GBP may be in a sweet spot

GBP has made gains since Friday and may be placed to extend these in coming weeks after recent stronger than expected UK economic reports, upbeat comments from BoE Governor Carney, and a political win for PM May that should help ease Brexit uncertainty in the near term. Trade tensions remain fraught between the US and China and recent weakness in global export confidence may keep Asian currencies under pressure. China is courting the EU in trade relations to counter the risks of a US trade war. The EU may find it can ease its trade risks while the US and China slug it out.

May Prevails

The GBP firmed modestly late Friday on news that UK PM May had prevailed in gaining her government’s cabinet approval for a Brexit negotiating plan at the much-watched gathering at Chequers, the official country residence of the PM.

This yet another hurdle for holding together her leadership and the Conservative government.

Business in the UK has been complaining over stalled trade talks with the EU, and this was undermining business confidence and investment. The negotiating plan will be seen as a positive outcome for UK business, but of course, it still has to be agreed by the EU.

The plan provides a path to a more certain outcome for UK goods-producing companies, preserving much of their current trading status with the EU. A better outcome, most agree, than leaving the EU without a deal in March 2019. A positive for the UK economic outlook and the GBP.

However, it would restrict the kind of deals the UK might be able to agree with the USA and other non-EU countries, a point of contention for the Brexiteers in Cabinet.

What the cabinet has agreed at Chequers Brexit meeting; 6-July – TheGuardian.com

Theresa May gains backing for ‘soft Brexit’ plan; 6-July – FT.com

May’s soft-Brexit Chequers deal: What it means; 8 July – FT.com

Also positive for the GBP is the simple fact that May has prevailed again. Each time she holds her cabinet together makes her look like a stronger leader. And the threats of the brexiteers in her cabinet to resign sound more hollow.

The voices are loud and angry on both sides of the debate in cabinet and across the country. May will never be able to make both sides happy. But she is doing the job of finding an acceptable middle ground that both sides can begrudgingly accept. This won’t necessarily make her popular, but she appears to be taking the only path that will work without causing a destabilising breakdown in government.

If the EU decides to knock down this plan, because the UK has attempted to cherry pick from the EU single market rules, they know they also risk triggering a collapse in the UK government. This would be a high stakes gamble, and a reason why the EU may accept the main tenants of the UK’s new plan.

There will be more hurdles ahead for PM May, the UK government, economy and GBP, but having cleared this one, the outlook for GBP has improved and it may strengthen further in coming weeks.

The UK government is to release a ‘white paper’ this week that will explain the new plan in more detail. This may generate some more political drama over whether the cabinet does, in fact, stick together.

BoE on track to hike in August

In a speech at the Northern Powerhouse Summit in Newcastle, on Thursday last week, BoE Governor Carney said: “Overall, recent domestic data suggest the economy is evolving largely in line with the May Inflation Report projections, which see demand growing at rates slightly above those of supply and domestic cost pressures building.”

Carney said recent data had given him “greater confidence” that weak first-quarter growth “was largely due to the weather”.

He said household spending and sentiment had “bounced back strongly”.

(Source: Bank of England governor Mark Carney upbeat on UK growth; 5 July – BBC.com)

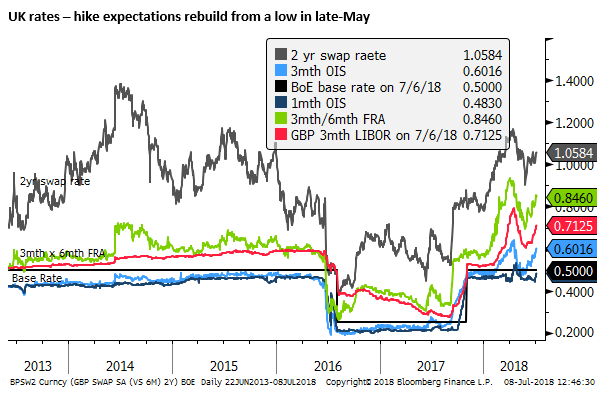

These comments and the lifting of near-term Brexit uncertainty increase the probability that the BoE will proceed with its second hike (after the first in November last year) at their next meeting on 2 August. According to Bloomberg, based on OIS, this is 81% priced-in.

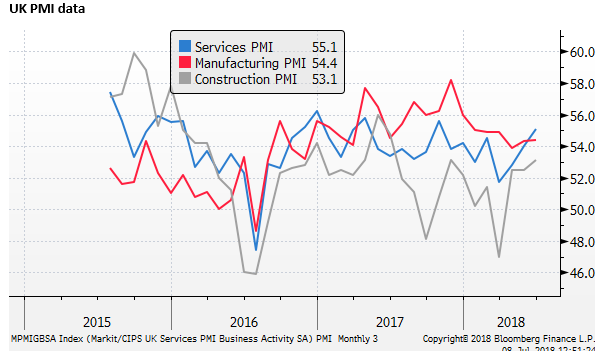

Carney’s speech also highlighted the dangers of trade tariffs, using Brexit as an example of how they can dampen business confidence and investment. The BBC reported that he cited the fall in fall in the export component of the UK PMI data.

Carney speaks again this week at the NBER on the Global Financial Crisis n Boston, USA.

UK data showing recovery

UK PMI data beat expectations last week, with all components lifting. Services, in particular, rebounded solidly to 55.1, above an expected unchanged outcome of 54.

The UK government Office for National Statistics will release the first in a new series – monthly GDP – on Tuesday this week. The first release will be for the three-months ending May, over the three-months ending February. In future, the ONS will release 3mth/3mth growth on a rolling basis every month.

The data is expected to show growth accelerated after bad weather hit activity early in the year. The FT reports that JP Morgan economists are predicting growth rebounded from close to zero %3mth/3mth in April to +0.3% 3mth/3mth in May.

GDP data undergoes shake-up with move to monthly figures; 2-July – FT.com

In light of the PMI reports, we expect to see other data this week show strength in the UK, including manufacturing production, construction output, and the index of services, all for May.

Global PMIs show goods export risks from tariffs, while overall growth is up

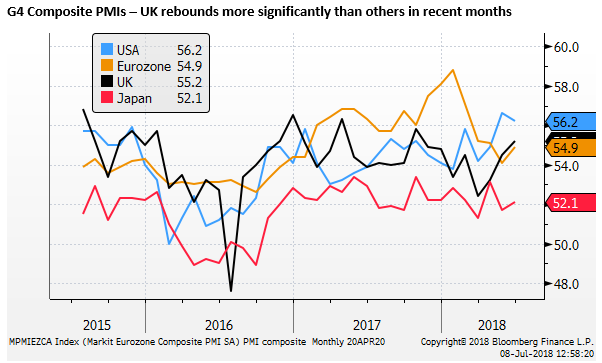

The Global PMI covering both services and manufacturing, produced by JP Morgan and IHS Markit in association with the ISM and IFPSM, rose in June to 54.2 from 54.0. A sign that the global economy retains moderate to solid momentum.

However, it suggests that tariff fears have dampened the manufacturing outlook. There PMI series showed a divergence, with the services PMI rising for a second month in a row to 54.6, approaching its high in February, while the manufacturing PMI fell for a second month to 53.0, a low since July last year.

We don’t pay for the component data, but the press release noted that the “pace of increase in new export business easing to near-stagnation” in the global manufacturing PMI (implying it was just above 50.0).

The PMIs suggest that global policymakers will continue to voice alarm over US protectionist policy, noting risks that it may drag down global growth, especially if it escalates and damages business confidence.

However, they are also likely to stick to their reasonably upbeat growth forecasts, considering that broader indicators, underpinned by services retain moderate to solid growth.

As FX analysts, we might see more risks ahead for countries that rely more heavily on global goods trade. This might include Asian markets.

The Eurozone is also more reliant on trade than other major economies. However, as we noted in our report last week, we would not be surprised to see the heat turned down on US, EU and NAFTA trade rhetoric, and a switch in gear in the US to retain its focus on trade and investment dealings with China.

Considering some improvement in recent Eurozone economic data, this may lead to some strengthening in European currencies, including the EUR and GBP vs. Asian currencies.

China courts EU to counter US trade risks

In the political game of trade relations, the EU may be played by both sides. China is looking to tighten its trading relations with the EU, it appears, to bolster or form a front against US trade protectionism.

China is hosting EU leaders Donald Tusk, president of the European Council, and European Commission president Jean-Claude Juncker at a summit in Beijing on 16-17 July. Before then, Chinese Premier Li is to meet German Chancellor Merkel in Berlin.

These meetings follow meetings between Chinese officials, led by Premier Li, and Easter European country officials last weekend where China was offering increased investment.

China seeks ally in Europe to face down US tariffs; 7 July – FT.com

China appears to be lifting its engagement with the EU to counter the economic threats posed by US trade and investment policies.

The EU may try to delicately balance relations with the US and China to attempt to maintain good trading relations with both. The US and China may attempt to assuage the EU to join forces with them in their battle with the other.

This may be viewed as a potential positive for the EU economy and the EUR.

Trump visits Europe this week to discuss NATO (Wednesday). His plans include a visit to the UK (Friday) and to meet the Russian President (16-July). There is a risk that he antagonises or improves his relationship with the EU, or and various times perhaps both.