US bond yields and the USD at key juncture

The fall in US yields continues to be a surprising development in global markets, coinciding with a weaker USD. There are a number of factors that may account for weaker US yields, although none are so powerful alone to suggest yields should fall significantly further. The outlook for inflation has eased from earlier in the year, wages growth remains subdued, some parts of the economy are facing headwinds, such as the auto sector, and oil prices have eased. However, the US labor market is now tight and tightening and the broad sweep of economic reports suggest that the US economy continues to operate at an above-trend rate of growth. It appears that weaker yields also reflect increased political uncertainty which is difficult to quantify. An approaching debt-ceiling issue may be generating increased concern. US 10 year yields are currently at a key support level (38.2% Fibonacci retracement and near an uptrend line). In the current political environment, the market may need to see evidence of renewed inflation pressure to generate a significant rebound in yields. As such, the USD is at risk of faltering further in the near term. The JPY may prove the main beneficiary of a break lower in US yields, less challenged by positioning that is now quite long for the EUR. Super Thursday approaches (ECB meeting, UK election, Comey testimony). But don’t forget the Bank of Canada Financial Stability review; it will be interesting hear what it has to say in the wake of the near failure of its largest non-bank mortgage lender and Moodys downgrade of its major banks in the last two months.

US 10 year bond yields at a critical juncture

The fall in US yields continues to be a surprising development in global markets, coinciding with a much weaker USD. A key question is does the fall in yields make sense and could we see a significant further fall? As the chart below shows, the USD has fully unwound the Trump rally, the risk is that yields may also have further to unwind, now sitting at a 38.2% Fibonacci retracement level.

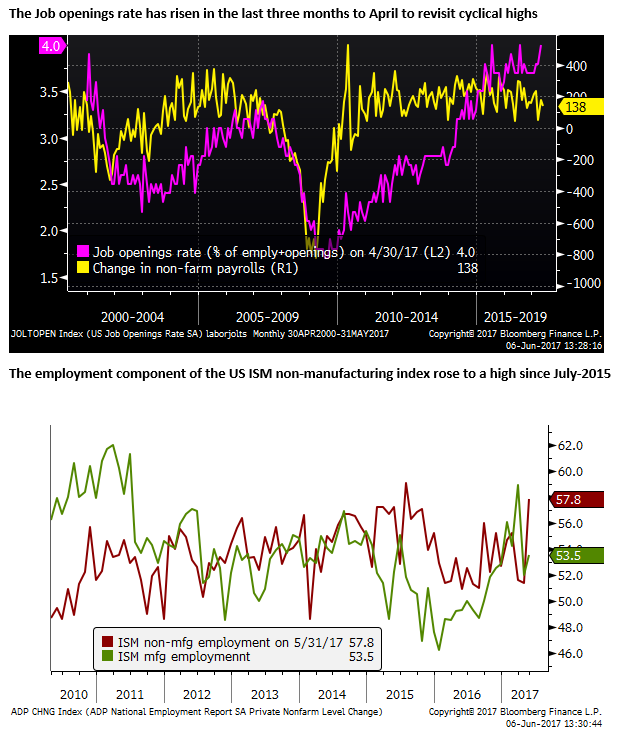

Wages stubbornly weak, but labor market tightening

US wages data were a bit below expected, and some may be wondering if wage growth will ever return. However, the US labor market has tightened significantly in recent months and is still pointing to increased inflation risks over the coming year.

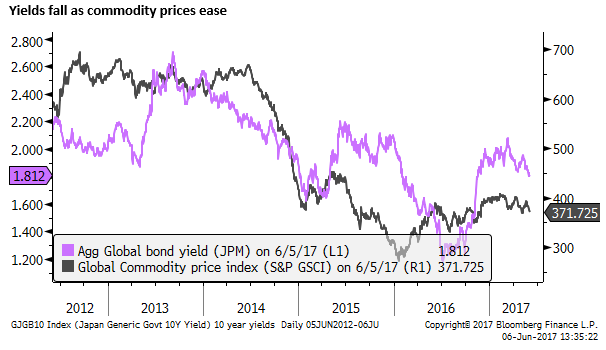

Weaker oil prices

The recent fall in oil prices to some extent may help explain lower US yields. Oil prices have been more volatile since March and are somewhat lower. The chart below shows a global bond yield index and a global commodity price index.

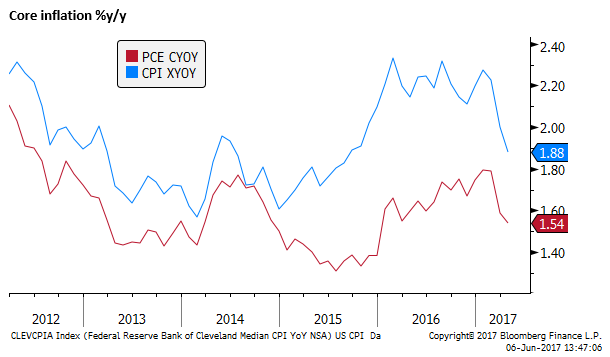

US inflation falls back in recent months

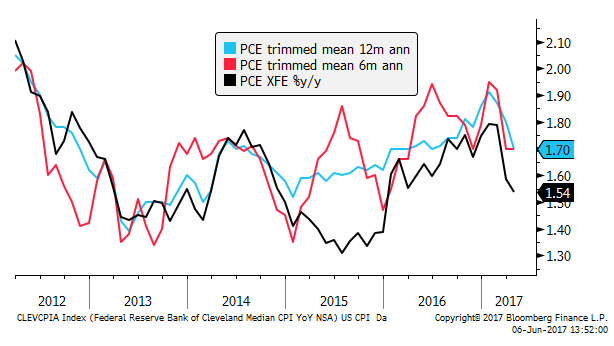

Recent US CPI data have been below expected, including core measures. The PCE deflator core (excluding food and energy) fell from 1.8%y/y in Feb to 1.5%y/y in Apr. The CPI core fell from 2.3%y/y in Jan to 1.9%y/y in April.

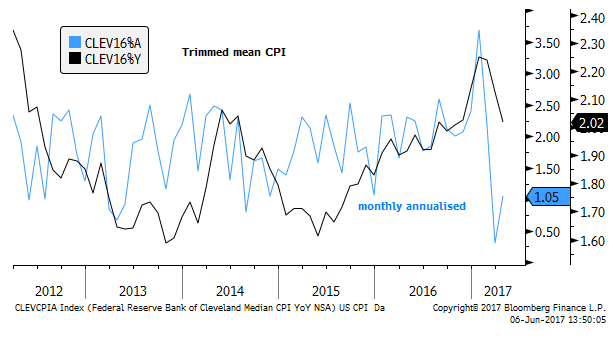

Alternative core measures concur. The Cleveland Fed’s 16%trimmed mean CPI fell from 2.3%y/y in Jan to 2.0% in April, and the chart below shows that this reflected sharply lower monthly outcomes rather than base effects.

The Dallas Fed’s PCE trimmed mean showed a fall in the 12mth annualized rate from 1.9%y/y in Feb to 1.5% in April.

It does appear that underlying inflation has moved down significantly in recent months giving the Fed again a sizeable gap from its 2% inflation target. As such it appears sustained inflation remains elusive.

It will be interesting to see the May CPI data that comes out on the same morning as the FOMC meeting next week.

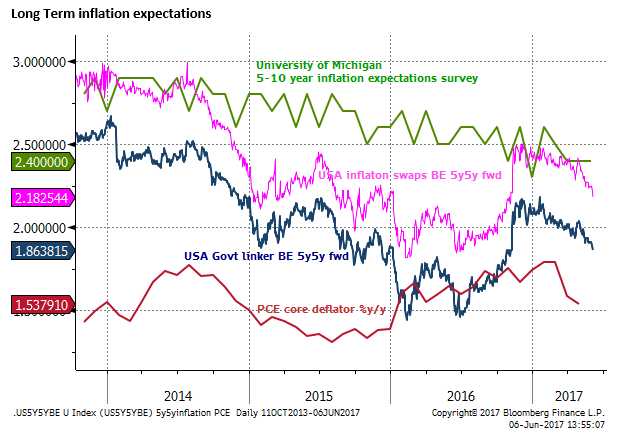

Lower inflation expectations

Market-based measures of long term USA inflation expectations have fallen relatively sharply in the last month. The University of Michigan survey of long-term inflation expectations has been stable by the Fed’s standards, but is near the record lows of 2.4% in the last two months.

The New York Fed’s survey of three year-ahead inflation expectations is not as weak, it was 2.91% in Apr, up from the lows around 2.5% in Q3 last year, down from the recent peak of 2.98% in Feb.

The lower inflation outcomes, somewhat lower commodity prices, and no apparent lift in wages growth may be contributing to lower US yields.

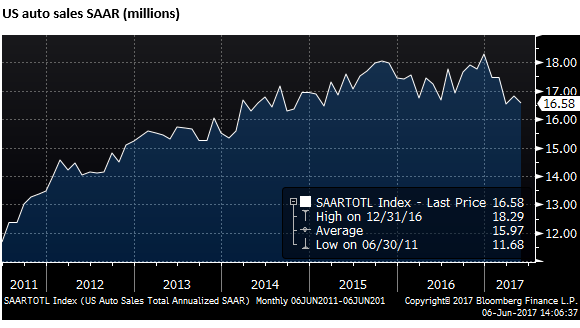

Auto sector a headwind

There has been some evidence of headwinds in the economy including slower auto sales this year. Banks are reported to be pulling back from the auto loan market. Part of the reason for lower inflation may be falling used car prices. Lower used car prices are increasing the risk to auto lenders from defaults, contributing to a tightening in lending conditions. Some say the rapid build-up in auto-lending has gone too far and a contraction in the sector is underway, weakening the overall auto market.

Debt pile-up in US car market sparks subprime fear; 29-May – FT.com

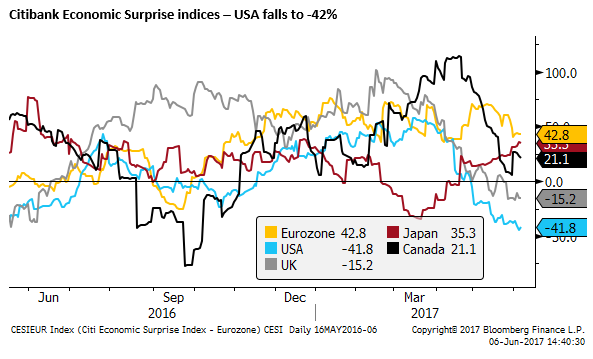

US economic data has tended to underwhelm expectations over recent months, also contributing to some correction in US yields

Trump big on promise, weak on delivery

A good deal of the blame for lower yield may reflect diminishing confidence in the Trump administration that has been big on promise and weak on delivery. Trump has succeeded in poisoning many international relationships and the political well in Congress. He faces ongoing pressure on investigations over Russia election meddling. Not least the immediate threat from the testimony of Comey on Thursday. Many may be seeing growing risk as the debt ceiling problem is coming into view.

(Trump is a dead-weight on the USD; 5 June – ampGFXcapital.com)

US economy still humming overall

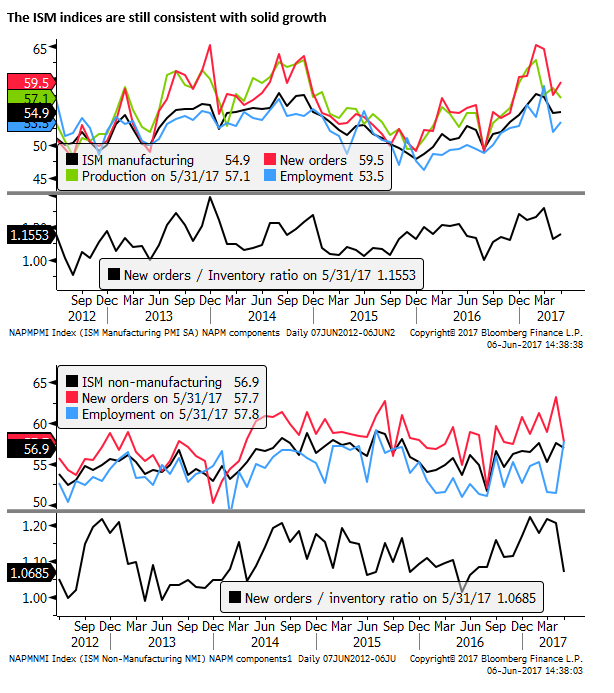

However, how far should yields fall? There is a good deal of uncertainty related to the Trump factor, but the broad thrust of US Economic reports still suggests that the economy is continuing to grow at a solid rate. As such, further downside in US yields may be limited.

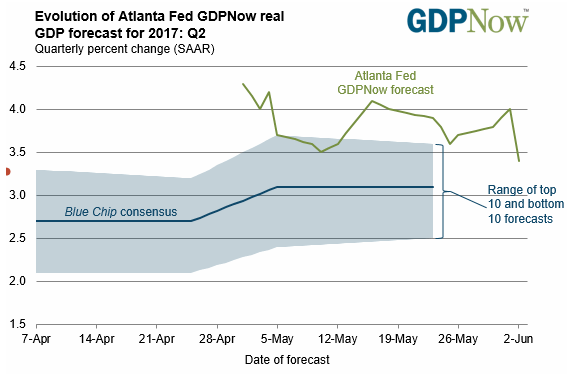

The Atlanta Fed’s estimate for Q2 GDP SAAR %q/q was revised down from a peak of 4.0% to 3.4% on Friday. It noted that the employment report caused it to lower its estimate of real consumer spending and its so-called factor dynamic model. However, this would still be a solid rebound from the weak 1.2% SAAR %q/q result in Q1.

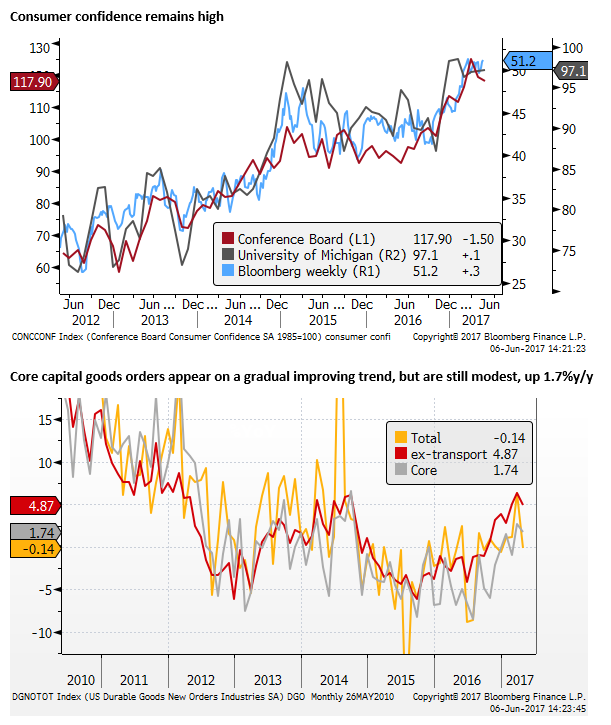

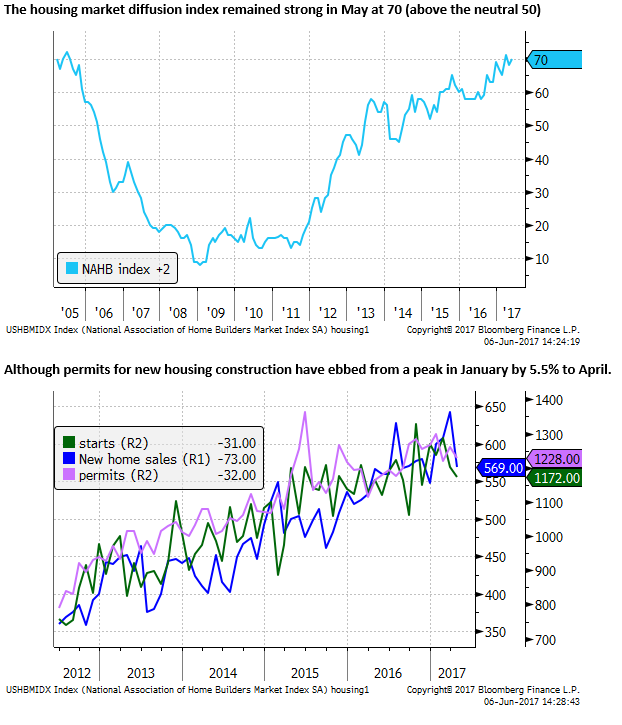

A broad sweep of economic reports in the US still suggests that the US economy retains above trend growth momentum

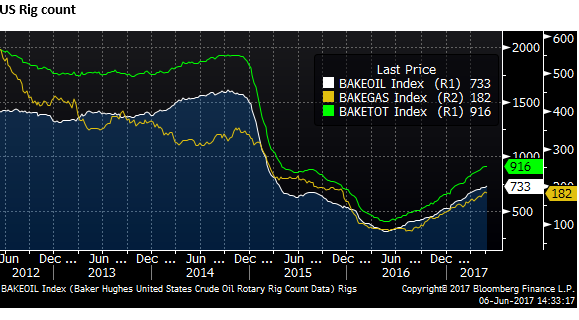

The fall in oil prices has not been severe enough to put a significant dent in the recovery in the US energy sector with the rigs count continuing to rise.

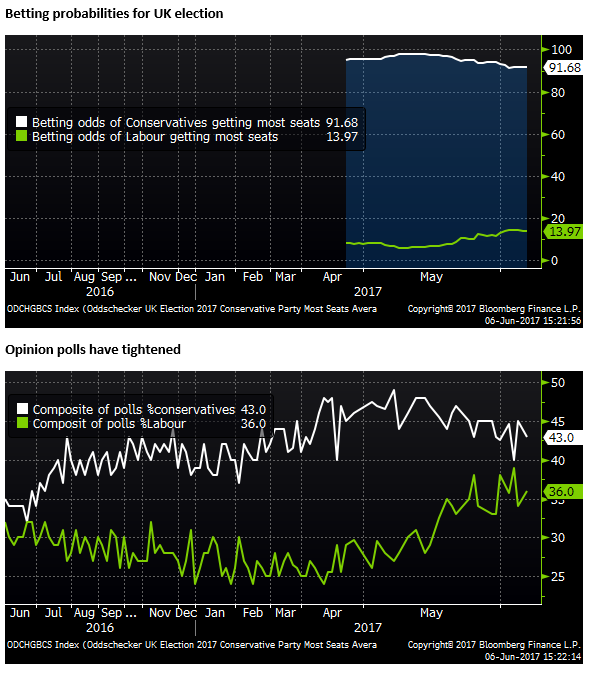

UK may have limited bounce after election

The GBP has been relatively stable heading into the election in Thursday, indicative of the fact that a Tory victory and outright majority is still a very high probability, even if the race has tightened during the campaign.

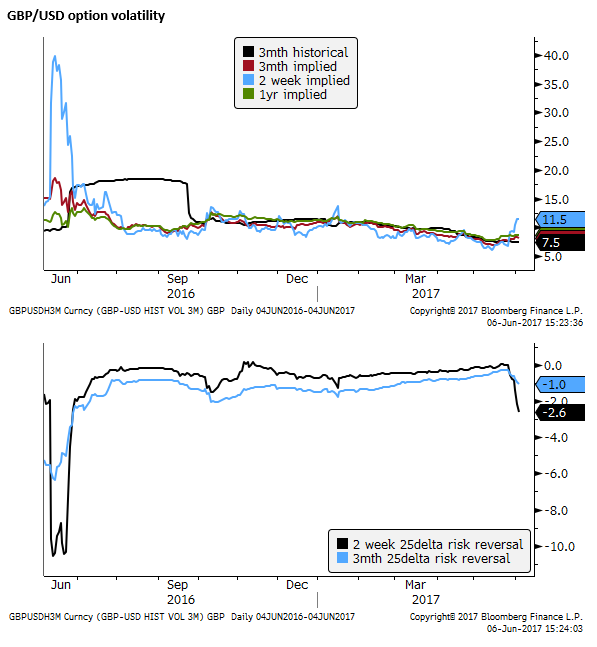

However, the options market is showing the market is still wary of a negative outcome for the GBP. Short term vol is moderately elevated, and risk reversals indicate the highest downside GBP risk since the Brexit vote.

A failure of the Tories to regain an outright majority, would potentially see the GBP significantly weaker. A much worse outcome, but highly unlikely, is for the Tories to fail to get enough seats to control government. This would be very negative for the GBP, seeming to throw considerable doubt on the UK’s commitment to Brexit, but still largely locked into it, and greatly damage its ability to negotiate effectively with the EU.

Currently, Conservative (Tories) holds 330 seats in the 650 seat House of Commons (a 5 seat outright majority), Labour holds 229, Scottish National Party holds 54 out of a maximum possible 59 Scottish seats, and the Liberal Democrats hold 9 seats.

An increase in the number of Tory seats will probably see a moderate knee-jerk increase in the GBP. However, UK economic data has underwhelmed in recent months and the economic headwinds from Brexit may be starting to drag on the economy. The Brexit process remains a long and difficulty one and upside for GBP is likely to be limited.

The chart below shows EUR/GBP trading near the top end of its range, consistent with the strengthening confidence in the outlook for the Eurozone economy and diminished political risk since the French election.

Fundamentally we prefer the EUR over the GBP and would prefer to use a post-UK election recovery in the GBP to buy EUR/GBP.

EUR faces headwind from positioning

The ECB monetary policy meeting on Thursday is now quite widely expected to involve a shift in the governing Council’s risk assessment from negative to essentially balanced. Such a move may do little to further extend the EUR rally at this time, especially if President Draghi manages to down-play expectations that the council is yet contemplating revising its overall QE or rates guidance.

The market has moved to a significantly long EUR position, suggesting there may be limited upside for the EUR at this juncture.

Bank of Canada may steal the show

Also released on Thursday is the Bank of Canada’s semiannual Financial Stability Review. Six Canadian banks were downgraded by Moodys on 10 May; due to “Continued growth in Canadian consumer debt and elevated housing prices.”

Canada’s largest non-bank mortgage lender, Home Group Capital, experienced a run on deposits and near failure in April. Its share price remains depressed.

The BoC will have to address the risks in its housing market, household debt, and state of shadow-bank lenders. Its comments may return focus to the Canadian financial system and economy, posing a risk for the CAD.