US Political Risk Threatening the USD and More

Political risk in the US is elevated and likely to rise further as the market contemplates the possibility of Democrats taking control of one or both houses of Congress in the mid-term elections. The close outcome of the special election in Pennsylvania on Tuesday points to Democratic momentum. US political risk over the last year has appeared to contribute to a broad USD decline. However, there are reasons to be less sure that EM and commodity currencies will benefit going forward; Trump is pursuing protectionist trade policies, and equity markets have become more volatile. Draghi was upbeat but warned on risks to the inflation outlook from a possible trade war and a strong EUR that cannot be fully explained by stronger Eurozone economic growth.

Rising US political risk

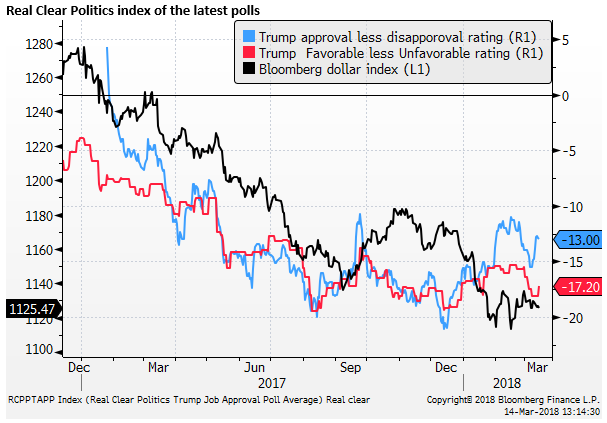

Political risk in the USA appears to have been a factor contributing to a weaker trend in the USD over the last year.

The success by Trump in passing major tax cuts and the strength in the US economy may have been a reprieve for political risk in the USA and provided scope for some recovery.

However, the tariff news appeared to weaken the USD, perhaps via generating more political uncertainty as the policy received widespread criticism from inside and outside the USA.

Furthermore, it led to the resignation of Trump’s most respected economic advisor, Gary Cohen. In the last day, the firing of Secretary of State Tillerson appeared to undermine the USD further, raising the appearance of an unstable administration.

On the one hand, the staff changes at the White House can be viewed as a more confident Trump directing policy towards his core America First agenda, potentially boosting his public support.

However, the staff changes suggest that Trump will push harder on protectionist measures and may reignite tensions with Iran. Through this policy agenda, Trump’s combative style of leadership may come to the fore. This may raise political risk at home and geopolitical and global economic risks.

Russia’s alleged poisoning of an ex-Russian spy in London feeds back to US politics, further adding to questions on why the US administration has been ambivalent towards Russia, contributing to perceptions of a president swimming against the tide in Congress.

Uncertainty in US politics has remained high since Trump was elected, as he won against the odds and divides opinion. He is supposed to have a highly motivated supporter base that might be able to swing elections, even if his overall approval rating appears to be depressed. Trump speaks directly to this supporter base via Twitter, while dismissing a lot of media commentary as fake news.

On the other hand, Issues such as gun control and immigration remain highly contentious and maybe firing up left-leaning voters. At the very least, there are a lot of currents running through US politics that increase uncertainty.

Various polls show significant net disapproval of Trump. There was a modest bounce after the passage of tax cuts. A dip in Feb that may relate to the Florida school shooting and equity market correction. There has been a little bounce recently since the tariff and N.Korea announcements.

Pennsylvania election outcome points to trouble for Republicans

As the mid-term US elections in November approach, political uncertainty is set to increase. The risk is significant that the Democrats take control of one or even both houses of Congress. The result of the Pennsylvania 18th District Special Election on Tuesday appears to increase this probability.

The result is currently too close to call, but Democrat candidate Lamb appears to be in front. Trump won this district by 20 points in the November 2016 election. On the face of it, this suggests there has been a big swing against Republicans that may reflect a Trump backlash. If repeated in the mid-term elections it would propel Democrats to a big win.

The Republicans can claim that the Pennsylvania result is not representative since Lamb was a moderate who was not in favour of gun-control, and backed the tariffs, a Trump policy that appears to have more Democratic support than from his own party.

The Democrats can claim it is representative since Trump stumped for the Republican candidate Saccone.

Both are probably right to an extent, but certainly, the result is such a significant swing that it may point to a more energized anti-Trump vote that could make a difference in the mid-terms.

The Democrats can also claim a trend with the victory in the Special Senate Election for the State of Alabama in December and the Gubernatorial election in Virginia last November.

Conor Lamb Roared. Republicans Should Quake. – NYTimes.com

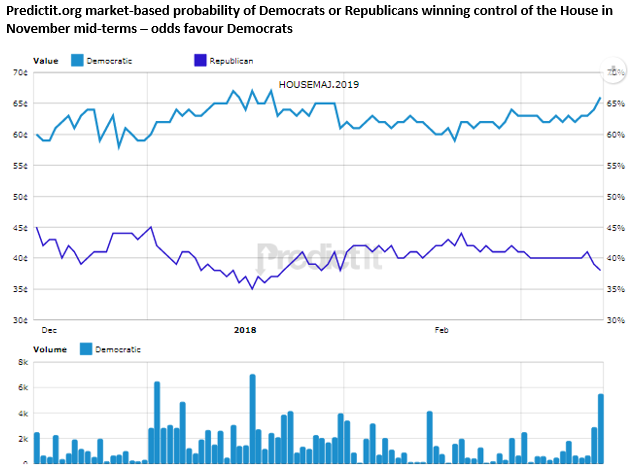

The chart below shows the probability as measured by trading on Predictit.org. It suggests that the Democrats have a 67% probability of winning control of the House of Representatives. This probability has increased in the last two days from 63% in the lead up to the Pennsylvania election.

https://www.predictit.org/Market/2704/Which-party-will-control-the-House-after-2018-midterms

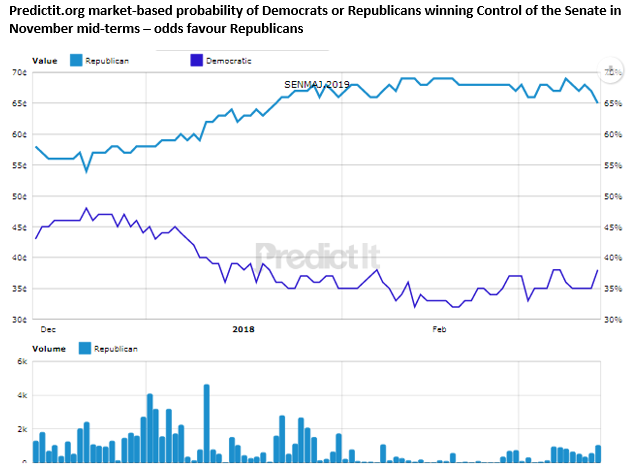

The Senate race is still seen to favour Republicans retaining control. This reflects the greater number of Democrats up for re-election and the individual cases where more of these races are in toss-up states. This is despite the fact that Republicans hold only a slim one seat majority in the Senate, after losing the seat of Alabama in a special election in December.

https://en.wikipedia.org/wiki/United_States_Senate_elections,_2018

https://en.wikipedia.org/wiki/United_States_House_of_Representatives_elections,_2018

Nevertheless, the probability of a Republican victory has declined in the two days leading up to the Pennsylvania election from 68% to 65%. Given the narrow margin of Republican control in the Senate, the risk of Democrat’s winning control is not insignificant.

https://www.predictit.org/Market/2703/Which-party-will-control-the-Senate-after-2018-midterms

Mid Terms loom large for the market

If the Democrats take control of one or both houses of Congress, it may not be all bad. They may crimp more contentious policy direction of the administration, such as on immigration and border control. They might be able to help bring about some gun-control. The tax cuts have been delivered, and a degree of grid-lock my be considered better than the alternative. Trump and the Republican party might be able to avoid criticism for not being able to pass legislation, and could turn the tables on the Democrats if they cannot show cohesion.

However, a key issue that hangs over the government in the US is the Mueller investigation that has broadened and may open the door for Democrats to put more intense pressure on the Trump administration if they win control of one or both houses of Congress.

This may open the door for impeachment proceedings. At the very least we should expect more poisonous discourse between Trump and Congress over alleged collusion with Russia, accusations of a lack of action against Russia for election meddling, and obstruction of justice in the firing of FBI Director Comey.

We do not know what evidence Mueller has gathered or is still gathering with a number of former Trump campaign workers facing prosecution and cooperating under plea deals.

The risk of Democrats gaining control in Congress is likely to generate increasing political uncertainty in the US as the mid-term elections approach. This could have a significant impact on global markets.

Political risks may undermine the USD, but generate more volatility in riskier assets.

To date, political risk has appeared to have a more negative impact on the USD than US equities or broader global risk appetite. In fact, the weaker USD combined with ongoing strength in the US and global economy may have reinforced demand for EM equities and currencies.

However, there are a number of reasons to be less sure that increasing political risk in the US will continue to support EM currencies and global equities.

For one, Trump’s protectionist policies are now a key focus of the administration. This poses clear risks for emerging markets. It may also pose a risk for the EUR that has been very strong in the last year, given Europe is also in the administration’s trade cross-hairs.

A second reason is that the equity market has been more volatile since early-Feb, and global investors may have become more permanently attune to risk scenarios. It might not be so easy for the market to separate the political risk in the US from the strong underlying trends in the US and global economy.

A more mixed result for EM and global equities could tend to support the JPY and gold against the USD that may continue to be undermined by political risk.

Draghi concerns over the EUR and Trade

In our report on Monday, we noted several reasons why EUR may be at risk of a correction lower. This includes waning Eurozone inflation expectations, a cooling in recent Eurozone economic data, and a weaker EUR performance since the last ECB meeting, despite the removal of a key easing bias in its statement.

Cracks widening in EUR’s foundations; 13 Mar – AmpGFXcapital.com

In a speech on Wednesday, ECB President Draghi made comments that gel with these developing risks for the EUR.

Firstly, he emphasized that the ECB needs progress on “the path of inflation towards our aim” not just strong growth, “to bring net asset purchases to an end.”

He further emphasized that the pace of rate increases, once asset purchases have ended, will much depend.

He said, “While we are now more confident than in the past that inflation is on the right track, risks and uncertainties remain. For this reason, even once the outlook becomes less dependent on net asset purchases, monetary policy still needs to be patient, persistent and prudent to guarantee the return of inflation to our aim.”

While expressing confidence on the state of the Eurozone recovery, and eventual return to its inflation target, Draghi noted a number of uncertainties in this outlook.

He said, “To build confidence that inflation dynamics are on track, we will need to see the actual data improving over time, which means stronger evidence of both strengthening wage growth and wage growth translating into ULC growth.”

He said, “Moreover, there are still two risks to the outlook that could – if they intensify – conspire to reduce our confidence in the inflation path.”

The first is the risk of a trade war escalating out of the recently announced tariffs, extending to other goods. We know that Trump is intensifying his protectionist rhetoric, and specifically against the Eurozone if it attempts to target other US goods. As such, this may be seen by the FX market as a reason to be less certain of its EUR outlook.

The second is the EUR exchange rate itself. Draghi said, “The euro has appreciated since the beginning of last year, and according to our analysis, this has recently been driven more by exogenous factors – that is, purchases of euros that cannot be explained solely by the economic expansion. This might weigh on inflation down the line as it does not fully arise from stronger euro area fundamentals.”

Monetary Policy in the Euro Area; Speech by Mario Draghi; 14 Mar – ECB.Europa.eu