The white trashing of the US dollar

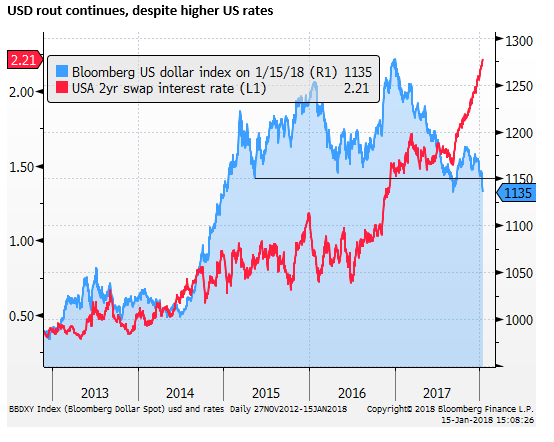

The US dollar rout of 2017 has so far continued into 2018, despite a rising US interest rate advantage and tax reform that should help power the US economy. The dollar looks to be in a bear market and will not easily regain its mojo. Perhaps it’s better to consider the broader implications of a weak USD despite a strengthening US economy embarking on fiscal expansion late in its economic expansion cycle. Trump’s ‘America First’ agenda might have taken a much more acceptable path, based on a valid premise that the USA needed to do more to look after its own, but it is tightly entwined in a much more sinister sense of racism and broader lack of respect for any other country or global challenges. The USA risks being increasingly sidelined by global leaders, diminishing the value of its assets to global investors. Cryptocurrencies are holding up well against a regulatory onslaught that may backfire.

USD rout continues

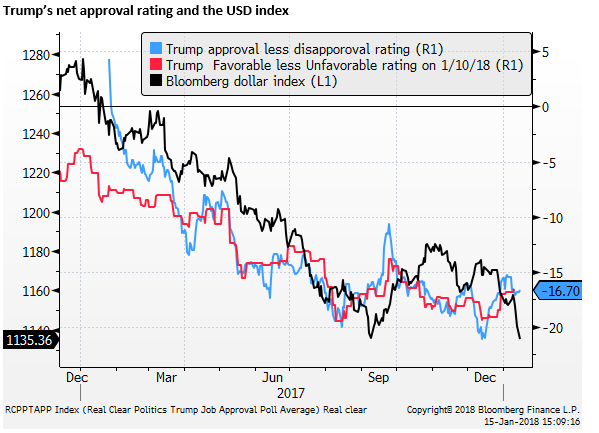

The USD rout of 2017 has reasserted in 2018. I discussed my thoughts on the dollar in my last post last year (Forget bitcoin; the real bubble is global equities; 19 December – AmpGFXcapital.com). The dollar slide reflects the chatter about QE unwind potential in Europe and Japan, and confidence in EM markets reflecting an outlook for sustained synchronized and more solid global growth. And it may also reflect the US political climate; including a diminishing status of the US as a global leader in socioeconomic and geopolitical issues.

Trashing of America

This diminishing status may have accelerated under the Trump presidency. Every time he tweets or makes some gobsmackingly insensitive statement that status slips further. The optimists might argue it’s surely only three more years before sense prevails in America, but the fact is that America voted him in, and a large minority of business and community leaders feel working with him is justified by the shift towards more mercantilist economic policies, like corporate tax cuts.

Alternatively, many business and community leaders are inherently bigoted, and indeed the fact is that large sections of the community are easily coaxed towards bigoted thoughts. The white supremacists hear the dog whistle loud and clear, and many in the community fail to feel the history of Nazi Germany and are willing to put up with, and even like, a bit of trash talk. The rest of society and much of the world is appalled and shocked, and a wide wedge is being driven into American society.

Trump’s ‘America First’ agenda might have taken a much more acceptable path, based on a valid premise that the USA needed to do more to look after its own, but it is tightly entwined in a much more sinister sense of racism and broader lack of respect for any other country or global challenges. Instead of realigning global relationships to the advantage of the USA, Trump’s ‘America First’ is increasingly sidelining the USA and making it seem less relevant for the global economy. In doing so, it diminishes the long-held respect, albeit sometimes begrudgingly, that other countries have for the USA, diminishing the value of its assets; including the USD. That respect will not be easily restored; once lost, it is much harder to rebuild.

Dysfunctional government and rolling shut-down threats

Without the veneer of respectability in the White House and for Government institutions over which the administration influences, the dysfunction of Congress is laid bare for the world to see. Many investors may be wondering why that had so much faith in US democracy in the first place. Sure Congress managed to pass a tax bill, but only via blowing a big hole in the budget deficit, and it continues to fail on virtually every other major policy decision. Every few months is punctuated by another threat of government shutdown. Again a new deadline looms for Friday, and a toxic mix of immigration policy tradeoffs for border security funding is set to throw a spotlight on the lack of consistent policy direction, and simple capacity to assure that government departments will remain funded.

On shutdown and DACA fix, more questions than answers – CNN.com

The four big fights Trump and Congress must resolve to avert a government shutdown – USAToday.com

And into the heady mix of a belligerent white-trash presidency, polarized society, and dysfunctional bipartisan Congress, the mid-term elections are slated for this year. Is this the country you want to invest in when the rest of the world is exhibiting more synchronized growth?

USD bear market

Is this all just too melodramatic? Will the US economy power up, boosted by tax reform, and attract a higher share of global investment? How important is the chaos in US politics to economic and investor trends? I don’t know the answer to these questions, and it is difficult to have faith in any of the explanations for a weaker USD, but it does seem to respond negatively to Trump’s twitter feed.

It is hard to say if the USD should continue to fall against the grain of the rising trend in US interest rate advantage against most other currencies, or the prospect of repatriation of a large amount of offshore retained earnings by America companies to take advantage of a one-time tax break.

It might be better just to accept that this is a bear market for the USD. It will not easily regain its mojo. It may now be late and dangerous to start selling the USD, so instead consider what are the consequences of a weak USD despite a strengthening US economy embarking on fiscal expansion late in its economic expansion cycle. I have my eye on rising US bond yields, more on that in my next post.

Crypto attack

Cryptocurrencies are under attack from several countries regulators (China, Korea, Indonesia) and persistent verbal attacks and derision; arguably an attempt by ‘the establishment’ to discredit them. This may be causing some position squaring by speculators and a correction in prices. And it is a setback for investors that are anticipating a move into mainstream finance for cryptos.

However, these attacks serve to bolster the very argument for investing in digital currencies. The more that nations show their fear of cryptocurrencies, the more reason investors have for doubting the creditworthiness of these countries own currencies. Regulatory restrictions are often dressed up to protect investors but smack of fear of competition from alternative assets outside regulatory control, reducing these countries’ capacity to extract income from their own countries assets, via captive investors, including seigniorage from inflation, taxation, and lower interest rate expenses.

Bitcoin is, so far, holding up against the government attempts to shut it down. The longer it prevails, the more it will appear to have a future as a credible store of value asset.