Major commodity currencies may diverge – CAD set to shine

A lot is happening in global markets this week. No doubt you are reading much about key central bank meetings in Japan and the UK, and key data releases including Euro GDP and CPI. However, we have decided to hone in on the AUD, NZD and CAD which present there own opportunities in a market searching for fresh direction. We see upside potential for CAD on recent solid economic reports, rising rates, and positive news developing on NAFTA vs. ongoing trade tensions between the US and China. NZD appears more vulnerable and faces a key hurdle this week with NZ labour data released for Q2.

CAD may be set to shine

CAD has firmed in the last 4 to 5 weeks after making a new low for the year, and is testing a year-long falling trend. In the last week, Canadian core inflation indicators firmed a bit more than expected to be near the BoC 2% inflation target, and retail sales were much stronger than expected in May, reversing a weak result in April. Recent housing market activity data have firmed showing stability in the face of higher rates and regulatory tightening. Manufacturing and wholesale sales data were also stronger than expected in May. Capacity indicators appear relatively tight.

The CFIB business survey fell back in July and is not showing the same strength as the PMI data. This may be a sign that the manufacturing PMI data due for release on Wednesday, along with a multitude of other countries’ PMIs this week, will dip from its relatively strong June reading of 57.1.

Nevertheless, the general tone of the recent reports suggests that the Canadian economy is displaying solid momentum and this may be reflected in the May monthly GP report on Tuesday this week.

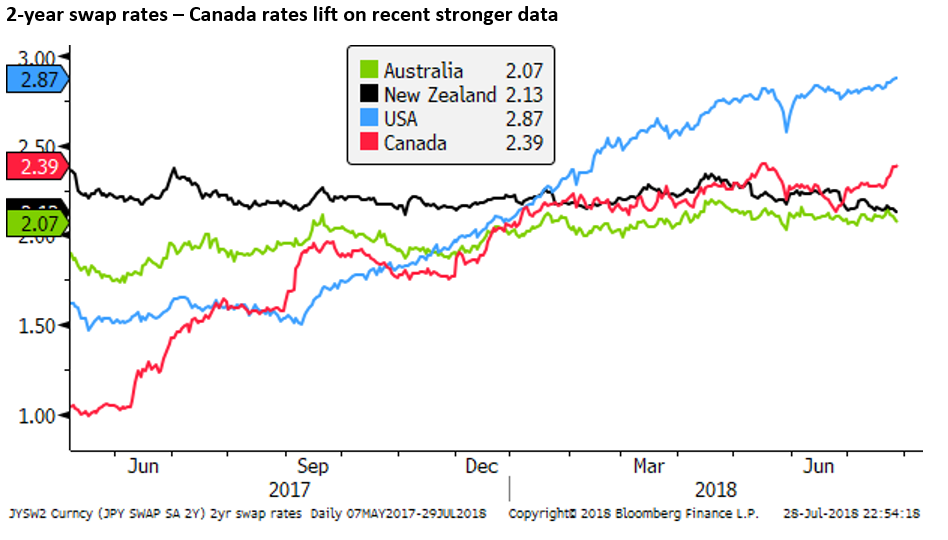

The strength in Latam markets in recent weeks, more positive noises on NAFTA, firming Canada rates, against stagnant or lower rates in other major economies outside of the USA, and still relatively high oil prices, suggests CAD may tend to out-perform other major currencies.

Nafta Talks Are Now Making ‘Amazing’ Progress, Trump Aide Says; 28 July – Bloomberg.com

The CAD may also benefit from positioning indicators that suggest, along with other commodity currencies, that the market may have established a significant short position in the CAD against the USD.

Weaker leading indicators for NZ job’s report

NZD has been ranging around 0.69 for five weeks, around a low in two years. Economic reports in New Zealand suggest economic activity has lost momentum this year and may keep the RBNZ on hold for the foreseeable future at record low-interest rates.

Factors that may support the NZD are firming emerging market assets and positioning data that suggests that the market is significantly short the NZD, perhaps more so that other commodity currencies. This could leave it vulnerable to a short squeeze if the tide turns against the USD more broadly.

This week, the NZ Q2 labour market report is released. It may confirm moderation in the economy with leading indicators, including the ANZ business survey and job ads series losing momentum this year. Updates on both these data points are also due this week for July.

Latam leads a recovery in EM markets, Asian currencies lag

There are reasons not to be overly pessimistic about Asian markets. China is reported to be easing both fiscal and monetary policy. And easing back of credit tightening to support growth. Outside of the CNY, Asia currencies have been more stable in recent months, several firming from their lows. And Asian equities are participating in a recovery in EM markets. This may tend to underpin regional currencies, including the NZD.

However, relative to other EM markets, Asian markets may appear more vulnerable to ongoing trade tension between the US and China. The CNY remains in a falling trend in recent months, and this may limit the potential for recovery in other Asian currencies.

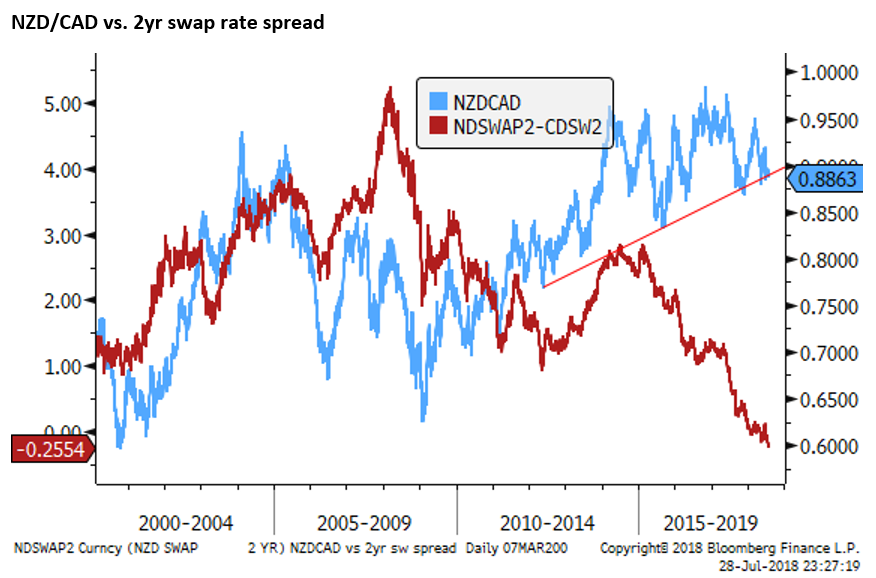

NZD/CAD viewpoint

As such, we continue to see downside risk for the NZD. The chart below compares the NZD to the CAD. We note that 2yr Canadian rates have moved into the rare position above those in NZD. The potential for better news on NAFTA and ongoing trade tensions between the US and China may tend to support the case for a weaker NZD/CAD cross. Based on the rate developments and our perception of US trade policy, we have been pursuing this trade for some weeks.

Bank of Canada may pick up the pace, 10 July – AmpGFXcapital.com

AUD difficult to call; more going for it than NZD

The AUD has been ranging around 0.7400 for six weeks, around its low in a year. The super-Saturday bi-election in 5 federal government seats have returned four opposition party Labor Party members and is being reported as a disappointing result for the ruling conservative LNP government. At the margin, this might be seen as a negative for the AUD as the risk of a change of government and policy upheaval in the next six to nine-months increases.

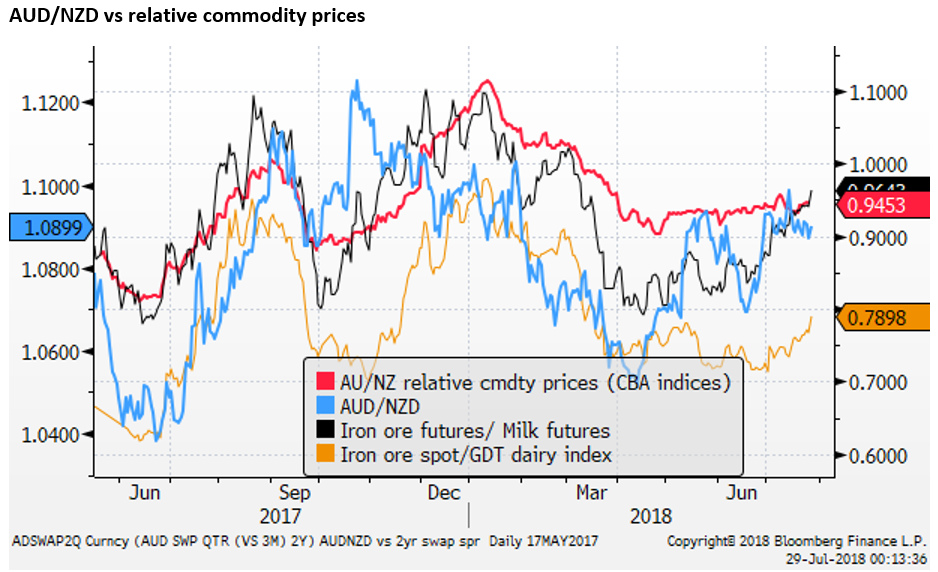

AUD remains a difficult currency to predict. The slowing economy in China has not slowed demand for key Australian commodities, and this is supporting the mining sector in Australia. The prospect of China moving to shore up growth, including via more infrastructure spending, may seem to support the AUD.

On the other hand, a weaker trend for CNY, ongoing trade tensions between China and the US should prevent too much exuberance for the AUD.

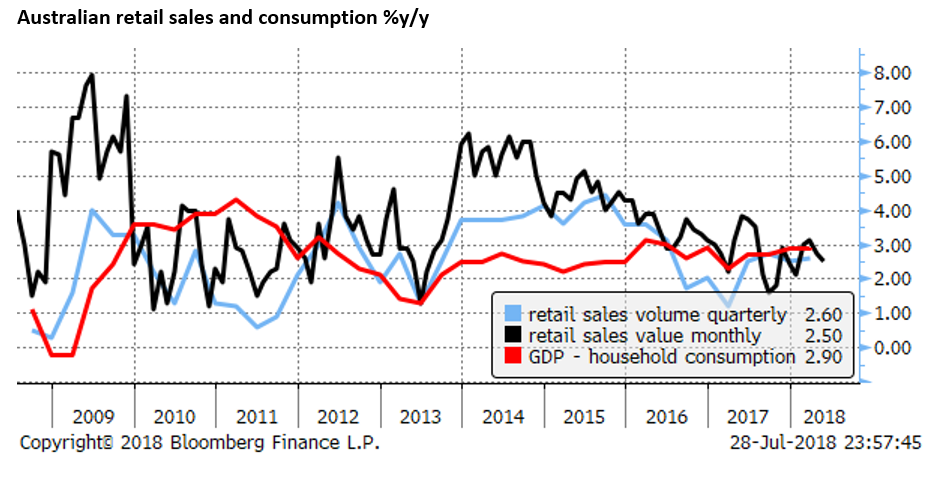

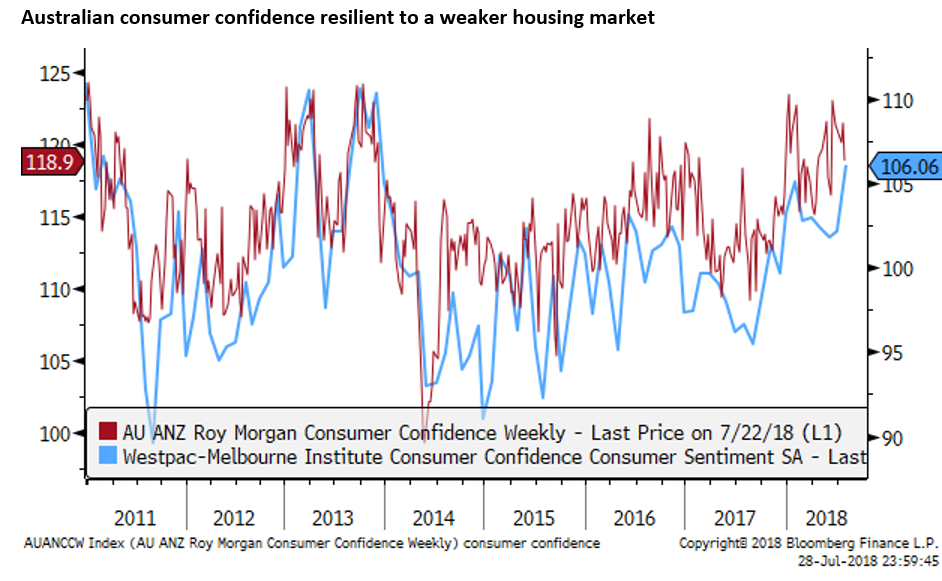

The overall Australian economy appears to be operating somewhat above trend. The June employment report two weeks ago showed a strong rebound in jobs growth, after a weaker than expected period in the previous four months. Business surveys continue to show above trend readings, and consumer confidence has held a little above average despite a persistent downturn in the housing market for almost a year.

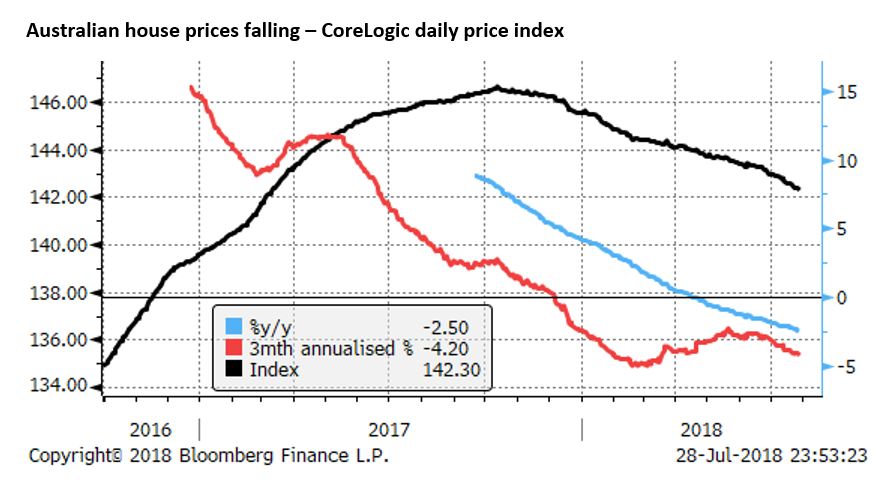

News from the weekend on housing sales at auctions has shown a modest improvement for a second week in a row in sales volume, which may help stabilise fears that an accelerating fall in house prices may spill over to a weaker economy and AUD. However, there is no sign that house prices are stabilising; falling at an annualised 4.2% rate in the last three months according to a national hedonic daily index from CoreLogic.

Most significant on the economic calendar for Australia this week may be the retail sales report for June and the volume data for Q2 due on Friday. A key concern of the central bank is the risk that high household debt and weakening housing prices might undermine household spending; currently running near long-term potential at 2.9%y/y in Q1.

Also due on Thursday this week is Australian trade data. This has improved in the last year, tending to show a consistent surplus, underpinned by stable to stronger commodity prices and higher export volumes. It is notable that as the Australian trade balance has improved this year, the New Zealand trade balance has deteriorated.

Comparing rates and relative commodity price developments, we see more upside for the AUD than the NZD from current levels.