Frustration, Despair and case for Gold/JPY

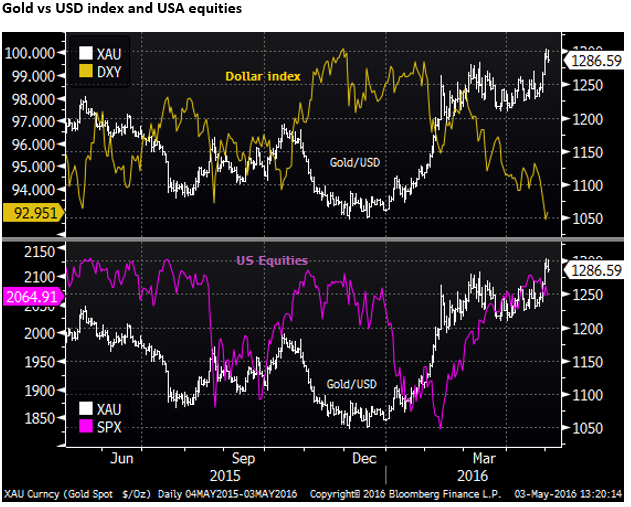

Global equities look tired and are exhibiting investor fears over diminishing capacity for and returns from further global monetary policy easing. Policymakers are admitting problems and looking more impatiently to governments to step up efforts to stimulate growth with fiscal stimulus and structural reform. However, significant progress on this front almost seems hopeless and central banks are being forced reluctantly to do more. These same fears have returned in China with its capital markets displaying a lack of confidence in the sustainability of policies aimed at boosting growth, as rapid credit expansion yields little overall economic advance. In this environment we expect gold to continue its advance. However, gold has been boosted recently by the surge in JPY and overall weakness in the USD. These trends may be tired with Japanese policy makers stepping up their threats of intervention and further policy easing, while US rate hike expectations have been pushed further out and strength in US labor data this week may support the USD. As such we now see long gold/short JPY as offering a better reward for risk.

Equities look tired

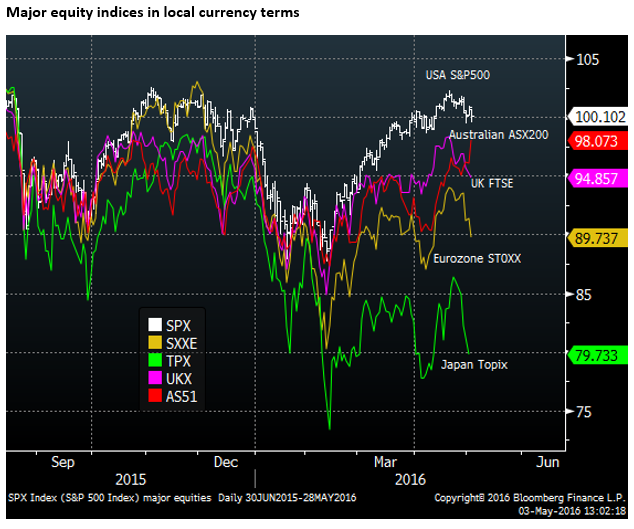

The US stock rally looks tired. It has stalled around previous highs in November last year, and since June last year the highs have been getting lower. The RSI indicator illustrates momentum has turned lower, diverging with the recent price action.

The lack of go forward in US assets combined with softer economic data and earnings growth will make it hard for the Fed to raise rates. The market senses this and already has low rate expectations, significantly below FOMC projections.

If USA jobs growth and inflation data keep pressure on the Fed to raise rates it may unsettle US equities placing the Fed in a conundrum of seeing tightening financial conditions versus a tightening labor market.

Obviously the two cannot coexist for long, but soft USA and global asset prices will tend to keep the US Fed on the side line while increasing demand for risk havens. The combination is supportive for gold.

Global equities weaker, especially European and Japanese bank stocks

Globally equities have turned lower. The other major equity markets in Japan and the Eurozone and the have fallen much more than the USA due in part to the strength in their currencies.

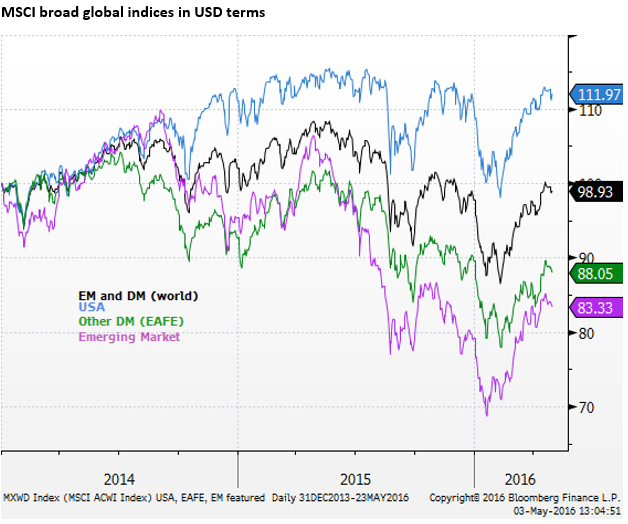

Broad equity indices measured in USD are down in unison, and all have peaked below previous peaks.

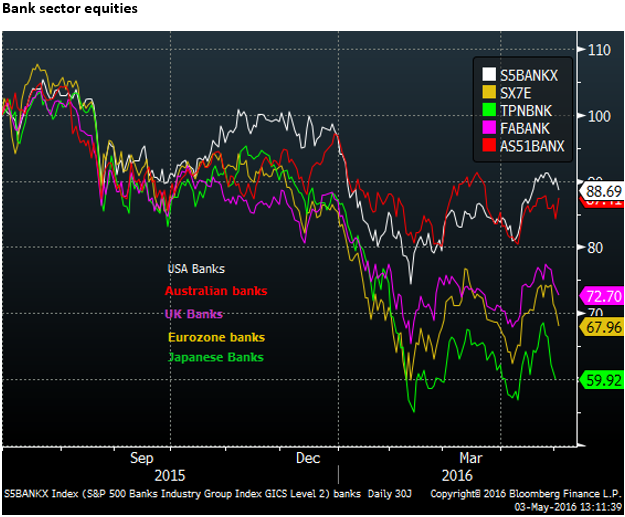

Bank equites in Europe and Japan have led recent falls in their equity markets reflecting fears over profitability in a negative yield environment and ongoing loan asset quality and balance sheet size issues in Europe.

Gold has already strengthening as equity prices have lost momentum. It has further benefited from a weaker USD trend in recent months as the market doubts the Fed has the stomach to raise rates.

Diminishing Returns from Monetary Policy Easing

Equities rallied strongly out of the lows in Jan/Feb supported by further monetary policy easing implemented by the ECB and Japan, delays to rate hikes by the Fed, fiscal and monetary easing in China and generally lower global bond yields as central banks adopted easier policies.

The weaker USD in recent months has probably contributed to easier monetary policies in a number of countries that have experienced stronger currencies. Australia and New Zealand have both cut rates in recent months. Singapore also further eased its policy.

However, the failure of the BoJ to further ease its monetary policy in April, contributing to a surge in the JPY and a fall in Japanese equites and spilled over to a recent decline in global equities. It fueled fears that major central banks are running out of ammunition to ease further and that the effectiveness of these policies is diminishing.

Most expect Japanese policy makers to expand both fiscal and monetary policy again in coming months, and this may again provide support for Japanese and global asset prices, but after the sharp rebound in global equites since the Feb/Mar lows on the back of another bout of global monetary stimulus, the market has swung back to worrying more about the lack of growth and responsiveness to the global economy to monetary easing.

The market fears over diminishing returns from monetary stimulus were voiced by the RBA Governor Stevens in New York (Observations on the Current Situation – RBA.gov, 19 April). It was perhaps easier for him to speak more candidly since the RBA still has some space to maneuver with conventional interest rate policy. Stevens like many central bankers is sounding quite frustrated with ever easing policy in major economies. It is forcing him and others to also further cut their interest rates to uncomfortably low levels. He in particular discouraged the notion of so-called “helicopter money”. All central banks have so far refused to say they are even considering such policies.

Screaming out for fiscal and structural reform

The message increasingly coming from central bankers is that governments have to step up their policy responses with targeted fiscal stimulus where possible and get more serious about structural reform that might unlock productivity growth and private sector demand for capital expenditure.

This might sound good in principal, but governments are much slower to be moved to action and are preoccupied in many countries by geopolitical risks and tougher opposition in parliaments. The market is unlikely to find confidence in the prospect of governments taking firm action.

There are some positive steps in this direction. The Canadian government came to power last year on a platform of using its fiscal space to expand infrastructure spending. It delivered an expansionary budget in March and confidence in Canada has significantly improved. The unfortunate aspect for Canada is that the CAD has also rebounded sharply and this is not helping.

The Japanese PM Abe is expected to announce fiscal stimulus in coming months and delay his government’s plans to raise the consumption tax currently slated for April next year. He said his main goal for the G7 meeting in May is to gain agreement on the need for fiscal spending. He said, “For the G7 to lead strong, sustained growth in the global economy, it must employ such tools as monetary and fiscal policy and structural reforms to launch its own version of the three arrows.” (Abe to decide on tax hike after G-7 summit – Asia.Nikkei.com). This highlights the shifting tone in official circles towards preparedness to see fiscal policy more as part of a global coordination to address global economic problems. However, the prospect of significant coordination action in fiscal policy and structural reform is low.

The debate might be moving in this direction but it has a long way to go. The fact that this debate is happening at all unfortunately only tends to highlight the lack of confidence officials and the market have in the effectiveness of ever more monetary policy easing.

Despite the observations and protests of many that further monetary easing may not be a good idea as it reaches extremes and its effectiveness wanes, it did not stop the RBA from cutting rates this week and ultimately central bankers are still the first line of defense against weaker growth and below target inflation.

The recent return to a more pessimistic frame of mind is also being influenced by developments in China. The scope for policy easing there appears much more limited by the rapid growth in its credit in Q1. It is obvious to all, including the Chinese officials, that this is dangerous and needs to be curtailed. As we have discussed in recent weeks, Chinese capital markets and currency are displaying little confidence that its modest growth rebound in Q1 is sustainable.

The Scream by Edvard Munch (1893)

Firm Focus on Gold, but against JPY

Our focus returned firmly towards looking for out-performance of gold in this environment. Sluggish global asset prices and pressure to further expand global monetary easing will send investors in search of gold as both a safe haven from sluggish asset prices and from currencies that are being pushed down by quantitative monetary easing, negative or very low interest rates. There is little security in any currency and gold offers an alternative.

Anecdotally we can see the effects of these concerns with Chinese demand for gold rising in March, perhaps helping but a base in for the gold price during its lull after it surged in February. And reports of solid inflows to gold ETFs across the US, Europe and China. The world’s largest gold ETF (SPDR Gold Shares) reports investor holdings have risen to a high since Dec-2013.

China’s Gold Imports Jump on Investment Demand as Price Falters – Bloomberg.com

Gold ETF’s Bullion Holdings Jump Back To ’13 Levels – Barrons.com

However gold is measured in USD and the USD has been beaten down over recent months. Already the market sees low odds of a rate hike by the Fed in the near term. Gold/USD has to some extent been pushed up recently by the sharp fall in USD/JPY.

USD/JPY has fallen rapidly and may appear now oversold. Japanese government officials and the BoJ’s Kuroda have stepped up their rhetoric suggesting they are closer to intervention and/or enacting further policy stimulus. As such, USD/JPY may start to find support, or at least fall much more slowly and cautiously.

Kuroda Warns Current Yen Strength Risks Harming Recovery – Bloomberg.com

The US labour market could again show strength in the data this week, if so it could bolster the USD that is now weaker and better placed to respond positively to such news. As such, we see long Gold/short JPY as a better risk reward.

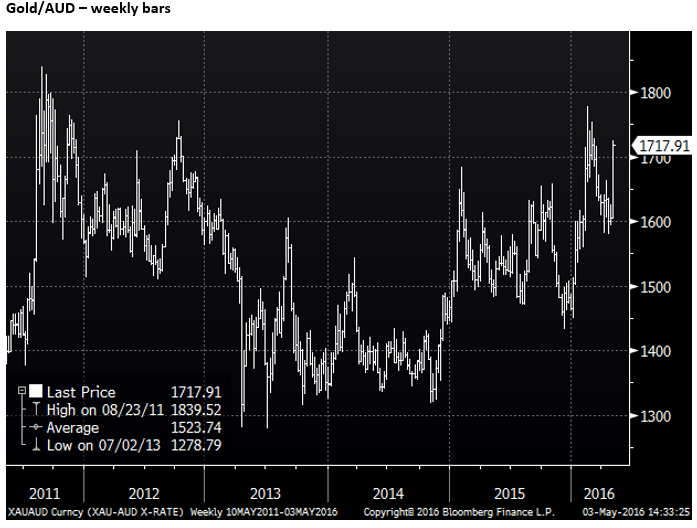

We continue to see upside potential in gold/AUD that has already rebounded sharply in recent days as we discussed last week (AmpGFX – Elevated and rising risk factors for AUD; 28 April). The low inflation data in Australia was a contributing factor, but the pair has probably also risen as confidence over Chinese growth has waned.