The USD has fallen in anticipation of a lower Fed rates path, but the outlook is not all bad

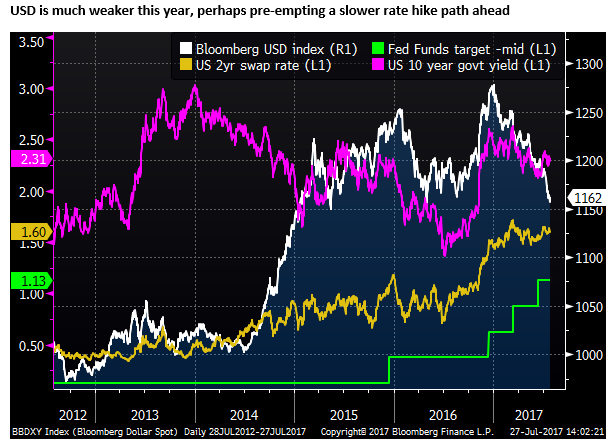

The USD has fallen further in recent weeks as the Fed indicated it is more concerned about low inflation outcomes. The shift in focus to QE balance sheet run down also points to a slower and more uncertain path of Fed rate rises over the coming year. The market still sees a 50% chance that the Fed hikes a third time by year end. However, it barely has one additional hike priced in for each of the next two years. The rates curve is already quite flat. The USD has fallen sharply this year and may already have factored in a more subdued outlook for US rate rises. The near term for the USD remains clouded by the approaching debt ceiling problem that is intertwined with budget and spending bills. The latest Trump machinations may also be increasing political uncertainty. However, consumer and business confidence remains elevated since the election, the most recent US economic indicators have improved, and the labor market continues to tighten. Political uncertainty has not significantly spilled over to weaker growth. These do not seem like great levels to consider selling the USD. We see scope for it to recover in the coming six to 12 months. However, it faces increased uncertainty in the next few months.

USD weaker on Fed’s inflation concerns

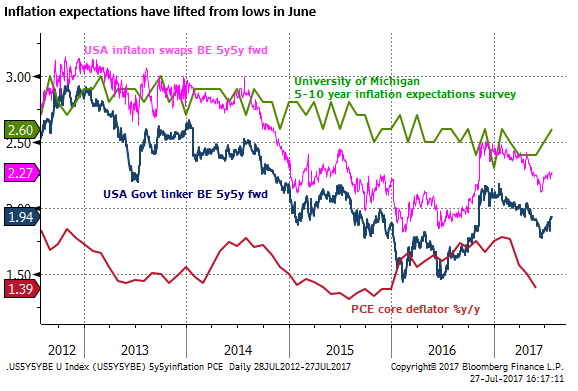

The USD has fallen further in the last month on weaker inflation, and Fed comments that it is something they are more concerned about. The FOMC statement this week added to this theme, but it started with the Yellen testimony to Congress on 12 July, more dovish speakers ahead of the FOMC, and the 4th weak CPI report in a row (June data) released on 14 July.

Phase two of Fed normalization also implies lower rates

The Fed has indicated that it plans to begin the run-down its balance sheet “relatively soon” suggesting that it has October in mind (the first full month after the 20 September FOMC meeting). But several Fed members have indicated that they see this policy slowing further rate hikes. As such, the outlook for US rate hikes has become more uncertain.

The June FOMC statements continued to forecast a third rate hike this year and three hikes per year over the next two years. However, Fed comments suggest that members are much less committed to further rate hikes. Fed speakers in the coming week will be closely watched for clues.

(Phase II of Fed Policy Normalization May See Bigger Dollar Fall, 18 July – AmpGFXcapital.com).

In Phase two of Fed policy normalization (where it is winding down its balance sheet), we should expect a lower path for rates.

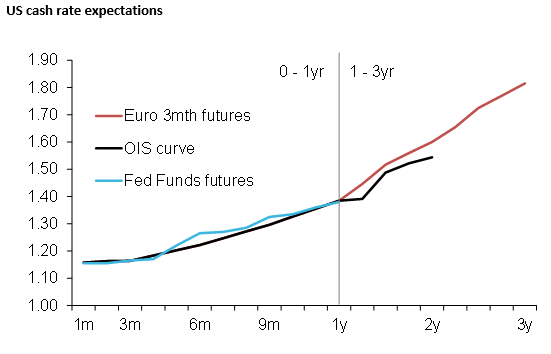

Fed rate curve very low next year

The OIS market is pricing in 4bp of hikes (16% chance of a 25bp hike) for the 20 September FOMC, and 12.8bp of hikes by the final meeting this year on 13 December. This is arguably still quite a lot, suggesting that the market is around 50% priced for the Fed to deliver on its forecast for a third hike this year.

However, beyond that, it is surprising to see how little in hikes are priced for 2018, the OIS curve only has one full 25bp of hikes priced into the curve by the June meeting next year. As such, it takes almost a full year from now before the market is fully priced for even one more rate hike, and the slow pace of hikes priced into markets for 2019/20 is also very low with bearly a hike priced into each year beyond this year.

The rates outlook for the rest of this year is balanced with half a hike in the curve. However for next year and beyond there are few rate hikes expected by the market which suggests that it is quite bearish on the capacity of the US economy to generate higher nominal growth, either via strong real growth or inflation.

The USD may have already adjusted down to reflect a modest rates outlook

There is a risk that the USD remains soft through the rest of this year, because the market is still clinging to hopes that the Fed will hike again before year-end. However, there is also scope for the US economy to out-perform what appears to be low expectations for rate hikes over the medium term. I wouldn’t be so cute to suggest that the USD Is likely to fall over the rest of this year and rally next. There are never clear answers.

The broader message is perhaps that rate expectations are relatively low over the medium term, consistent with the recent weakness in inflation, some more dovish Fed statements since June, and a shift to focus on balance sheet reduction. The market appears to have taken on this view and the USD is weaker as a result.

Pre-emptive USD fall

We might not expect an immediate turn around in the USD. However, it has been relatively pre-emptive in recent years in relation shifts in US monetary policy.

It rallied sharply in the second half of 2014 into Q1 2015, anticipating rate hikes in the US that did not begin until December 2015. It rallied to a peak in Dec/Jan 2016, pre-empting hikes this year in March and June. It has fallen more rapidly in recent months, perhaps pre-empting a shift in focus to balance sheet reduction.

There are of course other factors that may account for a weaker USD this year (such as US political uncertainty & stronger economic growth abroad). Nevertheless, the low rates outlook in the USA suggests that the weaker USD this year may have already built a relatively modest outlook for the US economy and slower moving Fed rates policy.

Political risk hangs over the USD but is hard to quantify

US politics remain a significant disappointment from the high hopes early in the year. It is possible that the latest machinations at the White House are raising political risk and undermining the USD. This includes intense pressure on Attorney General Sessions to resign, related suggestions that the President is trying to be rid of special counsel Mueller, the outing of Spicer, a new communications director, Scaramucci, pressure on Chief of Staff Priebus to resign. Trump has reverted to misdirecting the media by tweeting about alleged wrong-doings of the Clintons and on transgender recruitment in the military. From what it is not clear, but the investigations related to Russia appear to be troubling the presidency.

The market is no longer as shocked by the unusual workings at the White House, but it does appear that the administration is increasingly ‘off the reservation’ and it may be disrupting Republican efforts in Congress to make progress on its agenda.

Prospects for significant tax reform have been diminished and pushed out. In the meantime, the debt ceiling will need to be raised soon. Budget planning and spending bills to cover the period beyond September are all meshed in with the debt ceiling negotiations. A failure to move the health care bill to a successful conclusion further adds uncertainty to this process.

The debt ceiling approach may keep the USD weak until resolved, probably through to some time in October. This also interferes with the Fed’s start date for its balance sheet wind-down.

Political uncertainty has not clearly harmed the economy

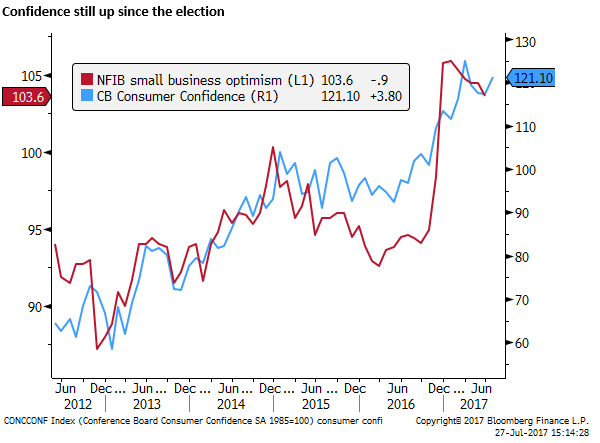

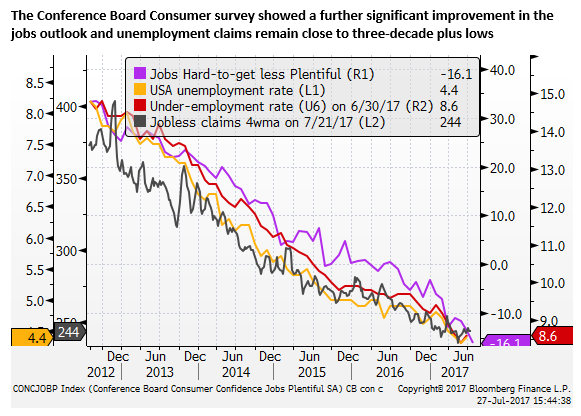

Some indicators, such as the rebound in Conference Board Consumer confidence data suggest that the political uncertainty in not having much impact on the economy. The US stock market also continues to power ahead.

While overall polls suggest that Trump’s popularity has waned to the lowest level for a President in his first year, the polls are not disastrous, and he maintains a high approval rating among his core supporter base. His core base may even like the fact that he has proven to be an unconventional President.

Economic activity has remained in a moderate path and employment growth continues. Trump has used executive orders to reduce regulation, he has cajoled some foreign investment, and small business confidence remains more elevated since the election. He has not done any obvious harm to the economy, and he has and will argue that stronger equities, high levels of confidence and job growth reflect his presidency.

The Myth of Trump’s Do-Nothing Presidency, by Greg Ip – WSJ.com

US Economic performance stabilizing

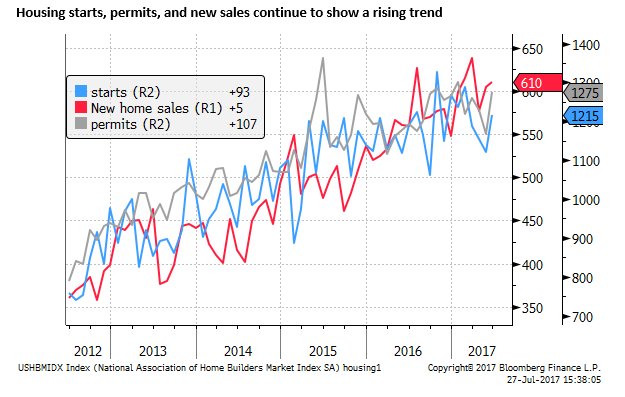

While in the last few weeks the market may have been focusing on the shifting tone of the Fed and political uncertainty, activity indicators in the US suggest that the economy may have stabilized and growing sufficiently to keep tightening the labor market.

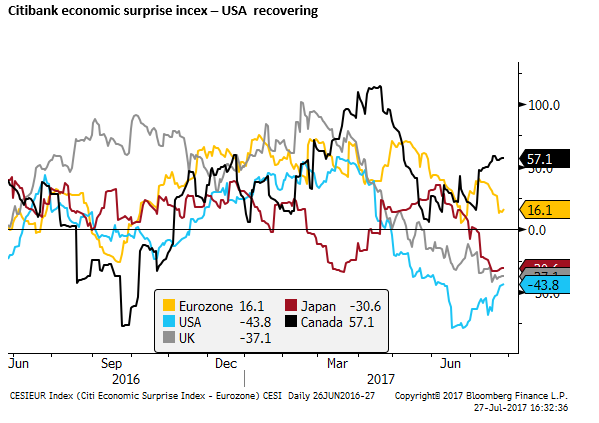

The Citibank USA Economic Surprise Index has recovered from a near record low -79% in June to -44%; as more recent data points meet or exceed expectations, ending the consistent underwhelming trend in much of the first half of the year.

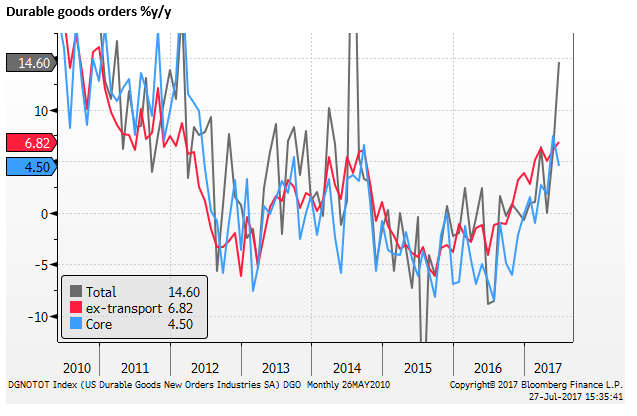

More recent manufacturing surveys have stabilised or firmed. Durable goods orders released on Thursday show an improving growth trend.

The US economy remains closer to full-employment than most other economies, and this yet may prove to raise the inflation outlook over coming months. Obviously how wages evolves remains a key piece to the puzzle.

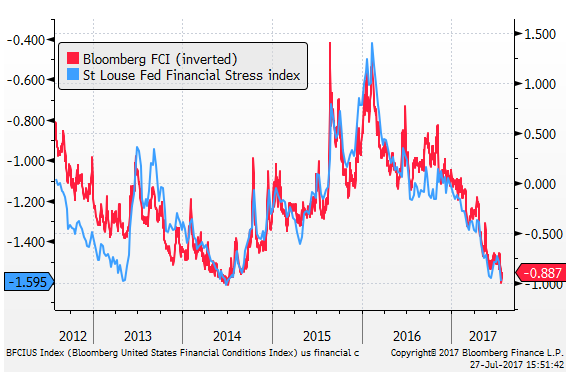

Financial conditions have eased further

A factor that may also keep the Fed pushing cautiously ahead with rate rises is easing financial conditions. This was a key consideration in the June FOMC decision to ignore low inflation and push on with rate hikes. Financial conditions have eased further since then. As such, arguably monetary conditions have not been tightened much, despite the rate rises in the last year.