Time for the USD to fight-back

There is a significant degree of USD weakness that has been unrelated to the relative improvement in its yield advantage, whether that be short or long term yields, real or nominal. This has made it hard to predict USD exchange rates, generating uncertainty and a pervasive bearishness towards the USD that is hard to shake. However, we may have got to a point where the USD has become so significantly stretched from yield spreads that it is resisting further depreciation. Furthermore, US economic activity and inflation risks have accelerated compared to most other countries.

Weaker dollar background

More typically, developed FX markets react relatively tightly to yield development, whereas the impact of bigger picture fundamentals are slow burner issues that have a less immediate impact on currencies. They tend to be background factors that might accentuate or dampen the market reaction to interest rate developments. However, in recent months, it feels like background fundamentals – fiscal and external balance – are playing a more important role in driving the USD exchange rates.

The weaker USD trend in the last year can be explained by a recovery in sentiment towards emerging market assets. And European and Japanese assets as they respond more positively to their extreme monetary policy setting involving both asset purchases and negative interest rates.

Capital that had moved to the US as it became the first major economy to begin policy tightening (2014/2016) and fear over political and financial stresses in BRIC economies was elevated, has been moving back out of the USA since around mid-2016.

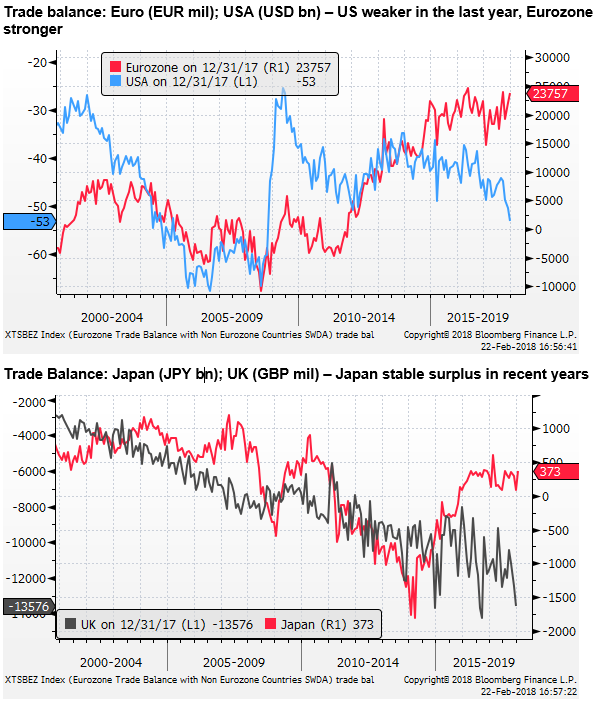

This might be regarded as a period of normalization in capital flows as the global economy appears more robust. The external position in a number of other countries has improved over recent years, in contrast to deterioration in the USA external balance, contributing to the notion that capital inflow to EM and Europe and Japan are supporting their currencies.

In our report on 31-Jan (Bond yields in driver’s seat; time for correction in equities and the USD; 31-Jan – AmpGFXcapital.com) we noted that the USD had become more tightly (negatively) correlated with the steady, strong synchronized rally in global equity markets. And that a period of volatility in global equity markets, perhaps triggered by a rise in US and global bond yields, might see a period of recovery in the USD, allowing it to reconnect to some extent with its wider yield advantage.

In the recent correction and more volatile equity markets in February, the USD has been stronger, although still rather mixed, and not as strong as we thought it might have been.

The equity market shake-out has not been so severe to significantly change investor attitudes. Underlying demand for emerging market and indeed global equities remains robust. And sentiment towards the USD remains challenged.

However, we may have got to a point where the USD has become so significantly stretched from yield spreads that it is resisting further depreciation.

EUR yield disadvantage increases and broadens

The 2yr EUR/USD yield spread is more negative than at any time since 1999, and yet the EUR/USD has risen since a low point in December 2016, to be now above its long-run average against the USD (around 1.20).

The chart below illustrates the degree of divergence in EUR/USD from both short and long-term yield spreads on a long-term scale. There have been lengthy periods where the exchange rate has diverged from yield spreads. These are shown by the green boxes.

Honing in a little closer, to the last five years, we can see that the EUR/USD had appeared to pay more attention to the 10-year bond yield spread (US less German government bonds) since 2015. However, this broke-down noticeably from around November last year.

Honing in a little closer again, to the last year, there was some suggestion that the strength in the EUR/USD might be related to a real long-term yield spread. From mid-Dec up to early-Feb the real yield 10-year yield spread firmed in favour of the EUR/USD. However, the more recent trend has been towards a lower real yield spread that might argue for a weaker EUR.

EUR and equities

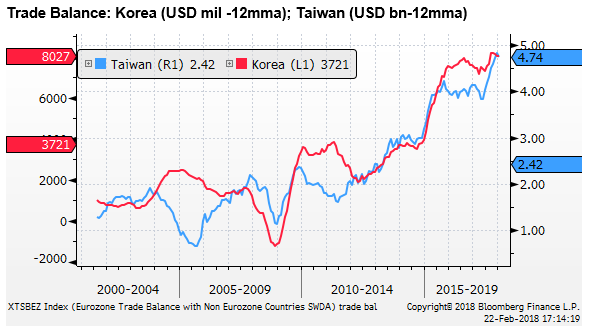

The rise in the EUR in the last year has to some extent matched the rise in global equity markets. The peak in early-Feb, dip to a low on 8-Feb, and subsequent volatility has tended to match the recent gyrations in equities. However, EUR has been relatively stable in this period of equity volatility.

If equity flows have been an important driver of the EUR gains in the last year, we might expect the greater uncertainty and volatility in equity markets, as they react to higher bond yields, to dampen inflows to the EUR; increasing the risk of a deeper correction in EUR.

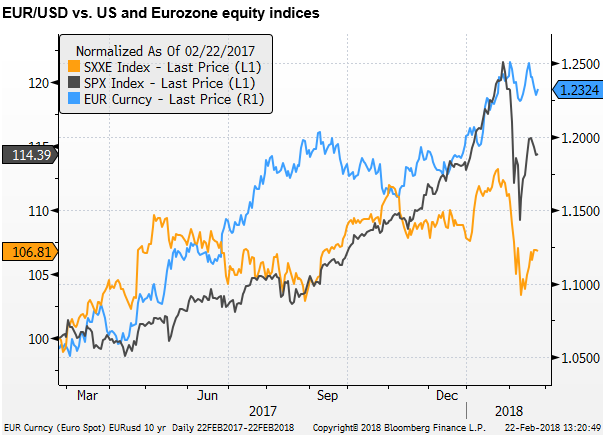

Eurozone economic momentum ebbs, USA accelerates

The strength in the EUR over the last year is consistent with the resilience of the Eurozone economic recovery; that has out-performed expectations and defied the dampening impact from the strength in the EUR.

However, the most recent data shows some peaking in the pace of the recovery, at the same time that the US expansion appears to have picked up its pace.

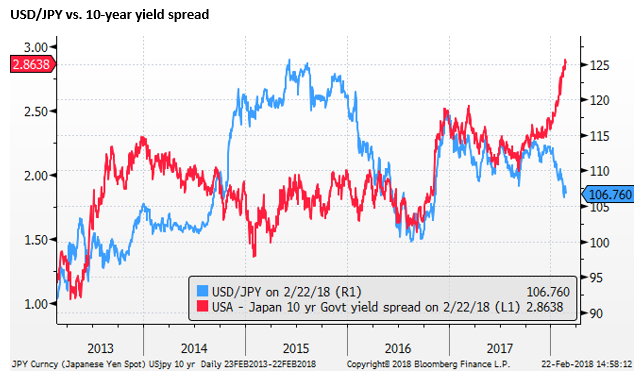

JPY strength confounds experience

The correlation between USD/JPY and the 10-year yield spread became quite tight from around mid-2016 to around October last year. However, the two diverged sharply from around mid-December.

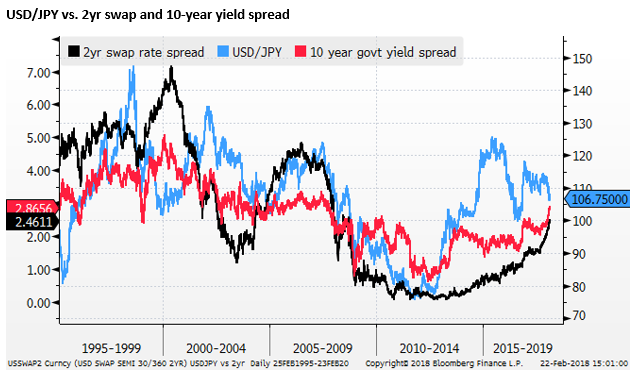

The USD/JPY short and long-term yield spreads have risen to highs since 2007/08. Even without the quantitative policy measures in the post-crisis era, taking a long-term view, the current more elevated yield spreads might support the current levels of the USD/JPY. Adding in the fact that the BoJ is still some way from considering reversing its world-leading QE policy, JPY could justifiably be much weaker.

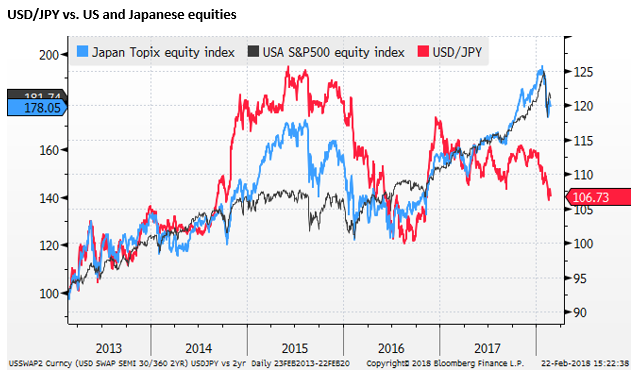

JPY strength independent of equities

Another interesting feature of the JPY action in the last year is that it became more independent of equities. Over much of the BoJ QE era since 2013, Japanese equities and the JPY have behaved like two-sides of the same coin, highly negatively correlated.

However, in the last year, Japanese equities rallied solidly alongside global equities, while USD/JPY remained largely range bound. In January this year, the USD/JPY fell (JPY strengthened) as Japanese equities rose to new highs since 1991, more clearly breaking the nexus between strong Japanese equities and a weak JPY.

It appeared that investors were more confident that BoJ policy was working and were looking ahead to a time where it might be withdrawn, despite the assurances from the BoJ that it was not contemplating any retreat of its QE/yield control policy.

JPY has it both ways

During the most recent equity market correction in early-Feb, JPY has strengthened retaining its tendency to act as a safe haven currency.

Many analysts have turned bullish on the JPY, seeing it benefiting from strong global growth and strong global equity markets, but still acting as a safe-haven and rising when equities correct lower.

Furthermore, it has shown little reaction to a rising yield disadvantage. Some may be wondering what is left to potential reverse recent gains in the JPY.

In past times, notably before the 2007/08 financial crisis, the JPY acted as a funding currency for global investment. Japanese and foreign investors would borrow JPY at low-interest rates to enhance the carry/yield on higher-yielding foreign bonds and assets. Such thoughts do not appear to be playing a role in the current market.

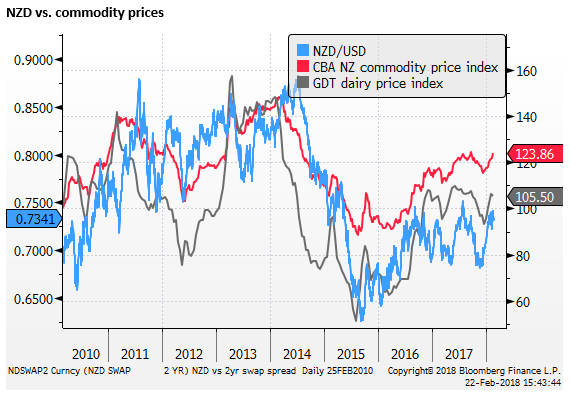

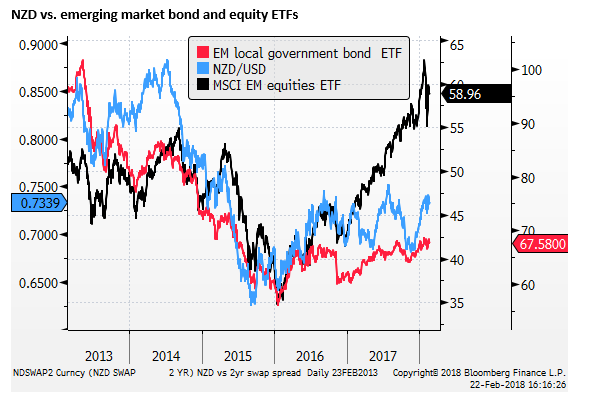

NZD loses its yield premium

The NZD has typically been viewed as a high yielding currency, relying on a yield premium to support the exchange rate, and fund a current account deficit and sustain a relatively high level of foreign debt. In this vein, it has historically been highly sensitive to degrees of global risk appetite.

NZD/USD hasn’t necessarily been highly correlated to its yield spread, but a significantly positive spread has been a key feature of the currency. That yield spread has now disappeared. The 2yr swap rate spread is at a record low -33bp, and the 10-year bond spread is a negligible +4bp.

Despite this lack of yield, the NZD is well above its long-run average levels.

Factors that might help explain the strength in the NZD is firmer commodity prices, supported in part by a weaker USD and stronger global recovery.

Even though it is no longer a high-yielder, the NZD has still retained a risk-sensitive nature, retreating recently with the correction in global equities, although in a modest, mild fashion.

Volatility has increased in global equity markets. However, the rising trend over the last year has not been broken, and emerging market yield spreads remain at relatively tight levels.

New Zealand has achieved a fiscal surplus, and its current account deficit has narrowed to less than 2% of GDP. This might help account for the NZD sustained strength against the USD recently.

However, New Zealand retains a high degree of household debt (168% of disposable income) and net foreign liabilities 58% of GDP (albeit down significantly from a peak of 85% in 2009).

New Zealand’s net foreign liabilities: What lies beneath, and ahead?; Jul-2017 – RBNZ.govt.nz

Household Debt Sees Quiet Boom Across the Globe – WSJ.com

In a rising global interest rate environment, these debt levels generate significant risks, pointing to higher potential funding costs that may both weaken the external balance and undermine household finances. As such, the market should probably still expect to earn a significant risk premium for holding NZD exposure.

The NZD should still be vulnerable to rising global yields, especially when its yield advantage is gone. The real kicker may be if rising global yields begin to spill over the wider risk premiums in global credit markets. Nevertheless, it is surprising to see how stable the NZD has been recently.

AUD/NZD expensive

The NZD also appears elevated compared to its historical relationship with the AUD. While New Zealand has achieved more than Australia in returning to fiscal surplus, both countries have similar external balance and have similar outlooks for economic conditions and interest rates and external balance.