JPY reveals strength, EUR weakness, Australian non-mining economy lifting, tight USA labor market

JPY gains on what should have been entirely anticipated Abe comments this week suggest there remains strong underlying demand for the currency and power in its rising-trend. USD/JPY may bounce on further central bank policy divergence, but sustained gains look more elusive for the time being. EUR on the other hand looks weaker, unable to hold gains after the ECB meeting and may resume its down-trend as odds build in favor of a Fed rate hike in June or July. As noted earlier this week, the Australian economy appears to be building momentum in non-mining sectors. This was further supported by a strong GDP report, resumption of strong house price gains and strong growth in services exports. AUD appears to have built-in a degree of risk premium for uncertainties including the national election. We thought that AUD might be set for gains against JPY earlier in the week, but recent price action suggests EUR may be a better short sell.

JPY revealed its underlying strength

The power of JPY’s rising trend was revealed this week when it rallied after announcements by Japan’s PM Abe that were essentially fully expected; they were widely discussed in the media weeks before he made them. There should have been no surprise to the market and no new reason for the JPY to rally.

Fiscal stimulus in many circumstances is seen as a reason to buy a currency, especially if is expected to replace monetary policy easing. However, in this instance the announcements give more reason to expect BoJ easing sooner to support and enhance the government measures. In the lead up to the announcements, the JPY was modestly weaker, suggesting that the market may have been anticipating Abe’s announcements and were increasingly seeing further BoJ easing sooner.

However, in the event, the USD/JPY retreated sharply and neatly after failing to breach a key resistance level around 111.90; the level from where it retreated on 28 April after the BoJ disappointed expectations and left its monetary policy settings unchanged. This rally in JPY is information in itself and should warn the market of significant underlying strength in demand for JPY that will not be easily countered by further BoJ policy easing.

On Wednesday, just ahead of the Abe announcements, we wrote that we saw potential for upside in AUD/JPY on improved Australian data, more stable Chinese markets and potential for policy divergence between the Fed and BoJ that might drive USD/JPY through key resistance; but in light of the JPY rally this week that strategy has essentially failed. (AmpGFX – AUD/JPY may gain on diverging Fed/BoJ and improved risk sentiment, 1 June)

It remains difficult to buy JPY given the likelihood of further BoJ easing and Fed policy tightening. Japanese authorities will not be pleased with JPY strength and it should spur the BoJ into action sooner. Intervention to weaken the JPY cannot be discounted, although it is likely to be used more to counter rapid gains in JPY rather than defend a hard line under USD/JPY. And it is unlikely to be used in force until USD/JPY makes new lows this year, probably sub-105.

Justifying the JPY rally

The strength in JPY may be justified by:

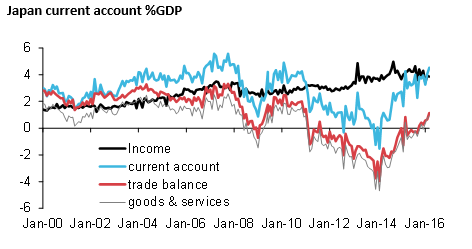

- Its current account surplus that has swelled to 4.5% of GDP a high since 2010;

- The advanced state of the reallocation of pension funds to hold a greater share of foreign assets;

- The risks to global growth and emerging market assets, reducing Japanese investor appetite for foreign assets;

- The greater sense of responsibility that Japan and other major countries feel towards avoiding policies seen to be purposely weakening their currencies;

- A sense in the market that the BoJ will accept a slower glide path to achieving its inflation goals, lowering inflation expectations;

- And an official agenda that is shifting more emphasis to growing domestic demand away from export led growth.

The JPY may weaken again if and when the BoJ further expand its monetary easing, but even then the market will be wary of the power of this action to turn the trend. Clearly it failed to do so on 29 Jan when it introduced Negative Interest Rate Policy (NIRP), and the market will be wary of being fooled again.

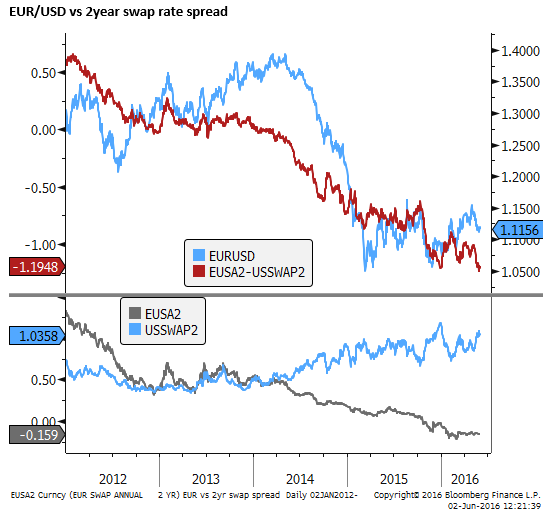

EUR may be resuming down-trend

On the other hand, EUR/USD may be revealing more legs in its recent down-trend, falling back after an upside test during the ECB meeting which delivered the expected no change in policy. EUR/JPY has also broken to a new low suggesting its down-trend remains in-play.

Increasing case for Fed hike

We wrote in our report on Wednesday that the USD is not overly responsive to improvement in its yield advantage this year. This is especially true vs. the EUR and JPY; both currencies’ central banks have further eased policy this year, keeping their rates low and negative across much of their maturity spectrum, while US rates have increased from a low in February, pushing up in the last month on increased rate hike expectations.

Nevertheless, the EUR/USD does appear to have been dragged down from its highs by the prospect of a higher rates in the USA in the last month.

The market is still not fully on-board a rate hike by the Fed in June or July. A hike by the end of July appears to be around 60% priced-in.

The market may be wary that despite the rhetoric from Fed members displaying a preference to hike in the summer (June or July), the data in the lead up to these meetings will not be strong enough to keep the Fed on-track.

The reluctance to believe the Fed hike goes ahead may also reflect cautiousness ahead of the Brexit referendum, and the risk that Brexit pushes the Fed back to the sidelines for longer.

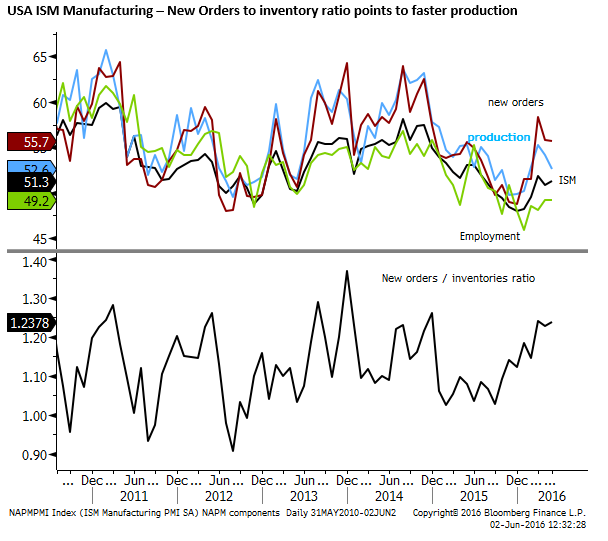

USA labor market tight

The payrolls report on Friday will play its usual significant role in influencing hike expectations. The bar for this data does not appear to be especially high; the Fed is unlikely to be derailed from a hike if the data show little improvement on the past month. But it will be emboldened to act if it shows even moderate further strength, especially if wages growth tends to confirm their rising trend. (The market is expecting wages growth unchanged at 2.5%y/y in May, payrolls growth unchanged at 160K, unemployment at 4.9% or 5.0%).

While several of the regional manufacturing surveys suggested that USA activity in May dipped again, the US ISM manufacturing survey was stable, at firmer levels since the turn of the year. The new orders to inventory ratio, an indicator of the degree of tightness that may prevail in markets for manufacturing goods, remained at around its high since 2014.

Fed Beige Book sees tight labour market

USA Jobless claims data and the ADP report this week suggest that the labour market remains robust and becoming tight. The Fed Beige Book said, “Employment grew modestly since the last report, but tight labor markets were widely noted in most Districts.” This may be the first time in a while that the Fed has described the labour market as tight; the previous two beige books did not.

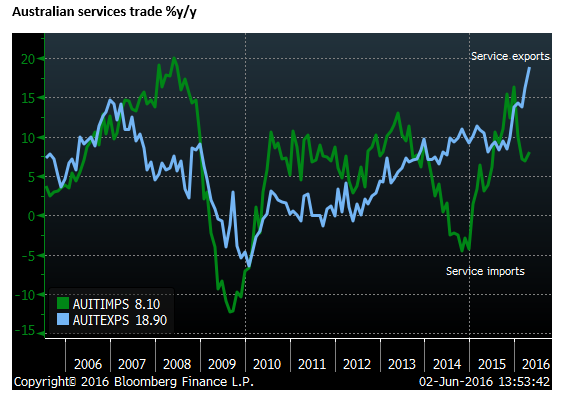

Australian economic data robust

We noted on Wednesday reasons to see gains in AUD. This included stronger data recently suggesting that while inflation pressure is low, economic activity has solid momentum supported by the non-mining sector.

- Export growth in Q1, helped lift GDP to 3.1%y/y, a high since 2012; reported on Wednesday.

- Trade data in April showed a narrower deficit and ongoing rapid growth in service exports (up 18.9%y/y); reported on Thursday.

- Business credit growth gaining momentum (+6.5%y/y); reported on Tuesday.

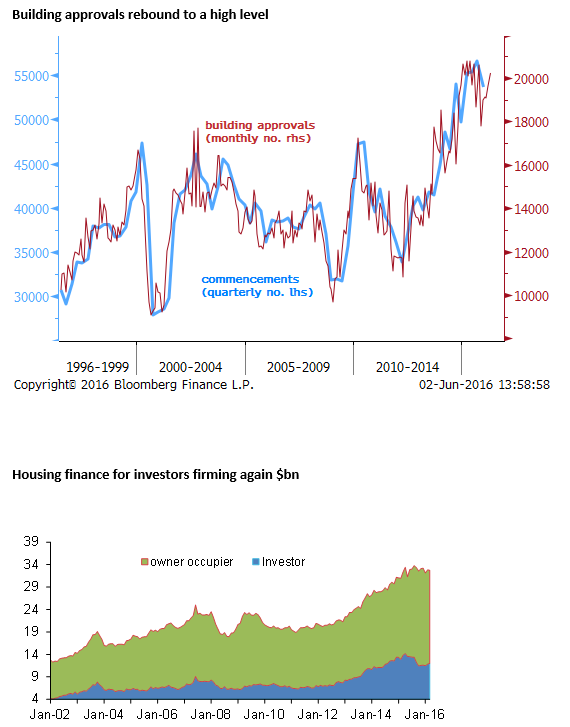

- Building approvals recovering in recent months to remain at a high level; reported on Tuesday.

- A rebound in house price growth this year (10.1%y/y nationally in May); reported on Wednesday. Upticks in housing investor lending since a bottom in November last year suggest that banks are returning to lending to investors after cutting back last year in response to regulators’’ prudential guidance (up 4.6% in in Feb/Mar).

Chinese equity, currency and rates markets have been relatively stable over recent weeks. There is a range of Chinese activity and lending data due over the next week that may rekindle fragile sentiment towards China. But we have no strong reason to see this data as tipping the market into a more bearish frame of mind. In general global markets have tended to firm and exhibit resiliency to prospects of a near term Fed rate hike.

It is hard to believe for many outsiders looking in that Australian investors are still prepared to pile up exposure to a housing market that may be becoming over-supplied with apartments and the variety of other factors that suggest the housing market is over-leveraged and expensive. Nevertheless, the resilience of the housing market that is showing strong price growth again in recent months should make the RBA very reluctant to further cut rates. Policy on hold next week may help support the AUD.

The AUD has arguably built-in some of the risk factors. AUD/NZD has returned to the bottom of its range over the last six months. AUD/CAD has returned to its lows over recent years. AUD has generally under-performed a wide range of currencies in the last month. These comparisons suggest a degree of risk is priced into the AUD related to housing, China and political uncertainty.

As it stands, the ruling Coalition is still well ahead in the betting market (even though polls suggest the race remains close) to win the 2 July election and this outcome might boost confidence. Recent housing market strength may delay and dampen risks related to an over-supply of apartments in the near term. Chinese financial market risk may not worsen in the near term, and Chinese demand for services in Australia may continue to boost non-mining sector confidence.

Given we see EUR potentially resuming a downtrend and the USD may still perform solidly into the 15 June FOMC meeting, it may be worth looking at selling EUR/AUD.