NZD resilience rooted in immigration, low global yields and strong EM markets, political risk looms

We are a bit surprised to see the NZD/USD test new highs in light of some correction in emerging market currencies and equities in recent weeks. However, in a broad context, the steady narrowing in global risk premiums in the last two years and renewed fall in US government bond yields this year appears to be supporting the NZD, even if its yield advantage is at a low since 2001. The NZD has also been supported by stronger commodity prices since mid-2016. The CBA NZ commodity price index for New Zealand is at a high since 2014. The RBNZ noted that immigration and terms of trade support the NZD growth outlook. Indeed both are at record highs. The construction boom may have peaked, and the housing market may have cooled more permanently. GDP growth has been below potential in recent quarters. However business surveys remain stable at a strong level, and the outlook for growth remains solid. The NZ government has returned to a budget surplus and has loosened the purse strings a bit heading into the election on 23 September. Hot button election issues are immigration and housing affordability. These issues open the door for opposition parties to place heat on the governing National Party. The market appears oblivious to the risk that a less stable or change of government. The RBNZ retained a subdued view on the inflation outlook, in part because they are influenced by the global theme of stagnant wage growth and subdued core inflation. However, its low stable rates guidance includes plenty of wriggle room. Compared to most other countries, NZ has stronger more stable growth, nearer its capacity. As such, many participates see upside risk for NZ rates. The NZD may seem more fully priced, with some election risk, but it is hard to identify immediate threats. A return to a stronger USD and higher US yields may eventually see the NZD lower.

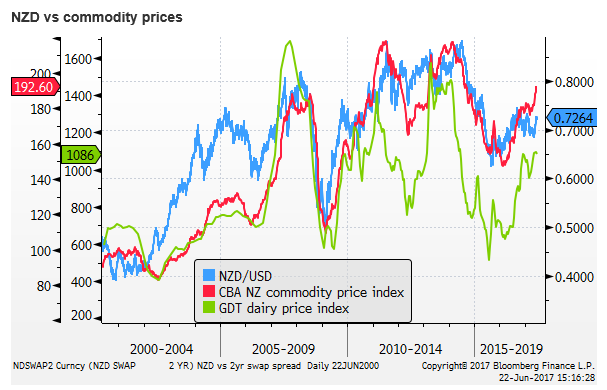

Strong NZ commodity prices

The NZD has rallied post the RBNZ statement on Thursday, even though there was no change in the rates guidance and 2yr yields are little changed. The rise in the NZD suggests that the market continues to see the risks skewed towards the RBNZ needing to raise rates sooner than they forecast in there May MPS; i.e. the second half of 2019.

Perhaps not fully appreciated by the market ahead of this statement is that NZ agriculture-based commodity prices (principally dairy, but also meat and forestry products) have risen this year, and help justify the rebound in the NZD since its lows in May.

Dairy prices started to recover from July last year. They ebbed somewhat in Q1 this year, but picked up again in April/May. The broader NZ commodity price index has risen to a high since 2014.

On Thursday, the RBNZ did again signal its preference for a lower exchange rate to help rebalance growth towards the tradables sector, but it acknowledged that the rise in export prices accounts for part of the NZD’s renewed strength. It did not return to saying a lower exchange rate was “needed”. A term that it used most of the last year and up to March this year to express a strong desire for a lower exchange rate.

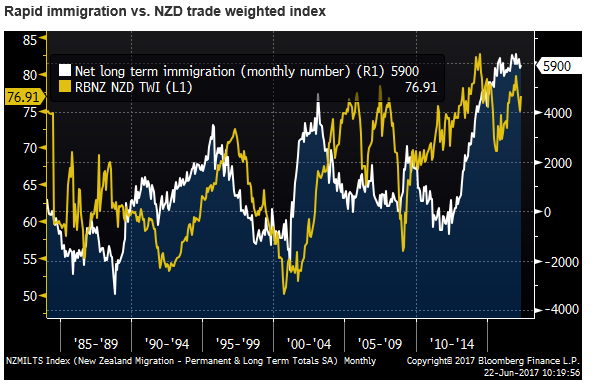

Rapid Immigration underpins growth

The New Zealand economy remains robust, supported by rapid immigration growth that has been running at record levels for around three years. This phase of immigration has not been as inflationary as past cycles, and it is helping keep wage growth low despite rapid employment growth. Nevertheless, it continues to add to demand and place pressure on housing and infrastructure.

The May RBNZ MPS noted that net immigration contributed around 1.5 percentage points to the 2.1 percent annual population growth over the past year.

Immigration an election issue

Immigration has, understandably, become a major issue in the 23 September national election. The opposition Labour party has said it plans to cut immigration, but has not placed a number on this. The populist NZ First Party, which has a high chance of holding the balance of power between the right and left sides of politics is also campaigning on cutting immigration. The Governing National Party has made some policy changes aimed reducing the number and improving the “quality” of immigrants by requiring skilled migrants to be paid above a threshold.

It is hard to say whether there will be any significant decline in immigration over the coming year or so. The RBNZ has often said it expects immigration to fall as growth abroad picks-up. The relative state of the Australian and New Zealand labour market is considered a key factor. As such, the recent improvement in the Australian labour market may help slow NZ immigration.

Nevertheless, the rapid pace of immigration could affect the election, creating an opportunity for the opposition parties to attract votes away from the governing National Party. We see a significant risk that Nationals lose seats and either have to form a less stable coalition with NZ First, or finds itself on the opposition benches.

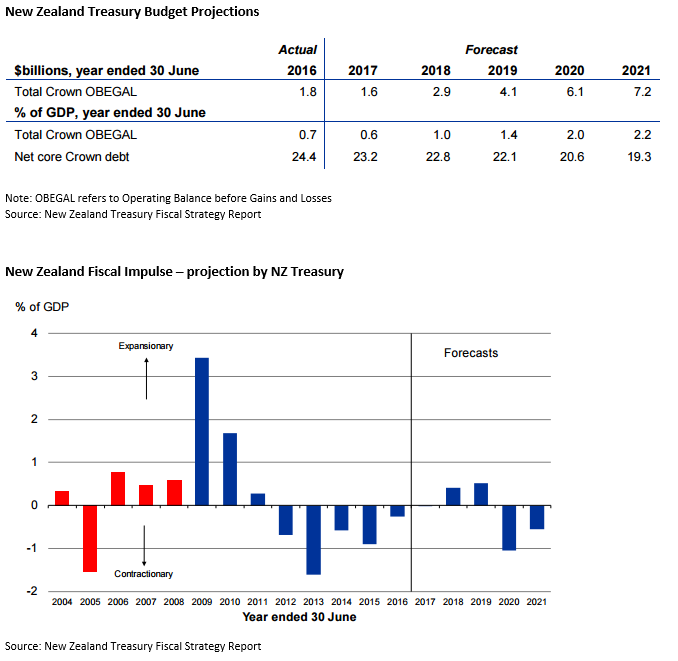

Budget position and fiscal expansion in an election year

The sustained solid growth in the NZ economy over the last several years has helped the national government return to budget surplus ($NZ1.8 bn surplus; 0.7% of GDP, in 2016/17 fiscal year), a result that is the envy of most countries (although as a nation, New Zealand is still a large net borrower, owing mostly to household mortgage debt; 3% current account deficit, and 60% net debt of GDP).

This being an election year, naturally, there has been some easing in the budget announced in May. And there is a good chance, if the race tightens up, that more spending will feature in the campaigns of both major parties.

The Government May budget papers call for $NZ 1.8 bn in net new operating spending per year, $NZ2bn in a “Family Incomes Package”, and $NZ4bn in new infrastructure spending over four years. This is mostly paid out of the forecast growth in budget revenue, and thus might not be considered net fiscal expansion as a percentage of GDP, but the amounts are significant in a roughly $NZ 275 bn annual GDP economy.

Without putting a number on it, the RBNZ said in their policy statement on Thursday that “recent changes announced in Budget 2017 should support the outlook for growth.” The Government Treasury papers project a fiscal impulse of around 0.4% of GDP in 2018 and 0.5% in 2019, before contracting again in 2020 and 2021 as it seeks to further reduce government debt to below 20% of GDP.

Budget at a Glance 2017 – Treasury.govt.nz

Fiscal Strategy Report 2017 – Treasury.govt.nz

Macroprudential measures allow lower interest rates

In comparison to the rest of the world, New Zealand has experienced faster economic growth and rapid employment growth over recent years, supported initially be the rebuilding activity after the 2011 Canterbury earthquakes and then by record immigration growth, which continues.

To help control upward pressure on house prices, the RBNZ has implemented LVR controls on mortgage borrowing. Tougher measures implemented in October last year appear to have taken the heat out of the property market. These measures have allowed the RBNZ to cut rates to record lows (1.75%), despite strong growth, in an attempt to boost stubbornly low inflation and address a relatively strong exchange rate.

Loan-to-valuation ratio restrictions – RBNZ.govt.nz

The RBNZ has said in recent statements that, “the slowdown in house price inflation partly reflects loan-to-value ratio restrictions, and tighter lending conditions. This moderation is projected to continue, although there is a risk of resurgence given the on-going imbalance between supply and demand.”

The success of these LVR measures is helping keep rates low. The RBNZ is working on further measures (debt-to-income [DTI] limits). In may take until next year before they are ready to deploy, but they should help keep the housing market in check, and allow the RBNZ to keep rates low for some time.

DTI as a potential macroprudential tool – RBNZ.govt.nz

NZ Banks themselves, for a variety of reasons (tighter regulatory measures on parent banks in Australia, reaching internal funding source limits), have tightened lending conditions, and are likely to build in new DTI limits into their lending criteria before they are implemented. The heat may have more permanently been relieved in the housing market.

Housing an election issue

Housing affordability is another major election issue, another reason why this election is not a slam-dunk for the governing National Party. The opposition Labour Party has policies to “ban foreign speculators from buying existing NZ homes”, remove negative gearing tax concessions for domestic investors in housing, and require a 5 year holding period to avoid gains being treated as taxable income.

Both major parties are proposing policies to encourage more building of affordable housing. Labour’s policies appear more dampening on the housing market than National’s.

National’s comprehensive housing plan – National.org.nz

Crack down on speculators – Labour.org.nz

Construction boom peaked

The strong underpinnings in the New Zealand economy, rapid immigration, record low interest rates, more recently renewed strength in terms of trade (export prices over import prices), and some fiscal expansion are reasons to see ongoing solid GDP and employment growth. A point made by the RBNZ policy statement on Thursday.

However, GDP growth has lost momentum in the last two quarters to Q1 this year, annualized at less than 2%. Growth was 2.5%y/y in Q1, below potential growth that may be currently above 3% in consideration of strong immigration, adding to the labour force.

A lot of demand appears to be heading offshore (net exports) and construction activity has declined over the last year. Evidence from approvals suggests that construction has now peaked. This reflects the wind-down in the rebuilding activity in Canterbury and dampening in housing demand discussed above. Housing credit growth has also eased, although from high levels

RBNZ to remain dovish; 21 June – ampGFXcapital.com

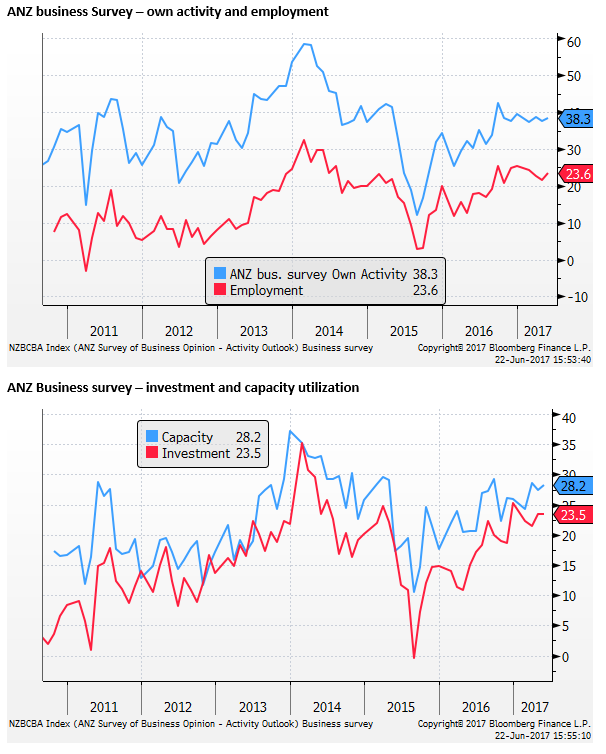

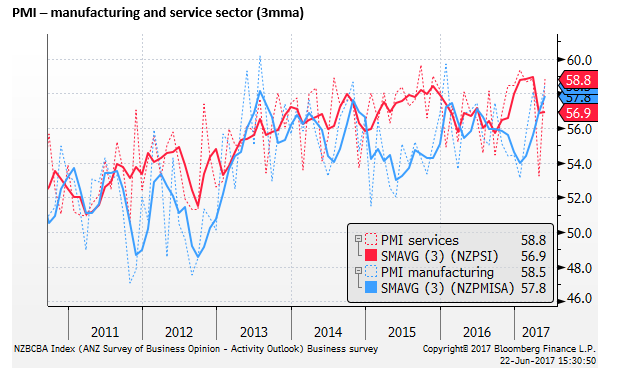

Business activity surveys solid

It appears that growth may not be as strong as the RBNZ had forecast. As such, there may be less risk that rate hikes will be brought forward.

Nevertheless. Surveys of business activity and confidence remain well above average levels. As such, it appears that capacity pressures in the economy are still building.

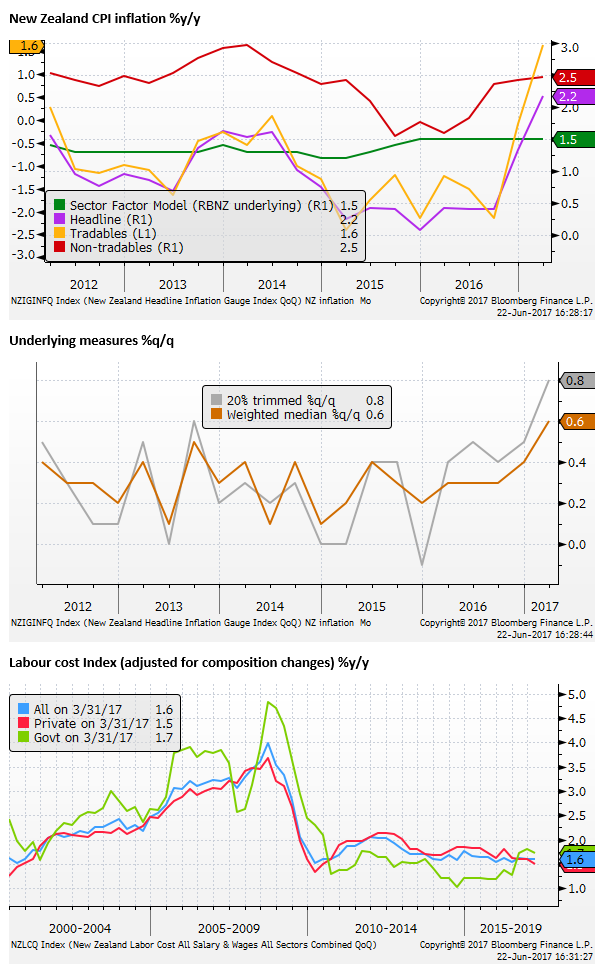

RBNZ sees low inflation as a global theme

To date, CPI and wage inflation remain subdued, although there is some evidence that it has picked up over the last year. The RBNZ is less impressed by these fledgling signs of inflation than most market participants. It is forecasting only a very slow rise in underlying inflation to meet its target only near the end of this three-year horizon.

New Zealand, like most major economies, is experiencing low wage growth. The RBNZ is looking at the global experience, and is not convinced that price pressures will emerge as quickly as the standard models might project. In any case, while New Zealand has experienced rapid employment growth, immigration and labour force participation has ensured the fall in unemployment has been moderate and some slack may remain.

RBNZ retain plenty of wriggle room

They have concluded since May that “Monetary policy will remain accommodative for a considerable period. Numerous uncertainties remain and policy may need to adjust accordingly.”

This guidance gives them plenty of wriggle room to change policy at any time. They are prepared to adjust policy if domestic and global events diverge from their projections.

In comparison to most countries, the NZ economy appears on a higher growth path, and most of the risks appear to lie towards higher rates and sooner rather than lower rates. As such, it is perhaps not a huge surprise that the NZD has proven to be one of the strongest currencies in recent months.

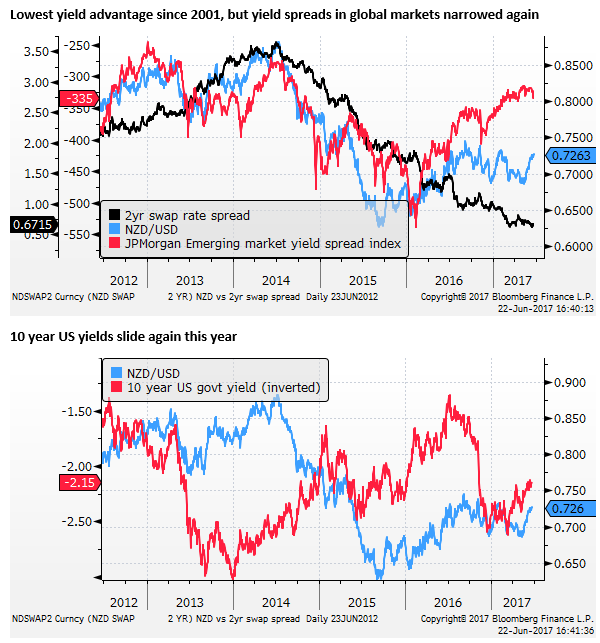

Valuation is stretched by some metrics, but can be explained

Nevertheless, the NZD/USD 2yr swap rate spread has narrowed to 67bp, a low since 2001. As such, many may view the NZD/USD as expensive. It has failed to respond much to the narrowing interest rate gap over the last two years.

However, emerging market and other high-yield assets have steadily recovered over the last two years. Yield spreads globally are again being squeezed. As such, even the narrowed 67bp of NZD yield advantage makes the NZD relatively attractive.

We do note that in recent weeks, EM markets have weakened, and it is a little surprising to see NZD test new highs in this environment.

On the other hand, US and global government bond yields have been testing lows for the year. The NZD is also responsive to long-term yields more generally. Apart from the search for yield attracting demand towards NZD, lower bond yields tend to reduce bank funding costs in New Zealand and ensure mortgage rates remain low.

NZD may not need as a high a yield advantage in light of its improved budget position. Its external balance remains a weakness, but it too has improved over recent years and appears stable.

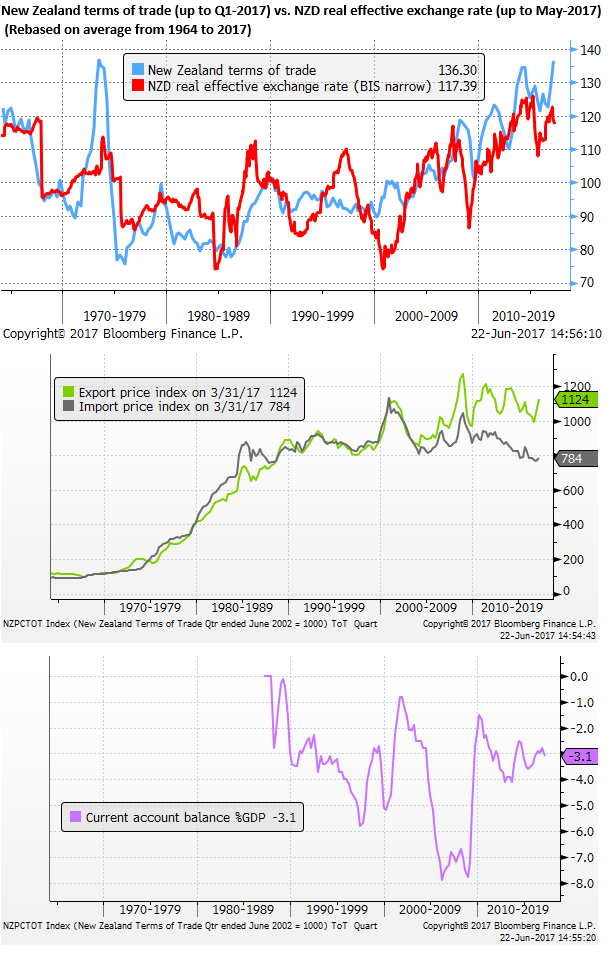

The high terms of trade are helping support the external balance and internal income and thus GDP growth. Terms of trade were at a record high in Q1, driven as much by weaker import prices, probably indicative of lower oil prices since 2014, and declining prices for high-tech goods.

The chart below shows terms of trade and a real effective measure of the NZD dollar. The REER is below its peak in 2014, but remains around record highs, consistent with the stronger terms of trade.