The dollar and the meeting between Trump and Xi

The G20 is scheduled for 26 November to 1 December in Argentina. The schedule starts with deputies and sherpas. The leaders’ summit is on 30 Nov and 1 Dec. Presumably, Trump will meet Xi on one of those two days.

The meeting of the two leaders provides an opportunity for some kind of agreement on a trade deal. Of course, a full trade deal cannot be made by one meeting of the two leaders. But Trump, in particular, can generate speculation for or against a deal with his press statements after this meeting.

There is no clear way to assess the probability of the outcome of this meeting, so uncertainty may keep asset markets in check as it approaches. It will be regarded as hugely important since the Chinese economy is already slowing down, led by weaker export markets, and this has spilled over to other Asian exporters and potentially to global growth. The US administration has plans to further expand its tariffs if no progress is made on a deal before year-end.

No meaningful progress (30%)

We rate the probability high of little change from this meeting, let’s say 30%. Although we place a wide confidence band around this guesstimate.

Trade policy hawks appear to have the upper hand in administration. There appears to be a deep and broad concern in the Administration that China is closing the technology gap with the US and is employing aggressive tactics of espionage, investment and regulatory tactics to acquire leading technology from the US.

U.S. Accuses Chinese Firm, Partner of Stealing Trade Secrets From Micron; 1-Nov – WSJ.com

New Evidence of Hacked Supermicro Hardware Found in U.S. Telecom; 9 Oct – Bloomberg.com

Mounting risks for Eurozone and China; 10-Oct – AmpGFXcapital.com

Apart from the fear that the US may be losing out on economic growth to China, the US fears the growing power of China in the global arena, and wants to contain its strategic power and subtle influence in the US political agenda through its involvement in education institutions, entertainment industry, private sector companies, news and social media. Trump may be advised by policy hawks not to give ground on trade issues.

Remarks by Vice President Pence on the Administration’s Policy Toward China; 4-Oct – WhiteHouse.gov

Trump may also see a political advantage by retaining a tough stance against China. It is an issue that is popular with his supporter base, and indeed has wider appeal across the political spectrum in the US. It is an issue that has considerable sympathies in many countries around the world.

The no progress outcome might further undermine the outlook for Asian economies, extent the weakening trend in the CNY and other Asian currencies. It might generate broad USD strength.

However, there is also the risk that trade policy uncertainty will feed back negatively on US economic confidence, and weaken the USD. It is possible that safe haven alternatives like JPY and gold out-perform. We would expect a mixed USD performance in kneejerk to a no progress outcome.

The medium-term performance of the USD may depend on how inflationary tariff policy proves to be in the US, how resilient is the US economy in the face of a weaker global outlook. If the Fed faces the challenge of balancing higher inflation and moderating growth, it could generate considerable volatility in global markets and the USD.

In this instance, we might expect Trump to increase his pressure on the Fed to cut rates and talk down the USD. The USD could suffer on the grounds that it has a large fiscal and current account deficit, facing greater economic and policy uncertainty, and government interference in monetary policy.

If on the other hand, the US economy tends to retain its momentum, and the performance gap between US and global equities tends to widen again, we might expect the USD to strengthen broadly.

Trump raise hope of a trade deal (50%)

We rate the probability that Trump allows some increased hope for a trade deal also relatively high; let’s say 50%, again with a wide confidence interval. Within this scenario is the degree of hope he allows. It may be vague, or it may be somewhat optimistic.

Trump has claimed that he has great personal respect and rapport with Xi. Both Xi and Trump would like to come from the meeting appearing to be great leaders that can get things done for their countries. The fact that the two leaders are meeting places pressure on them to make some progress.

We might expect, for instance, that they announce plans to restart high-level talks between the two sides. Trump may announce a hold on further tariffs that are planned to be implemented early next year if there is no progress on a trade agreement.

Hope may spring eternal if the leaders announce new trade talks. Global equity markets are down significantly this year, and a modest increase in the possibility of a trade deal may provide a lift to global market confidence. We are witnessing that in trading on Thursday.

The fact that equity markets in the US and China have fallen significantly may have spooked advisors in both countries that a no deal outcome could threaten their economies, something they should avoid.

Trump has seen the weakness in Chinese equity markets as a sign that his policy is working. However, falls in the US equity market in the last month may increase his willingness to consider making a trade deal with China. Or at least provide hope that deal will be made.

A rebound in global markets is likely to boost Asian and EM currencies, and thus may weaken the USD. Stronger global equity markets and ongoing confidence in the US economy, raising the prospect of higher US rates would tend to support the USD against safe havens – gold and JPY.

Trump announces a deal is imminent (20%)

We would view as a low probability that Trump would give a strong indication that great progress towards a full trade agreement has been made following his Xi meeting. Let’s say less than 20%.

You could not dismiss the prospect. Trump could see it as a tactical ploy, knowing that he could still threaten to impose tariffs if a deal does not come off. He could see it as a way to claim a kind of victory.

He appears adept at proclaiming confidence in outcomes no matter how very unlikely, often generating enormous media interest, perhaps simply for the objective of generating publicity for his presidency and as a great negotiator.

Such an outcome could generate a strong positive reaction in global equity markets. The positive response in Asia may be greater, given its equity markets have been more beaten down. The impact might be particularly negative for the USD, as it would encourage capital to flow to global markets, on the view that they may again close the growth gap with the USA. Talk of synchronized global growth and a weaker USD, employing the ‘dollar smile’ theory that drove sentiment in 2017 and early this year may return.

However, the risk is that the market gets ahead of itself in this outcome. The China policy hawks in the US administration are likely to prove a major sticking point to a deal.

China also has a history of making policy changes in name only, while subtly encouraging its state-owned companies and local government to implement an alternative strategy. Suspicion between the US and China is likely to remain high. A trade deal and winding back on tariffs may prove elusive and in time we might expect global market confidence to fade.

US Trade policy impacts

The market has arguably adjusted to the negative impact of the tariffs announced to date, in that Chinese and global equity markets are weaker. However, business will not have fully responded to the tariffs. The uncertainty over how long, at what level, and on what goods tariffs may be applied to will have delayed the business response.

Some companies claim to be looking for new supply chains and reconsidering where they set up production facilities. However, the uncertainty still threatens to undermine business confidence and investment in China, Asia the USA, and globally. As such we might expect there to be some ongoing economic fallout from tariff uncertainty well into next year.

Chinese PMI data released this week showed further declines in manufacturing, broadening to non-manufacturing with falls led by export orders.

The break down in China’s PMI by company size, shows a deep slide for medium-sized companies; falling to a new low in data back to 2012, suggesting that the tightening in shadow-banking finance and the pledged collateral fall-out from weaker equity markets on private sector businesses may be generating deeper economic concerns.

Weakness in Chinese exporter conditions has spread to other nations in Asia. Both Korea and Taiwan reported a fall in Q3 GDP, below expected in the last week.

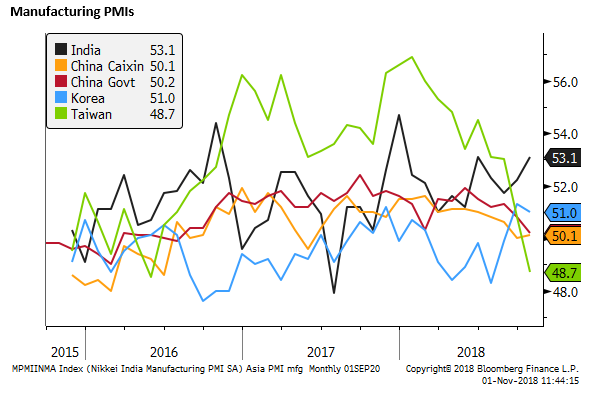

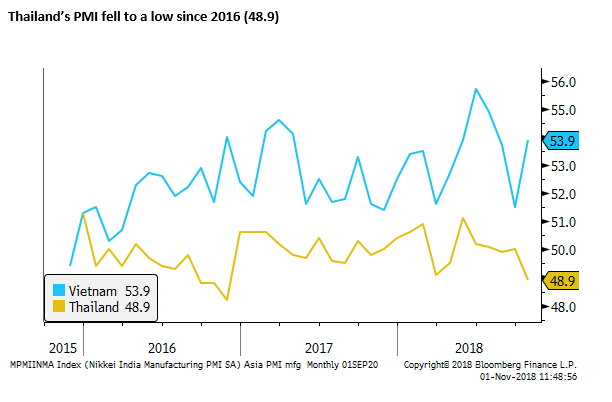

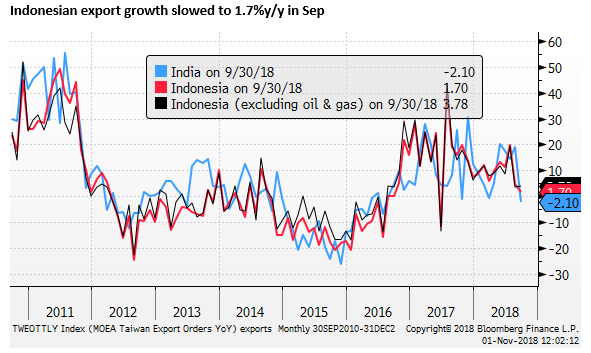

Taiwan’s manufacturing PMI plunged sharply from a recent peak of 56.5 to 48.7 in Oct, a low since 2016. However, PMIs were not all bad in the region. India’s rose to revisit recent highs at 53.1 (India is less exposed to trade with China than other Asian countries). Korea’s PMI has recovered from weakness in the middle of the year, at 51.0 in October.

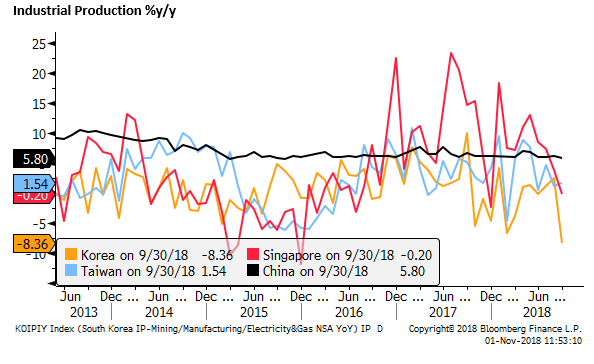

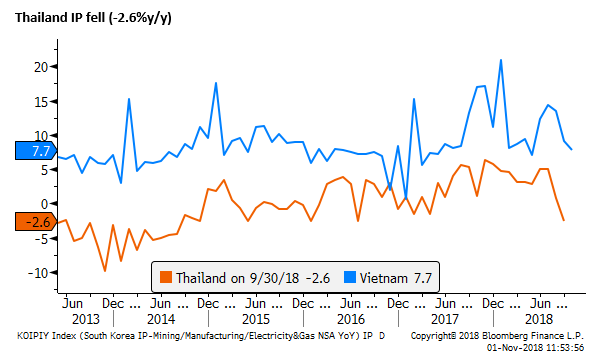

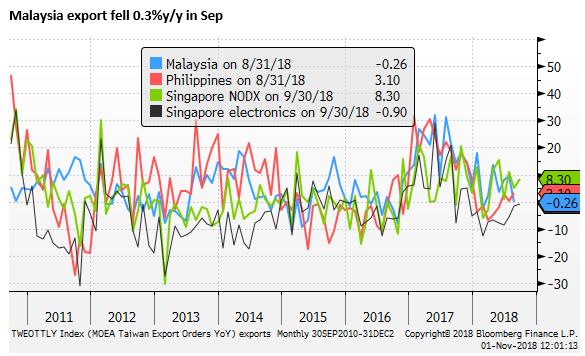

In September, Industrial production fell in Korea (-8.4%y/y) and Singapore (-0.2%y/y), and slowed in Taiwan (+1.5%y/y)

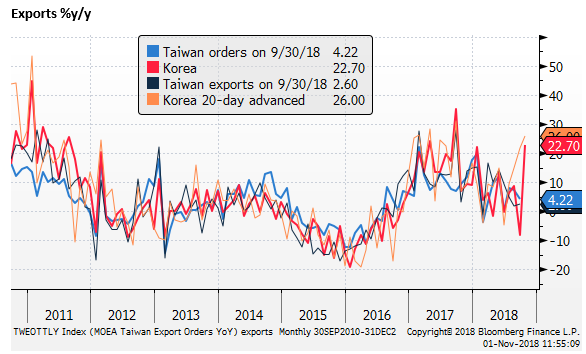

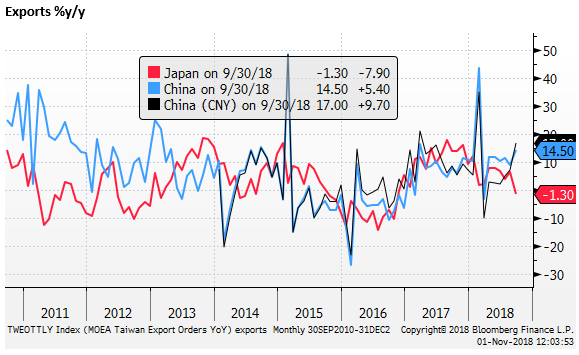

Exports rebounded in Korea in October (22.7%y/y) from a weak September (-8.2%y/y), but have trended down (averaging +8.1%y/y over three months, down from around 20%y/y in 2017). Taiwan export growth slowed to 2.6%y/y in Sep, around its weakest rate since 2016. Taiwan export orders slowed to 4.2%y/y in Sep

Japan’s exports fell 1.3%y/y in Sep, trending lower this year, in line with the Asian trend, although were dampened in Sep by disruption from a typhoon and earthquake in the month. The Chinese bounce in trade in Sep was probably a rush to get ahead of tariffs

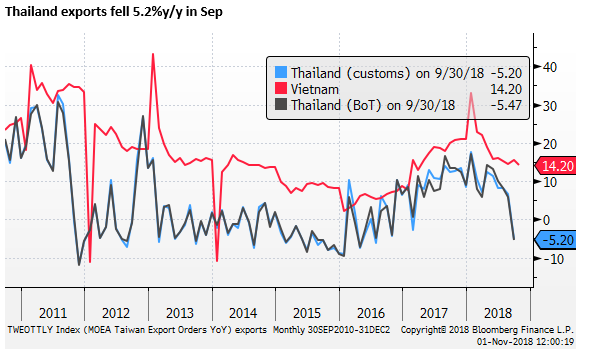

The slower growth indicators in Asia may reflect weaker global growth trends related to tariffs, financial stress in China, and weaker growth related to emerging market upheavals abroad.

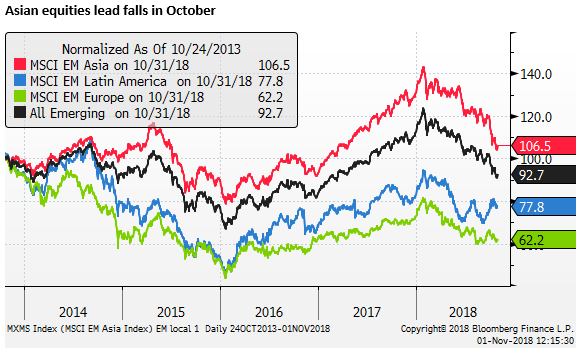

Asian equities have fallen more than other emerging markets in the last month suggesting that financial stress in China and tariff effects were undermining confidence in the region more than other regions

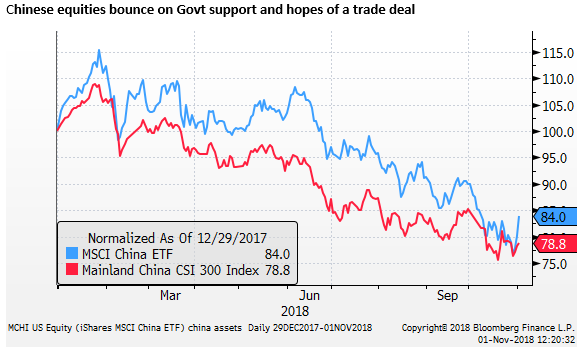

On Thursday, Chinese equities are mounting a sharp rebound. This has extended into the US market with the China MSCI ETF up over 5%.

This reflects recent efforts by the Chinese government to counter the negative equity sentiment and weaker activity reports by announcing a raft of measures designed to shore up private sector company finances, and fiscal policy measures including income tax cuts to take effect early next year. The Chinese government has announced that it will take further unspecified measures, raising expectations of more direct fiscal spending to shore up economic growth.

Global equities have rebounded in recent sessions, supported by Chinese actions and plans to underpin its growth. They also appear to be gaining traction on Thursday as US President Trump has raised hope of progress on a trade truce with China.

On Thursday, Trump tweeted, “Just had a long and very good conversation with President Xi Jinping of China. We talked about many subjects, with a heavy emphasis on Trade. Those discussions are moving along nicely with meetings being scheduled at the G-20 in Argentina. Also had good discussion on North Korea!”

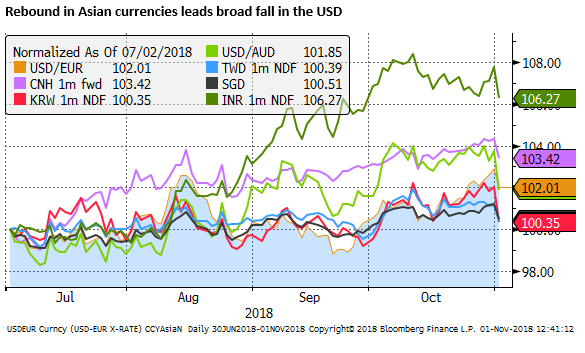

The USD has weakened broadly, and it appears that optimism on trade is a key element generating the rebound in CNY, and other Asian currencies. The USD had extended recently to highs for the year, and the reversal on Thursday, like the bounce in equities, may have been exaggerated by extended positioning and excessive bullish dollar sentiment.

There remains much uncertainty over the extent of Chinese policy measures to shore up growth, and how persistent will be the credit tightening that has arisen in China from its effort to clean up excesses in its financial system. It is also difficult to assess the direction of US trade policy towards China.

It is possible that we will see a sizeable further rebound in Asian currencies and equities in the short term. The unknown creates that space for a rebound it optimism.

China has succeeded before in arresting a slide in its economy related to regulatory efforts to clean up its financial system. Economic growth rebounded in 2017, arresting a downturn in 2015/2016. China is viewed as still having significant fiscal capacity to boost growth.

The market may view the sell-off in Chinese and Asian equities, and currencies this year as providing good value to re-enter the market, ignoring for the short term at least the still substantial risks that hang over the region related to US trade policy and broader Chinese efforts to clean up its financial system; including crimping down on shadow-finance and overly debt-burdened companies.