No respite for AUD, Market still to get on-board a Fed summer hike

The Fed minutes and member comments suggest the probability of a hike in July is now significantly above 50%, we see closer to 80%, and two hikes by year end also appear quite likely. The USD and US rates market have responded, but are yet to fully get on-board; still pricing-in less than 50% chance of a hike by July, and only one hike by year end. As such, we continue to see further upside for the USD. The EUR/USD may be the safer place to position for a stronger USD, appearing to break-down from its uptrend since December last year, while USD/JPY is now encountering resistance between 110/112 and has been more volatile and difficult to predict this year. GBP may benefit from hope of a ‘Bremain’ vote, although uncertainty is likely to remain high over coming weeks. We see weakness in the Australian wages and labour market data. Combined with renewed evidence of financial markets weakness in China and the close fought Australian election campaign suggest little respite for the AUD. Lower New Zealand inflation expectations are likely to keep the RBNZ on an easing bias and present forecasts for lower rates at its upcoming policy meeting, although it may hold rates steady on 9 June.

Fed sets state for a July hike and two more this year

The Fed minutes gel with our report on Wednesday (ahead of those minutes) that the probability of a hike in July is higher than 50% (AmpGFX – For the Fed July is the new June, RBNZ on hold in June, 18 May). I’d say after the minutes the odds now are closer to an 80% chance

June is a possibility, but as we argued in our report on Wednesday, it makes sense to wait for the outcome of the Brexit referendum. Even though the probability is high of a ‘Bremain’ outcome, significant lingering uncertainty is likely to precede that vote.

As New York Fed President Dudley said on Thursday, “If I’m convinced that my own forecast is on track, then I think a tightening in the summer, the June-July time frame, is a reasonable expectation.”

Dudley said in relation to the 23 June Brexit referendum that, “We’ll have to think about that in term of waiting – whether it makes sense to go in June or wait a little bit later.” (Source: Bloomberg)

That seems to give a strong nod to July. And we should expect the June 15 statement and Yellen press conference to hint very strongly at a hike on July 27. The Fed likes to get the market ready for its moves, and the June meeting may set the case for a July hike, subject to reasonable global financial market stability in the wake of the June 23 Brexit referendum.

As we argued in our report on Wednesday, a July hike (largely delayed one-month due to Brexit uncertainty) is likely to significantly boost the chances that the Fed follows through with a hike in December. We should expect then to see this represented in the FOMC projections released at the June policy meeting.

Market is still coming to terms with this Fed Outlook

The USD has rallied on the Fed minutes, but there is scope for it to extend these gains, and the market is still coming to terms with the much increased prospect of a hike in either June or July and the heightened risk of another in December.

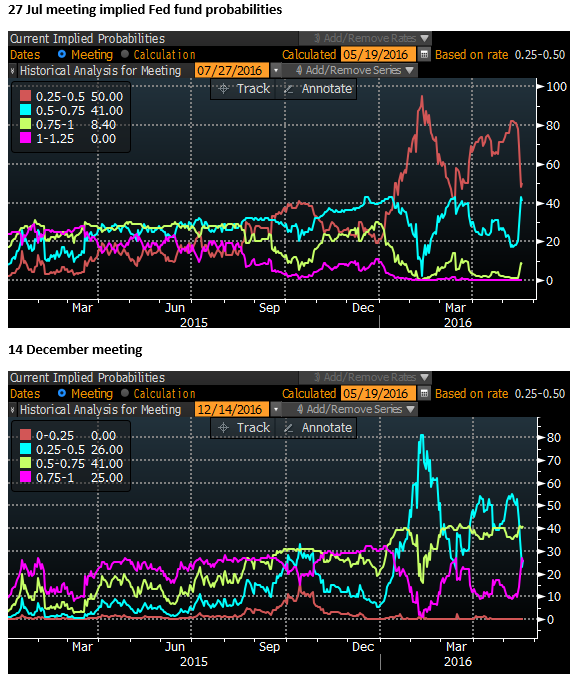

The odds of a hike in June or July are still a bit less than a 50% chance , and the market has only priced in 29bp of hikes by year end, suggesting that most still only see one hike this year.

Bloomberg analysis of market (Fed Fund futures) probability of where rates will be after the July 27 and December meetings is depicted in the charts below; the red line is no hike, the blue line is one hike, the green line is two, and the pink is four. (Adding the blue, green and pink lines is the probability of one or more hikes)

The chance that the Fed holds back from tightening would increase if the US economic data in the coming month or so were surprisingly weak or global markets took fright. We might expect some further weakness in global equities in the lead up to the June policy meeting, at which the Fed is likely to forewarn the market of a hike, but some of this might be considered a normal and healthy adjustment provided it doesn’t go too far.

RBNZ unlikely to cut, but low inflation expectations support easing bias

As we also discussed on Wednesday we do not expect the RBNZ to cut on 9 June, as the economic data has remained robust and the housing market has resumed rude strength, but it could use its MPS to project lower rates and hint of macroprudential measures in the advanced stages of planning to contain the housing market. It will no doubt also continue to talk the NZD down with ongoing risks to its dairy farmers from low milk prices.

This week, lower inflation expectations surveys somewhat increase the probability that the RBNZ pushes ahead with a cut. The 2-year ahead survey of inflation expectations were little changed around a record low at 1.64%, released on Monday.

As the RBNZ is more concerned by long run inflation expectations it will be more worried by the further fall in the surveyed expectation released on Tuesday showing 4-year ahead expectations had fallen from 2.0% to 1.9% (below the 2% inflation target) and 7 year ahead expectations had fallen from 2.1% to 2.0%, both new lows.

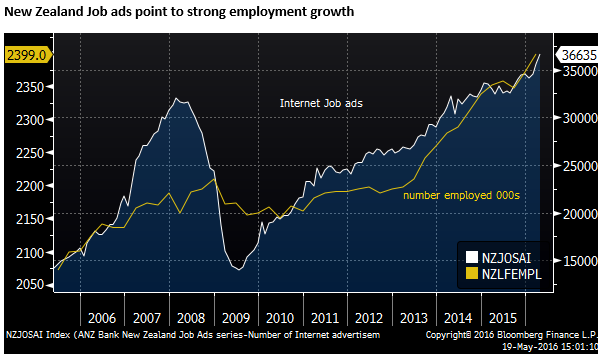

However, countering these data was another solid increase in job ads in April, up 12.8%y/y, suggesting employment growth will accelerate in coming months.

The RBNZ may feel comforted by the prospect of a Fed hike to follow its meeting in June or July, helping contain any positive impact on the NZD. In the wake of the Fed minutes, the market probability of an RBNZ cut on 9 June has fallen from 50% to 35% (down from 80% two weeks ago).

Australian wage and labour data weaker

The data this week in Australia on balance keeps the RBA likely to ease rates, probably after the 2 July Federal election, either on 5 July or 2 August.

Waiting until August would allow the RBA to gather another quarterly inflation report, give a little breathing room for the new government to bed down and allow for broader discussion in the quarterly Statement on Monetary Policy the same week. As such we see another rate cut in August.

At this stage the market has about 15bp of cuts priced in for August, pointing to a better than an even chance of a cut by August.

Considering our views on the risks coming from the housing market and Chinese economic and financial uncertainty, and the close fought election that generates a significant chance of a change of government, we continue to see down side risks for the AUD.

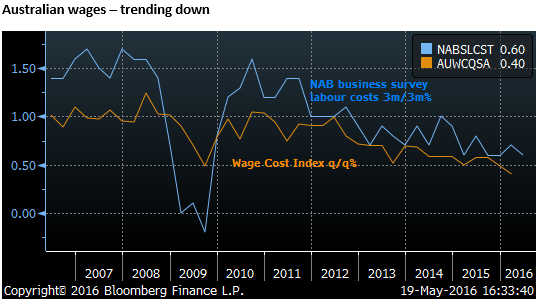

This week, the Australian wage data again hit a new low which will feed concerns over prolonged low inflation.

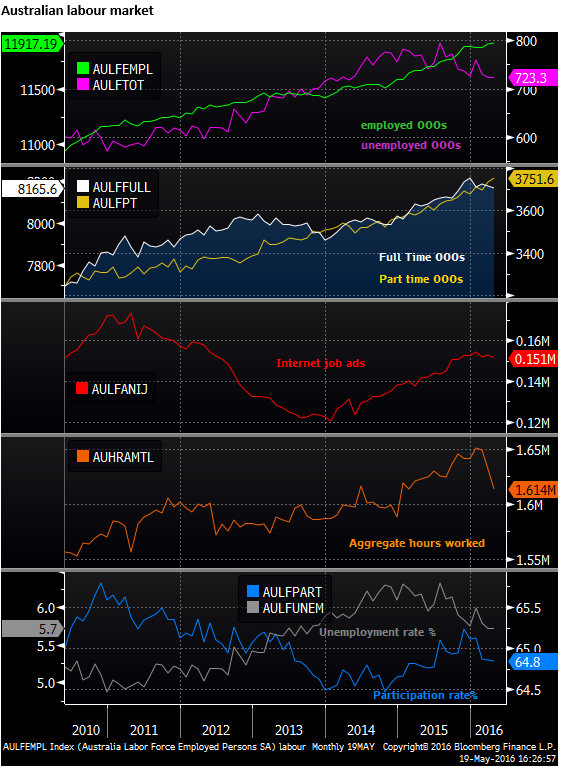

The employment data were also on balance less impressive with the number of full-time employed falling to a low since October last year and aggregate hours worked to a low since February last year.

Total job growth in recent months has been driven by part timers. The unemployment rate was stable at 5.7%, around the lows in two and a half years, but this has been at the aid of a drop in the participation rate to a low since June last year. Job ads have fallen from a peak in January. Overall it appears that the labour market has softened this year, and we may see the unemployment rate rise in coming months.

Chinese market indicators weak

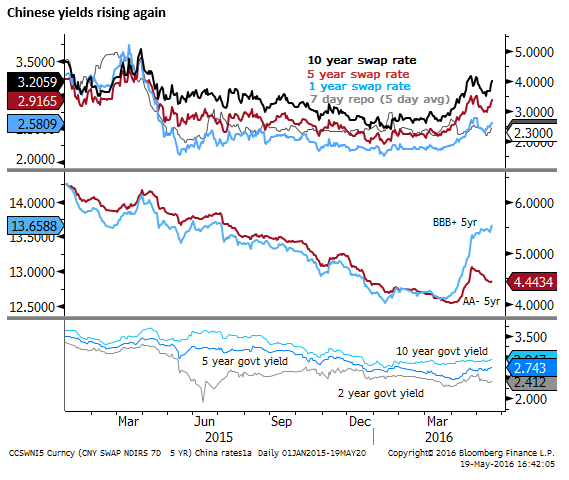

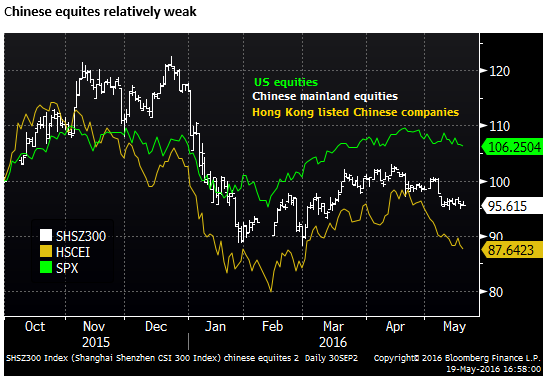

Chinese yields are on the rise again lately, and Chinese equites remain weak, continuing to point to financial system weakness.