Mnuchin Takes a BAT to the Dollar

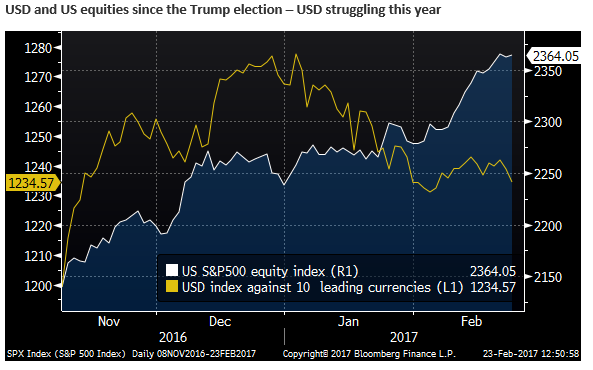

Mnuchin and Trump reinforce a growing impression that the US administration wants to reset US global trade relations and they prefer a weaker US dollar. Rising uncertainty of over progress towards US tax reform appears to be undermining confidence in the US economic recovery and the USD. Emerging and commodity currencies have benefitted this year from stronger global economic indicators, a weaker USD and as a haven from Eurozone and Brexit political risk. These gains may stall, at least against JPY and gold, if global uncertainty remains elevated. Even though the USD is broadly weaker in recent days, metals prices have fallen. This may be a sign that some of the confidence in the global economy is slipping. On Wednesday, the Fed minutes outlined its concern over government policy uncertainty. Some Fed members thought the US equity market was frothy and further dollar strength could dampen growth and inflation.

US dollar take a beating

The USD is taking a bit of a beating this week, and US yields are lower following the Fed Minutes on Wednesday, even though the minutes said that many FOMC members want to raise rates “fairly soon”.

However, as we noted in our report emailed yesterday (Fed minutes scatter the birds and dollar rally sucks wind), the minutes offered a pretty scattered view on the outlook, and said US government policy direction is generating heightened uncertainty. It suggested that near-term economic activity, in particular, business investment, may require progress on tax and regulation reform. Alas, evidence of progress is lacking.

Furthermore, the Fed commented four times in its minutes that strength in the USD was a risk to its growth and inflation outlook.

Comments made by US Treasury Secretary Mnuchin and President Trump on Thursday may tend to weaken the USD further. They reinforced the impression that the administration prefers a weaker USD, is focused on “leveling the playing field” on trade, and highlight the difficulties in developing and passing tax policy legislation.

Where is the budget progress?

The Wall Street Journal reported that Mr. Mnuchin said the administration was working with House and Senate Republicans to smooth over differences among them on tax policy, with the aim of passing major legislation before Congress leaves for its August recess. He added, “that’s an ambitious timeline. It could slip to later in the year.”

Treasury Secretary Steven Mnuchin Sees Tax Overhaul by August – WSJ.com

August may not be too far way to maintain US business optimism, but he noted this timetable is ambitious, and the tone suggests there is little reason to think progress is being made.

The market may be expressing some concern with the slow process of filling high-level posts in the Treasury and other departments, seeing this as a delay to negotiating and refining key legislation such as tax policy.

The WSJ reported that Mnuchin would not comment on whether the Administration’s tax policy will be budget neutral (not increase the deficit). But he said that stronger growth will reduce the urgency for major-trade-offs in any tax bill.

This suggests that the Treasury will adopt optimistic growth forecasts to plump up the budget. As such, there may still be considerable work remaining to fit the Administration’s higher spending and lower tax goals into a credible budget.

Mnuchin’s attitude on BAT reveals a preference for a weaker USD

The WSJ reported that Mr. Mnuchin said the administration is “looking seriously” at the House plan that includes border adjustment and was well aware of concerns raised by specific industries. The Treasury Department had its own concerns, he added, “about what the impact may be on the dollar” from a border-adjusted tax.

(A BAT is under serious consideration, but Mnuchin prefers if it didn’t boost the USD.)

A Border Adjustment Tax (BAT) is widely expected to place significant upward pressure on the USD (as we discussed in our report on Tuesday (EUR feeling pinch, Trump tax policies would boost USD). It would significantly shift the fortunes in favor of exporters and import-competing producers, while undermining import dependent companies, including large retailers.

As such industry is split and there is fear that it may cause significant economic disruption and inflation. Nevertheless, it should tend to boost demand for US producers, lift employment and capital investment, narrow the trade deficit and boost national GDP; all key goals of the Trump Administration (and arguably any government).

However, to the extent that the policy drives up the USD, many of these potential benefits of the policy may diminish.

Trade friction

A BAT is also likely to exacerbate global trade friction, since it has not been pursued by any other country and will appear to boost the US trade advantage sharply, triggering complaints, WTO actions, and possible retaliation.

The proponents of the tax have and will argue that it addresses an imbalance in trade competitiveness because other countries’ Value Added Taxes (VAT) that exempt exports give other countries an advantage. But the BAT would seem to go much further than the VAT in terms of addressing this imbalance.

Trump is eager to level the playing field

Trump has been very strident on “leveling the playing field” on global trade. So it is very possible that his Administration backs the BAT as a way to flatten the field.

Trump’s view of ‘level’ probably lean towards swinging the scales in favor of the USA, so he might not worry too much about arguments that the BAT goes too far.

In a show for the media on Thursday, kicking of Trump’s meeting with a roundtable of big US manufacturing companies to discuss how to bring jobs back to the USA, Trump commented on how unfair US trade relations are. He said he could not find any country that the USA had a trade surplus with. He said he had challenged others to find one and they couldn’t either, and highlighted the large imbalances with China and Mexico. He views trade deficits as an indicator of unfair trade conditions.

[Aside: In 2016, The USA traded with 234 countries and had a surplus with almost 60% of them. The biggest deficit was with China that accounted for 47% of the overall deficit, the next biggest was Japan 9%, Germany 9%, and Mexico 9%. The USA also had a shortfall with Canada although it represented a more respectable 1.5% of the total deficit and came in 16th on the list of biggest gaps. If we take out sizeable surpluses with Hong Kong, the Netherlands and Belgium (since they essentially come under the umbrella of China and the Eurozone) the biggest USA trade surplus was with Australia, which was somewhat bigger than the deficit with Canada].

Trumps’ comments on trade may be adding to market concerns over protectionist policies (including supporting the BAT policy) that might disrupt global trade and dampen global growth. In general, it adds to global investor uncertainty.

Debate over BAT delays policy progress while adding to protectionist fears

The BAT policy might eventually be seen as a boost for the US economy and the USD. However, if Trump decides to pursue this policy, it is likely to generate considerable debate and lengthen negotiations in Congress over tax reform. At the same time, it may further increase global fears over protectionist trade policy. As such, in the near term (most of this year), it may do more to increase uncertainty in the USA and globally than to boost confidence in US growth.

A weak dollar policy

US Treasury Secretary Mnuchin concerns over the impact of a BAT on the USD is yet another example of how the US administration appears to prefer a weaker USD and are focused on improving USA trade competitiveness.

From an economic stability perspective, an appreciation of the USD would smooth out the implementation of a BAT, helping reduce the price adjustment and labor and capital resource reallocation that would otherwise be needed inside the USA. A stronger USD might help alleviate political opposition to the BAT in Congress.

However, Mnuchin would appear to prefer a BAT without USD appreciation. He seems to want the disruptive price changes that would be required; seeing them as a way to fuel an improvement in the trade balance and boost GDP; albeit with winners and losers, disruption, and the risk of generalized inflation.

Mnuchin did pay lip-service to the long-standing US Treasury’s so-called ‘strong USD policy’. He noted that a strong dollar was a reflection of relative US economic strength and was a good thing in the long run. But it is abundantly clear that a stronger USD does not suit the US administration’s current focus on boosting US trade performance and growth.

Furthermore, this week, one of Mnuchin’s first acts was to call IMF Managing Director Lagarde to express his wish for her to vigorously pursue her mandate to report on fairness of all member countries’ exchange rate policies, (U.S. Treasury Secretary Urges IMF to Police Exchange-Rate Policies of Members – WSJ.com).

By linking his preference for a weaker USD to his support for a BAT, Mnuchin adds to uncertainty over US tax policy, making currency a part of an already complicated discussion. It also highlights how sensitive the administration is to US trade relations, adding to global concerns over protectionist policy trends. This may tend to weigh on USA and global economic confidence.

At present, this appears to be undermining the USD. It may soon take the steam out emerging market and commodity currencies, while maintaining upward pressure on JPY and gold.

Metals prices slip a sign of stress building

Even though the USD is broadly weaker in recent days, metals prices have fallen. This may be an indication that some of the confidence in the global economy is slipping.

Apart from uncertainty over US policy, market confidence is also facing headwinds from political risk in Europe. Furthermore, China has been gradually tightening monetary conditions this year, and concern over its pace of debt creation remains elevated.

Emerging and commodity currencies have benefitted this year from stronger global economic indicators, a weaker USD and perhaps also as a haven from a Eurozone and Brexit political risk. These gains may stall, at least against JPY and gold, if global uncertainty remains elevated.

The Fed minutes said that a few participates thought that “equity prices might in part reflect investors’ anticipation of a boost to earnings from a cut in corporate taxes or more expansionary fiscal policy, which might not materialize.”

If uncertainty over US policy remains elevated, US and global equities are vulnerable to a correction, which may further cause some correction in commodity and EM currencies relative to JPY and Gold, and perhaps also against the beleaguered USD.