RBNZ to remain dovish

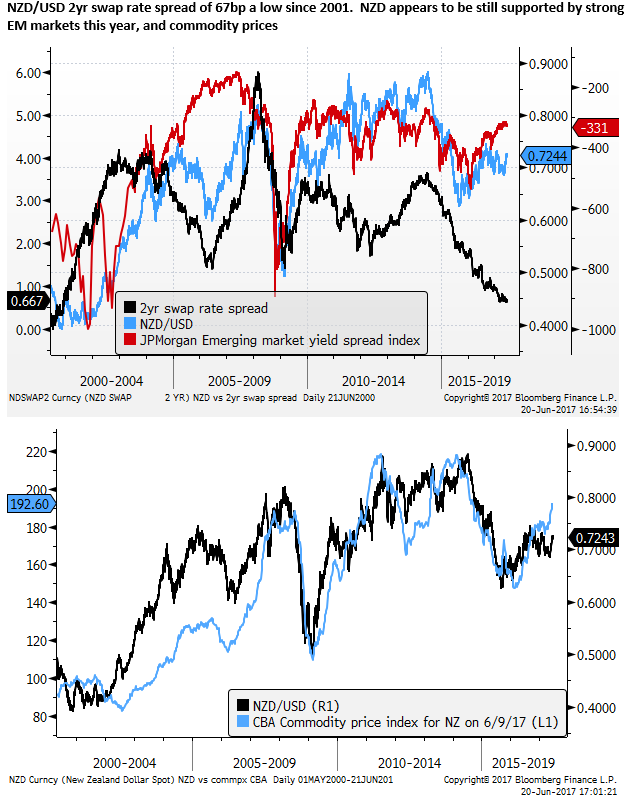

At its 11 May policy meeting, the RBNZ was surprisingly dovish, tending to dismiss the rise in Q1 inflation as largely temporary, and forecasting only a very gradual return in underlying inflation to its 2% target towards the end of its three-year horizon. It forecast rates on hold until the second half of 2019. This dovish assessment only had a very short-lived dampening impact on the NZD that has since rebounded to the top of its range again in the last six weeks. The rise in the NZD has been aided by weaker US bond yields, a weaker USD, and strong emerging market assets. NZ commodity prices have also firmed providing support for the NZD, especially against the AUD and CAD that have faced weaker prices for their main commodity exports. The RBNZ policy statement this Thursday is likely to maintain its dovish policy assessment. It does not release new forecasts at this meeting, but we expect it to repeat its view that “Monetary policy will remain accommodative for a considerable period.” While business and consumer surveys remain strong, since the May meeting, GDP was reported to be modest for the second quarter in a row, and annual growth has slowed to the low side of its range for the last 5 years. The housing market continues to remain more subdued, and the construction boom appears to have peaked. There has been no new data on inflation, wages or employment. The RBNZ is likely to express some disappointment with the rebound in the NZD. The RBNZ has released a consultative paper on adding debt-to-income limits to its macroprudential tools to control the housing market, which should keep rate expectations low. Political risk should also build for the NZD as its national election on 23 September approaches.

NZD rebound in line with commodity prices

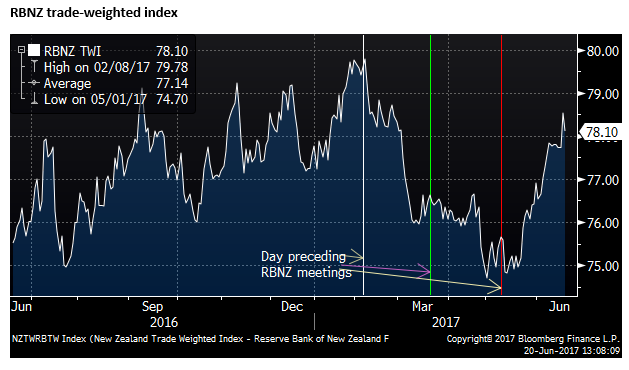

At its 11 May meeting (and quarterly MPS), the RBNZ said, “The trade-weighted exchange rate has fallen by around 5 percent since February, partly in response to global developments and reduced interest rate differentials. This is encouraging and, if sustained, will help to rebalance the growth outlook towards the tradables sector.” Since then the TWI has rebounded by over 3.5%. As such, the RBNZ may sound less encouraged.

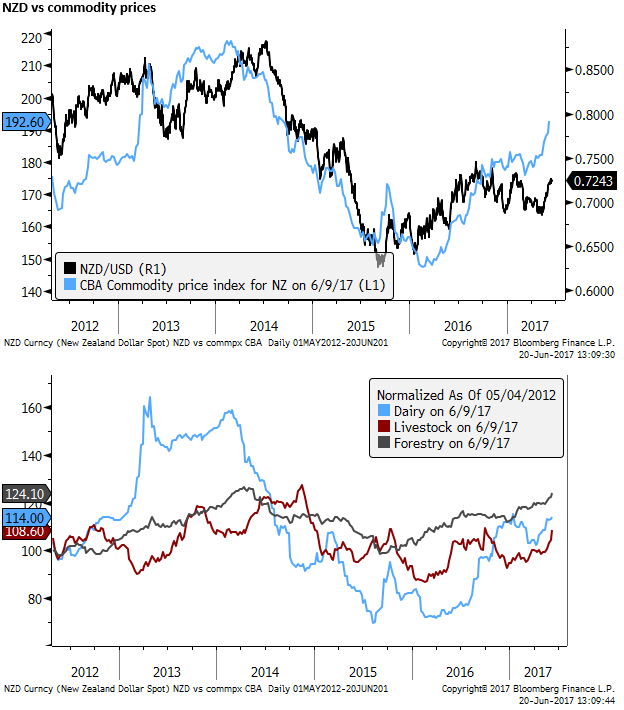

However, unlike AUD and CAD this year, the NZD has received more support from higher commodity prices. This may account for the rebound in NZD, and lower levels in AUD/NZD.

If there is an upside risk for the NZD from the RBNZ policy statement it is the possibility that it mentions stronger commodity prices supporting farm incomes. The RBNZ has not mentioned its domestic commodity prices in their statement for some time. If it does this time, it unlikely to be a prominent feature of the statement.

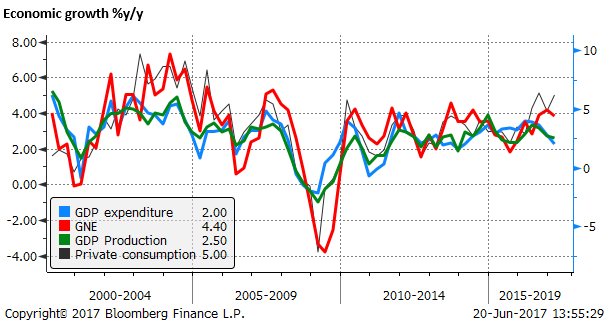

GDP growth moderates, but demand remains strong

At face value the GDP data in the last two quarters appear quite bearish for the NZD, rising modestly, slowing annual growth to 2.5%y/y in Q1 on the SNZ’s preferred production-based measure, and 2.0% y/y using the expenditure measure more commonly used abroad. Both near the low end of the range for the last 5 years.

However, underlying demand in the economy remains much stronger. Gross National Expenditure rose 4.4%y/y and private consumption rose 5.0%y/y in Q1.

The difference is a weak trade performance in volume terms. Exports were down 1.4%y/y in Q1 and imports rose 6.5%y/y. Export performance should be expected to recover in coming quarters with some rebound in farm production in the quarter.

Nevertheless, it is an issue of concern for New Zealand policymakers that so much of its expenditure has been on imported goods. On balance, the weaker trend in GDP is still likely to dampen enthusiasm for rate hikes in New Zealand and encourage it to call for a weaker exchange rate to promote a better balance it trade volume.

After the weaker than expected Q4 GDP report, the RBNZ noted that it had downgraded its measure of the output gap, a key input in the RBNZ inflation forecasts, it its May policy statement.

RBNZ not jumping at inflation shadows; 11 May – ampGFXcapital.com

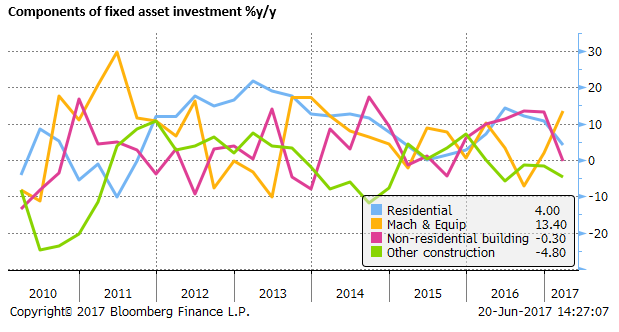

Construction activity fell

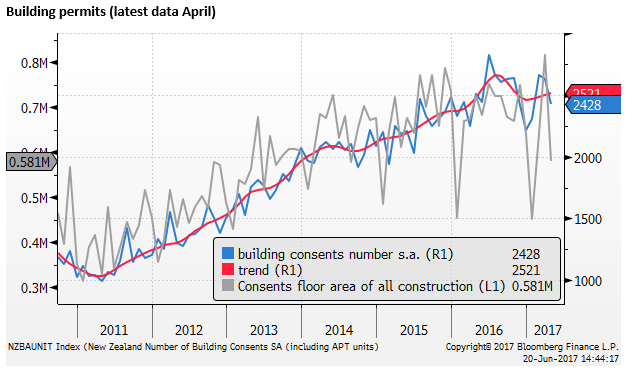

A factor dampening economic growth in the last year has been slowing construction activity. In fact, construction fell 2.1%q/q in Q1. The chart below shows slowing in all components of construction %y/y. In particular non-residential building construction slumped in Q1.

The decline in construction may have been exaggerated in Q1, but it appears that the construction boom that has driven the NZ economy over recent years is peaking. Building permits appear to have peaked last year.

More optimistic for growth was a surge in machinery and equipment investment in Q1. Potentially boosting productivity, but this is an area of demand that is likely to have been filled by mostly by imports. This is consistent with solid business surveys.

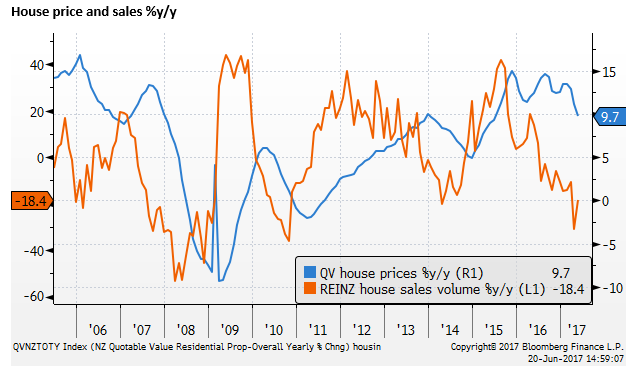

Housing activity cools

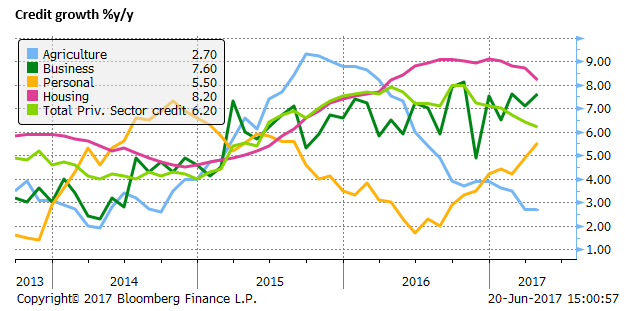

Housing data suggests that the RBNZ macroprudential measures are working to cool the market. Sales and house prices inflation have slowed this year.

Credit growth for housing has also slowed this year, albeit still at a high rate of 8.2%y/y in April, down from 9.1%y/y in December. Total private sector growth has also cooled to 6.2%y/y.

Business surveys suggest the RBNZ may be too negative on inflation

There has been no new labour market or inflation data since the previous policy meeting on 11 May. Leading into that meeting, many were speculating that the RBNZ might bring forward its forecast for policy tightening after higher than expected inflation data in Q1. Instead, the RBNZ went out of its way to downplay the data. There is little reason to see any reassessment this week.

However, there is some evidence from stronger business surveys that inflation pressure is building more than the RBNZ’s May assessment. The chart below shows the ANZ business survey of inflation expectations and pricing intention. The RBNZ would have been able to view most of the increase before its May meeting, only the last data-point for May came after the previous RBNZ meeting.

Overall business survey data suggests the NZ economy continues to operate at an above trend level. Consumer confidence also remains robust. However, the most recent job ads data do show some cooling.

On balance, there is little reason for the RBNZ to make any substantive change to their rates outlook in the policy meeting this week. It is likely to conclude again that, “Monetary policy will remain accommodative for a considerable period. Numerous uncertainties remain and policy may need to adjust accordingly.”

Macroprudential tool chest set to grow and keep rates low next year

Looking ahead we see downside risk for the NZD. The RBNZ has been working for some time to get the government over the line to introduce another tool for controlling the housing market (setting limits on debt-to-income ratios for borrowers). It has conducted a cost-benefit analysis for the government, has presented a consultative paper and is seeking submissions from the private sector by 18 August.

Its current macroprudential measures based on LVR restrictions appears to be working, and there are no immediate plans to introduce DTI limits, but the market should be aware that the RBNZ is likely to be able to deploy such measures sometime next year. This is likely to keep rate expectations in New Zealand stable.

Political risk to build

There is a national election on 23 September. As yet it does not appear that the market is considering the risk of the populist NZ First party holding the balance of power between the left and right of politics, and a change of government, or less stable governing coalition. As the election draws nearer, the NZD may begin to under-perform.

When does political risk matter in New Zealand?; 13 June – ampGFXcapital.com