USD bearing the brunt of anemic global economic confidence

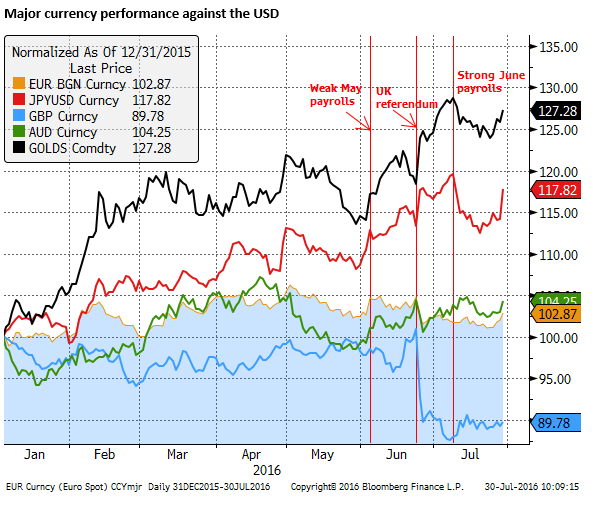

The USD’s performance last week was particularly lackluster after what should have been a supportive FOMC statement, and it was slapped back into a broad down-trend by a disappointing BoJ meeting and a weak US Q2 GDP report.

Not only did the BoJ fail to meet expectations of more QQE/NIRP, its decision to raises ETF purchases and support USD borrowing reduce Japanese demand for foreign currencies, exacerbating the rise in JPY. The BoJ said it was planning a “comprehensive assessment” of its QQE/NIRP policies at its next policy meeting, suggesting that it may yet be constructing a rabbit to pull out of the hat, but you are likely to suffocate under the weight of a sinking USD/JPY if you hold your breath.

US politics have become a risk for the USA and global economy. The Trump phenomenon has already pushed the USA in a protectionist direction against free trade. The final months of the USA election campaign may dampen US activity, and there is a lack of hope that much good will come of the next USA presidency.

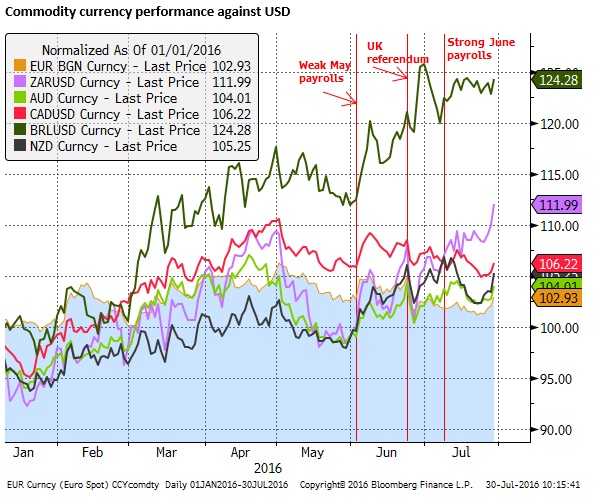

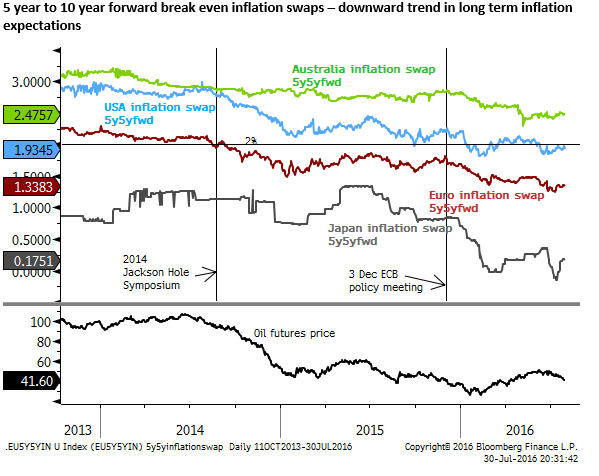

Global growth appears anemic, uncertainty is high, and confidence in the effectiveness of further monetary policy easing is low. Anti-establishment politics is on the rise, weakening and delaying government responses to economic challenges. It appears quite possible that we will continue to limp into next year with the same market trends that have played out this year. Weak to modest global economic growth, stubbornly low inflation and inflation expectations, low and perhaps even lower global bond yields, pressuring global equities higher in an environment of low investor confidence. A weak USD, uncomfortable strong JPY, and upward pressure on emerging and commodity currencies with higher albeit diminishing yields.

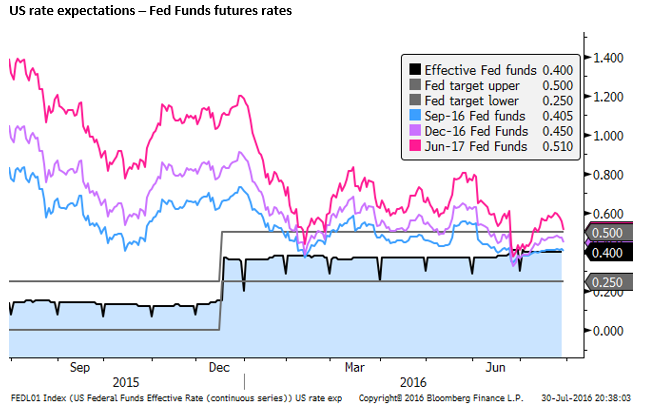

The USD appears to be bearing the brunt of any weakness shown in the US economy. Rate hike expectations have been whittled back to low levels and strong data could give the USD a reprieve, but the market appears to need more convincing that the Fed is prepared to raise rates.

Lackluster USD resumes down-trend – what happened to policy divergence?

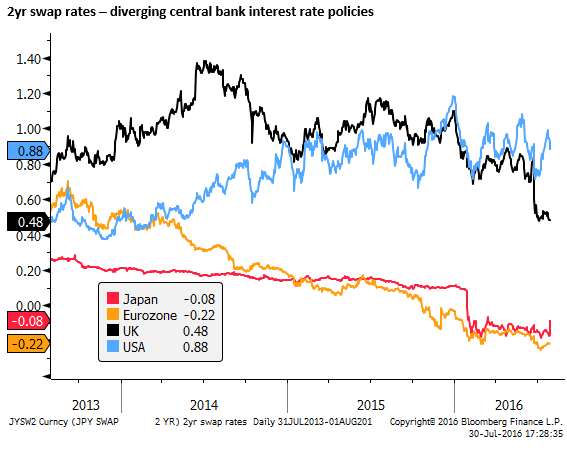

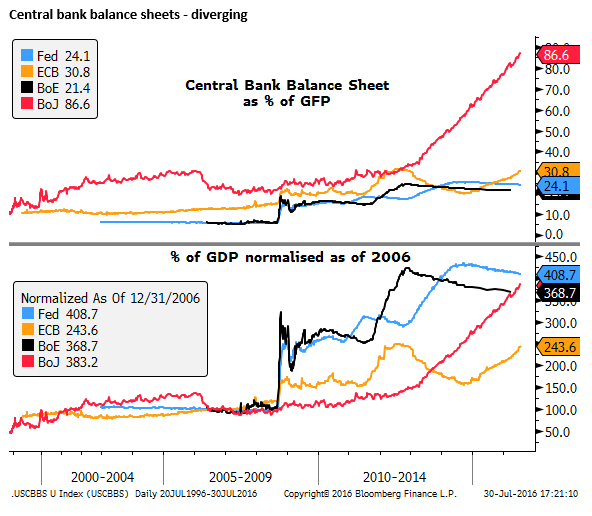

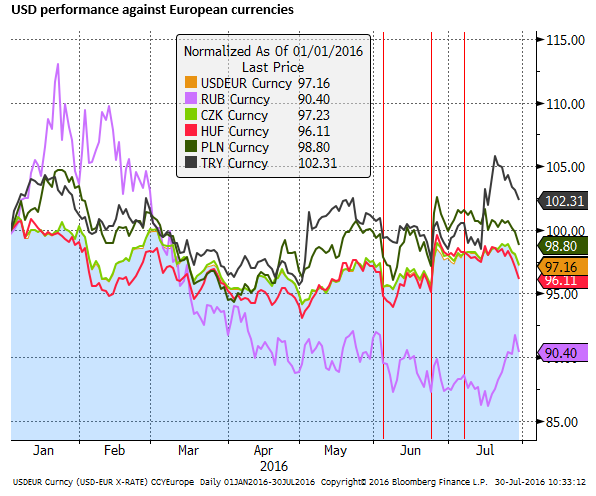

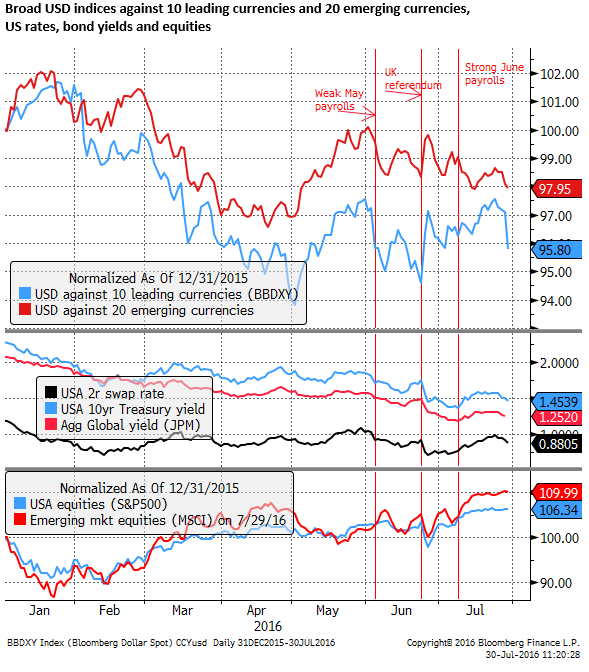

The USD been generally weak this year. The theme of central bank policy divergence that boosted the USD through the second half of 2014 and into 2015, began to fade in 2015 and reversed course this year. Policy divergence has continued but more gradually, with US rates stalling. However, the Fed has retained a tightening bias while many other central banks have further eased monetary policy.

In 2015 the strength of the USD tended to delay Fed rate hikes and thus slow policy divergence. A key difference this year is that a weaker USD is pressuring other central banks to reluctantly ease policy further into uncomfortable territory.

The RBA in Australia is given a 60% chance of cutting rates for a second time this year and the RBNZ is a virtual certainty to cut a week later, both grappling with a currency that is stronger than they would like and core inflation below target. (See our preview of the RBA meeting here)

The fall back in the USD last week after a surprisingly weak performance following a less dovish FOMC statement, and disappointment over the limited further policy easing in Japan and weaker than expected Q2 USA GDP, may push the RBA over the line to make that second rate cut. The RBA must sense little prospect that the AUD will fall and considerable risk that it strengthens further against the lackluster USD.

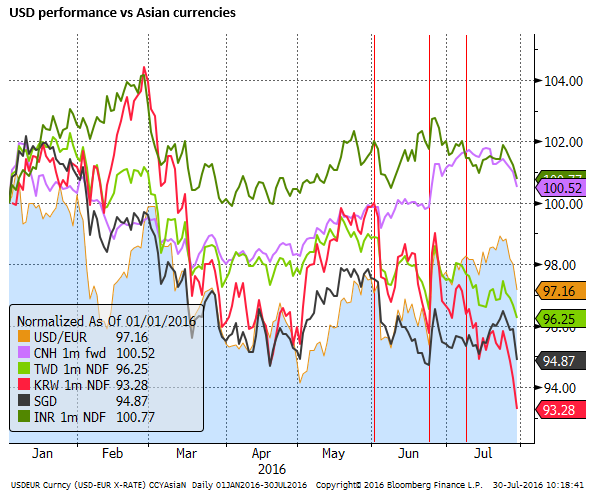

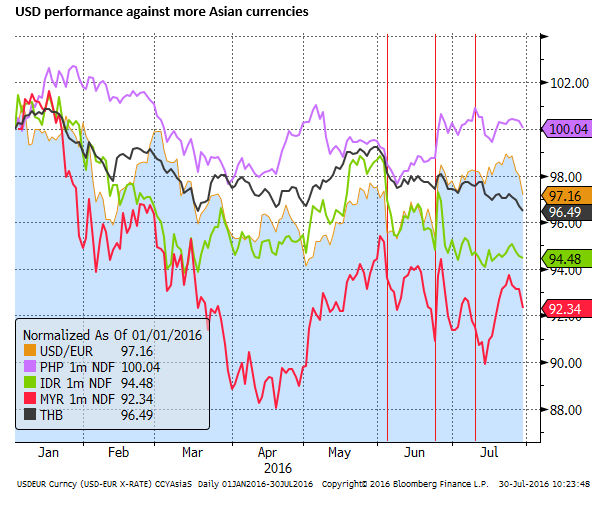

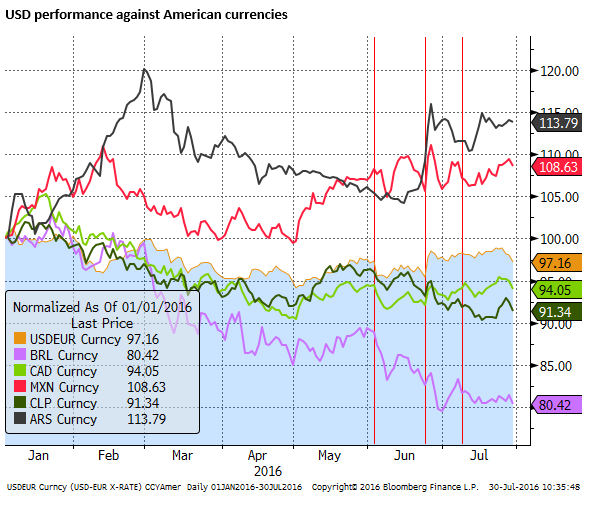

Note that the charts above have the major and commodity currencies as the base and they are rising when the USD is weaker. The charts below of emerging currencies are the opposite; they have the USD as the base and the lines fall when the USD is weaker. The blue shaded area on all charts is the performance of the EUR as a point of reference to compare charts.

Global Economic growth trends appear anemic

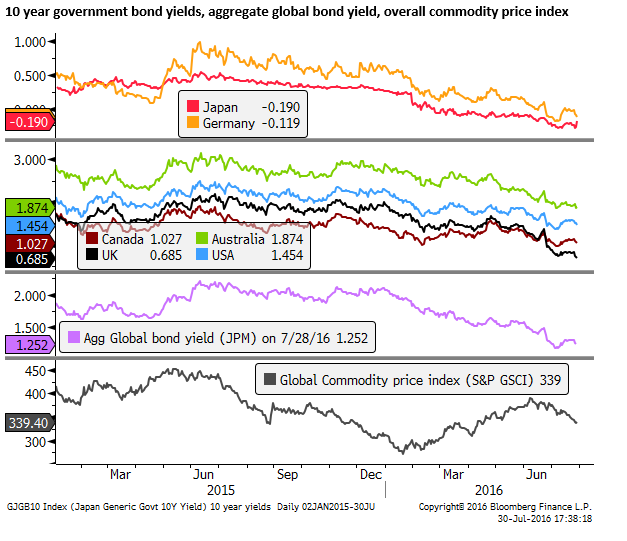

This has been a relatively strong year for global asset markets. Emerging market equities have out-performed developed markets, including the USA on its own, rebounding from a horrid second half of 2015 and a bumpy ride for the last several years since they peaked in USD terms in 2011. Global bond yields have fallen sharply to new record lows.

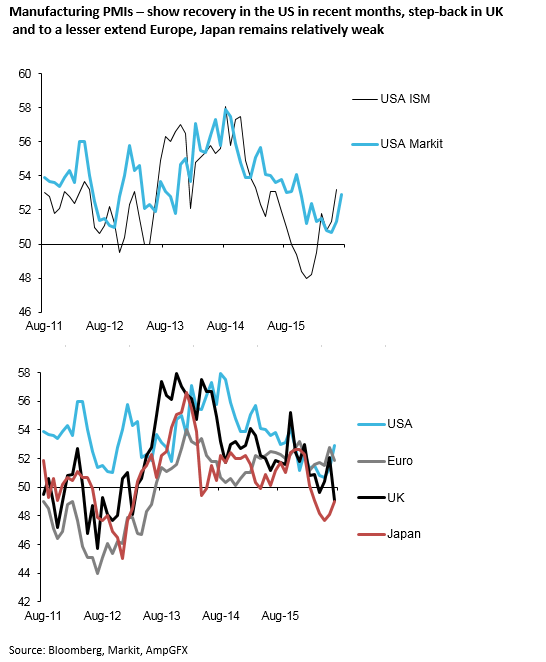

This has not happened in an environment of confidence in the global economy. Uncertainty is high and growth prospects appear anemic. Japan growth has not fired up after several years of aggressive policy easing, in fact it has struggled and progress in lifting inflation has partially reversed.

European growth has failed to lift much from still too low levels. European banks share prices have fallen sharply and concerns over the strength of its banking system have returned to dampen sentiment.

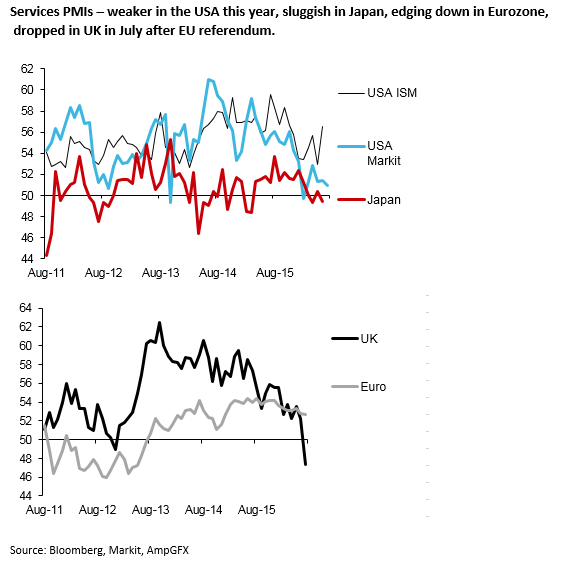

The UK vote to leave the EU has significantly undermined confidence in the UK and to some extend also in the Eurozone.

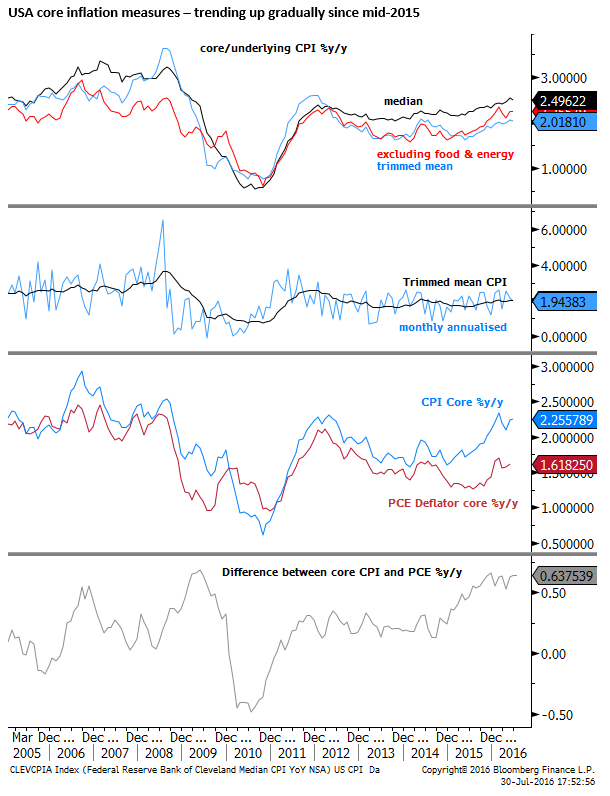

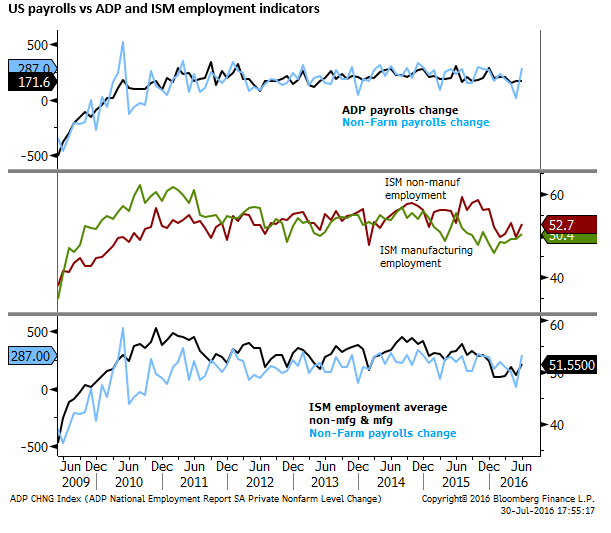

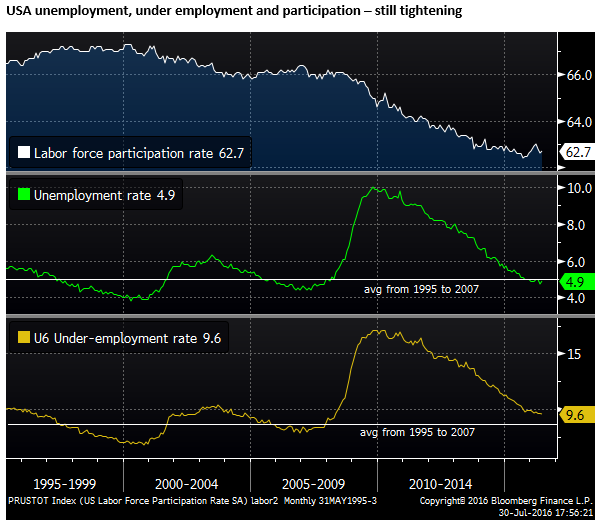

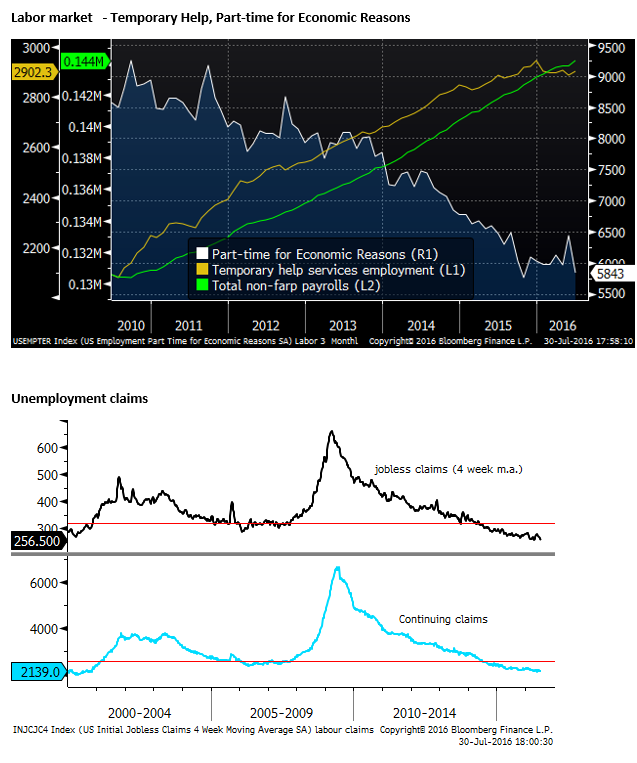

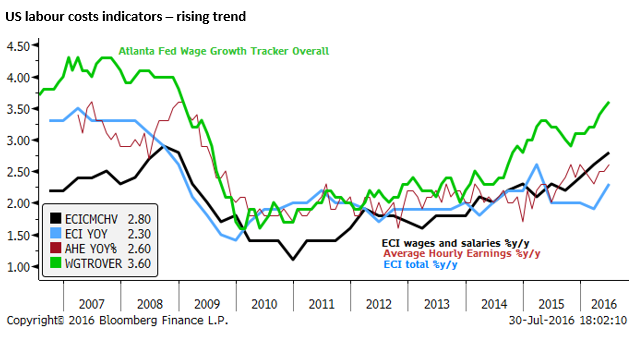

US economic growth has been mixed with weak business investment, weak growth in manufacturing and a moderating service sector. The labor market appears to be still robust, and consumer spending and the housing market remain in solid relatively stable growth trends. However, the US economy overall has lost momentum and risks have risen that it may be dragged back below trend by anemic global growth.

Commodity prices have lifted significantly from their lows in Jan/Feb. This has improved the growth prospects in commodity exporters somewhat, but they remain cautious and investment in this sector remains low. The recent slide in oil prices may limit hope of a recovery in inflation expectations.

China’s growth has improved modestly, but it has eased monetary and fiscal policy significantly, and weakened its exchange rate. The bang for buck from these policy measures appears historically low and may be building up bigger debt problems that threaten to disrupt economic growth and financial stability in coming years. Fears are high that China growth will stall again, as it has regularly over recent years.

Confidence in the effectiveness of further monetary policy easing is low

Confidence in quantitative policies and negative interest rates in reviving growth are very low. The market fears that the ECB and more so the BoJ are reaching the end of the line in ability to further expand monetary policy.

The effectiveness of conventional rate cuts when rates are already at record lows, such as in Australia and New Zealand, are also being questioned. Further rate cuts in these countries may achieve little to boost confidence and may in fact generate more problems down the road by pressing already highly indebted households to borrow more and pump up over inflated house prices.

US politics further restraining global confidence

US politics have become a risk for the USA and global economy. The Trump phenomenon has already pushed the USA in a protectionist direction against free trade. If Trump were to become president, and he should not be counted out, he would be a wildcard for the USA and global economies. He could further undermine cohesiveness in the USA, fueling distrust across racial lines that are already fraught by more senseless acts of violence in recent months.

His verbal attacks on NATO, China, Muslims, Mexican immigrants, the Fed, NAFTA, TPP, Saudi Arabia, overtures towards Russia, extremist views on extremists, insults thrown at all and sundry and double down approach to everything, while entertaining, are a threat to global economic, political and social stability. Under Trump’s populist agenda the USA might become both more isolationist and aggressive towards perceived threats from other countries. International cooperation on all matters might diminish significantly.

With the Republican and Democratic conventions over and the two candidates for US president chosen we a removing into the business end of the election campaign. This may be another reason for business and households in the USA to spend more cautiously. And for global investors to fret over the protectionist and isolationist trends in the USA.

In any case, there is a lack of hope that much good will come of the next USA presidency with two of the most unpopular candidates in US history. There is little hope that US Congress will revert from its increasingly acrimonious and partisan trends over the last decade. The US government capacity to deal with economic or financial crisis or even a cyclical down-turn appears much diminished. One upside is that if Trump was to become president his capacity to do much harm might be limited by an ineffectual Congress.

Geopolitical risks high

Anti-establishment politics is on the rise in many developed economies weakening and delaying government response to economic challenges. Terrorist attacks have become more frequent, particularly in Europe, potentially undermining economic activity. There are several potential hotspots between major economic powers.

It is very difficult to quantify the influence of geopolitical uncertainty on the outlook for global economic growth, policy and financial markets, but it has probably darkened investor confidence.

Hard to see the circuit breaker

It appears quite possible that we will continue to limp into next year with the same market trends that have played out this year. Weak to modest global economic growth, stubbornly low inflation and inflation expectations, low and perhaps even lower global bond yields, pressuring global equities higher in an environment of low investor confidence. A weak USD, uncomfortable strong JPY, and upward pressure on emerging and commodity currencies with higher albeit diminishing yields.

It is depressing to think this may be the case, equities and bonds already seem very expensive. The market is on the lookout for some circuit-breaker. The prospect of a big fiscal stimulus package and more monetary stimulus from Japan, a rebound in US payrolls in June, and a quick resolution of the political leadership gap in the UK helped lift spirits in much of July, but that lost momentum abruptly last week.

BoJ meek policy response opens door for USD/JPY down-trend to persist

We have argued that the direction of the JPY has been a significant confidence killer in Japan’s policymakers. In particular it has undermined the effectiveness of the BoJ’s QQE with NIRP. The sharp reversal of JPY’s fall in the last week has spilled over to further falls in global bond yields.

The policy actions by the BoJ last week not only fell short of expectations on the QE and NIRP front, they arguably also generated more demand for JPY. Higher purchases of Japanese equities discourages capital outflow. Expanded USD lending facilities appears aimed at combating a tightening demand for USD term-funding that Japanese investors use to hedge overseas investment. Both policies will reduce Japanese demand for USD in the foreign exchange market.

Nevertheless, we must be careful not to right-off Japanese policymakers entirely yet. Abe is set to unveil in more detail his fiscal expansion plans this week, and the BoJ is planning to “conduct a comprehensive assessment” of its QQE/NIRP at the next MPM, suggesting it may be constructing a rabbit to pull out of the hat. However, you are likely to suffocate under the weight of a sinking USD/JPY if you hold your breath.

US payrolls need to deliver to save the USD

Attention will inevitably swing to the US economy and whether it is battling through the global uncertainty and making headway towards lifting wages and growth and inflation. There is important data on this front this week in the form of the PCE deflator, ISM and payrolls.

It may be the case that the US economy is weathering the global uncertainty and retrenchment in its energy sector well. If so we may see some reprieve in the USD and bond yield down-trends. A solid payrolls will begin to revive the prospects of a Fed rate hike in Sep and Dec. Expectations for rate rises are quite low so it would seem limited capacity for yields to fall much.

However, we should not under estimate the capacity for the market to push yields lower still. Even if yields may not fall abruptly, a weaker than expected payrolls seems likely to place significant downward pressure on the USD that appears to be falling with ease on any sign of a delay in further Fed rate hikes.

Any hint of fear that the US economy may be genuinely losing momentum and we could see a sharp further capitulation in the USD. The USD appears to be bearing the brunt of any weakness shown in the US economy.

BoE baked in the cake

It might seem remiss to not mention the BoE meeting on Thursday. They are widely expected to cut rates 25bp. There is still some debate over whether it will also reintroduce QE purchases. However, for the most part BoE policy easing is built into the GBP, one of the few currencies that has fallen against the USD and whose direction appears to resemble the central bank policy diversion and interest rate spreads against the USD. This policy action may help support equities and weaken bond yields, but it is unlikely to have much influence on exchange rates. At the margin we may see some further weakness in the GBP, but spillover to weaken the EUR or the JPY is likely to be more limited. It may tend to reinforce a weaker USD against EM and commodity currencies.