Gold Confounds, A New Era of CNY Flexibility, Inflation Pressure Builds in the USA

The fall in gold may make sense against the stronger USD. However, it is odd to see it underperform other G10 currencies in an environment of higher global market volatility and increasing inflation pressure in the US. The steep fall in CNY may reflect a new policy era under a new central bank governor, allowing currency flexibility to act as a shock absorber for the economy. It hasn’t led to capital flight from China, and this may be helping limit contagion to global markets. However, weak Chinese currency and equities are spreading more clearly to Asian markets. The threat of tariffs has not significantly dampened activity indicators in Asia or globally. US surveys are still reporting rude health. Inflation risks are rising in the US and are likely to keep the Fed raising rates at a steady pace. The USD may remain relatively strong against most other currencies while it continues to raise rates. Negative feedback from global market volatility and tariffs to US markets and economic confidence may not be sufficient yet to halt the USD’s advance.

Confounding fall in gold

Last week, I thought that negative feedback from US protectionist policies may boost gold. This has not happened; in fact, gold has fallen to new lows for the year. There has been further upheaval in emerging markets, but this has failed to generate much contagion to US financial markets or economic confidence, notwithstanding warnings from Harley Davidson and US automakers that trade policy backlash might undermine their operations in the USA.

Trump Cites Car-Tariff Threat as Biggest Trade Leverage – WSJ.com

The fall in gold that has outpaced the falls in other G10 currencies against the USD is still hard to fathom when it might be compared to relatively stable safe haven currencies like the JPY of CHF, and there has at least been some contagion from weak EM markets to US equities and bond yields. Furthermore, inflation risks appear to be building in the USA which may start to make life harder for the Fed as it balances its mandate for inflation and employment.

In the face of a strong USD, gold might be experiencing selling pressure, but it is reaching its lowest levels in some years against other G10 currencies in an environment that might otherwise suggest it should be relatively strong on crosses, considering higher volatility, uncertainty and inflation risks.

Assessing the drivers in FX

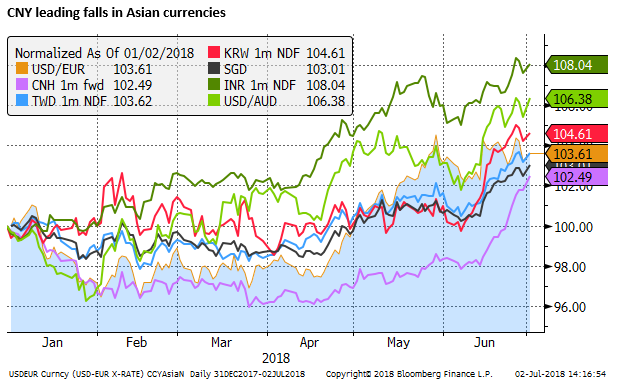

Perhaps the most important FX market development in recent weeks has been the rapid fall in the Chinese currency; out of character for this normally heavily managed and stable currency

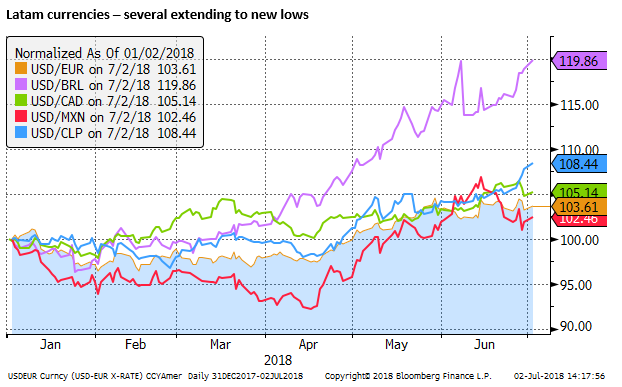

There have also been further declines in the several Latin American currencies. ARS fell sharply to new lows on Friday (rebounding in Monday after intervention). The CLP fell to a new low this year, and the BRL approached its low for the year.

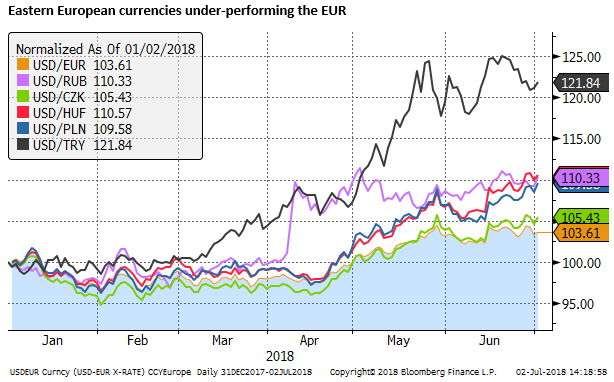

Eastern European currencies and the ZAR have been more stable than other EM currencies in recent weeks. This may reflect the stability of the EUR that has been choppy, but largely steady against the USD. The CZK, PLN and HUF that tend to be more closely aligned to the EUR have all significantly underperformed the EUR in recent weeks. The TRL and RUB have strengthened in recent weeks, but the TRL is only finding its feet after its deep slide over recent months and a sharp jump in interest rates.

Broadly speaking EM currencies have continued to show distress that began in April.

G10 currencies have also tended to fall in recent weeks, but have been more stable than EM currencies. The EUR has tested its lows for the year in the low 1.15s as few times since the Italian political uncertainty peaked in late-May, but so far it has held. GBP has fallen in recent weeks but not all that much.

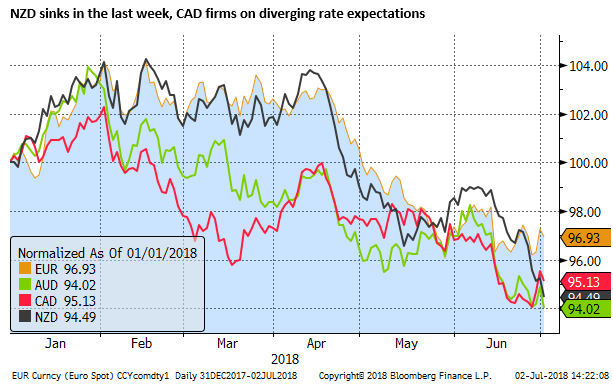

CAD bounced significantly on Friday, despite the falls in Latin American currencies, supported by higher oil prices, economic data that is doing just enough to keep a hike next week on the cards, and comments from its central bank governor, Poloz, that appeared to confirm as much.

The JPY has been relatively stable, near the low side of its range, but largely steady. One might have thought that it could have strengthened as a safe-haven in light of weaker EM assets and somewhat lower US bond yields. As such, its lack of strength may be an indicator that risk aversion is not as high as it might seem.

The AUD is also only modestly weaker in recent weeks, testing its lows for the year. NZD has fallen more sharply in the last week on signs that its economic growth has deteriorated. The New Zealand central bank reiterated that it is willing to cut rates further, although its central forecast is still a long period of steady rates before an eventual hike more than a year out.

Underlying strength in the USD

In summary, it appears that there is underlying strength in the USD that is driving down other currencies. There is also weakness in emerging markets that is tending to drag up the USD against other G10 currencies. In particular, weakness in the Chinese currency and several Latam currencies appear to be key drivers in EM markets.

The fall in EM assets has not triggered the intense rush into safe haven assets and currencies that it has often done in the past. Overall there is a sense of order in the decline in the EM assets.

As mentioned the JPY has not strengthened. Neither has the CHF that has been stable against the EUR and USD. Gold, in fact, has weakened to new lows for the year. On the one hand, this may attest to strength in the USD. On the other, it suggests that the market has been relatively calm in the face of weaker EM markets. Contagion to the overall market, while apparent, is not as strong as often has been the case.

Key questions to address are:

- What is driving relative strength in the USD and can it continue?

- What is driving the weakness in the Chinese currency, can it continue?

- Why hasn’t there been more contagion from EM market weakness, and will contagion to safe haven currencies and other G10 assets increase, remain limited, or decrease?

CNY fall may be more policy driven

Perhaps one reason why we have not seen excessive contagion from EM to G10 asset markets is that the fall in CNY may reflect a sensible shift in central bank policy, and is not generating much capital flight.

The new governor of the Chinese Central Bank, Yi Gang, that took over from Zhou Xiaochuan in March 2018, may be pursuing a more flexible CNY policy agenda. Zhou held the position from 2002 to 2018. While Zhou oversaw the de-pegging of the CNY from the USD in 2005, and was in charge in 2015 when the CNY experienced a discrete devaluation of around 5% over three days, for the most part, his term was characterized by maintaining stable trading in the CNY; and this stability was seen as key to maintaining broader financial stability in China.

It is possible that Yi Gang is willing to allow more flexibility in the CNY to reflect market supply and demand and move in a way that might contribute to managing monetary policy conditions.

The PBOC may be giving the market more say in setting the CNY and allowing its depreciation to act as a potential shock absorber for the economy; including to absorb downside risks from US trade policy.

Weaker Chinese equities a sign of underlying weakness in China

The Chinese equity market is sinking in unison with the weaker CNY, and this is not a good sign for the Chinese authorities. The weaker CNY should support the outlook for Chinese companies in the traded goods sector. The fall in CNY and equities in unison is a sign of underlying weakness in Chinese companies; perhaps related to Chinese authorities efforts to address long-standing credit market excesses.

Weaker CNY consistent with easier Chinese monetary policy

The fall in CNY may be a natural response to falling interest rates (easier monetary policy) in China and rising interest rates in the USA. Historically there is not a strong connection between interest rate differentials and the CNH, reflecting the heavily managed CNH. However, if the Chinese central bank, under Yi Gang, is allowing more currency flexibility, we might expect interest rate expectations to play a bigger role in CNH direction.

Less sign of capital flight

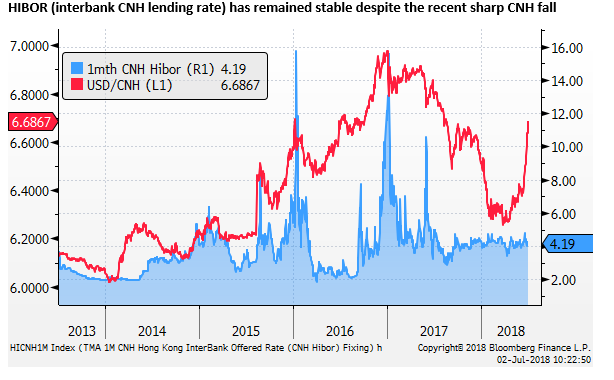

A key difference between the current fall in CNY and previous episodes of weakness, such as the spike higher in USD/CNY in the first days of 2016 and the finals days of 2016, is that it has not been matched by a sharp steepening in the CNY forward curve (spike in CNY implied yields). This suggests that there has been less capital flight from CNY.

The charts above show the spike in implied 12mth yields in the CNH fwd market at the beginning and end of 2016.

The relative stability in short-term implied yields during the recent sharp depreciation of the CNY compared to these previous episodes is also illustrated in the chart below that shows 1mth CNH interbank lending rates (HIBOR) compared to the USD/CNH exchange rate. Hibor has been largely unmoved during the recent sharp decline in CNH.

The recent spike in USD/CNH is larger than previous episodes, but so far it appears to be relatively orderly in that it has not caused a spike in CNH implied interest rates. This suggests that it has not spilled over to tightening short-term funding conditions for Chinese corporates, and this may be a key reason why Chinese authorities appear to be letting it run for the time being.

The orderly nature of the CNY fall may also be helping limit contagion in weaker Asia EM assets to the US and G10 asset markets.

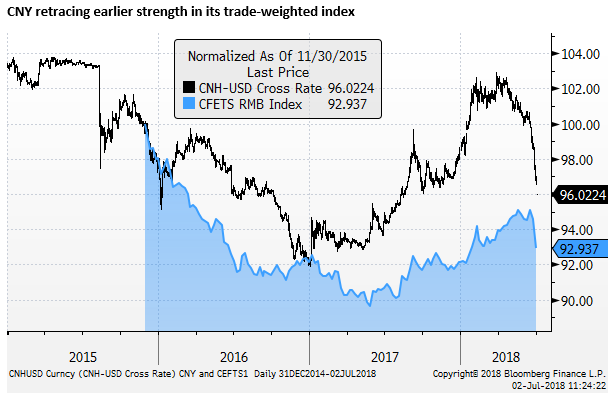

CNY playing catch-up

The fall in CNY appears to be leading falls in other Asian currencies in recent weeks. However, it is still catching up to the decline year-to-date in most other Asian currencies.

China’s published trade-weighted currency index (CFETS RMB index), has only recently come off its strongest level since April 2016. As such, the market may feel China is justified in allowing the CNY to fall to reflect more challenging economic conditions in China and strength in the USD against many other currencies.

Contagion from China to Asia, but limited

As mentioned earlier, it should be a concern to Chinese authorities that China’s stock market has weakened sharply in recent weeks, in unison with the fall in CNY. Equities across Asia are weaker, although the fall in mainland China equities has been deeper than other national equity indices in the Asia region.

The chart below shows the fall in mainland China equities is significantly deeper than the ‘All Asian less Japan’ equity ETF. And both have fallen far more than the US S&P500 equity index. The fall in recent weeks in Asian equities matches the fall in Asian currencies closely.

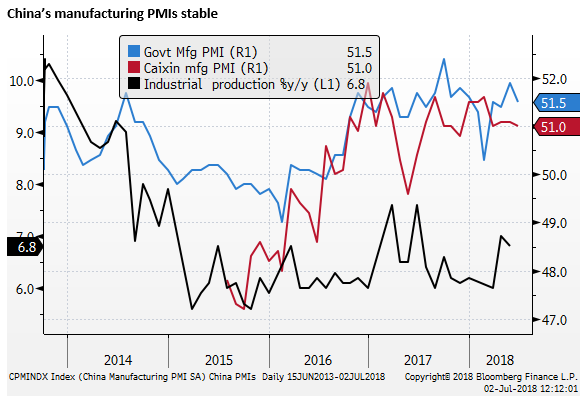

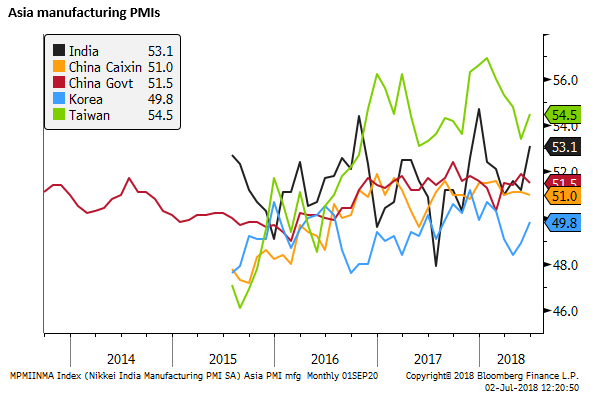

PMI data firmer in Asia

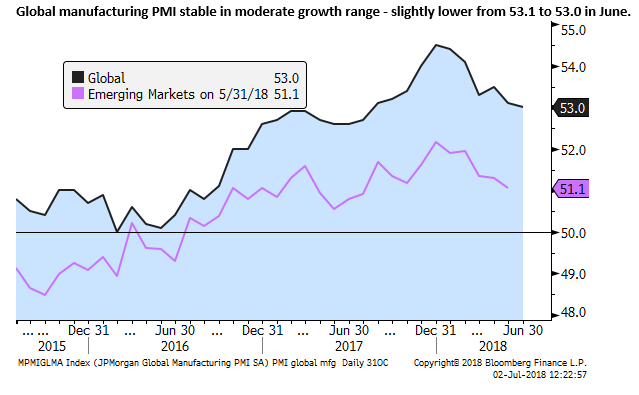

The weaker CNY may reflect some slowing in the Chinese economy; activity and credit data for May were significantly weaker than expected. The June manufacturing PMI data, on the other hand, was relatively stable at the same flat trend for the last two years (in modest expansion territory above 50).

Nevertheless, US trade policy does appear to be dampening the outlook for Chinese exports. The Markit/Caixin PMI headline dipped a tick from 51.1 to 51.0 in June. But the commentary from Markit said that the export component “fell to a low for the year so far and remained in contractionary territory.”

PMIs for other countries in Asia, on balance, also did not show any deterioration. Taiwan’s rose from a recent low of 54.5 to 54.5. Korea’s rose for a second month to 49.8. India’s rose from 51.2 to 53.1.

While markets may be swooning in Asia, recent economic reports suggest that economic activity is moderate and stable. And global manufacturing also remains in moderate growth territory. This may also be limiting the contagion from weaker Asia markets to G10 markets.

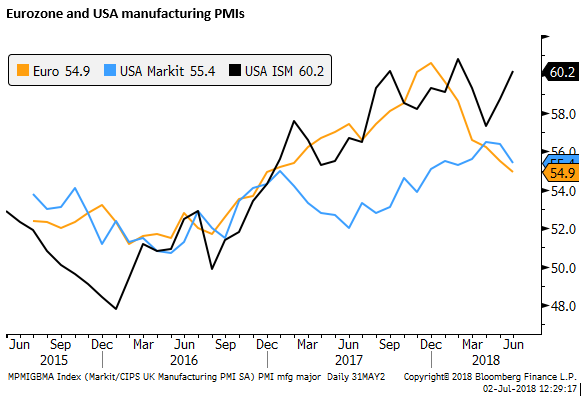

One of the bigger drags on the global PMI appears to have come from a further fall in the Eurozone manufacturing PMI. The Markit USA PMI also dipped, however, that is at odds with a stronger US ISM report.

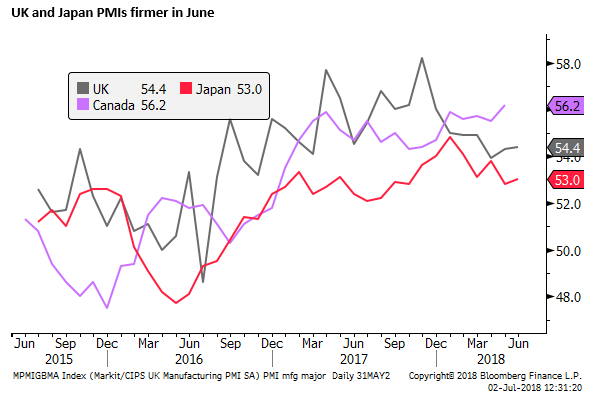

The UK manufacturing PMI surprised pundits by firming for a second month, helping support the case for a second rate hike in August (after the first hike in November last year). The Japanese PMI also steadied from a recent low in May, firming two ticks to 53.0.

Global growth indicators may have moderated, and confidence dampened in China, Asia, Europe by US trade policy, but activity appears to be relatively stable at this stage. China is allowing currency easing and easier monetary conditions to help support its outlook.

There is a risk that weak Asian asset markets undermines confidence in the region and spreads to weaker US Asset markets. But at this stage, contagion has been limited.

US recovery gained momentum in Q2

In the meantime, activity indicators in the US economy have strengthened, and there are few signs that tariff concerns have dampened overall economic confidence. Anecdotes like Harley Davidson’s threats to move production offshore, or US automakers arguing a trade war would potentially damage their operations have not been apparent in broad surveys such as the ISM PMI or business and consumer surveys.

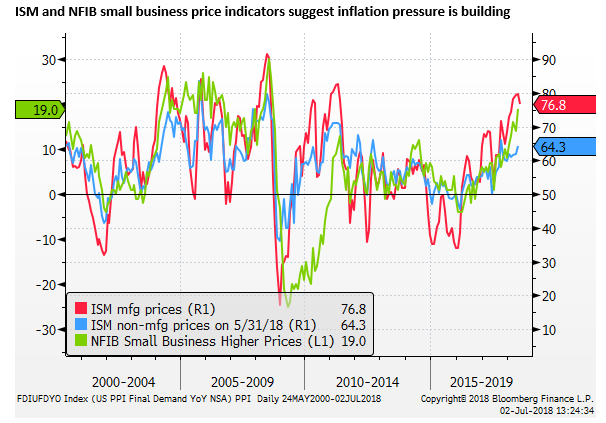

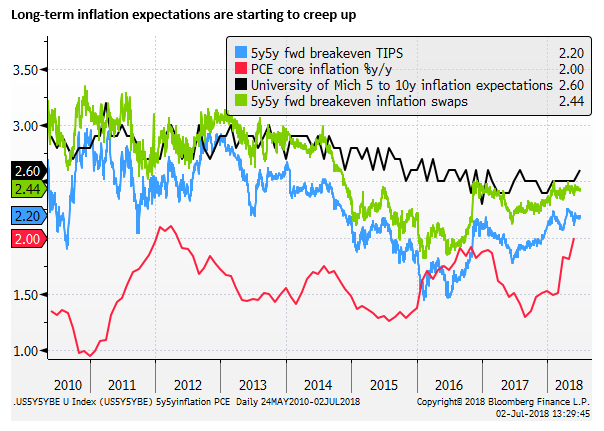

The Fed also appears close to achieving its inflation target on a sustainable basis. As such, it is likely to continue its steady schedule of hiking rates until it sees evidence that global markets uncertainty or trade policy angst causes significant signs of negative feedback to the US economy.

The Fed minutes this week may say as much. The payrolls report at end week could show wage growth starting to pick-up along with broader evidence of increased pricing power in the US economy and already tight labour market conditions.

Tariffs may, in fact, be contributing to higher inflation expectations and a willingness of companies to accept and pass on higher prices.

The 30 May Beige Book said, “Some Districts also noted that their retail contacts were more able to pass along price increases to their customers than in the recent past.”

The minutes from the 2 May FOMC meeting (released on 23 May) said, “In many Districts, business contacts experienced rising costs of nonlabor inputs, particularly trucking, rail, and shipping rates and prices of steel, aluminum, lumber, and petroleum-based commodities.”

It does not appear that price pressures have eased much if at all in the last month. But if inflation expectations have picked up somewhat, we might expect more pass-through of costs to prices. As prices rise, difficulty in finding labor might prompt employers to offer higher wages.

The Fed may be reluctant to increase this pace of policy tightening in the face of increasing uncertainty in global markets and the possible negative feedback from tariff policy. But ongoing steady rate rises through the rest of this year may keep the USD well supported, and maintain pressure on emerging market currencies.