Trump presses his advantage against China; CNY drags down Asian currencies

CNY falls sharply illustrating that China bears most of the fallout from the trade war. The US economy also suffers, mostly from the risk that China boycotts US brands, but Trump may have a significant advantage. Bilateral US tariff policy may be an effective policy to counter China’s policy of subsidizing and regulatory support of its industry. Trump can see a political gain from the trade war and is unlikely to easily back down. The escalation in the dispute is likely to more permanently dampen optimism that the global economy will soon rebound from its slowdown. Downward pressure on CNY is dragging down Asian currencies, although in the long run, production may shift to other Asian nations and support their currencies. The AUD is dragged down both as an Asian currency and a commodity currency. The EUR stabilizes, even though the EU economy is threatened, for the same reason JPY gains – little room for yields to fall, current account surplus, a reduction in carry trades. Safe-haven currencies gain against a weakened USD; including bitcoin.

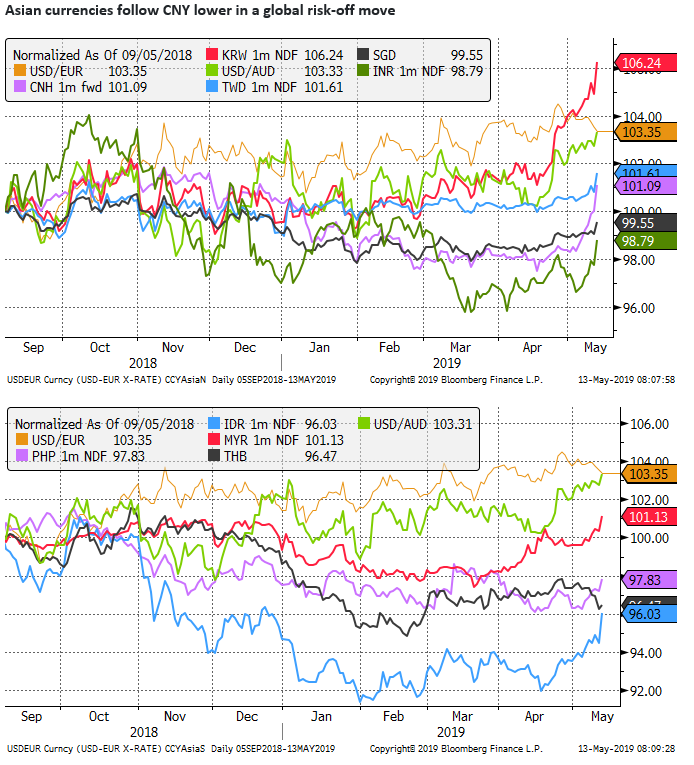

CNY leads deep fall in Asian currencies

The moves today are significant, some dramatic, as the market responds to the escalation of the US-China trade dispute.

The CNY has fallen rapidly in recent sessions, and it is dragging down Asia region currencies across the board. The higher risk more volatile IDR and INR have fallen the most, the more flexible KRW has also fallen more than CNY so far. But the slide in CNY is very large (over 1%) in the context of the more tightly managed currency. It is down around 2.5% in the last two weeks as the trade tension has ramped up.

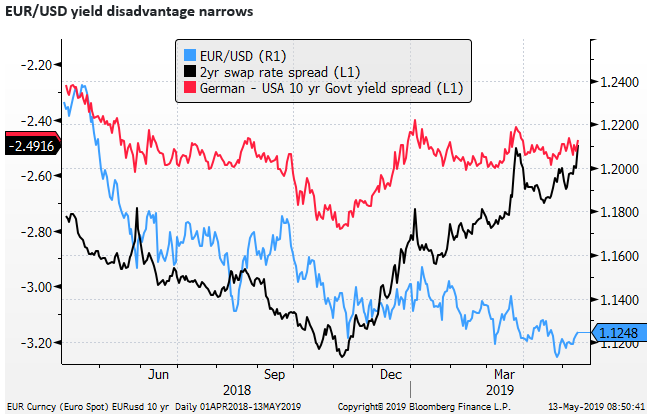

EUR stabilizes as trade dispute undermines the USD

It is interesting to see the EUR firm in the last week as the trade tensions have ramped up. This is helping insulate other European currencies.

The trade tensions do not bode well for the EU. A weaker Chinese economy would undermine EU exports. The EU is not a big part of the supply chain in Asia, so it is unlikely to pick up a diversion in activity in manufacturing from China that might arise from tariffs. The Trump administration has the EU in its sights over what it sees as unfair trade, and the US-China dispute suggests that it may at some point play hard-ball with the EU.

However, the Eurozone still has a large current account surplus, and there is little scope for Eurozone yields to fall. In times of global risk aversion, yields fall, and they fall most where there is scope for them to fall. As such, US yields have fallen faster than in low yield countries like Japan and the Eurozone; this is tending to weaken the USD against low-yielding major currencies.

The other aspect is that earlier in the year, several analysts were advocating the use of EUR as a funding currency for high-beta and higher yielding investments. As such, with global asset prices under pressure, the EUR may benefit from squaring in this type of ‘risk-on’ trades.

The US-China trade dispute also poses direct risks for the US economy. China may not have the same direct power to hurt the US with its own tariffs, but it has some power, and its tariffs on the USA will undermine confidence to some extent.

Furthermore, the risk is high that Chinese consumers are encouraged by the state-controlled Chinese media to boycott US products, even those produced outside the USA.

China has shown that it can disrupt commerce for foreign brands in its own country during political disputes. This poses a specific threat to US companies and US equities.

The US equity market has often proved more resilient than other countries’ equities over the last two years, but in recent sessions it has led falls in major equity markets, reflecting concern that the trade dispute is a specific threat to US companies. And this is increasing downward pressure on US yields.

The risk aversion has not spread significantly to periphery sovereign risk in the Eurozone. There is little additional fear that the US-China trade dispute will lead to economic and political stress on the Euro-system.

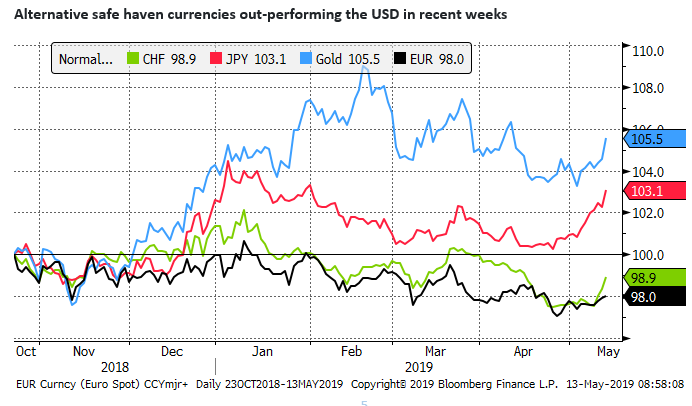

Safe-haven currencies (Gold, JPY and CHF) lead gains

The JPY is also strengthening. More recognized as a safe-haven currency, but largely for the same reasons that EUR may be firming – lower rate bound, current account surplus, squaring of carry trades and repatriation.

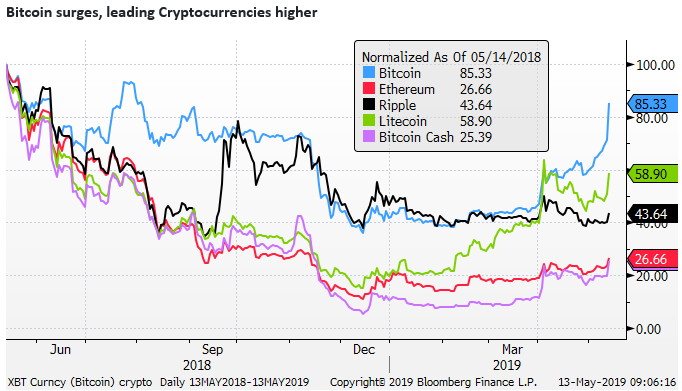

Bitcoin the leading crypto store of value soars

Bitcoin has returned to favour over recent months. It is arguably getting a further boost from the trade dispute. It is still a highly speculative instrument, and it has the capacity to move very sharply on minimal shifts in flow, reflecting a lack of liquidity. Nevertheless, the sharp fall in Asian currencies, where Bitcoin has greater acceptance, is likely to be adding to the recent upward pressure for Bitcoin. It has broken decisively above its consolidation range through the Mar-Nov last year; up over 20%. Bitcoin has led gains in recent months over alternative cryptocurrencies. This reflects its place as the clearest store of value with a fixed supply.

AUD hit as both an Asian proxy and commodity currency

The escalation of the trade dispute is dampening global growth expectations. The risk-off mood is impacting industrial commodity prices. Copper is down 2%, adding to falls over the last week. Copper producer Chile has seen the biggest fall in its currency among the American currencies.

Wages and labour data this week pose an additional downside risk for the AU this week. Any hint of softening will intensify speculation that the RBA will cut rates in coming meetings.

The Trade dispute threatens to prolong and deepen the global economic slowdown

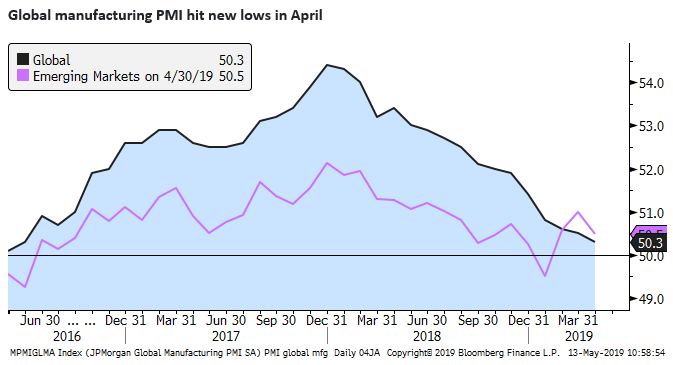

Global industrial production and trade data remained depressed in Q1, and the most recent global PMI data were generally softer in April. The equity market had rebounded this year despite the softer economic data, building in some expectation that the trade disputes would be resolved and monetary and other stimulus in China would generate a recovery in the global economy later in the year.

The risk is high that global economic activity will remain softer for longer, and possibly weaken further in the near term. The trade dispute appears to have weakened global business investment due to uncertainty; this is likely to remain a drag on the global economy, global equities and commodity prices, and emerging market and commodity currencies.

Trade deal optimism unlikely to quickly recover

The market may look to the 28/29 June G20 summit and a possible meeting of Trump and Xi to reset trade relations. However, this will only give the business sector more reason to sit on its hands for the time being.

The Trump administration appears to have significantly hardened its position and seems unlikely to give ground on its push for China to take specific legal measures and verifiable changes in its industrial policy.

The Trump tweets suggest that he can see a political advantage over the Democratic party by pressing the trade issue with China. Furthermore, it appears to be a core Trump policy, one that he will not easily draw back from.

It is possible that China will make sufficient concessions to allow a trade deal to be struck in the coming weeks or months. But the failure of the deal last week suggests that China is resistant to taking policy measures that seem to be a reversal of its core strategic industrial policy.

It remains difficult to predict the outcome of these trade talks. But the deal failure last week, the ramping up of punitive tariffs by the US, and retaliation by China, highlights that the risks have shifted to a larger rift.

The market might show relief if both sides creep back towards an agreement. However, the market is likely to be more permanently damaged the longer this trade dispute drags on. It will doubt the durability of any deal that may be struck in future.

Trump may be right

The calculation by Trump is that China has significantly more to lose than the USA in a trade war, and this advantage will eventually force China to concede to its demands to end regulations and subsidies that support their domestic industry.

There is a cry from around the world that tariffs are bad policy and threaten the global economy. The Trump administration has been criticised by many that say that the US consumer bears the cost of tariffs.

Trump has dismissed this notion and indeed has argued the opposite, that the costs of tariffs have been born by China, that the US Treasury will raise around $100bn per year from tariffs paid, and US importers from China can work around the tariffs by importing from alternative countries or producing in the USA.

For all the criticism, Trump may be right. The USA does have a significant advantage in this dispute. For one, it imports much more from China than China imports from the US. The tit-for-tat tariffs directly cost China more in tariff revenue.

Consumers may bear some of the cost of tariffs through price hikes, but the US inflation rate has remained subdued. A weaker CNY exchange rate will tend to offset the potential rise in goods prices in the USA. In a competitive market place, producers will also bear some of the tariff costs; if not most of the costs in a highly competitive market.

The weaker CNY imposes the cost of tariffs on China

The fall in the CNY exchange rate is the clearest evidence that China is expected to bear most of the cost of tariffs. The weaker exchange rate pushes up the cost of Chinese imports and reduces the purchasing power of Chinese consumers. Its fall is indicative of lost competitiveness, and the potential hit to sales the tariffs impose on companies in China that are exporting to the USA.

China may be allowing its exchange rate to fall to help provide stimulus to its economy and alleviate the dampening impact of tariffs on its economy. The US administration had included the CNY in its trade negotiations with China, and the fall in CNY may be a part of China’s retaliation to US tariff increases.

However, a steeply falling CNY may unsettle Chinese capital markets, risk triggering increased capital flight, tightening domestic credit conditions, and increase the cost of capital for Chinese firms with foreign currency debt.

The fall in CNY may do little to halt the pressure on businesses to move their production processing away from China to alternative venues in Asia. Other Asian regional currencies have also weakened, and the prospect of prolonged US tariffs on China might lead to permanent shifts in production activity from China to alternative venues in Asia.

US economy to face some downside risks

The US economy is likely to suffer if Chinese policymakers encourage consumers to eschew US made goods and services in favour of other countries. However, the US is not a major manufacturing hub, and it has less to lose from diversion in industrial activity to other venues. In fact, as Trump says, the tariffs may encourage some more manufacturing in the USA.

Tariffs may be an effective counter policy measure by a large country like the USA

Tariff policies may have a dampening impact on the global economy, especially if imposed on and by many countries. They may be disruptive as they generate uncertainty and delay business investment.

They impose a cost that must be born by a combination of the producers and consumers, and distort price signals for the efficient use of resources. But implemented by a country like the US, with a large share of global imports, they may be an effective policy to counter the subsidies and regulatory policies of another country.

Provided Trump can hold his nerve in the face of US equity market volatility, then he may generate medium-term gains from this policy.

The US may risk losing an important market like China, but Trump would argue that the US economy risks losing long term strategic advantage to China in key high tech industries that might damage the US economy in the long term if it does not act now.

China appears to have a lot to lose as a major manufacturer of goods. If Chinese produced goods are uncompetitive in the US, companies are likely to move production to alternative venues.

China has taken a larger share of the vertical supply chain over recent years. In a complex supply chain for goods, China may still attempt to hold onto production activity by exporting components to third-party countries, before the final assembled goods are exported to the USA and other countries.

It is difficult to assess how big an impact tariffs might have on industrial activity in China. However, the prospect of long imposed tariffs may make China uncompetitive in a broad array of industries, forcing activity to alternative venues. This might be a significant benefit for other countries, particularly in Asia, and a significant and structural drag on the Chinese economy.

China may attempt more fiscal and monetary stimulus to underpin its economy. However, there is a limit to the effectiveness of stimulus if it is set against a structural drag on the economy.

Similarly, if the US economy is dampened by lost markets in China, the Fed can cut interest rates to help support the US economy.

Upside for the rest of the world in a prolonged US-China dispute

If tariffs were imposed for the long term, production chains would adjust, third-party countries would pick up demand that is diverted from China and the USA. Ultimately, this should support other currencies at the expense of the CNY and the USD. The global economy would eventually adjust.

However, the problem for the global economy would be the geopolitical stress bilateral tariffs between two super-powers would place on global business confidence. The market would also have to deal with the risk of a Trump administration adopting more aggressive trade policies with other regions, including the Eurozone.

The more immediate concern for the global economy is that disruption to existing supply chains and heightened uncertainty damaging business and investor confidence.