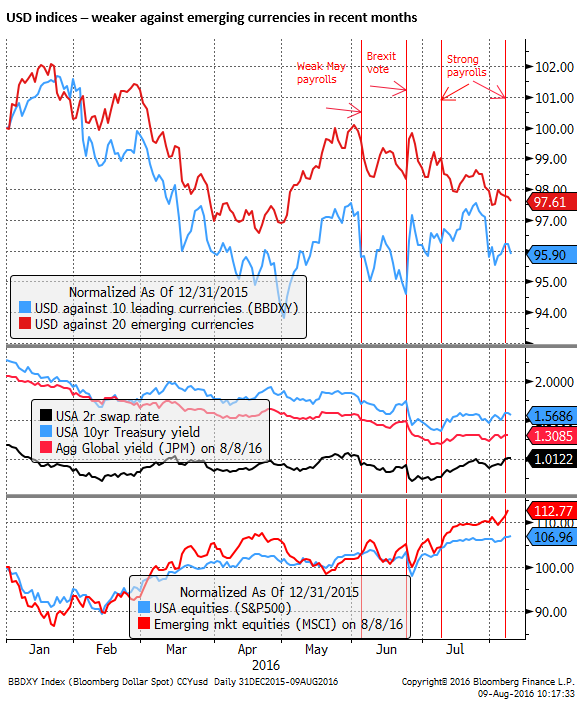

The strong performance in higher yielding equity and bond assets is spilling over to currency performance tending to boost commodity and emerging market currencies. The chart below shows the USD performance against an equal weighted index of 20 emerging market currencies and a weighted index against 10 leading currencies. The USD is weaker against emerging market currencies over recent months. Note that the strong payrolls reports in June and July did more to boost emerging market assets and currencies more than the US dollar.

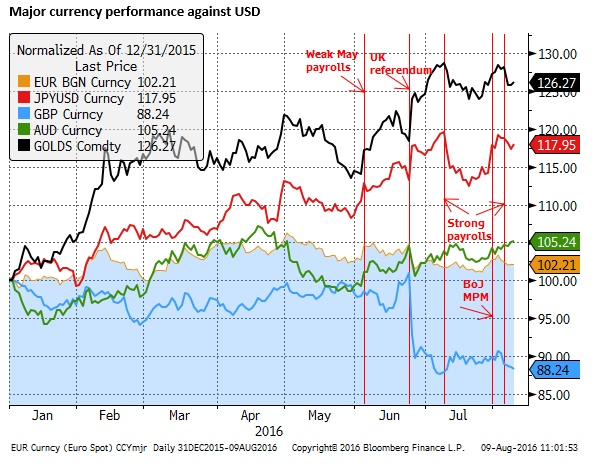

Volatile and strong JPY adding to broader USD weakness

The chart below shows the USD relative to other major currencies, illustrating a mixed performance. JPY has been volatile over recent months, still exhibiting a strong rising trend this year. The JPY surged on Brexit, while the GBP plunged and EUR weakened modestly. JPY then fell sharply on fiscal and monetary stimulus expectations in July following the strong showing by the LDP party, led by PM Abe, in upper house elections. This spilled over to modest USD gain against other currencies supported in part by a strong rebound in June payrolls.

However, the failure of BoJ to deliver much additional stimulus on 29 July and announcement of a policy re-think to be discussed at its next policy meeting on 21 September caused a rebound in JPY and sharp rise in Japanese rates and yields albeit still in negative territory. This spilled over to broader USD weakness.

The BoE policy easing on 4 August weakened the GBP and EUR to some extent. A second strong US payrolls report on 5 August gave the USD a further boost. However, the gains in the USD have been modest and unconvincing.

JPY appears to be still gyrating on uncertainty related to the BoJ policy review that contributing to a jump in Japanese bond and rates. It is paying relatively little attention to US data and rate expectations or degrees of global risk appetite.

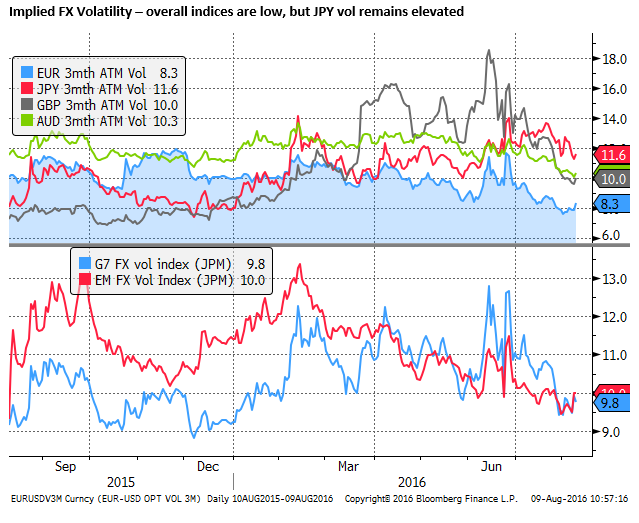

The chart below shows that implied (expected) volatility in the JPY is the most elevated of major currencies, significantly above the EUR that has been much more stable this year, and above GBP vol that has fallen sharply since the Brexit vote. The chart also shows that indices of emerging market and G7 FX volatility are around their lows for the year. The recent fall in vol is consistent with broader evidence of increased investor risk appetite.

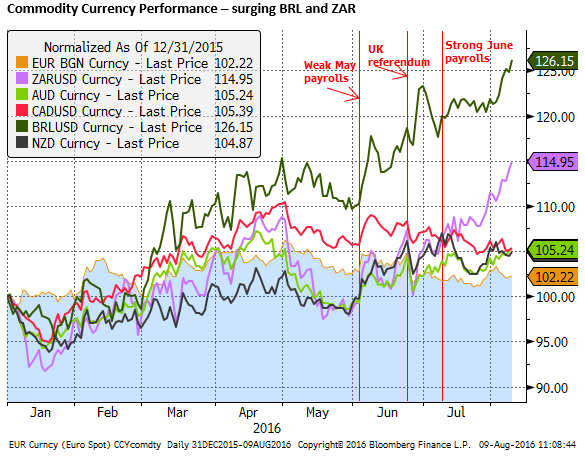

Commodity currencies stronger despite losing yield advantage

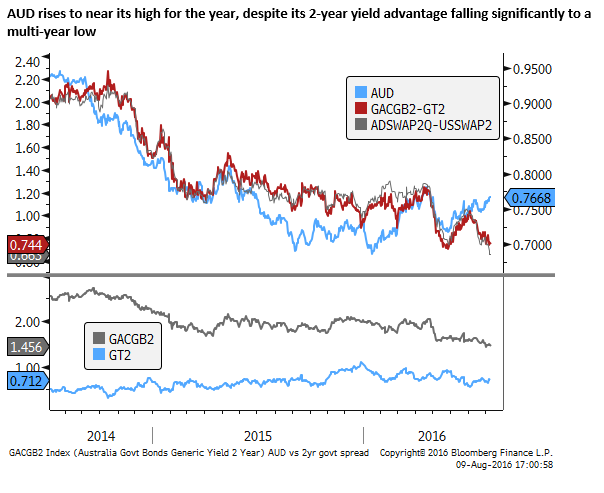

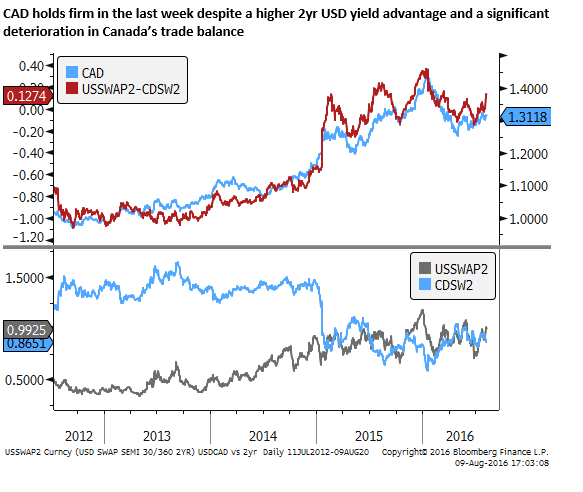

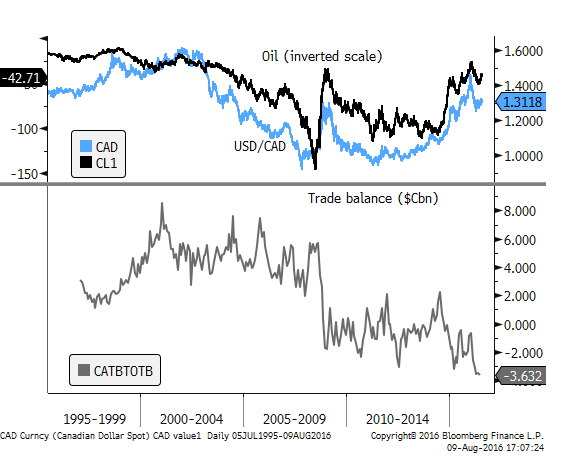

The chart below shows the performance of commodity currencies against the USD. BRL and ZAR, the two high risk emerging market commodity currencies have surged since Brexit, drawing strength from strong US payrolls and BoE policy easing. The AUD has also firmed despite cutting rates on 1 August. NZD is stable despite expectations that it will cut rates on Thursday this week, and CAD is also relatively stable despite much weaker than expected employment, trade and building approvals data in the last week pushing its yields down relative to the USA. Lower oil prices over the last month have also worked against the CAD.

Emerging currency gains

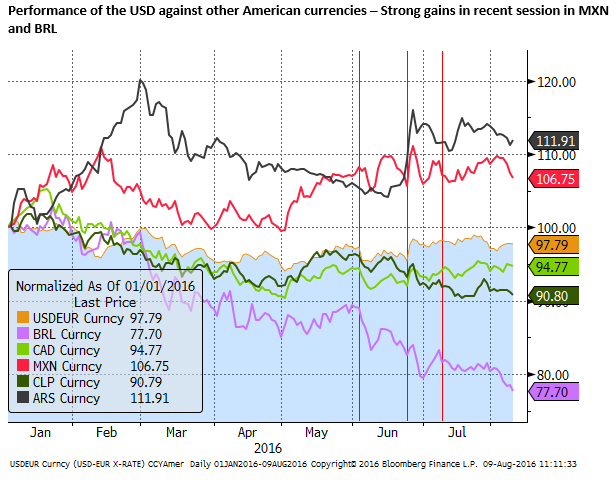

The chart below shows the performance of the USD against America currencies, showing broad strength with MXN joining solid gains in the BRL in recent days drawing support from strong USA July payrolls, BoE policy easing and rebounding global risk appetite.

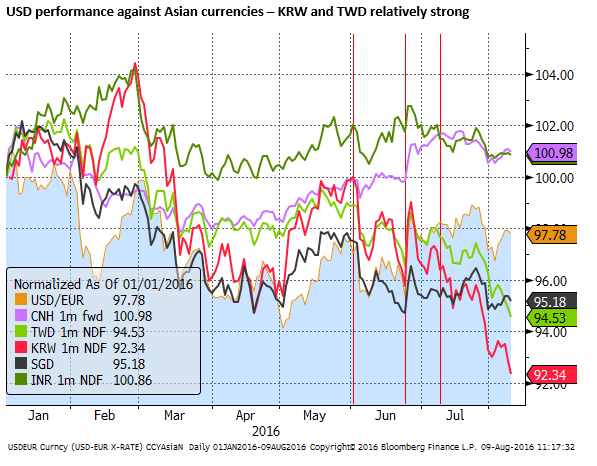

The chart below shows that while the INR and CNY continue to under-preform, the TWD and KRW, two major trade partners of and competitors with China and Japan, and exporters of High Technology goods, have strengthened relatively sharply to new highs for the year against the USD. They have drawn strength from the recovery in JPY since the 29 July BoJ policy meeting and the recovery in global risk appetite in the last week. High Tech sector equities have been leaders in the recent equity market surge, adding support to these currencies.

Confidence in global growth has improved

Confidence in the global economy has been boosted by the recovery in US payrolls and additional fiscal stimulus measures announced or expected, in Japan, Korea and the UK.

The UK’s BoE eased monetary policy more than expected, The ECB is thought likely to ease policy further and the market is viewing the Fed far less data dependent since the Brexit vote, prepared to wait for longer to raise rates. Even though US rates have risen modestly, the market is far from convinced the Fed will raise rates this year.

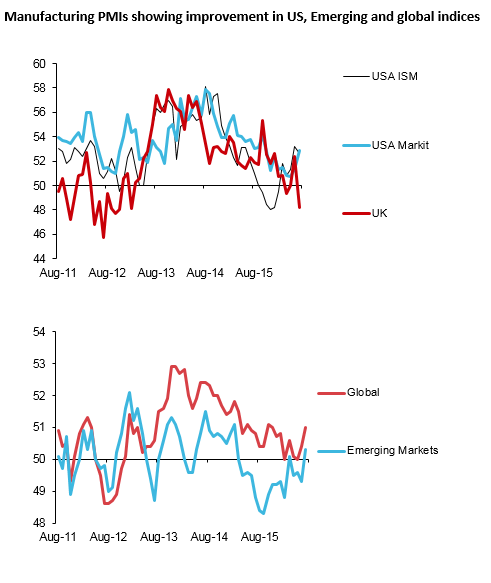

The most recent PMI survey data showed improvement in emerging and global indices in July, despite the sharp fall in the UK, suggesting that the market is not expecting significant negative global fallout form Brexit.

The chart below shows firmer US manufacturing PMIs and improvement in global and emerging market PMIs, despite the sharp fall in the UK PMI in July. The emerging market PMI is at a high since Feb-2015, albeit still only just above 50. The Global PMI is at 51 a high since Nov-2015.

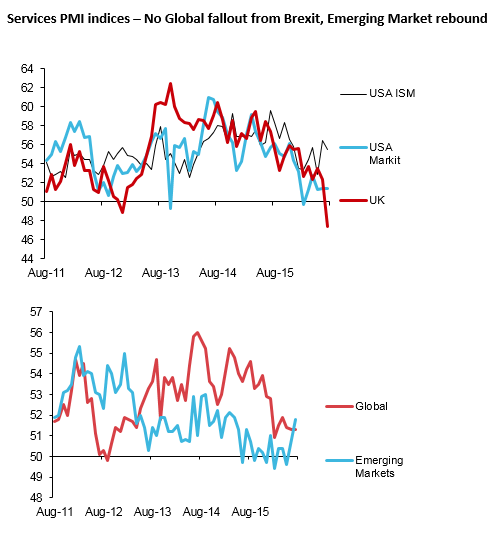

The charts below show service sector PMIs. The US ISM non-manufacturing index was down a touch in July after a much stronger than expected June, to post its best two months since Nov/Dec-2015, while the Markit PMI services measure remained more subdued. The UK services PMI, like the manufacturing measure, plunged in July.

The global services PMI was relatively stable in July, showing little fallout from the Brexit vote, and the Emerging market services PMI jumped to a high since April-2015, with solid gains in Brazil, Russia and improvement in India, while China services sector remained stable.

It is not surprising, therefore, despite the uncertainty generated by the Brexit vote, that global emerging markets are leading a recovery in global asset prices. Fallout from Brexit at first blush appears minimal, the US economy has shown signs of solid recovery towards the end of Q2 and into Q3 from a moderate to weak growth in the first half of the year, emerging market economic conditions, particularly for key commodity producers appears to have stabilized, and monetary and fiscal policy over the globe has been eased further.

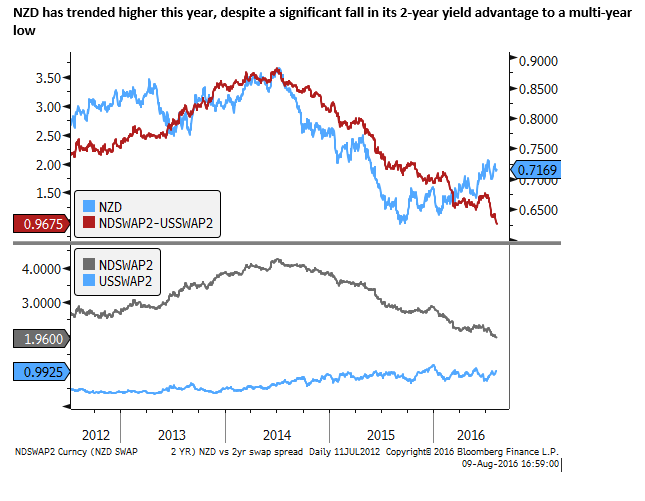

Renewed urgency to seek out higher yielding assets in a diminishing yield environment has boosted emerging and commodity currencies, even though the yield advantage of many of these currencies has narrowed significantly against the USD in the last month or so, in many cases, to multi-year lows. This is the case for AUD and NZD.

USD acting as the preferred funding currency

The market is displaying a preference to fund higher yielding investment out of the USD, rather than selling JPY or other major currencies. The additional volatility in JPY this year that has intensified again in the last month is discouraging sales of JPY.

The stability in EUR against the USD is harder to explain, considering its low and negative yields, but it has still lagged most other currencies. The fall in USD/JPY may be spilling over to broader USD weakness, including against the EUR.

The market appears to know that it wants to buy EM and higher yielding currencies. It has been comfortable selling GBP, but unsure how to view the negative yielding JPY and EUR. As such, it has sold the USD as a default position against EM and higher yielding currencies, even though US rates have firmed.

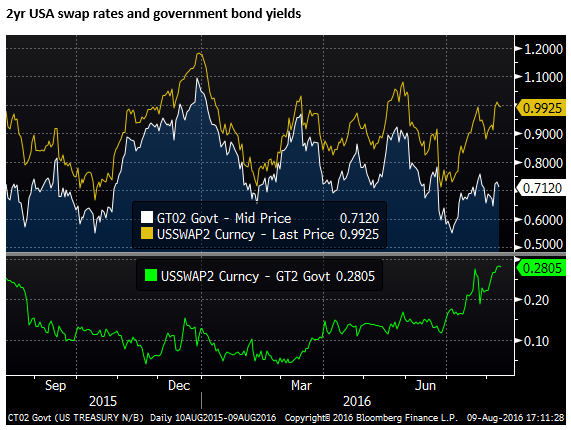

US rates have just not risen sufficiently to force the market to reconsider using it has the preferred funding currency. 2yr swap rates in the US have been in flat trend this year, returning recently to the high end of the range in late-May, when the Fed appeared to be warming up for a summer rate hike before this was scuppered by the weak May payrolls report. 2yr Treasury yields remain lower.

High beta risk assets globally may now have a higher degree of resilience to moderate further rate hike expectations in the USA that it had over the last year. As such we may continue to see the USD stagnate and lag the improvement in its yield advantage (or diminishing yield disadvantage).

The market may still have to contend with Fed policy tightening this year

However, the risk is that the market is now significantly underscoring the probability that the US raises rates not only this year but through the cycle. You have to go out about 18 months for one full 25bp hike to be clearly priced into the rates market.

Surely the Fed Chair Yellen, notwithstanding a possible mood-shift towards a lower long run neutral rate for US rates, would still like the market to see rates rising more than currently anticipated in the rates curve.

Yellen may conclude that it is prudent to make a second rate hike this cycle as soon as September or at least before year-end, given the strong rebound in global asset prices, evidence that the global economy may be stabilizing and improving modestly, and recent improvement in US economic reports.

This would be consistent with the July FOMC statement that said, “Near-term risks to the economic outlook have diminished”. The Fed would probably like the idea of delivering one hike this year to create the impression of a slight uptrend in rates, consistent with the long stated forecast of the Fed to deliver a gradual tightening cycle. A hike in coming months would still appear extremely cautious, consistent with nurturing a recovery, and engender a bit more certainty over Fed policy direction and indeed in the resilience of the US recovery.

Borrowing and hedging costs in the USD have risen

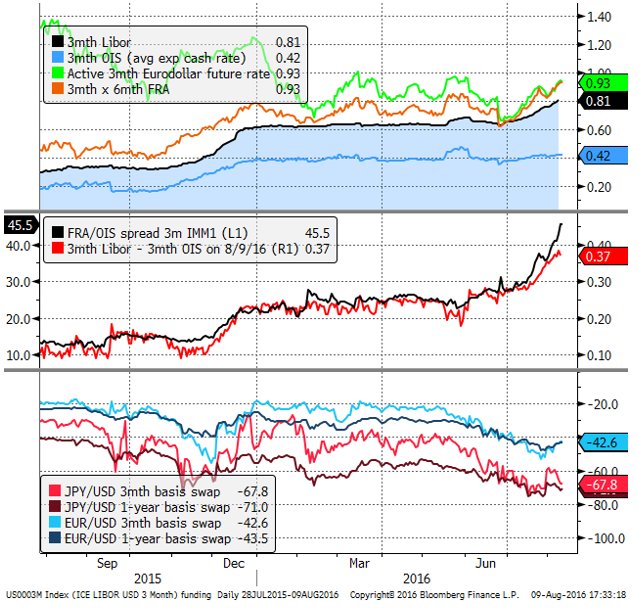

While the expectations for rate hikes in the US remain muted, term funding costs and the basis spread in the FX forward and cross-currency interest rate swap market have risen to make it more costly to borrow USD to fund or hedge USD investments.

USD interbank lending rates (LIBOR) and swap rates have risen independently of rate hike expectations and US Treasury yields at the front of the curve (the chart earlier showing that 2yr US swap rates had risen more than US Treasury rates reflect this development).

The chart below shows that USD 3mth LIBOR is up around 15bp independently of the expected cash rate over the coming three months. And JPY and EUR cross-currency basis swap points have become more negative against the USD. These add to the cost for Japanese investors that frequently use this market to hedge USD investments.

Rather than pay these additional costs for borrowing USD or hedging USD risk, investors in Japan and Europe can pick up additional carry from buying USD outright in the FX market and selling their own currencies. Or global investors in EM and commodity currencies, seeking higher returns, would pick up additional carry by funding these investments by selling JPY and EUR instead of the higher yielding USD.

As we discussed in our report AmpGFX – Fed Credibility Gap and rising USD borrowing costs, 28 July, these higher funding costs for the USD reflect new regulations coming into effect in October designed to make money market funds in the US safer and more transparent. We also think the hard to fathom strength in the JPY this year has increased demand for USD borrowing to hedge global investment, including in particular from Japanese investors that have been forced by negative Japanese bond yields to invest more offshore.

Some have supposed that the run up in USD borrowing costs may be a factor discouraging near term Fed policy tightening, since these higher US rates will affect borrowing costs in the US economy and act as a de facto policy tightening. This may be true, but in either case it still represents a higher effective yield on USD positons and should tend to support the USD as much as a Fed policy rate hike.