USD rebound is a creeper

In our report last week, (Bond yields in driver’s seat; time for correction in equities and the USD; 31-Jan – AmpGFXcapital.com), we anticipated rising US yields spilling over to a correction in global equities and the USD. The recovery in the USD has been modest so far, but it may be a creeper as the market pays more attention to risks associated with late-cycle economic growth and central bank policy tightening. Progress by the US Congress on a funding deal could be the immediate catalyst for more dollar gains. The recent fall in AUD/NZD appears out-of-line with relative economic trends, yield spread and commodity prices.

USD rebound a creeper

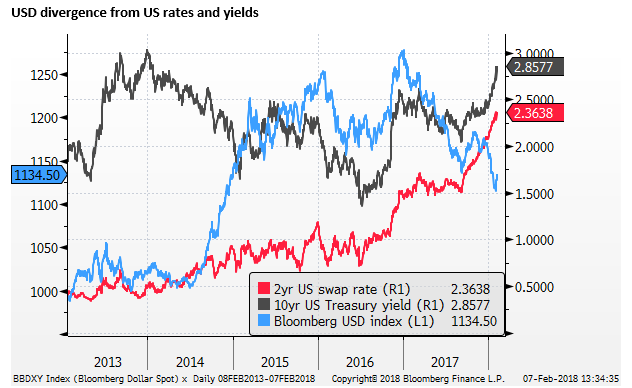

We wrote last week that, “The rise in bond yields may have moved into a phase which is self-sustaining, at least for a while, triggering a period of volatility and consolidation in global equities, if not a more significant correction. The fall in the USD over the last year has appeared increasingly correlated with rising global equities, diverging significantly from its improving yield advantage. A period of volatility in global equities may refocus attention back on yield spreads and contribute to a period of recovery in the USD.” (Bond yields in driver’s seat; time for correction in equities and the USD; 31-Jan – AmpGFXcapital.com)

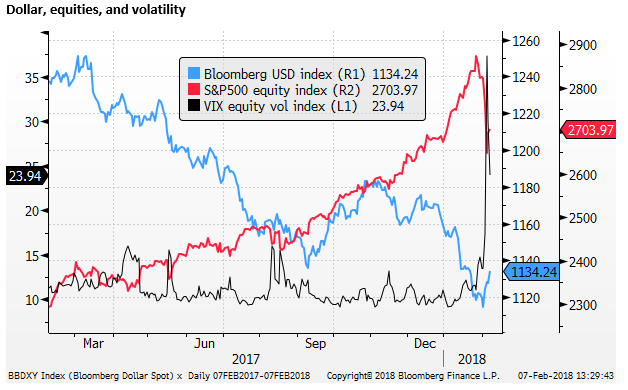

The USD may be now starting to follow this script, although it has been a slow starter. It is interesting to note that on Wednesday 7-Feb the USD fall accelerated somewhat even as equities were stabilizing and firming from their Friday/Monday correction. And the VIX equity volatility index declined, albeit still elevated from its near record lows preceding the recent equity market correction.

It is possible that the USD will continue to recover for a while even as equity markets stabilize. Investors appeared too narrowly focused on equity markets, before this correction, and were ignoring the significant rise in US interest rates and yields over the last year. The presumption was that the rise in yields would not derail the global economy or relentless low vol rise in global equities. And, therefore, could be ignored.

USD divergence from US rates and yields

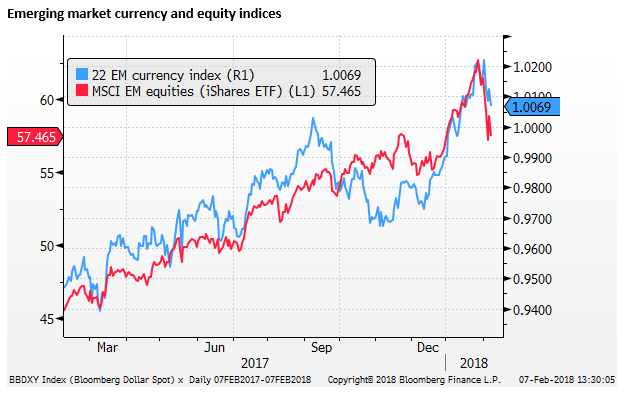

The market had come to see the fall in the USD as something more structural that would persist regardless of rising US yields, and, in fact, would reinforce rising equity markets. This helped sustain investor confidence in global unhedged equity investment, tending to create a self-reinforcing correlation in global equities and the USD.

Our view was that this was unsustainable, in part because a weaker USD was likely to increase inflation pressure in the USA, forcing yields up in the US, beyond market expectations, and eventually feedback negatively to equities. Not only would corrective price action potentially spill over to the USD, the market would potentially then question the prevailing view that yields no longer matter for the USD.

Multiple upside risks for US bond yields; 18-Jan – AmpGFXcapital.com

The market may not be so inclined to quickly revert to its complacency towards global equity investment and the dollar. Instead, it may continue to pay more attention to emerging global inflation risks and the rising trend in yields. While equities may rise through the year, the low vol state of the market may not so easily return, and the market may start to pay more attention to risks associated with late-cycle economic growth and central bank policy tightening,

Questioning the resilience of the EUR

The fall in EUR is a key example of the reassessment underway. Notwithstanding very strong German economic data (factory orders up 7.2%y/y in Dec, construction PMI 59.8 in Jan) and positive political news (coalition agreement), the EUR has fallen this week-to-date

Germany coalition talks: Merkel’s conservatives and SPD clinch deal – BBC.com

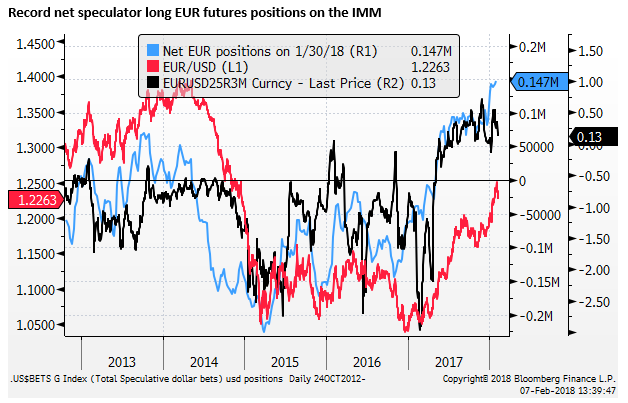

The market will be confused by this development and begin to question the resilience of the EUR. We may see a further correction in EUR strength as investors look to reduce risk and square-up long EUR positions.

The market may see the EUR fall as a partial reconnection to its much wider yield disadvantage in recent months.

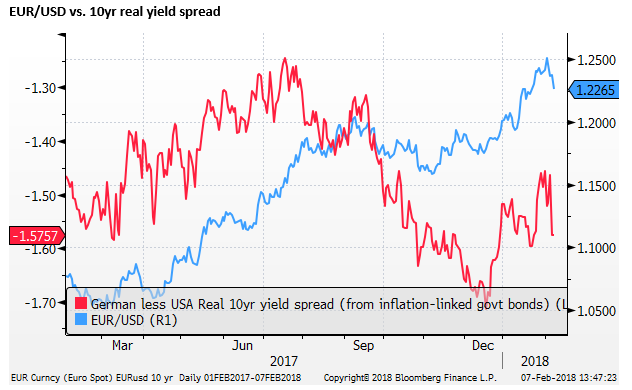

In an attempt to rationalize the recent strength in the EUR, some analysts have noted that the real yield differential between the USD and EUR had narrowed in favour of the EUR in recent months. However, even this spread has widened again recently, and, in any case, has done a poor job on a longer scale in explaining the EUR gains.

Part of the narrative that may support a further recovery in the USD is better political news in the USA. On Wednesday, The Senate leaders announced a bipartisan two-year budget deal, providing an additional $300bn in funding, and suspending the debt ceiling until March-2019. This provides a path to push out to next year the rolling government shut-down fear while adding yet further fiscal stimulus into a strong fully employment economy.

Senate leaders announce two-year budget deal – CNN.com

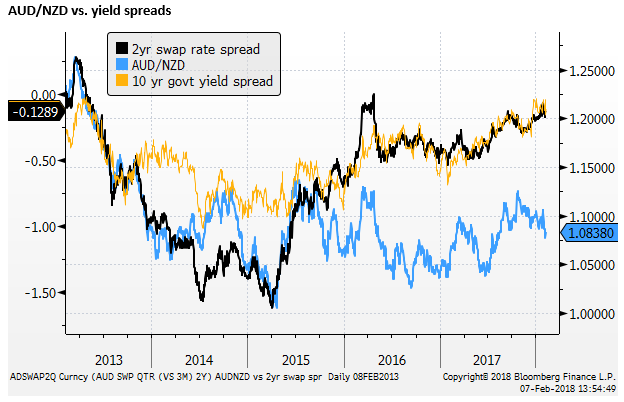

AUD/NZD fall seems out of place

A cross that has peaked our interest of late is the AUD/NZD. Its recent fall seems out-of-place with relative economic trends and yields, in our view.

So far this week, the fall has been supported by weaker than expected Australia retail trade and trade balance, and somewhat better than expected New Zealand Q4 employment data. A strong dairy auction may have further undermined the cross.

However, A broader view of recent economic and commodity price trends suggest that the cross should be higher.

The RBA policy statement released on Tuesday suggested there has been a modest improvement in the economic outlook, although still some wait before hikes are likely. Nevertheless, hikes appear more likely to occur sooner than in New Zealand. Further detail can be expected on Friday with the release of the RBA SoMP.

The RBNZ has just released its policy statement and MPS. It has not changed its rates forecast for no rate hikes until at least mid-2019, and then only projecting a full 25bp hike by Q1-2020.