This will be an occasional free commentary, less formal, free-wheeling, mixing some market thoughts with whats happening in my world and updates on our business.

Some of you know me well, other not at all. It has been quite a while since I reached out to share thoughts on life. I am not really that into keeping in touch, so sorry if you think that I have let our relationship slide.

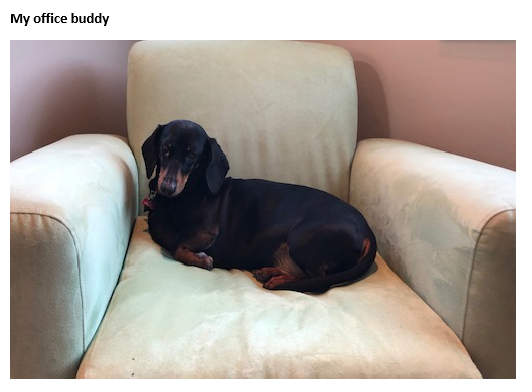

My boys often joke that I have no friends and sit at home all day alone. My oldest, contemplating which college he might attend, can’t imagine working from home and is looking forward to the day he can get back to a big city.

This is a bit harsh, I have some local friends and when you get to a certain time in life, a bit of alone time is as valuable as socialising. The view from my window is amazing and peaceful. It has taken some getting used to not having a busy office and bustling streets below. I remember how important it was to me when I was young to connect and be part of that buzz. Not so much now.

I have never spent too much time thinking about what type of person I am, do I like cities or small towns? Am I good at sales or analysis? Am I social or a loner? I am not going to start now. I don’t like to put anything in a box, including myself. I tend to get on pretty well where ever I have been. I like it here in Breckenridge and hope to stay for a while.

Most of the things I like to do, outside of my work, involve being active. Here that is skiing and biking. And there is so much more I have and hope to dabble in yet; golf, fishing, kayaking/rafting, hiking. I only hope my body holds together enough to make the most of it. My knees have started complaining more lately, so one of my life-long joys of running is coming to an end.

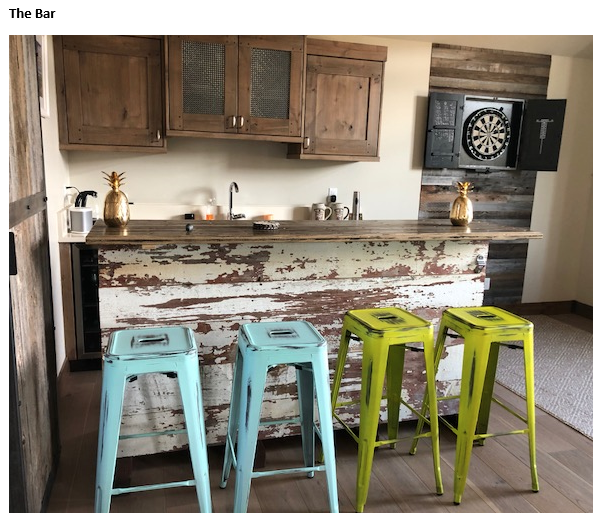

One of the joys of moving here was buying a truck and getting a big garage to put in a workbench and tools. A bit of a man cave. I did woodwork in high school and always liked the idea of building stuff. I built a bar last year from recycled barn wood and railcar flooring for a bar top. If you don’t look too closely at the detail, it came up pretty good.

With life, work and chasing around with our kid’s sport, you never get to enjoy the outdoor activities here as much as you intend to, so often it is a bit of a tease, and I feel sad I haven’t got out on the slopes or bike.

I am enjoying life here more than my family. They do miss the big city life. I feel a bit guilty sometimes taking them from their old life; the only one they knew. Team sport is much more important for young people and it is harder to make teams and travel for games here. But both my boys are doing well.

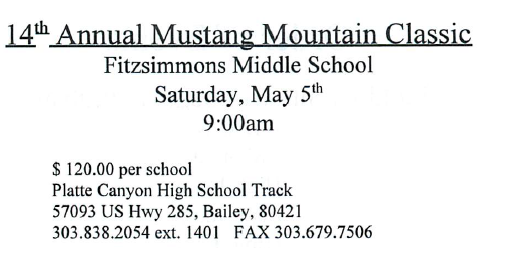

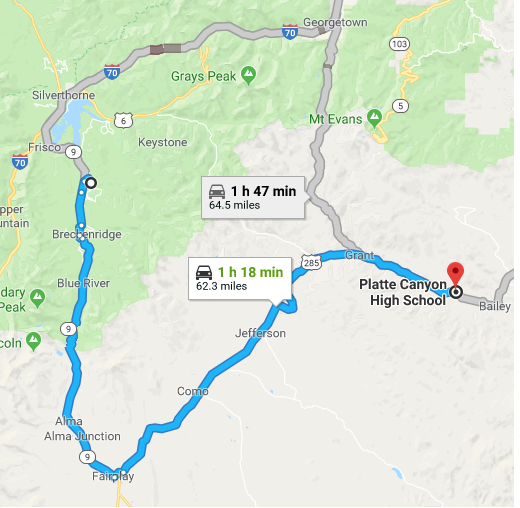

Both are playing basketball, although the seasons are too short. Not like Singapore or Australia where team sports go all year round, and you can play anything. Josh is doing track at the moment, so that means an hour and a half drive on Saturday to Platte Canyon, Bailey, to watch him run.

It’s a bit sad when parents live their life through their kids sporting achievements, but I can’t help feeling that pride when Josh runs. He is so damn fast, must get it from his mum. Small in stature, but hard-wired with fast-twitch muscles, natural balance and grace.

Gabbi is doing an online university degree majoring in the French language, she has opened an at home business doing facials and more (GabbiG.com), and she is on the road doing makeup and hair for weddings. Apart from skiing, the Colorado mountains are popular wedding destinations, especially in the summer.

Luckily she is making a bit of money, because I am not exactly shooting the lights out on the business front. After a great performance in the few years before kicking off on my own, the last few years of my trading performance has been at best mixed.

It’s too early to say if I am going to make it or not. I am still quietly confident and feel like I am growing and learning from my experience in what I will claim is a tougher market environment in recent years, although I am not going to make excuses.

As I tell my boys when they are playing basketball, keep your head in the game, play with confidence and always be thinking ahead. Of course, as teenagers, they take no notice of anything I say.

As I go into this weekend, I am short EUR and AUD vs the USD and short EUR/JPY. Position sizes not large, reflecting my modest confidence in the trades, but significant enough, especially when you add them up, to keep me on my toes.

If you follow my AmpGFX reports, you get a pretty good idea of what trades I am doing. My last three report titles tell the story:

Regime change for the USD; AUD breaks down

Time for a EUR reality check

A pervasive rise in yields may propel further USD gains

However, while I have painted a pretty firm picture that I think the USD will strengthen for a while and significantly, I am not so confident to load up for the big hit.

How forward-looking is the FX market

The USD has become quite disconnected from interest rates and yield differentials, generating quite a bit of debate in the market as to why that is.

As typically happens, analysts have drawn out more obscure metrics to explain this divergence. Some of it makes a bit of sense, but we cannot be sure if these are just another bunch of spurious relationships that will fade again.

For instance, some analysts have looked at forward curve spreads as reasons for a weaker USD. In other words, it’s not the hikes baked in the cake over the next 12 months that matter, but the hikes in the year after that.

There is some sense it this. It suggests that the market has built in the next three or four Fed rate hikes, and is looking forward to a time when it sees a peak in US rates, while it is building in the tightening cycle by the ECB even if it is still about a year out.

This basically suggests that the FX market is quite forward-looking at the moment. This sits well with the idea that the market is efficient and builds in events before they occur.

However, I recall back to the first half of 2014, when I was an FX strategist at RBS. At client presentations, I said that the reason the USD was not stronger was that the rate hikes built into the US curve were too far out and too uncertain to demand a shift in investor attitudes. Basically the complete opposite of the argument above.

I was bullish for the USD and suggested as we got towards the middle of the year, and those rate hikes appeared more certain, possible within the next six months, they might then drive up the USD.

One client quite rightly asked, but why should it matter if those hikes that are priced to occur 12 months out move to within six months just by the passage of time.

Of course, it was hard to answer that question, and I could not be confident that I was right, it was just my opinion of the psychology of the market at the time; i.e. it was just not very forward-looking.

There is a lot that goes into divining what moves the market at any time. I don’t know if the market has been trying to look forward to the time when US rates peak and other countries begin tightening policy.

There is probably some truth to this idea; that the market has built in much of the coming Fed tightening cycle and is looking further ahead to decide its current direction.

The recent recovery in the USD can be seen in this context; the market has come to see a bit more hikes in the US extending into next year, while delaying its timing of hikes by the ECB.

However, it also remains the case that what happens next year is incredibly uncertain and should matter only so much to the market.

Nevertheless, the market is now well into the Fed tightening cycle, it has got used to the idea of hikes on a quarterly schedule and will hardly be surprised if the Fed hikes two or three more times this year. The psychology of the market could be quite different than it was in the first half of 2014 when it didn’t care to look much beyond its nose. It is understandable that it is looking further ahead for the next big thing.

In my recent reports I argued that with equities moving into a more volatile less directional phase, the market may shift back to consider relative interest rates more in setting FX trades, arguing for a rebound in the USD.

I think this is playing out, but we need to be cautious anticipating a full reconnection with historical relationships between the USD and rate spreads. There is reason to believe the market has just got a bit more confident that the Fed can go a bit further and the ECB and others can wait for somewhat longer.

Un-tethered FX markets

It also appears to me that the FX market is not particularly tethered to any of the macro events playing out over recent years. We see reactions that are delayed and muddled. A lot of the moves across markets are highly influenced by positioning and short-term trading strategies, often driven by program trading that is quickly reversed. I have often mistaken moves to be related to a macro development, jumping on the back of it, to soon find the move reversed.

It may be the case that the macro events, such as Trump’s trade policy, are just too uncertain to have a lasting impact on market direction. They have generated volatility without direction.

I have to get better at being less reactive, become more thoughtful and patient.

A very stable genius

Politics has been very interesting in the US in recent years. I was as guilty as anyone in thinking Trump would not become President. I was equally clueless when it came to the Brexit vote. Trump has helped generate considerable uncertainty over the last year and a half, helping drive up the dollar early on, and then down again in 2017.

He is highly polarising, and the media here is in a frenzy over him and everything around him. He is brilliant at generating headlines.

There is plenty to dislike about Trump. He is a shameless narcissistic bullshitter and bully. But he may be gaining begrudging respect. At least he is from me.

I am deeply troubled by his dog-whistle to racists, vilifying of immigrants, and attitude towards gun control. Personally, if I could vote, I would never vote for such a person, and it will be interesting to see if there is a Trump protest vote in the mid-term elections.

However, Trump has essentially been true to what he campaigned on. Furthermore, he has been effective in achieving his goals. He has been able to shake up the way government works, which is what his supporters wanted. He has cut taxes and increased spending on the military. He has arguably slowed immigration even if the wall has not been built.

He has been a more confident and forceful leader in recent months. He has jettisoned moderates from his cabinet and brought in those that support and promote his agenda, Bolton, Pompeo, Kudlow, Navaro, Giuliani. It’s a nightmare for liberals, but Trump is taking charge and cutting through.

Trade policy is now high on the agenda, as he promised. And liberals begrudgingly are on board. Maybe it is time to draw the line with China and stop letting it get a pass as an emerging country. A more combative unconventional approach is overdue. The China issue extends beyond trade and the USA as it becomes a more assertive global power pedalling its influence openly and covertly. It’s not clear where it lands, but Trump is the man to shake this tree.

Something is moving on the Korean peninsula. Trump’s unconventional style probably had something to do with that, and it is possible he could oversee one of the biggest historical achievements in international relations. A Nobel Peace prize for Trump? OMG!

He has also injected uncertainty into the Middle East and Russian relations. Who knows yet what that may be a catalyst for. But Trump is increasingly being taken seriously in international affairs.

The Mueller investigation hangs over government in the USA, and it may yet unleash major upheaval for US politics, a possible distraction for FX markets; with bearish implications for the USD.

But even as Mueller may be closing in, Trump appears to be a tougher target to bring down. It is not clear that a Democratic-controlled House of Reps would be able or want to.

The political environment appears to be becoming more stable as Trump grows into the role of a strong, unconventional leader. In a way, the longer he can withstand controversy after controversy and keep hitting back at media detractors, the more stable his presidency appears; a very stable genius indeed.

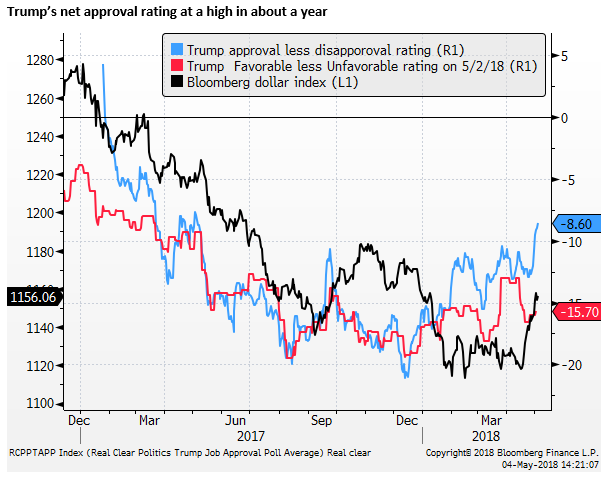

I am watching polls to see if he is cutting through beyond his base. There is some upward movement in his net approval rating this year. His presidency no longer appears to be a drag on the USD.

Anyway, there are a few random thoughts to whet your appetite.

I hope you have a wonderful weekend. Feel free to get in touch. I don’t want to be a stranger. Let me know what your thinking in the markets, on world matters, and your life.

Comments

Thank you sir, very thoughtful blog.

It’s been a very difficult few weeks for everyone in the market. Especially when the market decides to be quite fickle as to what drives FX.

It seems we have shifted regimes, although I am not convinced yet. I think yes there is a case to be made that EM Fx sells off but the EM crisis has already occurred. The fragilities are elsewhere.

hi greg

i enjoyed reading your commentary today and a bit about your family life – nice one!

you invited readers to keep in touch – whats the best way for you?

regarding your research, i have been on your free trial but my returns unfortunately dont justify a research spend at the moment – that will change soon i hope.

little bit of a background – I work at home trading my own capital and hope to extend into a funds management model this year (friends and family initially).

I used to work for banks in spot trading in Aust/ NZ and am currently based in Wanaka/NZ…some similarities to Breckenridge maybe!

I left banking about 3 yrs ago and entered into home trading on a part-time basis whilst undergoing some personal life changes which inevitably resulted in pretty flattish returns the last few years, and not surprisingly when I look at the minimal desk time I had undertaken during that time. Trading is going alot better now that I turn up to work daily. With respect to trading styles, I used to take pride in describing myself as a reasonably macro influenced Spot trader during my 13 years of banking – thats probably a bit inflated as what it really meant was I read a bit more and was more observant of other influences than the average spottie. Now, I have a new found respect on technicals and short-term momentums, which is probably algo driven I would suggest. My new found respect means i pay alot more attention to technicals than I used to, but I think I can describe myself as mostly an opportunistic short/med term trader, gauging short-medium term sentiment, with a mix of fundamental and techs. I used to look at relative values to gauge where fx should better sit but correlations seem to have broken down so I leave that alone for now. I typically try to gauge short to medium term sentiment and positioning by whatever the general buzz is out there (via reading commentaries/real-time posts) and price action. Price action guides me on the validation or invalidation of the current market sentiment (at least what i have perceived that sentiment to be).

Anyways, your post prompted me to say hi!

cheers and maybe we can keep in touch.

Hi Phil, I went to Wanaka once in my 20s, so quite a while ago. On a ski trip to Queenstown. Lovely place. I understand what you are saying re your style. It gels in many ways with the way I trade. It is always difficult to describe your style, it can be a bit of a moving feast. I think email is as good as any to stay in touch. I sent you linkedin request to connect, you can message me from there too. good luck with the venture.