RBA and RBNZ may reveal doubts

In a follow-up note from our report last week (Major commodity currencies may diverge – CAD set to shine) we preview the RBA and RBNZ policy meetings next week and see risks of dovish surprises in both. Business surveys have ebbed, particularly in New Zealand. The Australian economy is showing more resilience, but risks from a housing market downturn are intensifying. Uncertainty in global markets, particularly related to US-China trade relations, may be increasing. Even a subtle shift in message from both central banks may place significant downward pressure on their currencies. In contrast, Canadian economic reports showed strength, and this may be reinforced next week.

Australia faces adversity

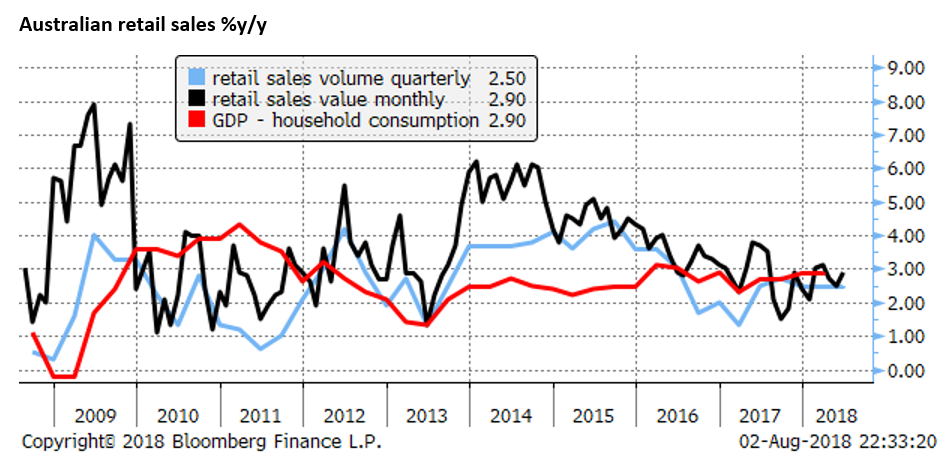

The Australian economy showed resilience in the face of adversity. Retail sales rose solidly in Q2, up 1.2%q/q in Q2 in volume terms, up 2.5%y/y. Nominal sales rose 2.9%y/y. The data suggest little net fallout from a slowing housing market and tighter lending conditions to household spending.

The Australian trade data were much stronger than expected, rising to a $A1.87bn surplus in June, a high since May last year, continuing to contrast with a weaker NZ trade balance in the last year.

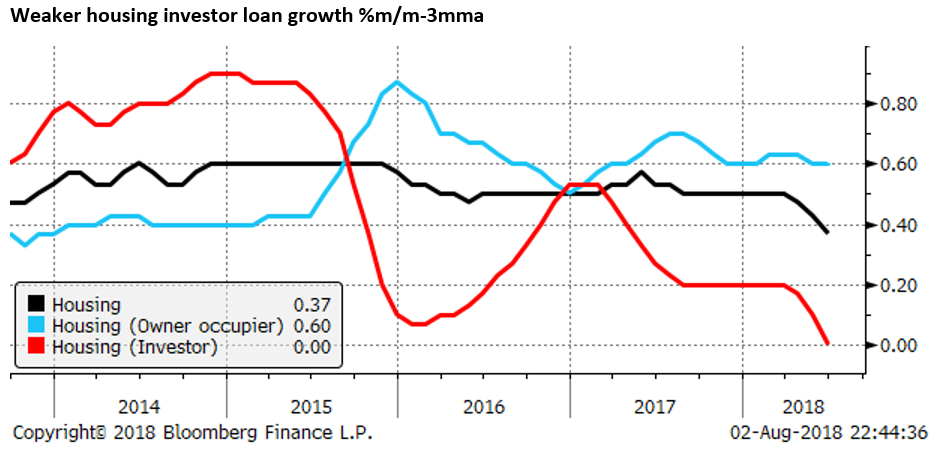

However, the AUD is likely to struggle as the housing market shows no signs of stabilising. Housing investor loan growth has fallen to zero over the last three months to June, a record low in data available since 1990.

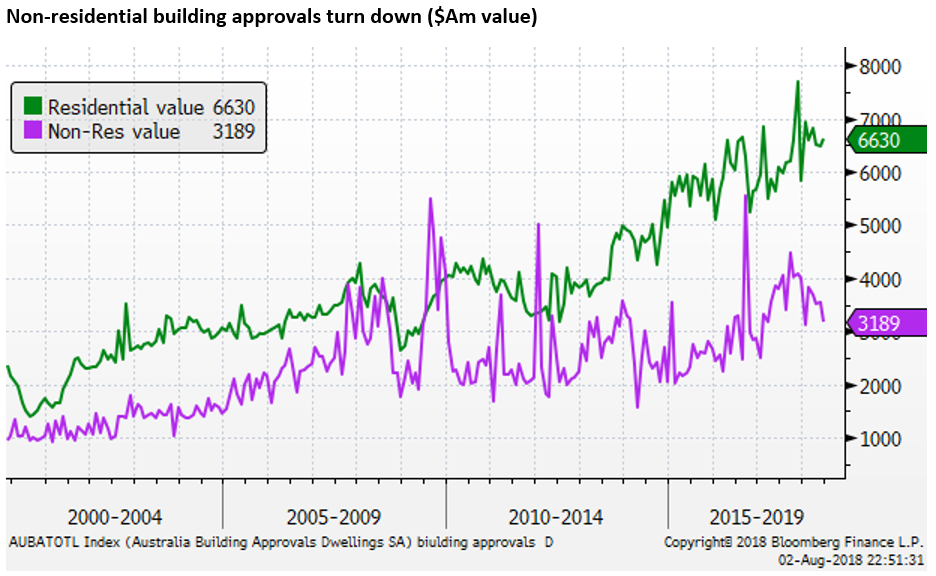

Australian residential building approvals were stronger than expected, but perhaps more concerning was that non-residential approvals have turned down from a peak last year, suggesting the business expenditure outlook may not be as rosy as the RBA expects.

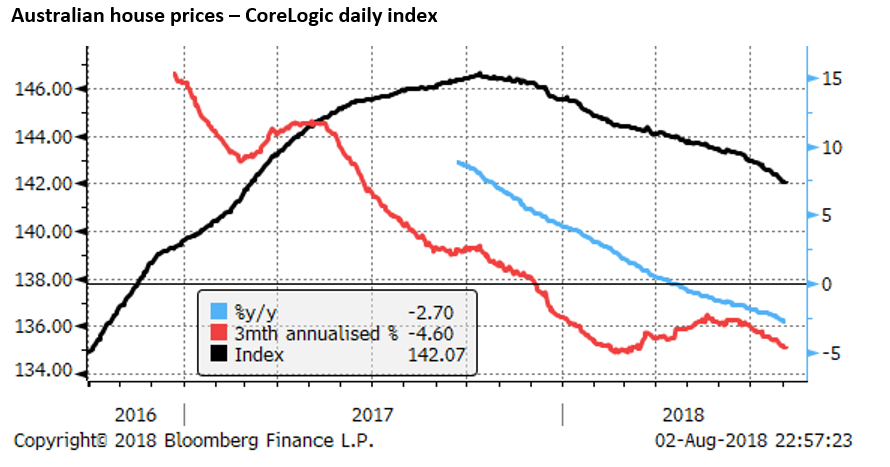

Consistent with their daily house price data, CoreLogic reported an acceleration in the fall in house prices in the last month in a widely reported data release during the week (-0.6%m/m in July).

PMI data from AiG and CBA/Markit were also less encouraging. The manufacturing components for the alternative measures, which are often widely diverging, were both in the 52s, the low end of recent ranges. The services components fell for both; the CBA version was modest in the 52s, a low in the 2-year history of this measure. The AiG services PMI fell back from a record 63.0 in June to 53.6 in July.

RBA may reveal doubts

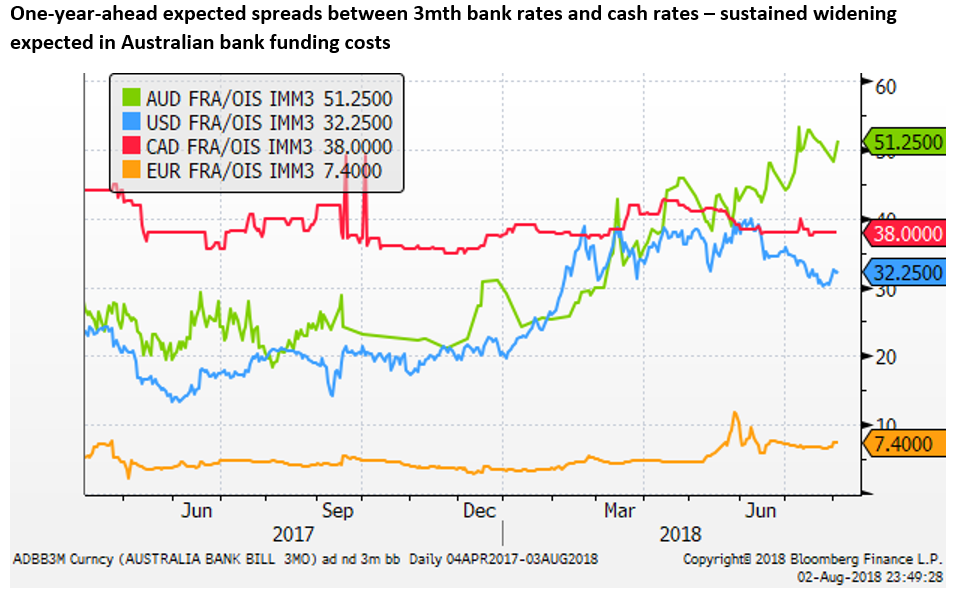

The RBA policy statements next week may reveal little change in its policy outlook. However, there is a risk that they sound somewhat less confident about the outlook for growth, considering some acceleration in the decline in housing activity, some moderation in business surveys, some intensification of risks related to US-China trade relations, and a sustained lift in bank-funding costs over the cash rate since early in the year.

The RBA is unlikely to make significant changes to its key forecasts, but there is scope for the market to react to even subtle changes in the messages from the RBA.

In its May Statement on Monetary Policy, the RBA said, “For some time the Reserve Bank Board’s view has been that holding the cash rate steady at 1½ per cent would assist that progress, with steady monetary policy promoting stability and confidence. If the economy continues to perform as expected, higher interest rates are, however, likely to be appropriate at some point. Notwithstanding this, the Board does not see a strong case for a near-term adjustment in the cash rate.”

The key message here is steady she goes, with an expectation that rates will rise at some point. If the RBA were to drop the reference for a hike “at some point” it would be viewed as a dovish tilt.

NZD downside risks intensify

NZ business confidence was again particularly disappointing, suggesting the economy has slowed well below potential. ANZ said, the own-activity reading of +4 was “the lowest reading since May 2009 and well below the long-term average of +27”

The NZ employment report was close to expected. The quarterly increase in jobs was a bit above expected, but the unemployment and under-employment rates ticked higher, weaker than expected, and wage growth remained subdued, as expected.

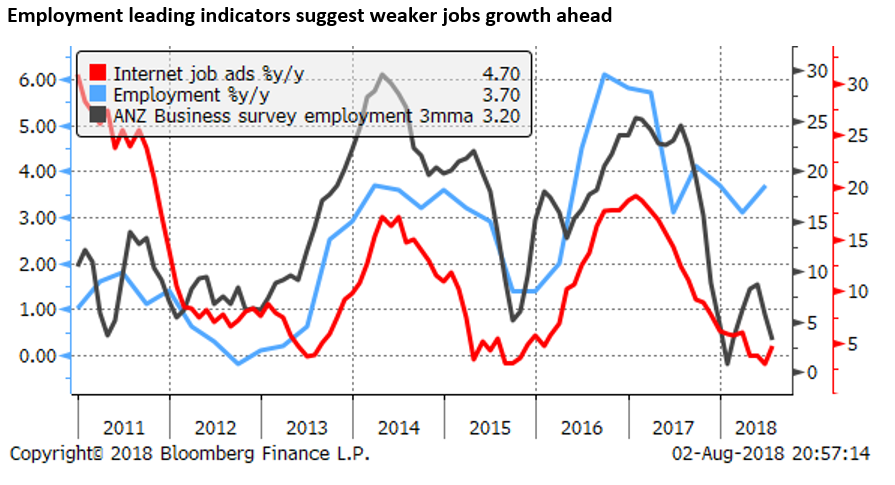

Job ads on Friday rose after recent weak readings. However, overall the market may be left with the impression that future employment growth will slow from here.

RBNZ meeting may offer fresh downside impetus for NZD

Next week the RBNZ policy statement should maintain a neutral policy stance noting that it is “positioned to manage change in either direction – up or down – as necessary”

And “The best contribution we can make to maximising sustainable employment, and maintaining low and stable inflation, is to ensure the OCR is at an expansionary level for a considerable period.”

This RBNZ meeting is accompanied by the MPS and press conference. So there will be more fodder for the market to move on.

The Q2 inflation data did show an uplift in underlying inflation. The RBNZ’s preferred Sector Factor Model rose from 1.5% (revised up to 1.6% in Q1) to 1.7% in Q2, moving closer to the 2% inflation target, a high since 2011. So the RBNZ will probably not need to sound more dovish. On the other hand, the recent weaker business surveys suggest underlying activity has weakened, so they are likely to maintain a balanced outlook.

It will be interesting to see how Governor Orr balances the softer activity indicators with the higher inflation outcome. He may decide to indicate that while the pick-up in inflation is encouraging, NZ has experienced several years of below-target inflation, dragging down inflation expectations, and the RBNZ could afford a period of above-target inflation to help lift and sustain inflation around the target. If so this could be viewed as a dovish outcome and propel further weakness in the NZD.

Canada shows strength

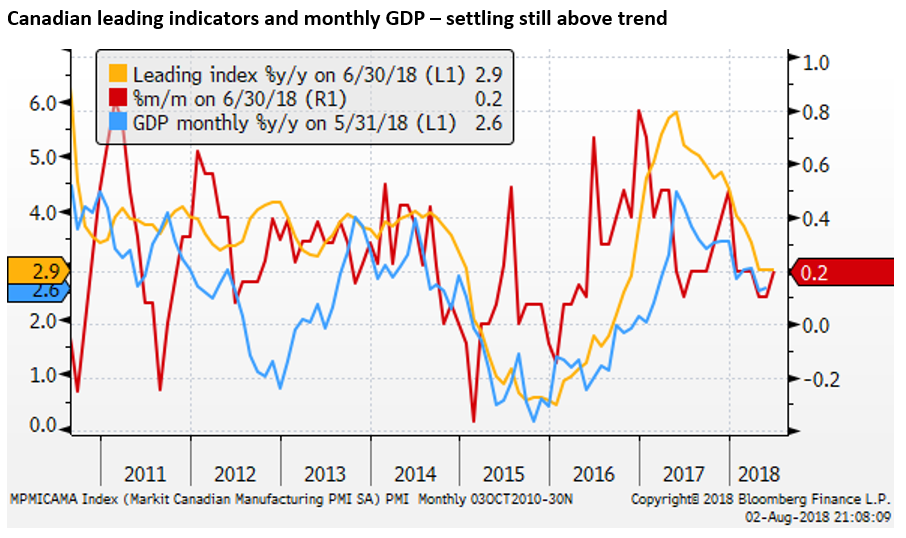

Canadian economic reports, on the other hand, were robust. Monthly GDP rose significantly more than expected in May, running well above potential; up 2.6%y/y in May, down from the peak last year, but settling at a still high level. Leading indicators rose 0.2%m/m in June, on a stable growth trend this year.

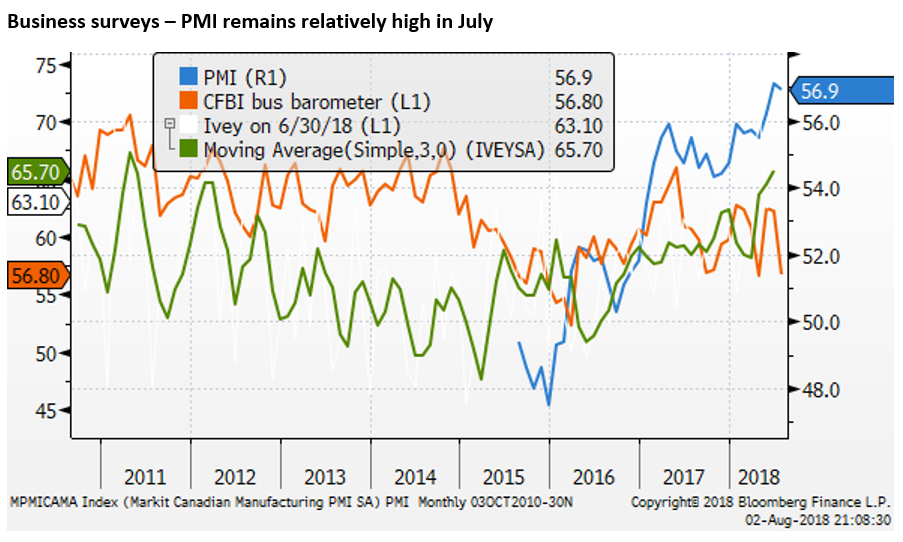

The Markit manufacturing PMI dipped only modestly from its high in June of 57.1 to 56.9 in July.

Next week Canadian housing data and the employment report is due. There is every reason to expect a solid employment report.

Weaker Asia and Global Risk Appetite

Contributing to the further weakness in NZD and AUD vs. CAD in the last week has been some intensification of the US-China trade threats, leading to a further fall in CNY and a weaker Chinese equity market. This generated some contagion to other Asian markets; including the AUD and NZD.

There was also broader weakness in global risk assets and USD strength. Contributing factors were an uplift on global yields in part generated by a more flexible BoJ yield target, steep falls in the TRL, in part generated by threats of US sanctions. The EUR and GBP were weaker perhaps in sympathy with broader USD strength, but certainly lacking their own strength with issues related to Brexit and Italy contributing to weakness in European assets.

In the midst of this greater global uncertainty and a stronger the USD, the CAD held its own against the USD. News from the week continued to suggest that the US, Mexico and Canada are making progress on NAFTA negotiations, in contrast to the US-China trade dispute.

A weaker CNY and weaker EM markets, in general, may continue to weigh on AUD and NZD more than CAD in the week ahead. However, on the same token, we need to be wary of a potential break-through in US-China trade relations that might see a rebound in Asian markets, and/or a set-back in NAFTA talks, that might undermine the CAD.

The oil price is always a wild-card for the CAD. It has been relatively stable in recent weeks, not playing a big role in CAD direction. USD/CAD is hovering near the psychological 1.30, supported by stronger Canadian data and firmer Canadian rates in recent weeks. But held back by broader USD strength. In general, it seems likely that the CAD will remain relatively stable against the USD.