Bond yields in driver’s seat; time for correction in equities and the USD

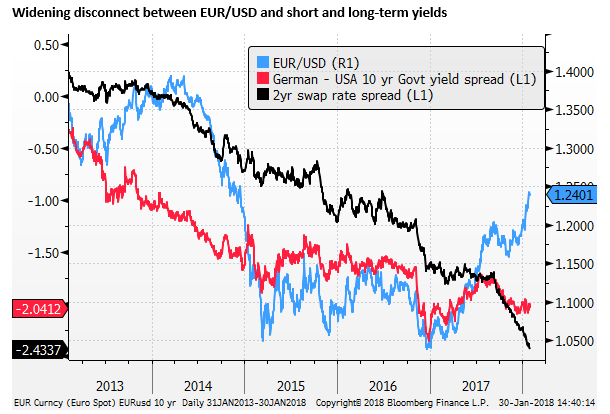

The rise in bond yields may have moved into a phase which is self-sustaining, at least for a while, triggering a period of volatility and consolidation in global equities, if not a more significant correction. The fall in the USD over the last year has appeared increasingly correlated with rising global equities, diverging significantly from its improving yield advantage. A period of volatility in global equities may refocus attention back on yield spreads and contribute to a period of recovery in the USD. The EUR may now be over-bought and near long-term technical resistance. Some easing in Eurozone inflation expectations may further contribute to a corrective fall in the EUR from its highs since 2014.

Waiting out the USD decline

We decided not to get involved with a short USD position so far this year. Moves in January are often head-fakes for the rest of the year. The prospect of fiscal expansion in the US at this juncture in the cycle was already pushing up the USD yield advantage and might continue to do so. This made it hard to want to sell the USD, even if it had been diverging from its yield advantage for some time.

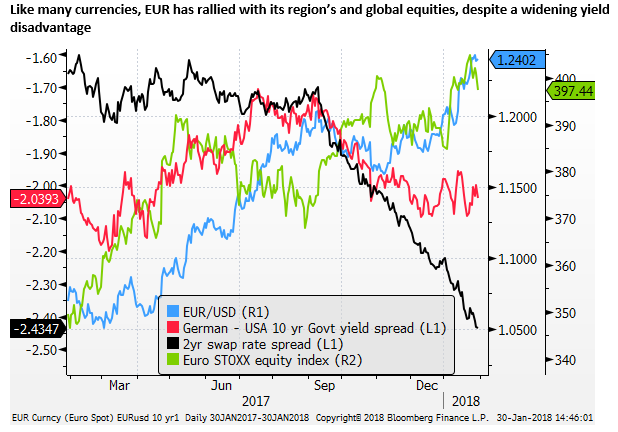

Perhaps too belatedly, we could see that stronger synchronised global growth indicators were driving investors to focus on global equity investment, and these flows were dominating FX markets. We wrote about our USD views recently in the following reports

Stable genius or dumb luck, Trump gets a weak dollar; 24-Jan – AmpGFXcapital.com

The white trashing of the US dollar; 16_Jan – AmpGFXcapital.com

Forget bitcoin; the real bubble is global equities; 19 Dec – AmpGFXcapital.com

Complacency in global bond markets

Instead of selling the USD at this juncture, after it had already fallen significantly in the last year, we decided instead to sell US Treasury bonds, seeing a weaker USD adding to already significant reasons for higher yields in the US.

Multiple upside risks for US bond yields; 18-Jan – AmpGFXcapital.com

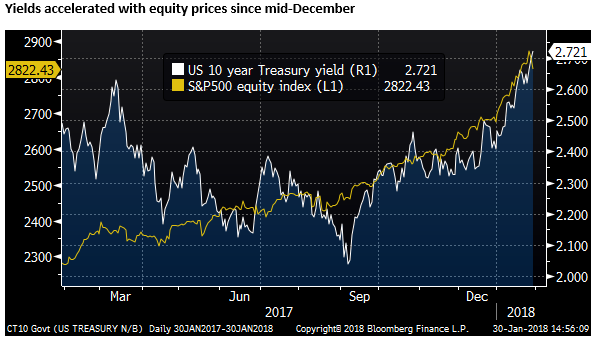

One of the reasons we sold US Treasuries was a sense that the market was very complacent about the prospect of higher yields. There were more analysts than not saying yields will probably go up this year, but most thought the rise would be limited. Most forecasts were for US yields to rise little more than 20bp in the year towards 2.7% or so.

This view, we thought, was a case of investors expressing their preference for an ongoing rally in global equities and a weaker USD. Their main investment was in equities and non-dollar currencies. They were happy to see modest upward pressure on yields, but didn’t have much risk in the government bond market.

Our view has been that yields would rise at least modestly; dragged up by rising global asset prices, diminishing output gaps, easing financial conditions that central banks would need to lean against, and a slowing in the pace of QE. The upside kicker for yields might be that nascent inflation pressure may come to the foreground. In the US this could be brought on by a weaker USD adding to inflation pressure.

Bond yields in the driver’s seat

This view relied initially on equities remaining in the driver’s seat. As equities rose and the USD fell, the fundamental pressure for US yields to rise would increase.

The rise in yields did indeed pick up pace with the accelerated rally in global equities. However, yields have already risen as much as many investors were anticipating for the year as a whole. It has been a little fast for their liking, and it may now be causing a few nerves in the equity market.

It appears to us that we are moving into a phase, albeit potentially a relatively short one, where bond yields are in the driver’s seat. Yields are tending to rise in recent days even as equities have fallen.

Higher bond yields appear to be now driving a correction in global equities. After the surge in equities in the new year, adding to an already strong 2017, they could fall significantly further before causing much negative feedback on bond yields.

Equity investors, in the first instance of a stock market correction, are likely to view it as a healthy consolidation, rather than a reason to fear global economic consequences that might dampen the rebound in bond yields.

They may also begin to see the rise in yields as a readjustment to their already optimistic views for the global economy and shift in global monetary policy direction. As such, we could see a period of global market correction where yields rise, and equity markets move into a choppy corrective phase.

Corrective phase to spread to the USD

If the USD has ignored rising US yields because of a low-vol rise in global equities, then a period of equity market correction and volatility could refocus market attention back on the already higher USD yield advantage, contributing to a period of recovery in the USD.

Considering that the fall in the USD has been correlated with rising global equity markets, the USD too could move into a corrective phase, in conjunction with equities. If bond yields rising faster in the USA, this could further support the USD.

All the good news is priced-in to the EUR

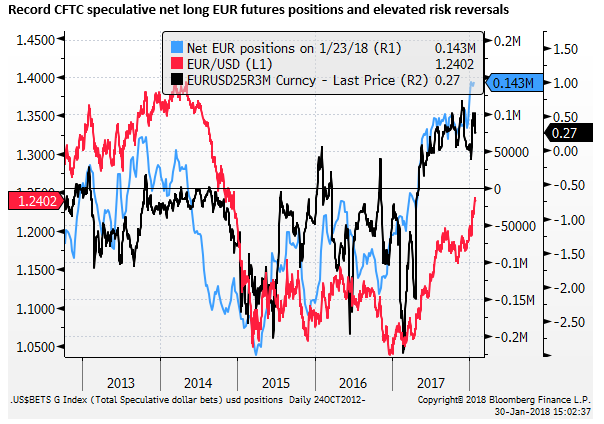

Nowhere does the market appear more bullish and structurally long against the USD than the EUR. The market has bought the EUR due to the strong recovery in the Eurozone, increasing speculation that the ECB will end its QE in September this year, and be in a position to raise rates (albeit from -0.4% to something less negative) by the end of 2018.

Relative political stability and a higher current account surplus (3.2% of GDP), has further contributed to a rebound in the EUR from a low in January 2016 of 1.05 to a recent high near 1.25.

However, we may be close to the point where the EUR has factored-in the end of QE. We may also be now approaching a point where the EUR has risen so far in a relatively short space of time that is will delay the return to the ECB’s inflation target beyond further beyond their forecast horizon.

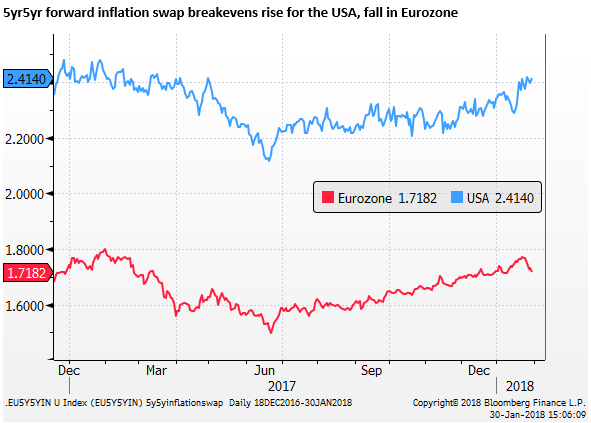

Eurozone inflation expectations ease

In the last week, 5yr-5yr forward inflation swap breakevens have fallen in the Eurozone, while they have risen in the US; suggesting that the strength in the EUR may be meaningfully capping long-term inflation expectations in the Eurozone, while they are rising in the USA.

In which case, notwithstanding the probability that QE ends in September, rates may be held low for a more prolonged period.

Furthermore, Germany reported a lower than expected January preliminary inflation outcome; slipping to 1.4%y/y from 1.6%y/y, below 1.6% expected for the EU harmonized measure. This suggests that the Eurozone inflation data due on Wednesday may also be softer than expected.

Long-term technical and psychological resistance

The EUR recently touched 1.25, a psychological resistance. It is also around its long-run average real effective rate, and near the lows of its range from 2005 to 2014. It has retraced to around the 61.8% Fibonacci level of its fall from 2014 to 2016 driven by its NIRP/QE policy.

Technical resistance, evidence of long positioning, the stretch from yield spreads, evidence that inflation in the Eurozone may be held back by EUR strength, and the potential for a corrective phase in global equities suggests that the EUR may be vulnerable to a correction of its own.