Trump tax plan is a big dollar booster

The Trump tax plan is potentially very positive for the USD, generating a significant incentive for capital inflow and business investment. The market response so far is muted, but may well continue to build. We like the USD/JPY, but the Japanese election may be a sticking point.

US tax plan a dollar booster

The USD response to the latest announcements on tax reform is muted. Arguably, new momentum for tax reform should be very positive for the USD. The USD is up significantly in recent weeks, and perhaps it is consolidating and may have built in some of these tax announcements. Month and quarter-end money manager flows may be dampening the USD. However, there may well be scope for significant further gains in the USD as the market builds in tax reform coming to fruition.

Big company tax cuts

The parts of the Trump tax plan that should support the USD include the deep cuts in the corporate tax rate to 20% (from around 35%) and the effective cuts for small business owners that have to pass-through income from their companies to personal income for tax purposes. The top rate on this pass-through income will fall from 40% to 25%. These cuts are likely to be seen as stimulating growth in business activity.

One time repatriation holiday

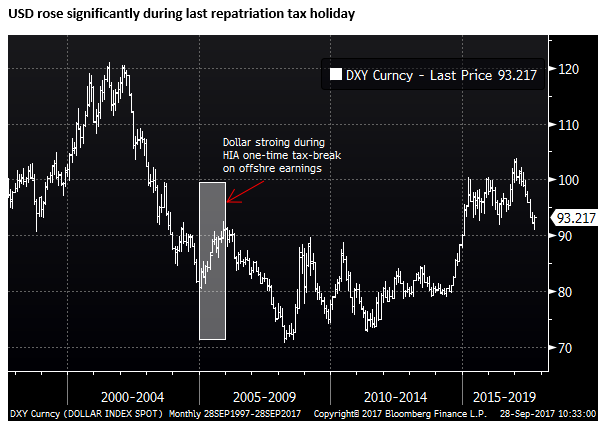

It includes a one-time low tax rate for repatriating multinational company offshore retained earnings. Many will argue that companies have effectively already moved these earnings back into USD. But the amounts held offshore are estimated to be enormous (More than $2.6 tn). If even a fraction of this were to be pushed through the FX market to buy USD in a short space of time (over a one-year one-time tax break) it could result in a significant broad appreciation of the USD.

During the Homeland Investment Act of 2004, when corporations were given a similar one-time tax break to repatriate earnings, the USD gains over the subsequent year were thought, at the time, in part, to be related to the HIA. $300 bn in overseas retained earnings were estimated to have been repatriated in 2005, when the tax rate was lowered on a one-time basis from 35% to an effective 5.25% for these earnings, five times the normal amount of repatriation. (Watch What I Do, Not What I Say: The unintended consequences of the Homeland Investment Act; June 2009 – NBER.org)

Ditching Global taxation

The announcements this week did not touch on global vs. territorial taxation, but previous announcements suggest that indeed the tax reform will involve a move to a territorial system. As such, US companies with offshore operations will no longer be subject to paying tax on profits from these operations when they are repatriated to the US. As such, going forward, there would be less reason to accumulate earnings offshore. More of these earnings may routinely be returned to the USA.

In combination with a much lower (20%) corporate tax rate, companies may be more incentivized to invest in operations in the USA as opposed to other low-tax countries. This could be viewed as encouraging more capital inflow and boosting USA business investment, both factors that could boost the USD.

Invest sooner rather than later

For the next five years, the plan will allow companies to expense large capital expenditures in the first year of purchase. This might be seen as a strong incentive to invest sooner rather than later.

Remarks by President Trump at Tax Reform Event – WhiteHouse.gov

Tax Reform likely to happen

There appears to be concern that this tax reform will get stuck in Congress and not get passed; like the healthcare bill. Indeed, tax reform is complex and it will take time to draft a bill and debate the details.

However, tax reform is likely to be far less contentious than healthcare reform. Republicans hold a majority in both houses, and they are likely to show more unity on tax reform. Democrats are less likely, as a block, to oppose tax reform.

Trump and the administration are approaching tax reform in a more proactive manner and appear to be working harder with Congress to pass legislation rather than grand-standing. Trump has had success recently reaching across the aisle and now seems more willing to work with Democrats to get things done.

Trump is also campaigning hard and honing in on those states where Democrat members of Congress are up for election in mid-terms next year, making it harder for these Democrats to oppose tax reform.

Republicans need a win on tax reform; they cannot afford to go into the mid-terms next year without making this happen.

As such, we see the market as sluggish to get on-board to prospect of tax reform. It is still getting its head around the weak USD performance this year and shy to get back into a more bullish frame of mind for the USD.

Japan election generates some uncertainty

We had considered USD/JPY as one of the best ways to express upside potential for the USD. This reflects its high correlation with US long-term yields and the BoJ’s yield curve control. USD/JPY may also tend to rise in an environment of strong global growth and demand for emerging market assets. The recent gains in oil prices might also be seen as a dampening factor for the JPY.

(Rising US yields to lift USD/JPY; CAD and NZD vulnerable – AmpGFXcapital.com)

However, we need to be aware of the political developments in Japan. Political uncertainty in Japan may lead to some reluctance to sell JPY, particularly by Japanese investors as they pause and wait for the outcome.

PM Abe, the leader of the ruling LDP party, has called a snap general election for 22 October. The election is for all seats of the House of Representatives, the lower house (465 seats).

Abe is thought to have called the early election to take advantage of a bounce in his approval rating in the last month or so on his strong stance against North Korea aggression, and the disarray of the main opposition DPJ. He has said that he is seeking a mandate to use revenue from a planned consumption tax hike in October 2019 to pay for spending on education and family welfare.

However, a new political force has joined the fray. The Governor of Tokyo, Yuriko Koike has formed a new party called the “Party of Hope.” Koike is popular and is offering an alternative conservative platform that may successfully challenge Abe’s grip on power.

Fresh in the market’s mind is the unlikely come-from-nowhere win by Macron in France, and the failed snap election bid by UK PM May to boost her mandate to negotiate Brexit on her terms.

And in the last day the DPJ leader, Maehara, endorsed Koike and her Party of Hope, and large numbers of the DPJ members are expected to run under the Party of Hope. It appears that the DPJ has essentially disbanded and joined the Party of Hope.

While Abe appears well placed on recent opinion polls to return to government with a solid majority, there is now significant uncertainty.

The question then is what would a surprise victory by Koike’s party mean for the JPY?

A side issue is that it is not clear that Koike is even running in this election. She has said she plans to stay as governor of Tokyo to see it through its hosting of the Olympics in 2020.

There has been nothing written about her platform to suggest she will want to change course on fiscal or monetary policy. It seems unlikely that she will want to mess with the BoJ’s aggressive policy stance.

The main differences in her platform are that she wants to transition Japan away from nuclear power, which over the long term, might be expected to lift Japan’s import bill for fossil fuels and weaken the JPY. She is also against raising the consumption tax in 2019.

As such, we don’t see this election as ultimately having much impact on the JPY. Nevertheless, the JPY tends to strengthen in uncertain environments, even if home-grown, or negative for Japan, such as threats from North Korea.

As such, there is some risk that the election period causes some strength in the JPY. We are not convinced it will, and it is possible that strength in the USD takes over. But we may see some reluctance in USD/JPY to rise, especially if the market takes its time to get its head around the tax reform, and gets too hung up on how long it takes to get passed.