EUR Hits a New Low for 2018, Emerging Markets Under-perform

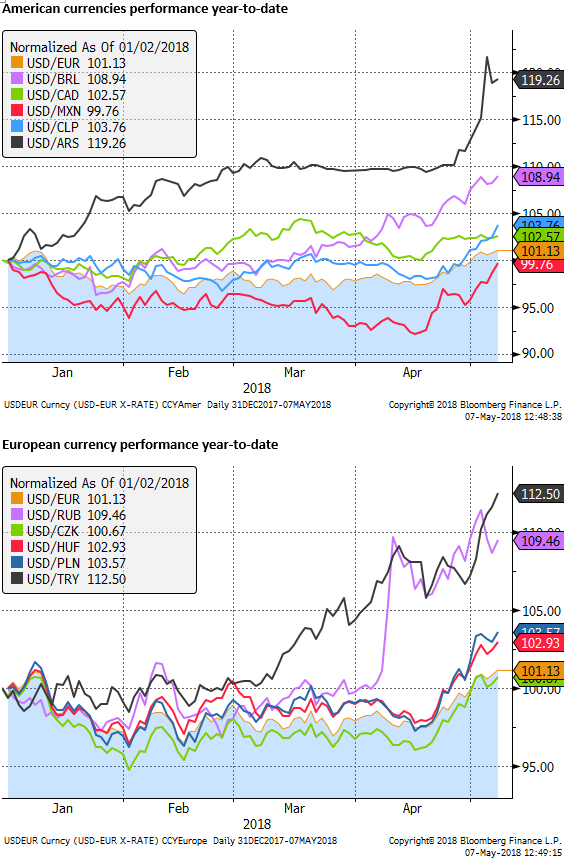

In recent weeks, EM has significantly underperformed the US and other major markets across currency, bond and equity markets. Several higher-yielding EM currencies have fallen more sharply; including ARS, TRL, IDR and INR. There appears to be some momentum behind the recent capital flight from EM that may not quickly reverse. US bond yields have stabilised near recent highs in the last week, but most other major market yields have retreated, further increasing the USD yield advantage to new highs. Our report today concentrates on the EUR. Economic surprise indices for the Eurozone have sunk to new extreme lows and maybe forcing a shake-down in the market’s stubbornly optimistic outlook for the region. EUR has hit a new low for the year, but it is too early to presume it will stabilise.

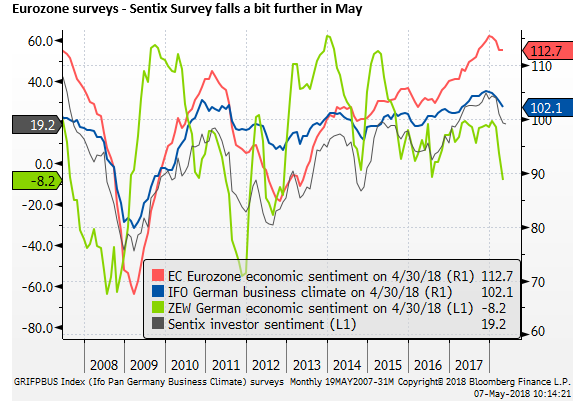

Sentix down again

The Sentix survey of investors’ confidence in the economy slipped further to from 19.6 to 19.2 in May (below 21.0 expected), a low since Feb-17. The first sentiment survey for May suggests that investors are not looking for a quick rebound from weakness over recent months.

Eurozone retail sector weak

The Eurozone PMI for retailing fell from 50.1 to 48.6 in April, a low since Nov-16, the first time below the 50 advance/decline line since Mar-17. Much of the decline appeared in Italy (48.0 to 42.7); which may reflect election uncertainty.

Eurozone retail sales were also reported on Friday to have slowed from 1.8%y/y in Feb to 0.8%y/y in March.

German factory orders retreat in Q1

German factory orders fell 0.9%m/m in Mar, below +0.5% expected, and were revised down from +0.3% to -0.2%m/m in Feb, to be down three months in a row. Total orders rose 3.1%y/y in March, down from a recent peak of around 9.0%y/y in Q4 last year.

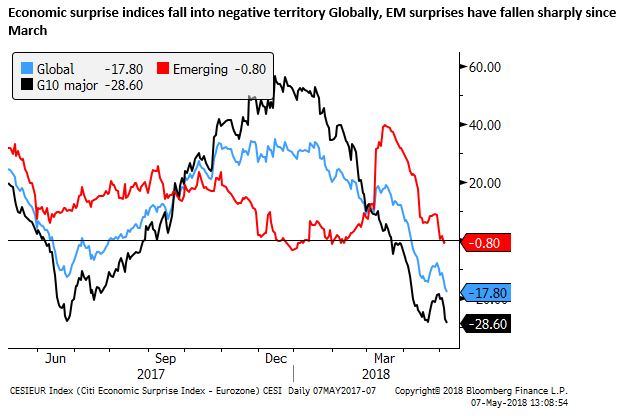

Euro Economic surprises are at crisis-level lows

The Citibank Euro economic surprises index fell to -110.1 the lowest since 2011. The difference between the EUR and the USA (-128.7) remains around its lowest since 2008.

The extent of the weakness in the Eurozone index is extreme, and we should expect it to bounce back in coming months, perhaps as expectations for growth in the Eurozone are revised lower.

The extreme fall is similar to that seen during crises, (Global Financial Criss in 2008 and Eurozone crisis in 2011). The Eurozone is currently far from a crisis; the deep slide in the surprise index suggests that the market has remained stubbornly optimistic for the Eurozone in the face of persistently softer reports.

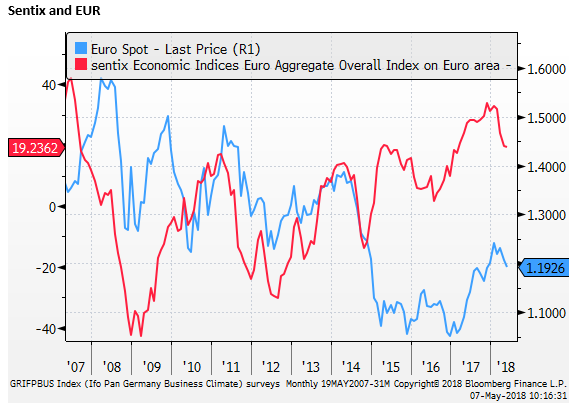

New Lows for EUR in 2018

The fall in the EUR/USD from highs around 1.25 to near 1.19 may have priced-in the slower pace of growth, but the ongoing soft tone in the data may threaten further declines and keep the EUR topside limited for the near term.

EUR/USD tested its low for the year in January of 1.1916, briefly pushing below this level (to a new low for the year (just below 1.1900), before rebounding to around 1.1930 (so far as I type).

The EUR has fallen into the consolidation range during the second half of last year (between a low of 1.1554 in Nov and a high of 1.2092 in Sep). We might expect it to move further into this range given the current soft state of the Eurozone data relative to the solid trend in the US.

A key support for EUR/USD is likely to be the high in 2015 and low in Dec-17, roughly around the middle of this consolidation zone. (1.1715/20).

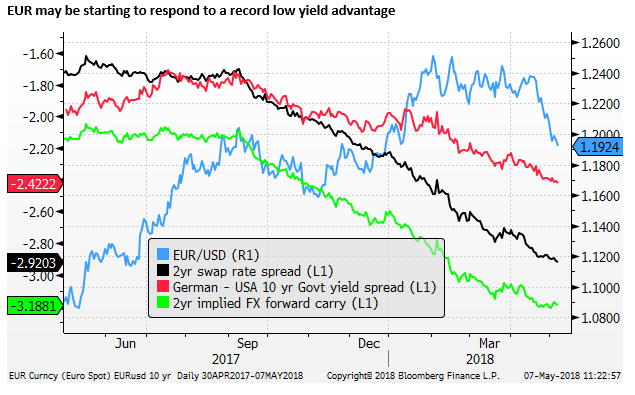

EUR closing a wide divergence from its yield spread

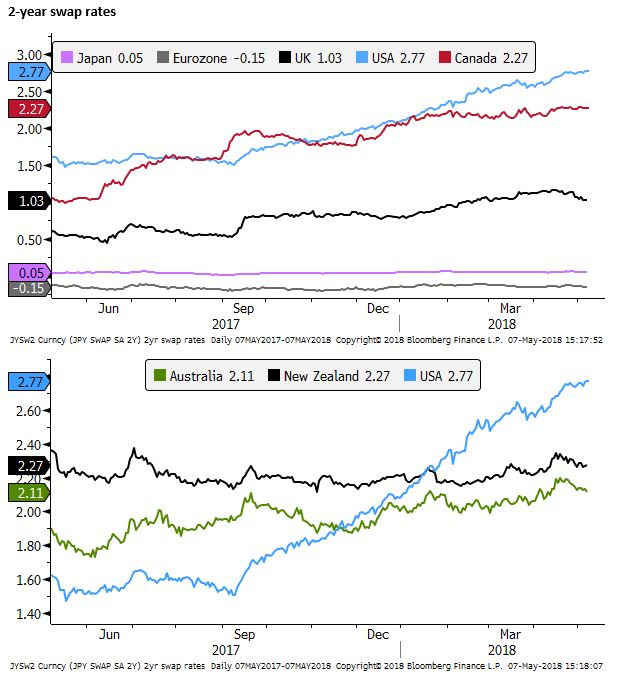

A record low (negative) yield advantage may now be dragging EUR/USD lower, although it has a long way to go to reconnect.

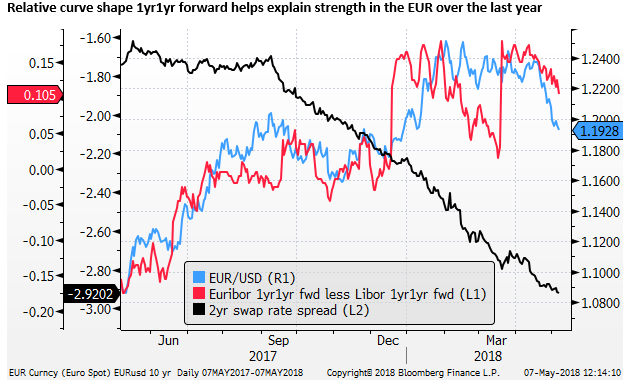

How forward-looking is the FX market

As we discussed in our blog over the weekend, the record divergence in EUR/USD from its yield spreads in the last year could be explained by relative rate expectations one-year one-year forward.

This suggests that the market has already priced-in rate moves over the next year, and is looking further ahead for guidance. The strength in the EUR over the last year suggests that the market is looking ahead to see a peak in US rates, and the beginning of ECB rate hikes.

To some extent, this makes sense since the Fed is deep into its tightening cycle and the market is no longer surprised to see the Fed hike on a quarterly basis. It has had time to price in several more hikes into the FX market.

However, as we noted in our blog, the market is not always so forward-looking and what happens a year out is highly uncertain. The market must pay a very large cost of carry to sit on long EUR positions, and if it sees the EUR stagnating or falling, it may revert to pay more attention to the very large yield spread over the entire two year period ahead.

Those that read my blog may note the chart below looks a bit different than the one in the blog. This is because I used rolling 4th vs. 8th Euribor/Libor contracts below as opposed to Mar-19 vs. Mar-20 contracts in my blog. For instance, the chart below has a discrete jump in the relative curve spread at the contract roll date in March.

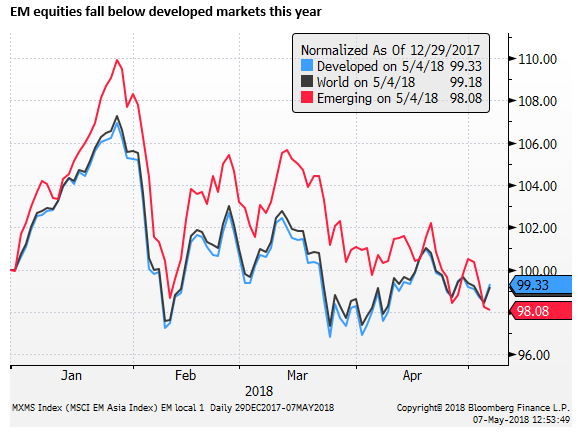

Emerging markets under pressure

As the market prepares for a number events this week, there are some significant observations to make about the status quo.

One is that emerging markets have significantly underperformed major markets across currencies, equities and bonds in recent weeks with severe capital flight from some more vulnerable EM markets with higher yields and external deficits. The weakest currencies include ARS, TRL, IDR and INR.

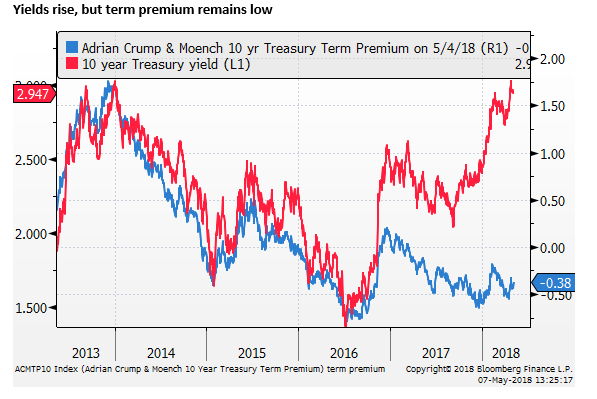

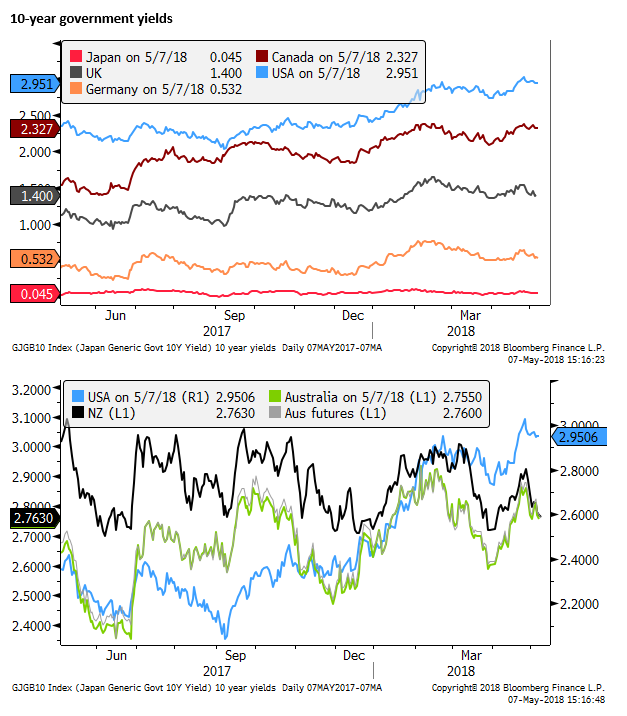

USD yield advantage rises further

US yields have stalled recently, but they remain near their highs, while government bond yields in other major countries have fallen. This is consistent with the relative out-performance of US activity and inflation indicators.

Even though US yields have risen significantly in the last two years, the term premium appears to remain near record lows. This suggests there may be further upward pressure on yields ahead as QE unwinds and government supply increases.